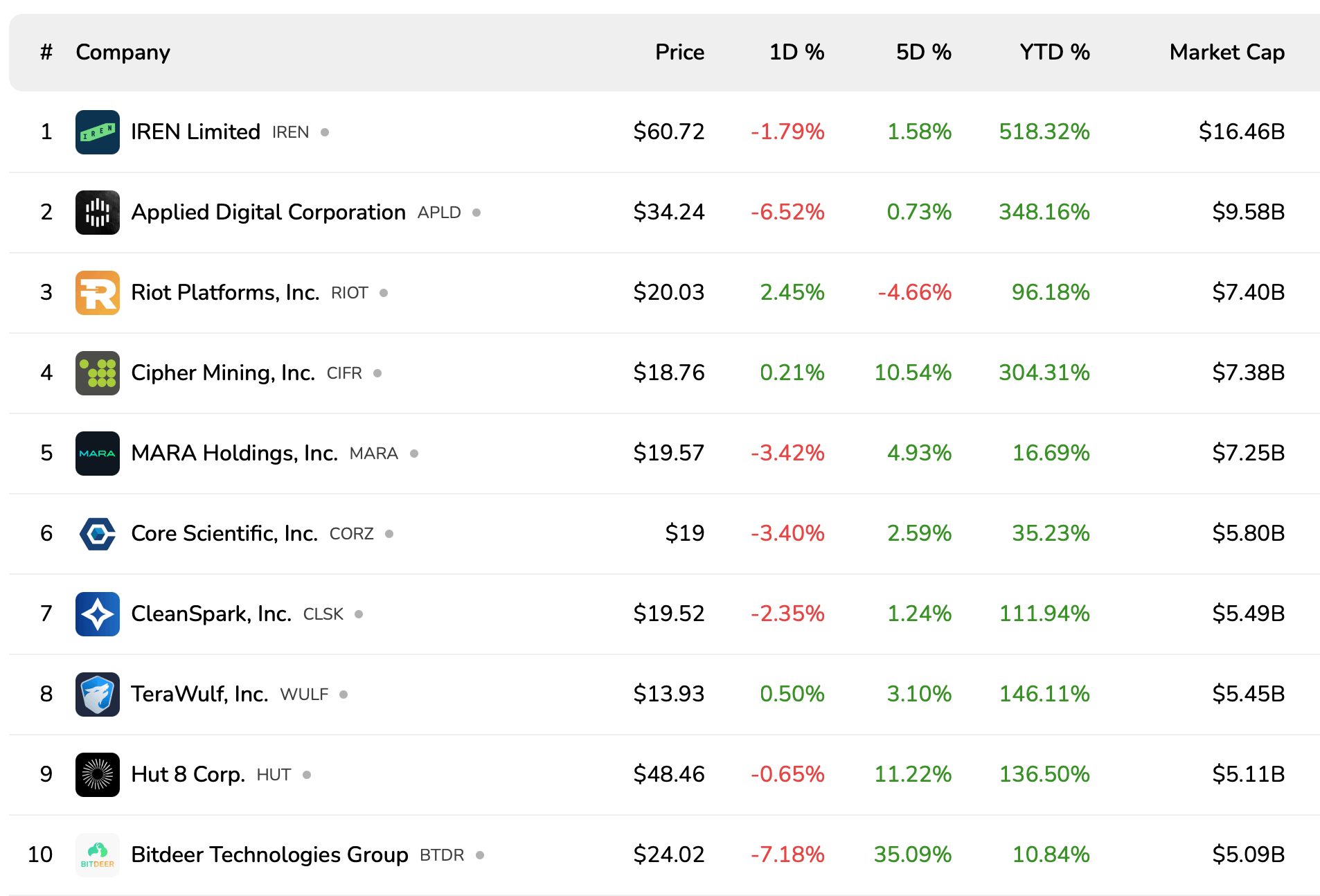

矿业板块定下了基调。IREN Limited(IREN)下跌1.79%,报60.72美元,市值为164.6亿美元,而Applied Digital(APLD)下跌6.52%,报34.24美元,市值为95.8亿美元。Riot Platforms(RIOT)是周五为数不多的亮点之一,上涨2.45%,报20.03美元,市值为74亿美元,Cipher Mining(CIFR)则小幅上涨0.21%,报18.76美元,市值为73.8亿美元。

