Source: "Yicai"

Written by: Wang Fangran

Edited by: Lin Jiechen

Introduction

"Is our project suitable for RWA in Hong Kong?" In a café in Nanshan, Shenzhen, several people gathered around a wooden table, and one of the representatives from the company opened the project book and asked seriously.

In recent months, such dialogues have been repeatedly staged in various cities in the Greater Bay Area.

RWA, Real World Assets-tokenization, refers to the transformation of real-world assets into tradable digital asset certificates (Tokens) based on blockchain technology.

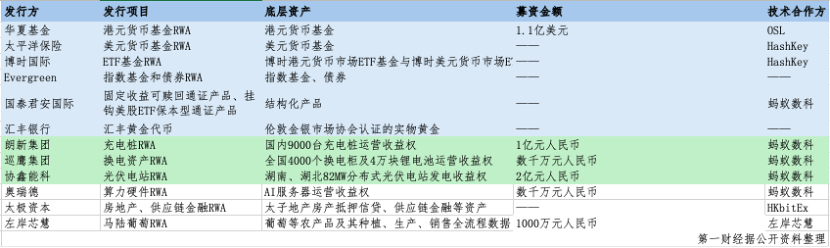

According to incomplete statistics from Yicai, in the past two years, more than 13 institutions have ventured into RWA, including well-known companies like Longxin Group, Huaxia Fund, and Pacific Insurance, with underlying assets covering new energy equipment, financial products, and even agricultural products. Behind them are technical support providers like Ant Group and OSL, jointly building a new pathway for "domestic assets - Hong Kong rights confirmation - global circulation."

Now, more companies are intensifying their efforts to lay out RWA, and the business volume of RWA consulting intermediaries has surged. In addition to financing purposes, listed companies are more focused on the diverse value of RWA. For example, paving the way for companies to go overseas, bringing brand exposure, and even boosting stock prices.

As the wave of RWA financing rises again, is there a risk of overheating? Several industry insiders have pointed out that not all assets are suitable for RWA. Even if the assets meet the standards, there are still risks in the early stages of the industry, such as high financing costs and uncertain financing effects.

Surge in RWA Transactions in Hong Kong

According to incomplete sorting by Yicai reporters, from 2024 to the present, there have been successful RWA cases involving 13 institutions or companies, including Longxin Group, Xunying Group, Huaxia Fund, and Pacific Insurance, with underlying assets including funds, bonds, physical gold, real estate mortgage loans, and agricultural products. Technical partners include Ant Group, OSL, and HashKey.

For example, Longxin Group's new platform, Xindian Tu, uses the revenue rights of charging piles as the underlying asset; Xiexin Energy Technology issues RWA based on the future revenue rights of photovoltaic power stations; Xunying Group and Aoride use battery swap asset revenue rights and AI server revenue rights as underlying assets, respectively. According to Hong Kong regulatory requirements, the aforementioned projects are not open to retail investors, limited to institutional or professional investors, and there is no secondary market trading, having completed fundraising ranging from tens of millions to 200 million yuan.

More and more companies are trying to replicate successful experiences. Zhang Jing (pseudonym), head of an RWA consulting investment institution, told reporters that recently, the enthusiasm of real estate companies consulting RWA has significantly increased, hoping to alleviate financial pressure through RWA financing by leveraging stable rental income from mature commercial real estate. Additionally, companies in the cultural tourism, trendy play, photovoltaic new energy, and charging pile sectors have also shown high interest.

Shenzhen-based law firm Mankun's partner, lawyer Shao Jiadian, told reporters that the consultation volume in the RWA field has risen sharply in the past year, with consulting parties including not only companies but also technical service providers, licensed managers, and some intermediaries engaged in resource matching.

According to RWA.xyz data, as of the end of July 2025, the total market value of global on-chain RWA assets has exceeded $25 billion (excluding stablecoins); institutions like Boston Consulting predict that by 2030, the RWA market size is expected to exceed $10 trillion.

