原创 | Odaily星球日报(@OdailyChina)

作者 | 叮当(@XiaMiPP)

10 月 18 日,币安 Alpha 上线的新币 Astra Nova(RVV)引起广泛争议。上线数小时内,项目方相关钱包被发现持续抛售代币,RVV 价格从最高约 0.03 美元 暴跌至 0.007 美元,跌幅高达 76%。刚上线币安,就如此明目张胆“出货“的项目在加密行业并不多见。Astra Nova 为何成为这样的典型?

AI、沙特与“宏大叙事”的开场白

Astra Nova 自称总部位于沙特利雅得,是一个以 AI 为驱动的 Web3 娱乐生态,核心聚焦于游戏、NFT 与创作者工具。成立于 2020 年的它,被定位为“沙特王国首个 AI 娱乐生态”,愿景是将 AI 生成内容、区块链与玩家叙事融合,打造出“新时代的数字娱乐王国”。

10 月 16 日,币安宣布上线RVV 代币预售活动。该活动目标是筹集 172.1 枚 BNB,但却收到 了 90,612 枚 BNB,超募 520 倍。一时之间,RVV 似乎成为了“明星项目”。

Astra Nova 还曾宣布完成 4,830 万美元融资,其中 4,160 万美元 来自最新战略轮。参与方据称包括沙特、阿联酋与巴林的家族办公室和机构投资者。在当前融资环境下,这样的数字颇具吸引力。

