原文作者:Odaily 星球日报(@OdailyChina)

参考链接:灰度报告

作为一个忠诚的 SOL 卫兵,现在的我对 SOL 有点失去信心了。

从代币价格上看,这个周期或许还没结束。但市值排名靠前的代币中,BTC、ETH、BNB 甚至 XRP 都曾在 2025 下半年创下历史新高,唯独 SOL 在 1 月份创下 295 美元的价格高点后,一直没有突破前高(期间有过长达数月的 Solana Meme 币热潮)。

SOL 为何迟迟不涨?可能是因为代币通胀机制,可能是因为 Meme 热潮转向其他网络,也可能是流动性问题和巨鲸不看好。还需要关注的一点就是,Solana 在追赶热度上好像永远慢别人一步。

(群聊截图)

前段时间,灰度发布了名为《Solana: Crypto’s Financial Bazaar》的 Solana 报告,报告分析了 Solana 的技术面、网络生态、代币总量和价值等数据指标,算是给 “SOL 卫兵”提供了一点信心、Odaily 星球日报整理了报告重点,如下:

Solana 的基本面:技术、链上活动、交易量

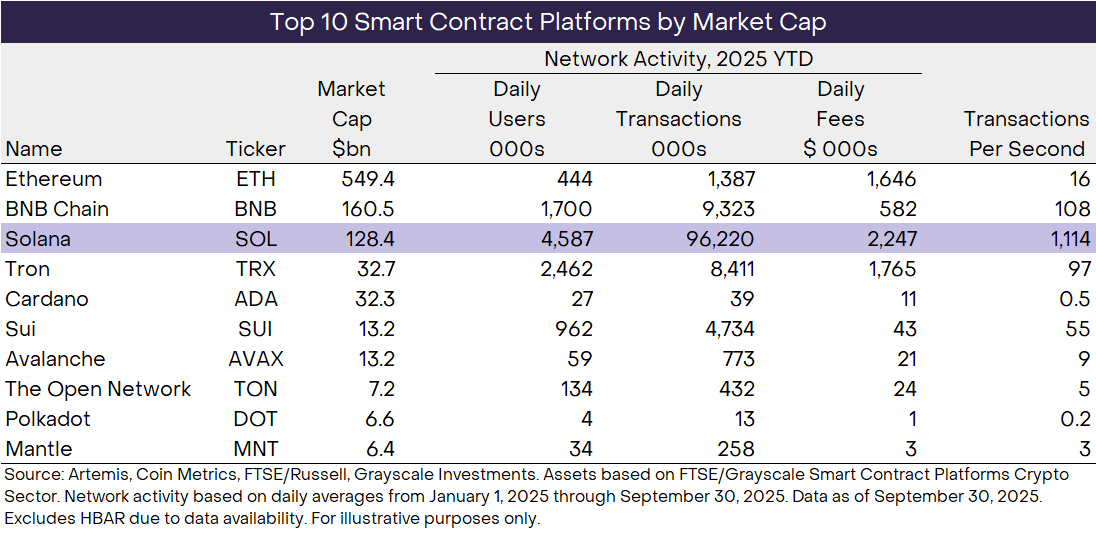

根据报告,与以太坊、BNB Chain、Tron、Cardano 和 Sui 等其他网络相比,Solana 的链上活动的深度和多样性占很大优势。在用户、交易量和交易费用方面均处于领先地位,Solana 网络有着更多的用户和经济活动,这些等同于更高的网络价值。

链上数据与交易量

如下图所示,SOL 的市值排名第三,但其日活用户、日交易量、日交易费和每秒交易次数均排名同类区块链首位。

生态应用和网络收入

而 Solana 网络也承载着很多行业内领先的应用,比如:

1、Raydium DEX,也是 Solana DeFi 基础设施的核心组件。年初至今,Solana DEX 的交易量已超过 1.2 万亿美元,超过任何其他区块链生态系统。此外,Solana 领先的 DEX 聚合器 Jupiter 也是加密货币行业交易量最大的聚合器;

2、pump.fun,长期霸榜的代币发行平台,pump.fun 每月活跃用户约 200 万,日收入约 120 万美元;

