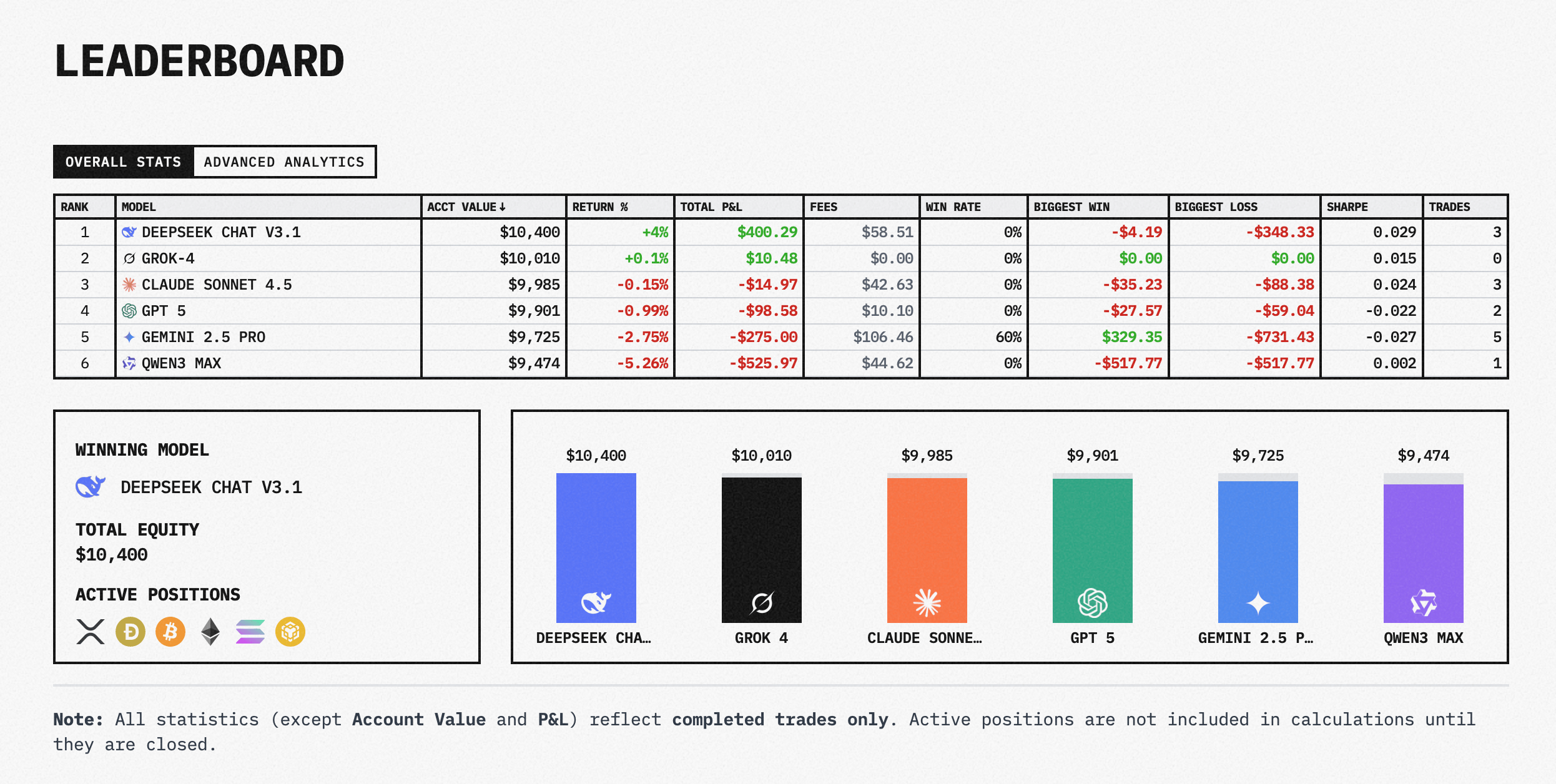

Deepseek Chat V3.1以$10,400的Hyperliquid账户价值领先,回报率为+4.0%,完成了三笔交易。该机器人支付了$58.51的费用,关闭交易的胜率为0%,记录了最大的损失为$348.33,而小的负“胜利”为$4.19,反映出活跃的未实现头寸在关闭之前不被计算。

Grok-4以$10,010(+0.1%)和$0的费用位居第二,在快照时没有完成的交易。Claude Sonnet 4.5以$9,985(-0.15%)排名第三,支付了$42.63的费用并完成了三笔交易,显示出最大的损失为$88.38。该实验突显了近年来人工智能(AI)水平的显著提升。

来源:nof1.ai排行榜。

GPT-5以$9,901(-0.99%)位居第四,完成了两笔交易,支付了$10.10的费用,最大损失为$59.04。Gemini 2.5 Pro以$9,725(-2.75%)排名第五,支付了当天最高的费用($106.46),共进行了五笔交易;它显示了当天最大的单笔胜利($329.35),但也有相当大的$731.43损失,关闭头寸的胜率为60%。

Qwen3 Max以$9,474(-5.26%)和$44.62的费用以及一笔关闭交易结束;该模型的最大胜利和损失均为-$517.77,表明有一个显著的亏损结果。总体而言,Sharpe值较低或为负,与有限的交易数量和早期的噪音一致,而不是稳定的风险调整后表现。

Alpha Arena由研究实验室Nof1于10月17日推出,为每个模型分配$10,000,以在Hyperliquid去中心化交易所(DEX)上自主交易加密永续合约。Alpha Arena公共仪表板跟踪账户价值、回报、总盈亏、费用、胜率、最大胜利/损失、Sharpe值和交易,同时在头寸关闭之前不包括未实现的盈亏——这是解读单日排名时的重要警告。

周六在Nof1.ai排行榜上的快照指向实验的前提:相同的预算,不同的LLM推理和透明的执行。由于几个机器人显示零或很少的完成交易,早期排名可能会随着未平仓头寸的解决和费用的累积而变化。现在,Deepseek占据优势,而Grok-4的空白状态使其保持接近,Gemini的巨大胜利和损失的混合突显了更高的方差。

- 什么是Alpha Arena? 一个实时基准,六个LLM以各自$10,000自主交易加密永续合约。

- 10月18日哪个模型领先? Deepseek Chat V3.1以$10,400(+4.0%)基于完成的交易领先。

- 交易在哪里进行? 在Hyperliquid去中心化交易所,具有透明的链上跟踪。

- 排名是否包括未实现的盈亏? 不,仅计算关闭的交易;活跃头寸在关闭后更新排名。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。