撰文:Danny @IOSG

TLDR;

链上预测市场爆发,预言机是最好的 infra 相关机会,预言机作为结算机制核心,决定了预测市场能够支持什么主题,能否正确、高效运行;

目前 Polymarket 预言机以 UMA 为主导,支持占 80% 市场规模的主观预测市场,Chainlink 被引入结算剩余 20% 的价格市场。Pyth被引入解决Kalshi预测市场数据上链问题,其他 Oracle 方案主要关注 AI;

作为唯一主观结算解决方案,UMA 在产品和运营经验层面,建立了较好壁垒。但仍存在结算时间长、大户操纵的问题,本质上限制了 Polymarket 等预测市场开拓新的市场类型。这为新的解决方案提供空间,包括引入 AI agent、解决操纵问题、连续/组合市场预言机、无许可/长尾市场预言机、预测市场事件驱动的 defi 集成等;

背景

Crypto 进入应用时代,上个时代的 infra 项目由赋能应用带动爆发,Memecoin 带动了 Dex infra,AI agent 带动了 Tee infra,Yield 带动了 Defi infra,而势头正猛的预测市场可能带动的则是预言机 Oracle infra。

预测市场成为 Crypto 新的增长引擎。2024-2025 年经历了从小众实验到主流 pmf 应用的质变:

2024 年美国大选期间,Polymarket 交易量从 7300 万美元暴涨至 26.3 亿美元(48 倍增长),Kalshi 达到 19.7 亿美元(10 倍增长)。

预测市场整体已达 157 亿美元累计交易量。纽交所母公司 ICE 向 Polymarket 投资 20 亿美元,许多知名的对冲基金已经进入预测市场交易或正在探索参与的方式。

监管方面,CFTC 批准 Kalshi 选举合约,同时 Polymarket 通过对 QCEX 收购,将以 mobile app 的形式重新合规进入美国市场。Polymarket 数次暗示其代币和 Crypto 生态的可能性。

种种因素都将成为催化剂,预测市场的爆发毋庸置疑。

预测市场具体分两类,一是主观类问题,多关注政治、文化、经济、体育等新闻类事件,如总统选举,世界杯夺冠等。通过自然语言对题干和结果进行定义,部分结论存在一定主观性,如「泽连斯基是否穿着西服」 - 什么样的衣服算做西服。

另一类是价格市场,类似加密货币/股票的二元期权产品,但更简单易懂的模式。如「BTC 的价格在某一时刻能否达到 $XXX」

目前 UMA 及其乐观预言机,是唯一主观市场结算提供者。对于任何去中心化、非结构化数据或需要主观裁决的市场,目前并没有其他解决方案。UMA通 过类似于 optimistic rollup 的乐观方案(及提出结果,若无争议则默认通过,若有争议则进一步裁决惩罚)解决这一问题。

结构化数据预言机服务,以价格数据市场为首。这些市场如「BTC 的价格在某一时刻达到 $XXX」则可以较好的通过价格预言机如 Chainlink 直接解决。事实上在 UMA 此前的解决争议的 escalation manager 中就已经存在 chainlink 对于价格争议的解决路由。Polymarket 与 chainlink 的直接合作让这一点更快速解决。

目前预测市场预言机仍存在许多机制与用户体验的改进。包括结算时间、激励模式、连续性数据、无许可结算等等。预测市场将带来全新的预言机产品和架构创新机会。

为什么预言机重要

结算分中心化和去中心化两类。绝大部分早期预测市场都采取中心化方案。去中心化方案成本高,执行难。但为了保持预测市场不受单点控制,让预测市场的「真理媒体」价值被认可,则需要去中心化结算方案,这又依赖预言机。

这项卡脖子的技术决定了一个链上预测市场能否持续独立运转、承载大体量市场。这也是为什么 BSC 想做预测市场项目需要先解决预言机问题。

同时,要让预测市场的数据产生价值,并在链上流通,也需要预言机的帮助。预言机可以将预测市场中的结果作为数据源,供链上使用。Kalshi 和 Pyth 的合作就主要围绕这一点。

预测市场数据作为原语,链上应用开发者可以依此创造出全新产品。Pyth 官方举的例子包括:

基于现实世界事件开发期货市场。这些协议可以使用 Kalshi 的实时赔率作为基础参考,随着来源市场的变动自动调整价格。

DeFi 协议可以构建对现实世界概率做出反应的条件性产品。

与政治结果挂钩的保险产品;

基于选举结果演化的 NFT 系列;

