The cryptocurrency market plunged on Oct. 16, with total market capitalization falling below $3.8 trillion. Leading the decline was bitcoin (BTC), which dropped to last seen during the Oct. 10 flash crash. The downturn, which began 48 hours earlier, was attributed by some analysts to investor caution ahead of a rumored speech by U.S. President Donald Trump. However, others linked the sell-off to reports of a continued impasse in Congress over a bill to end the government shutdown.

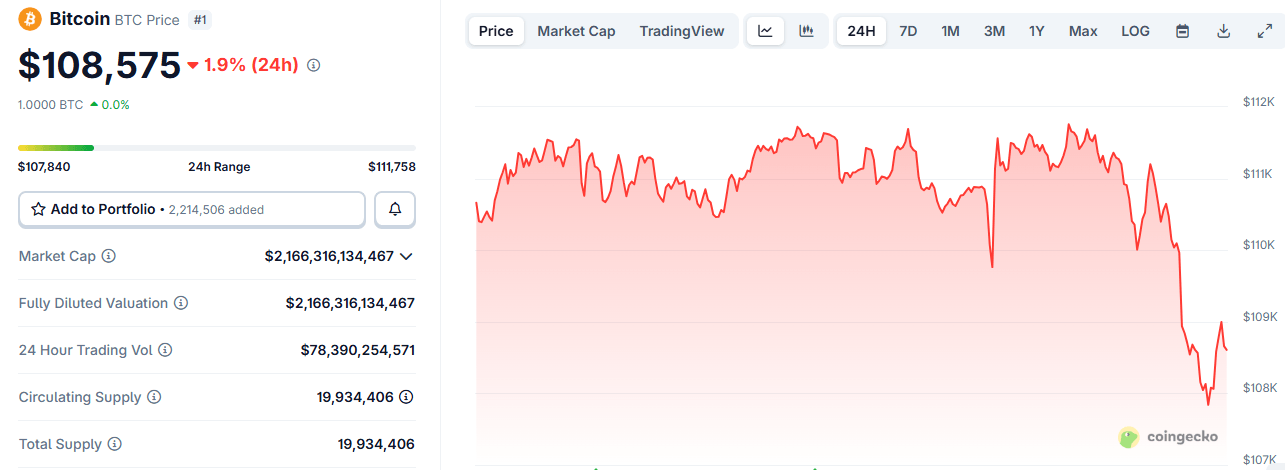

According to Bitstamp data, BTC hit a low of $107,625 around 12:35 p.m. EST, marking its lowest point in over six weeks. The drop pushed bitcoin’s weekly losses into double digits and left it roughly 5% below its Oct. 1 value of approximately $114,000.

Altcoins followed suit, with major tokens like ether ( ETH) and BNB falling 3.2% and 3.5% respectively over 24 hours, to $3,872 and $1,132. Other high-cap assets, including XRP, solana ( SOL), dogecoin (DOGE), and cardano ( ADA), also posted significant losses, while tron ( TRX) stood out as one of the few to register gains.

The sharp decline, meanwhile, triggered over $714 million in leveraged contract liquidations and affected nearly 220,000 traders within a 24-hour span. Coinglass data showed that Bitcoin alone accounted for more than $102 million in long liquidations in just one hour. The largest single liquidation occurred on Hyperliquid, where a BTC contract worth $9.78 million was wiped out. Total BTC-related liquidations surpassed $230 million, followed by $142.2 million in ETH positions.

On social media, the market-wide slump sparked fears of another wave of mass liquidations. However, those concerns appeared premature, as BTC had rebounded just above $109,000 and was climbing at the time of writing (1.20 p.m. EST).

- What caused the sharp drop in the cryptocurrency market? The downturn was linked to investor caution regarding a rumored speech by U.S. President Donald Trump and reports of a continued impasse in Congress over the government shutdown.

- How low did Bitcoin’s price fall during the crash? Bitcoin ( BTC) hit a six-week low of $107,625 around 12:35 p.m. EST, pushing its weekly losses into double digits.

- Which altcoins experienced significant losses, and which one stood out? Major altcoins like ether ( ETH), BNB, XRP, solana ( SOL), dogecoin (DOGE), and cardano ( ADA) all posted significant losses, while tron ( TRX) was one of the few to register a gain.

- What was the immediate financial impact on leveraged traders? The sharp decline triggered over $714 million in leveraged contract liquidations, affecting nearly 220,000 traders within a 24-hour span.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。