3、Helium,是一个专注于移动热点的 DePIN 项目。Helium 允许用户贡献网络容量,从而在全国范围内构建移动接入点网络。这些服务通常比中心化替代方案更便宜,Helium 目前拥有 150 万日活跃用户、11.2 万个热点,并与 AT&T 和西班牙电信等大型电信公司建立了合作关系。

而以上几个应用仅代表 Solana 500 多个应用程序中的一小部分。此外,作为一条几乎具备其他主流网络所有功能的区块链,Solana 在 NFT 交易上排名第三,在稳定币交易量上排名第五,在代币化资产上排名第七,其他近期获得交易的用例包括宝可梦卡牌收藏品交易和代币化股票的链上发行。

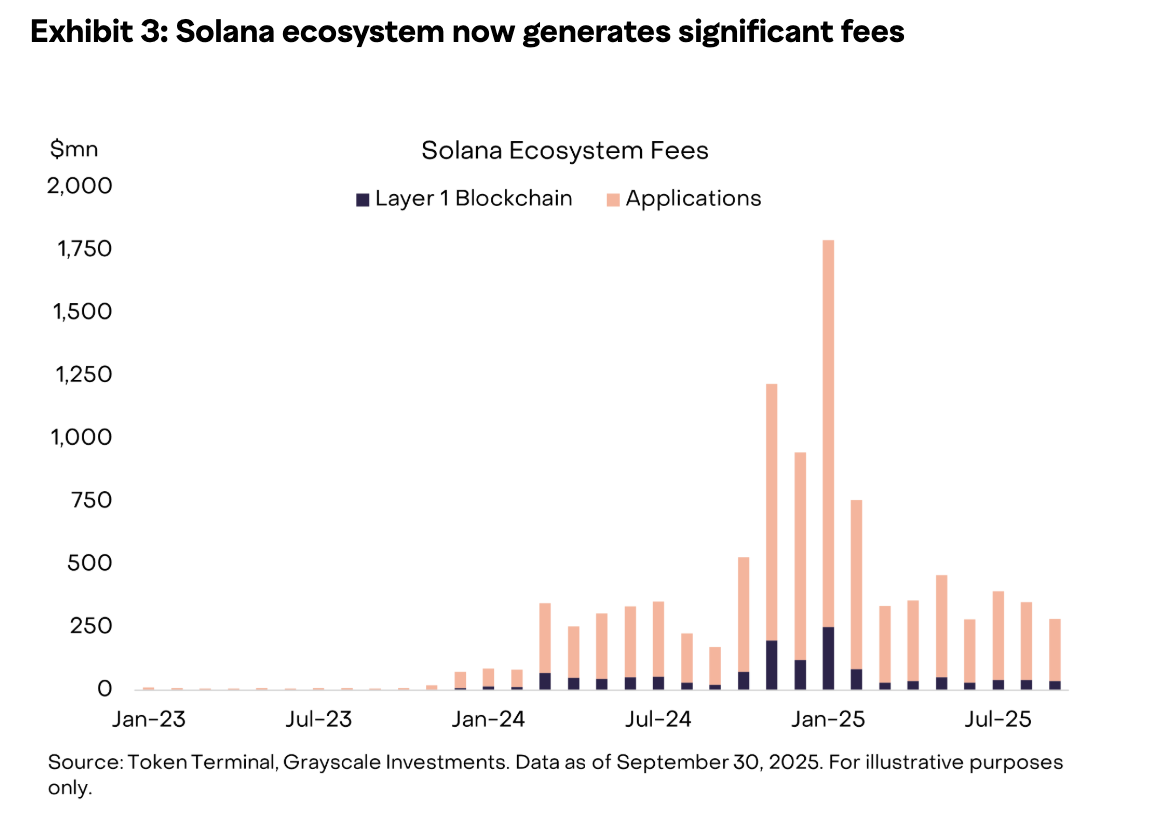

衡量 Solana 生态系统应该同时考虑区块链本身及其托管应用程序的经济活动,这些数据会随着时间的推移有所变化,但 Solana 生态系统每月产生的费用约为 4.25 亿美元,年收入超过 50 亿美元。灰度认为,费用是衡量区块链及其应用程序总需求的最直接指标,这些数据都表明 Solana 的需求巨大。

