Gold and silver have lost some of their edge in the past 24 hours, with sell-side pressure giving both metals a reality check.

Gold’s price per ounce slid 5.15%, landing at $4,126 as of 11:40 a.m. Eastern on Oct. 21. Silver, which recently strutted past the $50 mark to peak at $54.55, took an even steeper tumble—down 7% to $48.78 during the same window.

This dramatic volatility, commodities analyst Jim Wyckoff notes in a recent Kitco report, with a raised eyebrow, is anything but a bullish love letter. “Daily price volatility in gold and silver futures markets has turned extreme,” Wyckoff wrote on Tuesday. “This is not bullish and suggests, at most, a climaxing phase of the major bull market runs.”

The market strategist added:

“And, at least, it suggests an unknown time period of choppy, highly volatile trading that could drive away both speculative bulls and bears in the gold and silver futures markets, for fear of getting whipsawed.”

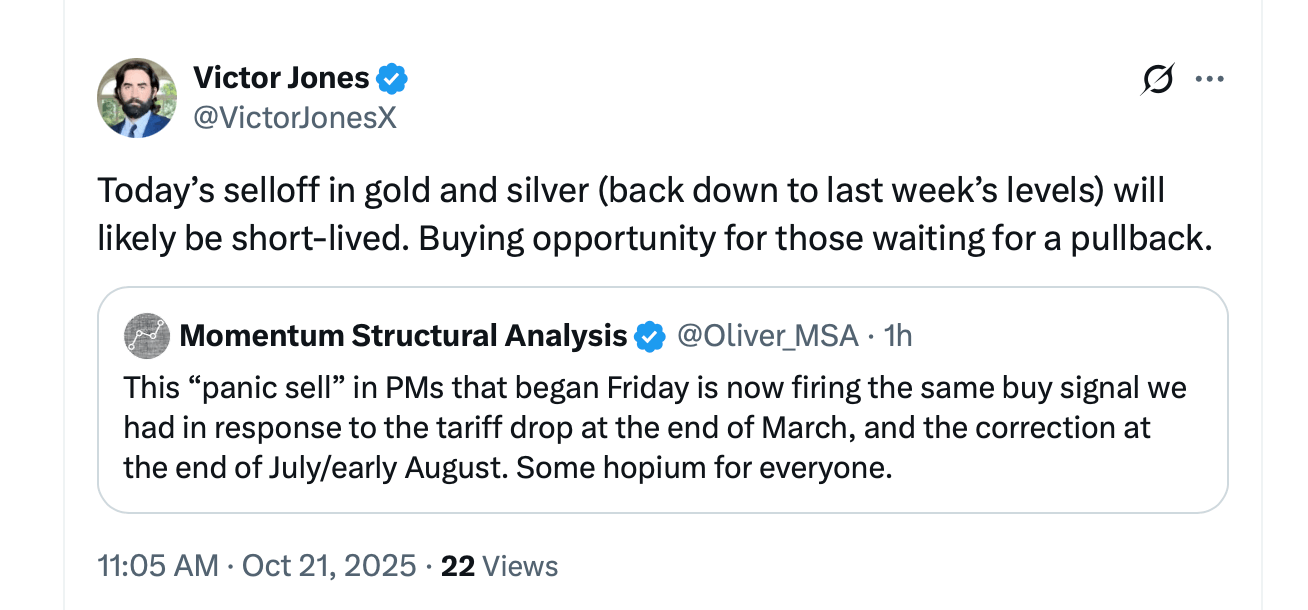

Naturally, gold enthusiasts are already preaching the gospel of “buy the dip” like it’s a limited-time offer. “Don’t worry, it’s a fake dump,” one X user explained. “I promise you that Gold and Silver will skyrocket soon. Last Friday is Black Friday, which [is] good for everyone [to] buy [the] dip.”

Others chimed in saying inflation isn’t going anywhere anytime soon—and this dip looks more like a golden opportunity than a cause for concern.

One X user exclaimed:

“Time to BUY GOLD & Silver on the Dip, as experts expect the Fed Gvmnts … to drop interest rates , thus inflation [wil]l still be coming worse.”

As traders bicker over whether this is a golden buying window or a glittering trap, one thing’s clear—volatility has taken center stage. With inflation whispers and rate-cut chatter swirling, both metals are waltzing to a wild rhythm that’s keeping investors on their toes. For now, gold and silver may have lost a bit of luster—but they’re far from losing their allure.

- Why did gold’s price drop on Oct. 21, 2025?

Heavy sell-side pressure hit the market after gold’s climb to $4,377 per troy ounce, triggering a sharp correction. - How much did silver fall compared to gold?

Silver dropped around 7% to $48.78, a steeper decline than gold’s 5.15% dip. - What are analysts saying about the gold and silver market?

Some experts warn that the two metals may be entering a volatile, “climaxing phase” after their extended bull runs. - Are investors buying the dip in gold and silver?

Yes, many gold proponents and traders on X view the drop as a prime buying opportunity amid inflation concerns.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。