Currently, several listed companies, including Longxin Group and Xiexin Energy Technology, are issuing RWA in Hong Kong. These listed companies have not disclosed specific details about the issuance of related RWA projects in their annual reports or announcements, including the stripped asset revenue rights and fundraising situations. Lawyer Shao Jiadian stated that if listed companies have not made relevant disclosures, it may be because they do not meet disclosure standards, or although decisions have been made and announcements issued, the topics are relatively routine and do not highlight a clear connection to RWA (real asset tokenization), thus specific details cannot be gleaned from the announcements.

Beware of Overheating Risks

Compared to traditional financing channels, RWA, as an emerging model, does not have an advantage in financing costs. Yicai reporters learned from several industry insiders that the total costs for issuing RWA projects in Hong Kong are usually no less than 2.5 million Hong Kong dollars, depending on the complexity of the project. Some institutions charge a commission of 3% to 5% when sponsoring the issuance, but some institutions waive this fee. In addition, issuers also need to promise investors a certain rate of return.

"The underlying assets are of a non-standard type, and the promised return generally needs to exceed 8%; if it is bond-type assets, it can be slightly lower. Otherwise, the product is hard to sell." An industry insider revealed that compared to some conventional financing methods, RWA financing costs are higher.

"There are not many cases that can really be implemented; we often find ourselves 'dissuading' people." Lawyer Shao Jiadian said that many people have misconceptions about RWA, thinking that once assets are on-chain, they will sell out quickly, even viewing it as a form of "mini IPO." However, the reality is far from this; the current difficulties mainly include two aspects: first, the high issuance costs, and many companies hesitate after learning about the actual expenses; more critically, the success of the issuance fundamentally depends on whether the assets can attract professional investors. Currently, such non-standard assets are only privately issued to professional investors in Hong Kong, who will strictly review core indicators such as project asset yield, safety, corporate credit, and debt-to-equity ratio.

Therefore, tokenization does not equate to successful fundraising. Planning to raise 50 million yuan may ultimately only secure around 10 million, not necessarily achieving the full amount. Once companies realize that the upfront cost investment does not guarantee a definite financing result, they often reassess whether to enter this field.

In a situation where neither financing costs nor amounts have significant advantages, why are many mainland companies still keen on RWA in Hong Kong?

"Rather than saying it's for financing, it's more about 'gaining momentum.'" An RWA information consulting intermediary told reporters that bank loans are relatively much cheaper, and most companies are not simply seeking financing but are focused on the diverse value of RWA. For example, paving the way for companies to go overseas, bringing brand exposure, and even boosting stock prices. Many companies have seen significant stock price increases after promoting RWA, and this "market value management" effect has been referred to by some market participants as "coin-stock linkage."

According to lawyer Shao Jiadian, currently, more listed companies are engaging in RWA:

First, they can afford higher intermediary fees; second, RWA issuance can provide listed companies with additional brand effects from coin-stock linkage, thus giving them more motivation to pursue RWA.

For example, on the second trading day after Aoride's RWA issuance (August 11), the stock surged 10% in a single day; Guotai Junan International launched its first batch of structured product tokens on August 26, and the stock rose over 15% on August 29; Xiexin Energy Technology, which had been struggling with low stock prices, saw its stock price double within three months after announcing a partnership with Ant Group, rising from 6.24 yuan/share on April 9 to a peak of 14.90 yuan/share on July 1; Longxin Group's stock rose from a low of 7.27 yuan/share in August 2024 to a peak of 26.07 yuan/share in June 2025, an increase of 2.6 times.

On the other hand, RWA indeed has the potential to activate "sleeping assets," reducing the resistance brought by high investment thresholds and long monitoring cycles in traditional models.

A cryptocurrency industry insider told reporters that even for relatively simple bank loans, financial statements and collateral evaluations must be submitted, and approval may take 1 to 2 months. In contrast, RWA can achieve full-process digitization through blockchain and smart contracts, reducing intermediary steps and manual operations. Asset rights confirmation can be completed through on-chain connections to official databases, and issuance and revenue distribution rely on contracts for automatic execution, with information disclosure updated in real-time on-chain without offline reporting, significantly shortening the overall process and time.