Solana 的优势:仅次于以太坊的开发者规模,且适用于所有用户

普世的技术优势

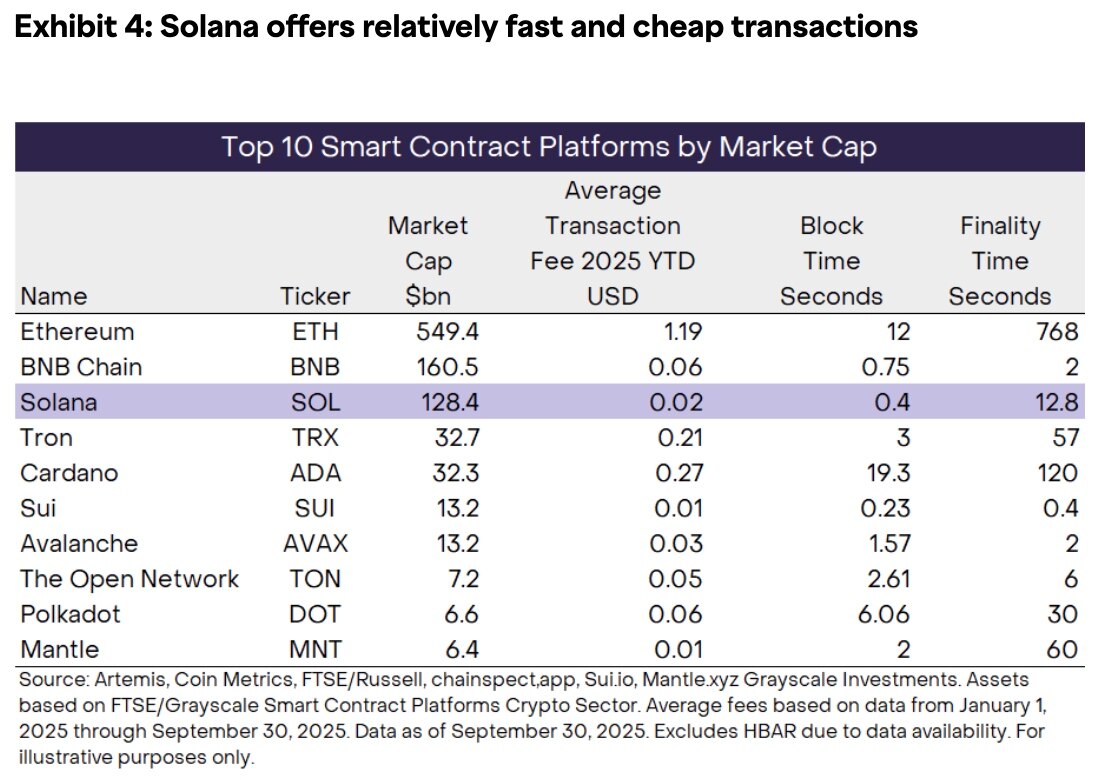

除了基本面的分析,灰度还提到,SOL 之所以有着不错的数据还是因其提供快速、廉价的交易和无缝用户体验,该网络每 400 毫秒生成一次新区块,交易可在大约 12-13 秒内完成最终确认,除了高吞吐量之外,交易成本也一直保持在相对较低水平:

Solana 使用一种称为「local fee markets」的技术,该技术将费用竞争限制在特定的应用中,今年迄今为止,用户平均支付的交易费仅为 0.02 美元,部分由于这一特性,今年的每日交易费中位数仅为 0.001 美元。Solana 的交易速度和成本效益相比同类区块链更快、更便宜。其即将推出的 Solana 升级版 Alpenglow 预计将把最终确认时间缩短至 100-150 毫秒。

Solana 的用户体验主要得益于其“monolithic”(单体区块链)设计而非分层设计(避免了在网络组件之间桥接资产的需要)的理念,和由 Phantom 主导的钱包基础设施。且近年来 Solana 网络故障次数也显著低于行业水平,这也是用户采用的基础。

此外,Solana 智能合约不依靠以太坊虚拟机 (以太坊和许多其他智能合约平台,包括 BNB Chain、Polygon 和 Avalanche 使用的系统)主导。而是使用一种称为 Solana 虚拟机 (SVM) 的独特架构。基于 SVM 的应用程序无法轻松转移到非 SVM 区块链,这会导致稳定的用户粘性。

