撰文:decrypt

编译:白话区块链

Mt. Gox在 2011 年的黑客攻击造成了比特币史上最严重的崩盘,在黑客以低价抛售窃取的 BTC 后,价格暴跌了99.9%。

主要的崩盘源于中国禁令、COVID-19 恐慌,以及Celsius和FTX等加密货币平台的倒闭。

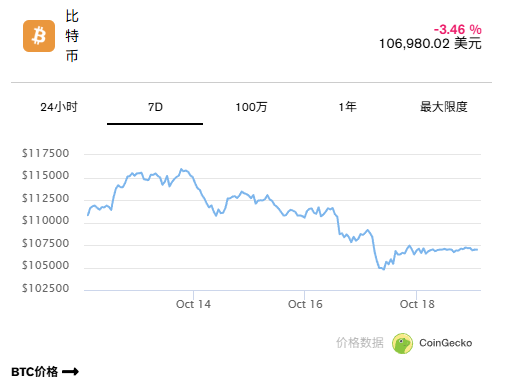

唐纳德·特朗普在 2025 年 10 月的中国关税威胁引发了13%的跌幅和 190 亿美元的清算头寸——但未能进入此榜单。

2025 年 10 月 10 日的加密市场崩盘,清算了前所未有的价值 190 亿美元的杠杆比特币和其他加密货币头寸。但这远未达到有记录以来 BTC 价格最大百分比跌幅的水平。

从 Mt. Gox 的「一分钱交易」到 FTX 崩盘的冲击,以下是比特币价格每次硬着陆及其背后的诱因。

1. Mt. Gox 闪崩(2011 年 6 月)

这是最严重的一次。在一名黑客窃取了价值数十万的 BTC 并以一分钱的价格出售后,Mt. Gox 上的比特币价格暴跌了大约99.9%。当时,Mt. Gox 处理了大约 90% 的所有比特币交易。由于 Mt. Gox 在当时主导了比特币交易,该交易平台的内部崩溃在短时间内几乎抹去了整个市场的价值。

(根据《吉尼斯世界纪录》,Mt. Gox 是当时最主要的比特币交易平台,但并非第一个。第一个是BitcoinMarket。)

Mt. Gox 黑客攻击实际上发生在 2011 年 6 月 15 日,但直到几天后才被披露。一个 Mt. Gox 审计员账户被盗用,被用来从客户那里窃取 74 万枚 BTC,从公司本身窃取 10 万枚 BTC。当攻击者抛售这些 BTC 时,价格暴跌至仅数美分。

当时,这批比特币价值约为 46 万美元。以当前价格计算,84 万枚比特币的价值将接近 940 亿美元。这相当于 Michael Saylor 的Strategy、比特币矿企MARA Holdings、Jack Maller 的XXI、日本比特币巨头Metaplanet、Adam Back 的Bitcoin Standard Treasury Co.以及新上市的Bullish的全部 BTC 储备总和。

2. Mt. Gox 熔断(2013 年 4 月)

由于 Mt. Gox 后来所谓的分布式拒绝服务(DDoS)攻击,比特币在 2013 年 4 月从 265 美元跌至 150 美元,跌幅约为43%。DDoS 攻击会用外部请求淹没目标 URL,使其无法被合法用户访问。

这次攻击意味着 Mt. Gox 上的交易在创纪录的流量中不断冻结,并引发了急剧的抛售。

Mt. Gox 当时表示,此类攻击已变得非常普遍。「攻击者等到比特币价格达到某个特定价值,然后抛售,破坏交易平台稳定,等着所有人恐慌性抛售他们的比特币,等着价格跌至某个数量,然后停止攻击并开始尽可能多地买入。就像我们在过去几天看到的那样,重复两三次,他们就能获利,」该交易平台在当时写道,据TechCrunch引用的一篇现已删除的Facebook 帖子。

3. 中国禁令恐慌(2013 年 12 月)

2013 年 12 月,中国人民银行明确表示不希望银行接触比特币,因为它没有得到任何国家或中央当局的支持。

比特币当时正经历着快速上涨。11 月底,比特币首次攀升至 1,000 美元以上。12 月 5 日,比特币已上涨至 1,200 美元以上。但两天后,随着投资者消化中国银行业禁令的影响,价格下跌了约50%,至 600 美元以下。

大约在这个时候,前美联储主席艾伦·格林斯潘开始公开嘲笑比特币是「一个泡沫」。

「你必须真正发挥你的想象力,才能推断出比特币的内在价值是什么,」他在接受彭博社采访时说。「我还没有做到。也许其他人可以。」

4. 又一次中国禁令(2017 年 9 月)