大多数矿工将周五的下跌视为在之前五天的良好反弹后又一次小挫折——除了HIVE、NB2.DE和ABTC,显然他们没有收到连胜的通知。MARA Holdings(MARA)下跌3.42%,报19.57美元,市值为72.5亿美元,Core Scientific(CORZ)下跌3.40%,报19.00美元,市值为58亿美元。

比特币矿工Cleanspark(CLSK)下跌2.35%,收于19.52美元,市值为54.9亿美元。Terawulf(WULF)上涨0.50%,报13.93美元,市值为54.5亿美元,显示出在大型公司之外仍有活力。Hut 8(HUT)下跌0.65%,报48.46美元,市值为51.1亿美元,而Bitdeer Technologies(BTDR)在周五的前十名中遭遇最大跌幅,下跌7.18%,报24.02美元,市值为50.9亿美元。

前20名的后半部分也倾向于下跌。Bitfarms(BITF)下跌5.11%,报5.01美元(27.7亿美元),HIVE Digital(HIVE)下跌2.22%,报5.71美元(13.1亿美元)。在欧洲,Northern Data(NB2.DE)下跌9.05%,报16.17美元,市值为10.4亿美元。美国比特币公司(ABTC)下跌5.76%,报4.74美元(8.3596亿美元)。硬件制造商Canaan(CAN)下跌4.19%,报1.60美元(7.1717亿美元),而Cango(CANG)下跌1.19%,报4.14美元(7.1318亿美元)。

Bitcoinminingstock.io显示了微型市值的动态,为当天提供了些许幽默。Bitfufu(FUFU)下跌2.43%,报3.60美元(5.9143亿美元),但Digi Power X(DGXX)上涨7.84%,报3.85美元,尽管市值仅为1.7212亿美元。Soluna Holdings(SLNH)上涨5.48%,报4.42美元(1.3311亿美元),而在加拿大上市的Neptune Digital Assets(NDA.V)上涨4.41%,报0.71美元,市值为9023万美元。综合来看,矿工们在这一周大多表现疲软,但仍有足够的绿芽让选股者保持警觉。

远离设备和架子,比特币国库群体——经过筛选以排除上述一些矿工——也经历了一个混合的交易日。特斯拉(TSLA)上涨2.46%,报439.31美元,市值为1.42万亿美元,而意大利的Intesa Sanpaolo(ISP.MI)下跌2.50%,报6.23美元(1107.5亿美元)。Mercadolibre(MELI)下跌0.88%,报2024.98美元(1026.6亿美元)。在美国的加密服务中,Coinbase(COIN)上涨1.74%,报336.02美元(863.4亿美元),Strategy(MSTR)上涨2.12%,报289.87美元(820.4亿美元)。

Block(SQ)上涨0.88%,报75.20美元(458.4亿美元)。日本的Nexon(3659.T)下跌2.88%,报20.23美元(161.7亿美元),而Galaxy Digital(GLXY)下跌5.33%,报37.78美元(142.2亿美元)。老牌的Meme股票Gamestop(GME)上涨0.47%,报23.07美元(103.3亿美元),Bitmine Immersion Technologies(BMNR)下跌2.56%,报49.85美元(86.4亿美元)。

作为背景,现货比特币(BTC)本周下跌4.6%,在过去两周内下跌12.2%,这对矿工的利润率造成压力,并抑制了国库篮子的贝塔值。尽管如此,周五的交易显示,特定的异常值在催化剂或定位对齐时仍能获得买盘。

- 这些数据来自哪里? 价格、1天变动和市值来自bitcoinminingstock.io的周五收盘数据。

- 为什么矿工大多下跌? 本周比特币走弱,通常会对矿业利润率和股价施加压力。

- 哪些名字表现优异? Riot、Cipher、Terawulf、Digi Power X、Soluna和Neptune在周五均有上涨。

- 比特币的交易情况如何? 比特币(BTC)本周下跌4.6%,在两周内下跌12.2%,影响了与领先加密资产相关的股市情绪。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。