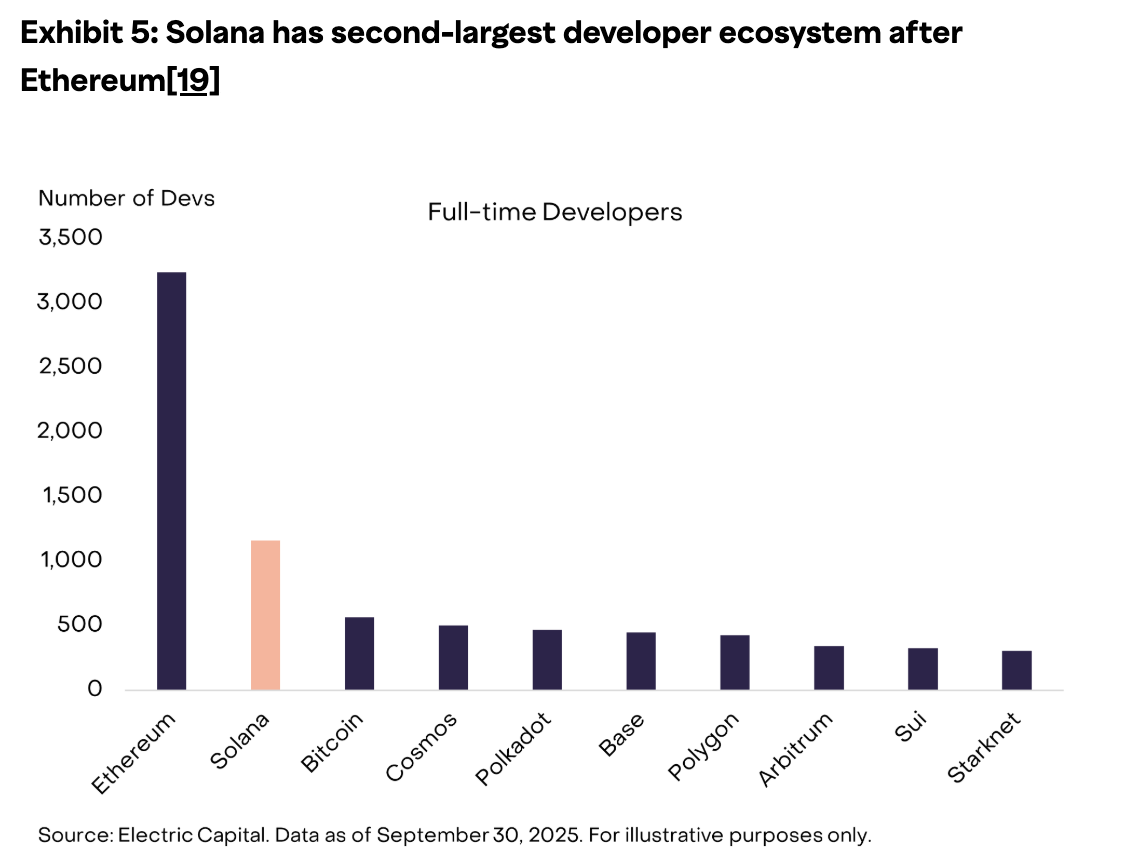

仅次于以太坊的开发者数量

目前,有超过 1,000 名全职开发人员致力于 Solana 和 SVM 的应用程序,并且在过去两年中,专注于 Solana 的开发人员数量的增长速度超过了任何其他智能合约平台(如下图),仅次于以太坊。随着时间的推移,这些人力资本可以为 Solana 持续的创新做出贡献。

SOL 代币的长期储存价值(通胀、代币表现和对手竞争)