Not Everything Can Be RWA

However, in practical operations, pursuing RWA in Hong Kong is not easy.

According to Zhang Jing, mainland companies must first confirm the rights of domestic assets and operational rights through a domestic alliance chain, then establish a Special Purpose Vehicle (SPV) company in Hong Kong, which will hold the relevant domestic assets and operational rights and conduct tokenization financing in the form of stablecoins. In this process, the scale of domestic assets should ideally reach over 300 million yuan, as the financing costs for RWA in Hong Kong generally exceed 1 million yuan. If the fundraising scale is too small, it may not be cost-effective. Additionally, it is important to note that the issued RWA needs to have buyers; some photovoltaic projects may need to provide a dividend return of 5% to 10% annually. Meeting these conditions is challenging for most companies.

Not all assets are suitable for RWA. In the Hong Kong Monetary Authority's "Ensemble" sandbox project, "fixed income and investment funds, liquidity management, green and sustainable finance, as well as trade and supply chain financing" are clearly defined as the four major themes of RWA.

Among them, physical assets with digital twin attributes that can achieve real-time synchronization of business data through technologies like the Internet of Things (e.g., charging piles, battery swap stations, distributed photovoltaics) are easier to track, settle, audit, and evaluate their underlying asset cash flow returns, aligning better with the characteristics of crypto assets being "decentralized" and "transparent"; while assets with applications in green environmental protection and energy conservation are more in line with the guiding direction of industrial policies.

Recently, the "RWA Industry Development Research Report - Industry Section 2025" (hereinafter referred to as the "Report") jointly released by the Hong Kong Web3.0 Standardization Association, Hong Kong Polytechnic University, and other institutions shows that not all assets are suitable for RWA tokenization, and the notion that "everything can be RWA" is a fallacy. Successfully achieving large-scale implementation of assets needs to meet three major thresholds: value stability, clear legal rights confirmation, and verifiable off-chain data.

Even if the underlying assets meet the conditions, RWA still faces strict regulatory requirements.

The "Report" indicates that RWA is still in a stage where "overlapping" and "gaps" in regulation coexist. Regulatory agencies can clarify classification and regulatory logic based on the existing regulatory frameworks for securities, commodities, and credit, according to the attributes of RWA underlying assets, yield structures, and market circulation levels, establishing a "penetrating + function-oriented" compliance path to connect the entire process of asset digitization, assetization, and tokenization.

Zhao Wei, a senior researcher at OKX Research Institute, told Yicai reporters that the key to risk control lies in enhancing transparency and strengthening custody mechanisms. If there is insufficient regulation or a lack of transparency, RWA may accumulate systemic risks.

Zhao Wei believes that for assets suitable for standardization and on-chain management, the quality of underlying assets, cash flow distribution, and asset pool composition should be as much on-chain as possible and remain traceable to avoid "black box" information asymmetry. Meanwhile, off-chain custody and independent audits are indispensable to ensure that tokens strictly correspond to real assets. In terms of regulatory pathways, a layered approach can be adopted, incorporating different types of RWA into corresponding regulatory frameworks based on asset attributes. In the early stages, it can be limited to qualified traders, gradually reducing risk exposure.

"Currently, the RWA model in Hong Kong is legally compliant under the existing regulatory framework and is regulated." Lawyer Shao Jiadian stated, but investors need to be aware that RWA products are not without risks.

First, the underlying assets themselves are not risk-free. Most of these products sell future revenue rights, and the future returns of the assets are not guaranteed. Second, there are differences in the RWA issuance structures designed by different projects in the market, and whether these structures are fully compliant, can adapt to local regulations, and effectively protect investor rights varies significantly and is even subjective. Finally, the issuers or platforms of RWA projects may also have performance risks; there have already been some default scandals involving RWA issuance platforms in Europe and the United States.

Therefore, lawyer Shao Jiadian stated that risks may arise from the assets themselves, from the design of the transaction structure, or even from the credit of the issuer or platform. Investors should rationally view the so-called "asset endorsement" and should not blindly believe that "having underlying assets is absolutely safe."