在特定事件发生时解锁奖金池的游戏锦标赛。

目前的预测市场预言机

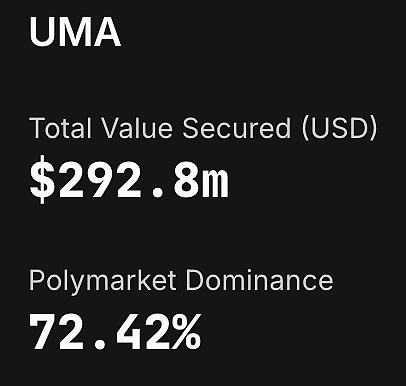

理解目前 UMA 的垄断地位,可以通过预测市场中的 TVS 来衡量。TVS(total value secured)衡量预言机保障的价值总量,目前主要是 Polymarket 的 80% 的市场份额,Chainlink 用于剩下的 20% 价格市场。

▲ source: Defilamma

在商业模式上,Stable 采取近期优先扩张市场占有率,收入次之的策略,利用免 Gas 费的 USDT 支付来赢得用户并建立支付流量。长期来看,盈利将主要来自其消费者应用程序内部,并辅以部分精选的链上机制。

除了 USDT,Stable 也看到了其他稳定币带来的重大机遇。随着 PayPal Ventures 在 2025 年 9 月底对 Stable 进行投资,作为交易的一部分,Stable 将原生支持 PayPal 的稳定币 PYUSD,并推动其分发,让 PayPal 用户能够「直接使用 PYUSD」进行支付,且 Gas 费同样以 PYUSD 支付。这意味着PYUSD 在 Stable 链上也将是免 Gas 费的——这将把吸引 PSP 的 USDT 支付轨道的操作简易性,同样扩展到 PYUSD 之上。

UMA

Polymarket 目前使用 UMA 的 MOOV2 (Managed Optimistic Oracle V2 ) 来结算市场。市场到期需要结算时,市场先关闭,提议者会提交结果。该结果在争议窗口期内未被质疑时被视为正确结果。如果受到质疑,UMA 的去中心化裁决机制将介入以做出裁决。

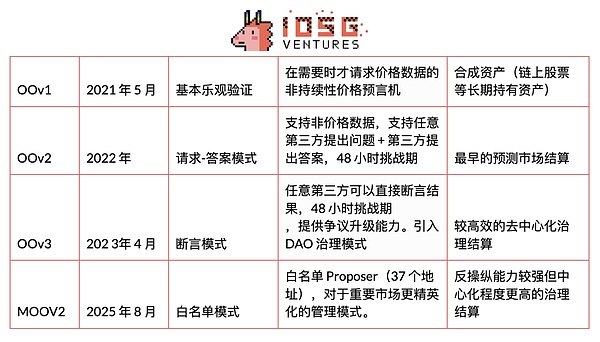

UMA 乐观预言机经历四个版本,从一开始关注合成资产到不断进化适配预测市场:

目前 Polymarket 支持 MOOV2 合约。此变更是在 UMA 于 8 月 6 日通过 UMIP-189 治理提案之后进行的。此前,OOV2 的一个问题是许多提案被过早且在缺乏经验的情况下提交,这常常导致出现争议,使得市场结算延迟长达数天。

UMA 背后的实体 Risk Labs 公布了一个包含 37 个地址的初始白名单,白名单包括 Risk Labs 和 Polymarket 的员工,以及拥有超过 20 个提案且准确率超过 95% 的用户。这是目前 UMA「精英」治理的原型。

作为被使用最多的预言机,UMA 多个版本的迭代也体现出其建立起了对预测市场 use case 的深刻理解与健壮的生态和基础设施。但目前 UMA 的表现并非完美,问题主要来自于两个方面:

大户操纵风险

结果敲定时间长

在操纵风险方面,UMA 的 DVM(Data Verification Mechanism)依靠代币持有者投票决定数据结果。虽然设有最低投票量(GAT,约 500 万 UMA)和投票一致性阈值(SPAT,65% 一致)来确保安全。

但由于代币市值较低,分布高度集中,大户可以轻易影响投票结果。2024 年 Polymarket 平台上,一场关于「乌克兰是否会与美国签署矿产协议」的市场被 UMA 裁定为 「YES」,尽管现实世界真实情况并非如此。

链上数据显示,单一大户通过多个地址投下约 500 万枚 UMA,占总投票量约 25%;仅两名大户便掌握超过一半有效投票权。这种集中结构让小额投票者倾向「跟随大户」以避免惩罚。UMA 对错误投票的惩罚比例仅约 0.1%,成本极低,使得大户操纵的实际风险大幅上升。目前 UMA 的 MC 为 100m,但其支持的 polymarket 市场 OI 为 >200m,这体现出经济关系的不对称,给予恶意操纵者空间。