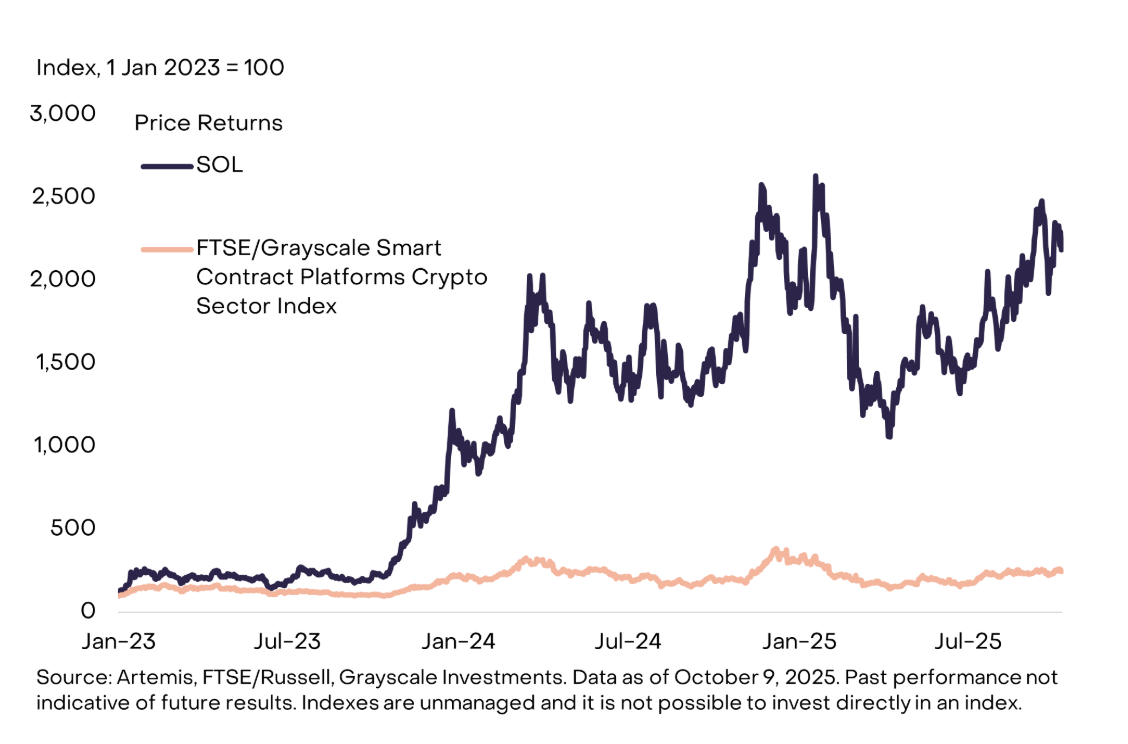

众所周知,因 FTX 的暴雷,SOL 代币的价格从 2021 年 11 月近 260 美元的峰值跌至 2022 年 12 月的仅 2 美元。在 FTX 破产后,很多散户对 Solana 的未来感到不确定,尽管当时仍有大量 SVM 开发人员留守在 Solana。

