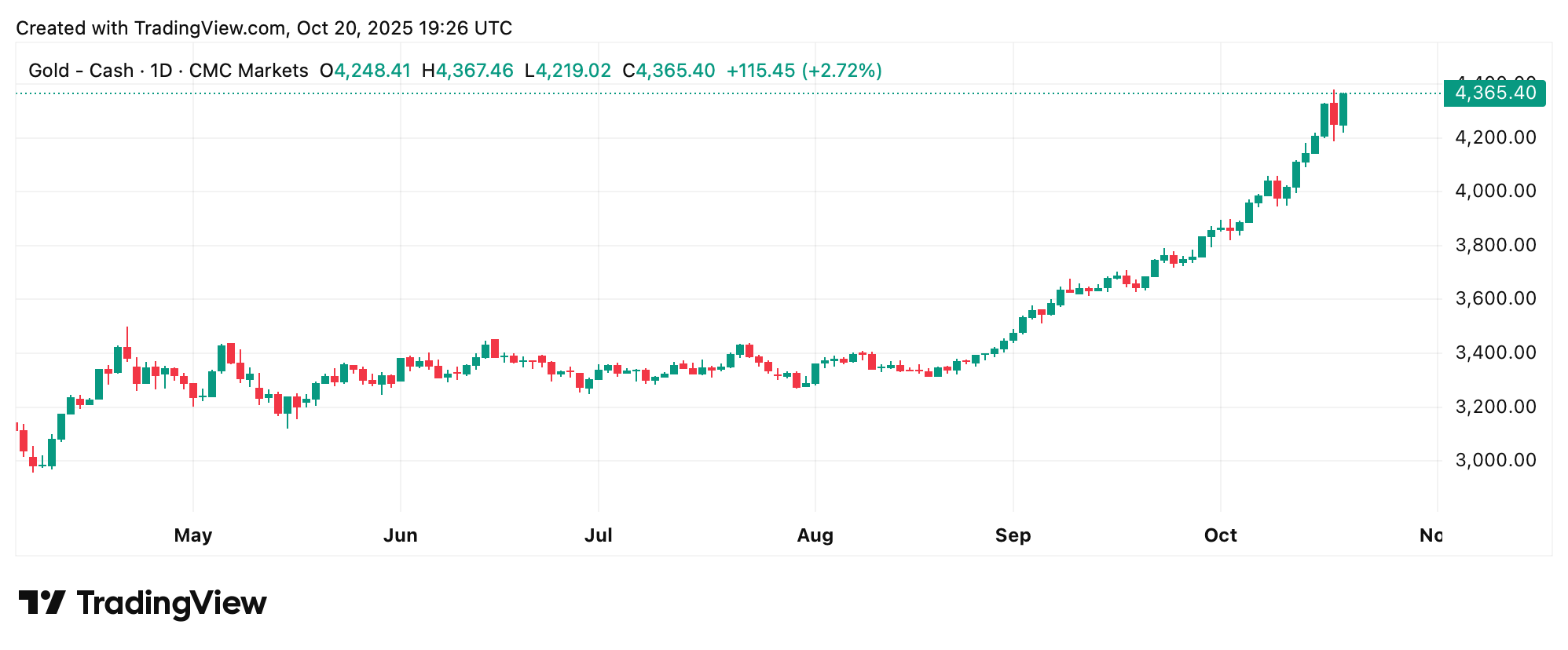

Gold’s got its groove back—climbing 2.48% against the U.S. dollar on Monday after a quick dip. Even with that glittering rebound, Sagar Khandelwal, strategist at UBS Global Wealth Management, thinks the shiny metal still has room to climb, calling for gold to hit a dazzling $4,700 per ounce.

After tapping an all-time high of $4,376 per ounce, gold took a breather and slipped to $4,233 on Sun. afternoon. Fast forward to today, and it’s strutting back up 2.48%, with each ounce fetching $4,365 as of 3:26 p.m. Eastern time. Silver’s playing sidekick, up 0.70% over the past day at $52.30 per troy ounce.

Platinum’s showing off with a 2.24% boost, while palladium’s keeping pace with a 2.69% climb. Even with gold’s recent cooldown, plenty of market watchers still expect the yellow metal to keep blasting higher—and UBS strategist Sagar Khandelwal remains convinced it’s got plenty of sparkle left in the tank.

“Gold has risen over 60% this year, outperforming all major asset classes, with the U.S. government shutdown and renewed trade tensions injecting fresh momentum into the trade,” Kitco reported on Monday. Khandelwal stressed that Given gold’s knack for marching to its own beat—rarely syncing with stocks or bonds, especially when markets get twitchy—UBS favors “a mid-single-digit exposure to gold in a well-diversified portfolio.”

Gold’s latest rebound has investors buzzing, and with platinum and palladium also glinting brighter, the metals market is anything but dull. Analysts say the yellow metal’s independence from equities and bonds gives it a steady edge when markets wobble. For those eyeing balance and a bit of sparkle, UBS’s pitch might just be the portfolio glow-up everyone’s looking for. Khandelwal believes a fresh peak is within reach.

The UBS Global Wealth Management strategist added:

“Finally, as economic, geopolitical, and policy uncertainties remain, we expect continued flows into the yellow metal, which could spur additional gains toward our upside case of USD 4,700/oz.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。