其次,在结果确认速度方面,UMA 的争议处理流程较为冗长。任何数据请求在提交后需经过「活跃期」,若无人挑战才可自动确认;若被挑战,则进入 DVM 投票阶段,通常持续 48 至 96 小时。如未达到阈值,还需开启新一轮投票,导致结算可能延长至数天。

在预测市场、杠杆产品等需要快速结算的场景中,这一延迟问题尤为明显。用户资金被锁定且无法复用,同时增加了信息滞后带来的套利空间。

UMA 在去中心化与抗审查方面具有优势,但代币集中度高与结算周期长的问题,使其存在操纵风险和效率瓶颈。若要在更广泛的预测场景中承担主流数据预言机角色,UMA 需要进一步优化。

UMA目前也在探索新的颠覆式架构,其正在与 EigenLayer 合作,研究并有探索利用 Eigenlayer 的质押系统开发下一代预言机,同时其也在 AI 方面做一些新的尝试,Optimistic Truth Bot 是一个预测市场中的提案者代理。它监听 Polymarket 的问题,7/24 地第一时间提出问题的最有可能的答案并等待挑战,大幅减少结算时间。可以通过 @OOTruthBot 推特帐号找到看到具体市场。

Chainlink

Chainlink 是老牌 defi 预言机服务提供商,其产品能力是主动从多个来源获取并聚合链外数据(例如价格),通过节点网络将其传递到链上。目前 Polymarket 和 Chainlink 合作,服务于价格数据预测市场。

在此前 UMA 的 Escalation manager 争议升级系统中,已涉及到 chainlink 的路由。这意味着 Polymarket 其实早就是 chainlink 的使用者,目前和 chainlink 的结合让这一点更加直接。

Pyth

pyth 目前和 Kalshi 合作,主要是将 Kalshi 的数据传导出去。Kalshi 数据受 CFTC 监管,因此其价值在于将合规数据,主要包括体育、经济数据作为数据源传导出去。这类似于合规赌场售卖自己的体育赛事实时数据给下游。

新玩家

绝大部分聚焦在通过 AI 提供验证服务。目前 Agent 的角色更偏于提交解决意向,不过由于 AI 可以 24 小时在线,因此可以保证任何市场,尤其是一些无许可创建的高频市场能够得到有效结算。前文提到了 UAM 通过 OO AGENT 正在探索 AI 参与结果提出的方案。

类似来自 Solana 的 XO market 是一个比较好的例子。其使用 AI 模型从可信 API(实时新闻、体育数据源等)提取分析数据通过模式识别快速解析 Yes/No 问题,优化到了比较高的成功率。CZ 最近提到的 BSC 上的某些预言机项目也在探索这个方向。

预言机还有什么机会

预测市场的爆发对预言机的支持范围、智能化、实时性和激励设计提出了更高要求。目前主流预言机仍存在瓶颈:UMA 的结算时间为 24-48 小时、平均争议解决周期数天,结算争议率高,大户表决权集中... 仍存在对中心化与效率的优化,且其能够支持的市场类型仍受其架构限制,或许是影响 Polymarket 在市场类型创新上的最大阻碍。

AI 辅助

AI 能够理解自然语言,这在政治、体育或社会事件等市场非常适配。以前人为判决情况下,会出现非常多语义差异与主观因素,导致争议频发。AI Oracle 通过多源验证、中立的语言模型等可显著改善这一问题。

反操纵

UMA 的代币持有者既是投票者又是利益相关方,形成结构性冲突。大户仅凭 500 万 UMA 即可左右投票结果。在代币设计层面,如何保证有足够的经济安全,在代币设计之外,如何建立反操纵的机制(如实时标记恶意地址,检测群体恶意行为等)

多阶段与主观预测、实时数据与连续价格源

预测市场长期关注二元结算,导致预测市场极为信息降维。未来的社会感知型预言机,需要获取更多数据源,并对于不同的数据采取动态的模型以综合评估。在和 Polymarket 相关的 defi 项目交流下来,意识到在市场进行中的动态结算数据也有非常大的设计空间。支持更持续的预测市场如体育赛事的实时动态赛中交易等,在连续价格市场或组合性市场如 parlay 等模式有非常大的机会但是目前预言机并不支持。

无许可扩展与长尾市场

未来无许可的预测市场将会达到 pumpfun 类似的资产创建速率,大量的市场结算需求将使得 UMA 目前的人工审核升级模式无法运行。如何快速解决长尾市场的创建、结算、流动性分散问题,或可以从预言机的角度至上而下解决。

事件驱动的 defi 集成

预测市场与 DeFi 结合后,事件概率上链可直接影响借贷和衍生品定价。例如,当「加息概率 > 90%」时自动降低借贷杠杆等。或许能够通过预言机 + 预测市场带来 Defi 领域的创新。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。