Amidst a backdrop of market overheating, recent reports from Reuters, citing two informed sources, indicate that Chinese securities regulators have advised some domestic brokerages to suspend their real-world asset (RWA) tokenization businesses in Hong Kong. However, this information has not been confirmed.

Can It Be Used for the Return of Chinese Stocks?

As RWA gains momentum in Hong Kong, in the United States, stock tokens have become the most popular asset class within RWA due to their clear underlying assets and high recognition.

On June 30, 2025, the American online brokerage Robinhood and the U.S. cryptocurrency exchange Kraken announced the launch of U.S. stock tokenization products on the same day, supporting trading of popular U.S. stocks and ETFs such as Nvidia, Tesla, Apple, and Microsoft, providing users with 24/7 trading services. Additionally, centralized cryptocurrency exchange Bybit, along with decentralized platforms like Raydium and Art.fun, have also launched stock tokenization products.

The surge in U.S. stock tokenization has sparked discussions in the market about tokenization of Hong Kong stocks. In July 2025, Hong Kong Legislative Council member Paul Tse stated in an interview, "Some have raised related topics, but it is still in the preliminary stage."

However, this process may face challenges. A senior Web3.0 practitioner told reporters that if Hong Kong stock tokenization is pursued, it essentially serves as a price mapping and does not fundamentally change the registration and trading methods of stocks on the Hong Kong Stock Exchange. The real-name holders of the stocks remain the brokerages or professional investors, and actual trading continues to occur within the existing Hong Kong Stock Exchange system.

On-chain tokens do not represent the stocks themselves; they are merely a price tracking tool or a promise of redemption from the issuer to the on-chain holders. From a legal perspective, there are currently no significant obstacles, but there may be some difficulties in regulatory attitudes. In addition to legal and technical constraints, U.S. stocks have more popular targets suitable for tokenization (such as Nvidia and Apple), making it easier to attract users and traffic, while the Hong Kong stock market lacks comparable heat and appeal in this regard.

Some believe that RWA provides a new idea for the return of Chinese stocks. Zhao Wei told Yicai reporters that RWA indeed offers a new exploratory direction for the return of Chinese stocks. Compared to traditional secondary listings, RWA has higher flexibility on a technical level, theoretically allowing for the mapping of overseas assets to the Hong Kong market with lower thresholds and faster speeds, thereby expanding trading liquidity and the trader base.

According to Wind Information, as of now, there are still 406 Chinese companies listed on U.S. exchanges, with a total market capitalization of $1.1 trillion. Among them, leading Chinese stocks like Alibaba (NYSE: BABA, 09988.HK) and JD.com (NASDAQ: JD, 09618.HK) have already conducted secondary or dual listings in Hong Kong, but several well-known companies have yet to "return."

Goldman Sachs estimated in April that 27 Chinese stocks are expected to return to Hong Kong for listing, with a total market capitalization exceeding 1.4 trillion Hong Kong dollars. These 27 Chinese stocks include Pinduoduo, Manbang, Futu, Legend Biotech, Vipshop, and Zeekr.

Zhao Wei believes that for stock tokenization to truly scale, there are still many challenges. The first is regulatory recognition; if tokens directly correspond to stock rights, they inevitably touch upon the securities law framework, with cross-border compliance and trader protection being core aspects of institutional design.

Secondly, there is the reliability of the technology, especially in the areas of rights confirmation, custody, clearing, and settlement. Ensuring that on-chain tokens strictly correspond to off-chain assets still lacks mature paradigms. Additionally, market acceptance will take time to cultivate, as institutional traders are particularly sensitive to compliance and risk.

Furthermore, the market is exploring more directions. Zhao Wei told Yicai reporters that the development of RWA often aligns with the hotspots of the real economy. For instance, cross-border financial products are an important breakthrough.

As an international financial center, Hong Kong can leverage RWA to bring more bonds and fund shares on-chain, thereby serving traders in Asia and globally. In terms of equity assets, short-term developments may be limited to pilot programs, but as the regulatory framework gradually clarifies, related explorations are also worth paying attention to.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。