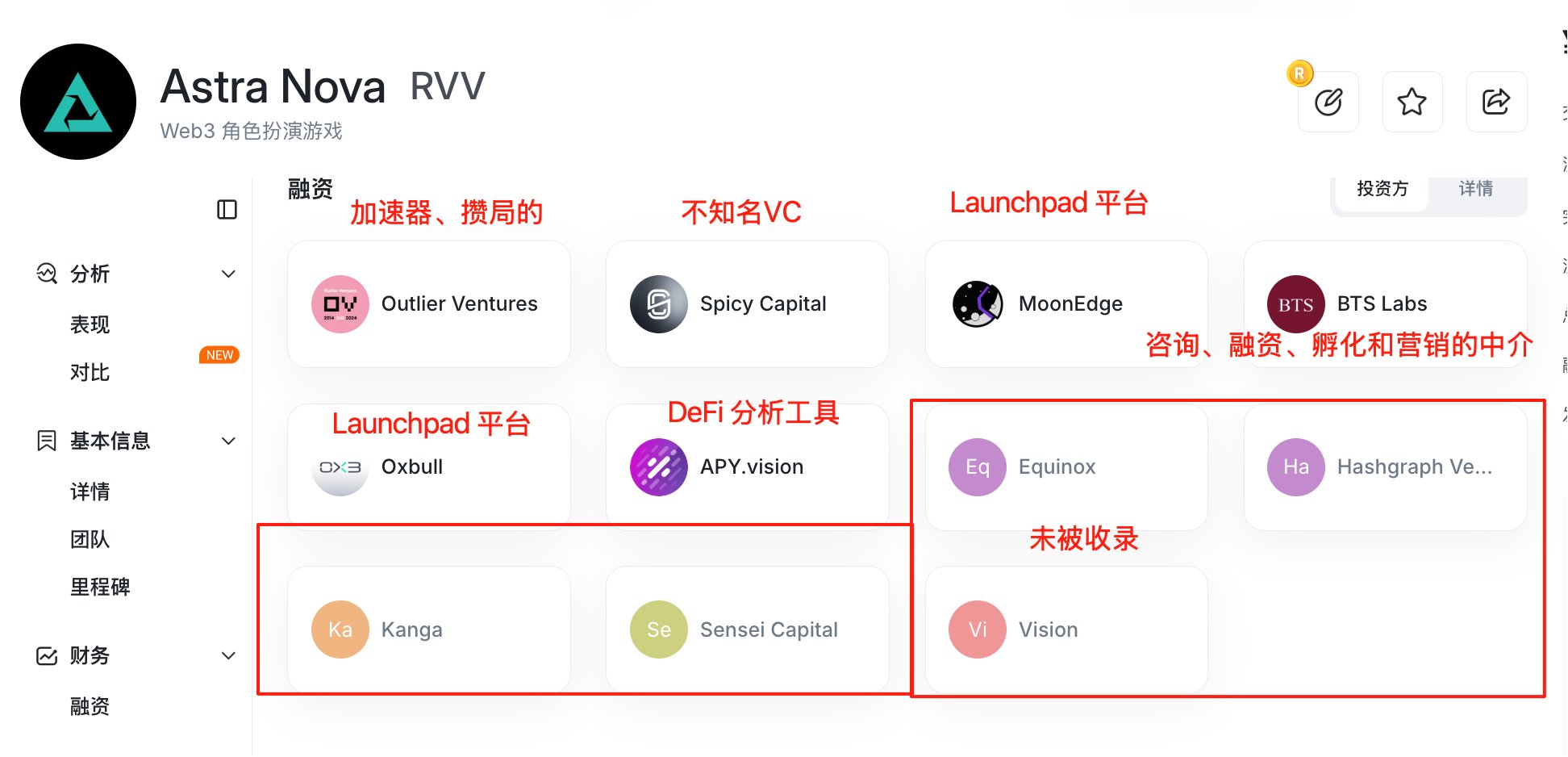

然而,加密 KOL@cryptobraveHQ 在披露的投资方名单中却发现,没有任何知名加密机构参投,而唯一叫得上名号的就是加密孵化机构 Outlier Ventures。

“AI + 中东 + 大融资”的外衣,似乎遮盖了某种空洞的实质。

空投规则突变,信任崩塌的前奏

Astra Nova 项目方原本承诺,将通过积分系统公平分配 3% 的代币作为空投奖励。用户可通过持有 NFT、质押或参与任务累积积分。

风波始于 10 月 18 日上线前一小时。项目方突然宣布修改规则,仅限积分榜前 15,000 名用户获得空投奖励,背离了原先广泛宣传的 3%代币分配计划。甚至,数千名真实用户发现自己在积分榜上的排名集体“后移”约 15,000 名——许多原本位列前 500 的忠实参与者(包括 NFT 持有者和长期质押者)一夜之间被挤出榜单,未能获得任何奖励。

社区迅速在 X 平台上爆发质疑,怀疑项目方通过机器人账户操控榜单、套取空投份额。更严重的是,项目方承诺的 7 个 NFT + 3 个特别版奖励 从未兑现。随着质疑声浪升高,Astra Nova 的 Discord 与 Telegram 群组被相继锁定,沟通渠道几乎中断。

与此同时,参与预售的用户原定在 TGE 时解锁 50% 代币,但项目方又临时更改规则:改为 7 个月悬崖期(cliff)+ 12 个月归属期(vesting)。这一变更意味着用户短期内无法出售代币,资金被长期锁定,进一步引发社区不满。

暴跌与“黑客事件”:谁动了手?

10 月 18 日,币安 Alpha 在上线 RVV 代币,正式开启交易。初始供应 100 亿枚,流通供应部分解锁。价格刚开始短暂上涨,但是很快出现异常。疑似团队地址开始大量抛售,流动性迅速枯竭。

币安 Alpha 随后紧急下架代币,理由是“技术不兼容”或“潜在黑客风险”,堪称是币安历史上最快的下架速度。不过代币期货合约仍在继续,这导致散户在高杠杆下持续爆仓。于是,社区纷纷指责币安审核不严。

在社区的炮轰下,Astra Nova 随后发声明称,“第三方做市商账户遭黑客入侵”。攻击者控制账户后开始抛售资产。团队表示,事件发生后已第一时间通知所有交易所合作伙伴,并确认项目智能合约与基础设施完全安全且经过审计。目前,团队正与链上安全分析机构合作追踪资金流向,并将在证据收集完成后移交执法部门处理。

当前,现货已无法交易,合约仍存风险。Astra Nova 项目方称,将从市场上回购与受影响数量相同的代币。

针对 Astra Nova 的此次黑客攻击事件,社区却不乏团队“监守自盗”、“自导自演”的声音。

余烬:哪个黑客会把偷来的钱换成 USDT 再转进中心化交易所?

链上分析师余烬称,约 8.6 亿枚的 RVV (总量的 8.6%) 从项目方铸币合约转出后,在链上被抛售,致使 RVV 严重下跌。这 8.6 亿枚 RVV 被出售换得了 1028.8 万 USDT,其中 822.6 万 USDT 被转进了 Gate 和 Kucoin,另外 204.1 万 USDT 还在链上钱包 0x643。项目方发推说是被盗了,不过我个人表示怀疑。哪个黑客会把盗取的资产换成 USDT 并持有呢?而且还直接转进 CEX。USDT 是可以被冻结的。

AB Kuai.Dong:同时得罪交易所、二级投资者、机构、博主

加密 KOL @AB Kuai.Dong更是直言,Astra Nova 同时得罪了交易所、二级投资者、机构、博主。该项目不光明牌链上砸盘,被币安紧急弹窗提示风险,还以交易所要求的名义,强行修改了所有投资者的解锁方式。

甚至更爆料称,Astra Nova 的做法并非个例,其之前在与一些做市商的接洽中就得知一套“砸盘套利”策略:如果项目能上线币安 Alpha 并开放合约交易,已是重大利好,上其它大所已是无望。那么与其被空投抛压砸盘,不如项目方加入进去一起去砸。最终合约 + 砸池子赚的,肯定大于缴的上币保证金。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。