但从 2023 年底开始,SOL 代币开始复苏,表现显著优于富时/灰度智能合约平台加密货币行业指数。

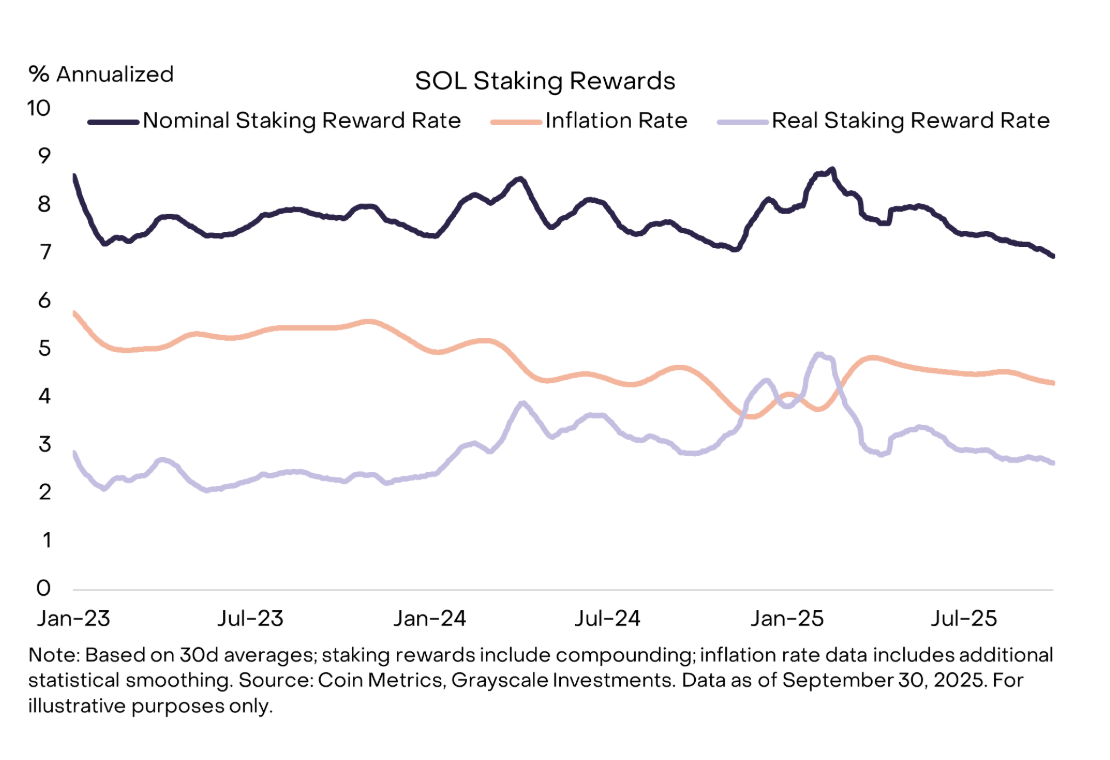

目前,SOL 代币的供应量每年以约 4% 至 4.5% 的速度增长,在其他条件不变的情况下,这可以被视为代币持有者价值稀释的原因。根据网络状况, SOL 质押者可以获得约 7% 的名义回报率,但经通胀调整后的获得的“实际”回报率约为 2.5% 至 3%。目前,约有三分之二的未偿还 SOL 代币已被质押。

灰度表示,SOL 在 Solana 网络中提供实用性,并可能获得额外的相应的财务回报,但它们的价值与网络规模相关,与其他智能合约平台代币一样,SOL 代币的投资理论以 Solana 网络规模的潜在增长为中心。与其他资产一样,SOL 代币价格并不总是随着网络基本面的变化而变化。但如果 Solana 网络随着时间的推移而增长——拥有更多的用户、处理更多的交易并赚取更多的费用——投资者可以预期 SOL 价格会上涨。

灰度认为:Solana 在愿景上表现为一个“面向所有人开放的快速、低价的区块链”。但其特定的设计为其竞争对手在某些用例中抢占或保留市场份额留下了空间。

例如,其他区块链有时会通过运营更中心化的网络(例如,仅使用少量活跃的网络节点)来提供更快和/或更便宜的交易。即使中心化可能带来风险,用户也可能青睐这种便利。其他区块链可能会通过保持其网络的许可(即仅允许获得批准的用户和/或获得批准的活动)与 Solana 竞争。

另一方面,与比特币或以太坊相比,SOL 代币可能不太适合作为长期的“价值存储”货币资产。这在一定程度上反映了 SOL 较高的名义供应通胀:稀缺性是任何长期价值存储的关键特征。但更重要的因素可能是网络抵御第三方干扰的能力。对于作为长期价值存储的数字资产,用户需要有信心在未来几乎所有情况下都能进行交易。支持这一结果的一种方法是保持较低的节点要求,以使网络保持高度去中心化和易于复制。Solana 的效率是以相对较高的硬件和带宽要求为代价的,因此许多网络节点都在数据中心运行。从理论上讲,随着时间的推移,这可能成为中心化的根源,并成为第三方干扰网络的载体。

当然,这些都是复杂且尚未解决的问题,投资者对加密资产可以作为长期价值储存手段的看法可能会随着时间的推移而改变。

结语

最后,灰度认为,衡量链上活动的三个最重要指标是用户、交易量和交易费用,在这些指标上 Solana 是目前链上活动的领先网络。虽然 Solana 网络面临很多强大的竞争对手,但 Solana 链上经济的深度和多样性为 SOL 的估值奠定了坚实的基础,这也是其未来进一步增长的必要条件。

网络性能强劲、用户数量巨大、交易量和交易费居首、经历过涅槃重生,主导过Meme热潮。此外,Solana还有着体量巨大的SOL财库支持,除了通胀机制外,SOL似乎没有什么严重影响代币价值的黑点,明明拿到的是“爽文主角”剧本,却迟迟不创新高。最后,在本文结束的时候,SOL 代币价格又跌回 185 美元,SOL 卫兵是真没招了。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。