2017 年 9 月初,中国宣布首次 Token 发行(ICO)非法,称其为一种「非法」的融资形式。

起初,市场对此不以为意,认为此举是对 Token 的打击,而非比特币本身。但一周后,当有报道称北京也将强制国内交易平台关闭时,恐慌情绪开始蔓延。随着BTCC、火币和OKCoin在 9 月 14 日和 15 日确认关闭,比特币在两天内暴跌了约25%——从大约 4,400 美元跌至 3,300 美元。

这次抛售标志着中国在加密交易中主导地位的终结,全球流动性转移到了日本和韩国。

5. 杠杆平仓(2017 年 12 月)

到 2017 年底,比特币一直在高歌猛进,首次逼近 20,000 美元大关。

随后,比特币期货进入受监管的交易平台,以及过热的市场情绪共同造成了一次下跌,使得 BTC 从 12 月 22 日的约 16,500 美元跌至次日的约 11,000 美元。在 24 小时内,比特币价值损失了大约三分之一,即33.3%,标志着长达一年的熊市的开始。

芝加哥期权交易平台(CBOE)和芝加哥商业交易平台(CME)刚刚推出了现金结算的比特币期货合约。

这不是说当时没有加密原生的比特币衍生品交易平台——Deribit、BitMEX 和 Kraken 当时都很活跃。但加密原生公司当时都在海外或不受监管。华尔街的「西装革履」们更喜欢使用已经获得商品期货交易委员会许可的场所。

数月后,旧金山联邦储备银行发布了一份报告,将 12 月的崩盘归咎于期货的引入。

该银行写道:「期货推出后价格的快速上涨和随后的下跌似乎并非巧合。」「相反,它与资产期货市场引入时通常伴随的交易行为是一致的。」

6. COVID:「黑色星期四」(2020 年 3 月 12 日)

COVID-19 大流行的爆发使投资者陷入恐慌,并导致比特币经历了其最大的崩盘之一。

BTC 崩盘发生在世界卫生组织正式宣布全球大流行的第二天。紧接着的一天,BTC 从略低于 8,000 美元开始,然后暴跌至约 4,850 美元,损失了近一半的价值。

超过 10 亿美元的杠杆多头头寸在那一天被清算,迫使 BitMEX、币安和其他交易平台发生连锁抛售。

这次崩盘非常严重,赢得了「黑色星期四」的绰号。但好消息是,这次崩盘之后是一个牛市年,期间BTC 打破了所有可以想象的记录。

7. 中国打压:「黑色星期三」(2021 年 5 月 19 日)

5 月中旬,特斯拉突然取消了接受比特币作为其电动汽车支付方式的计划,这让 BTC 投资者感到不安。市场有所恢复,但交易者只得到了短暂的喘息。

一周后,中国人民银行对中国比特币矿工进行了打压,导致价格自由落体,BTC 算力(有助于保护网络安全的挖矿能力)暴跌。

在北京重申其对加密交易的禁令后数小时内,恐慌性抛售和连锁清算从杠杆头寸中抹去了大约 80 亿美元。

这次崩盘非常严重,赢得了「黑色星期三」的绰号。在大约 12 小时内,比特币从约 43,000 美元下跌了大约30%,至 30,000 美元。损失并未停止。到 2021 年 6 月 22 日,比特币跌破了 30,000 美元,这是六个月来的首次。

8. Celsius 冻结和传染(2022 年 6 月 13 日)

加密借代平台Celsius在 6 月 12 日冻结了提款和交易,理由是「极端的市场条件」。此举发生在 TerraUSD 崩溃仅两个月后,引发了对更广泛流动性危机的担忧。

TerraUSD,Terraform Labs 的算法稳定币,在巨大崩盘发生仅两个月。该 Token 旨在保持与美元 1:1 挂钩,但在崩溃时跌至 13 美分。

因此,当 Celsius冻结提款,称此举是为了「稳定流动性」时,投资者感到恐慌。在鼎盛时期,Celsius 为客户的加密存款提供高收益。但当客户突然被切断与平台上的资金的联系时,比特币首当其冲。

在公告发出的当天,比特币从约 26,000 美元开始,然后下跌了15%,至 22,000 美元以下。

9. FTX 在破产前动摇(2022 年 11 月 8 日至 9 日)

当有报道称Sam Bankman-Fried 的 FTX 交易平台面临流动性短缺时,恐慌席卷了市场。

11 月 8 日,在 FTX 暂停提款时,比特币在 24 小时内下跌了超过17%,从约 20,500 美元跌至 16,900 美元,并短暂触及 15,600 美元。

几天之内,FTX 申请了破产——这次崩盘波及了整个加密行业,其影响在接下来的两年里都能感受到。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。