Author: Arnav Pagidyala

Source: Bankless

Translation: Shan Ouba, Golden Finance

The pre-IPO market has always been an insurmountable chasm for retail investors.

With a six-figure investment threshold, inflated valuations, a lock-up period of up to a year, high fees, and an opaque pricing mechanism, it has become one of the most inaccessible sectors in finance. Now, with companies like Circle, Figma, and Bullish going public, developers in the crypto space are rushing to democratize the private market through tokenization and perpetual contracts. But the problem is: they are building derivative tools on a market that is itself nearly dysfunctional.

Without a sufficiently liquid, real-time trading spot market as a foundation, these solutions not only fail to address the fundamental issues but may also lead to significant losses for retail investors in the process. The superficial appeal is evident: converting illiquid stocks into tradable tokens, using decentralized exchanges as oracles for perpetual contracts, seemingly allows retail investors to participate instantly.

However, the real opportunity does not come from the piling up of financial engineering but from solving a core problem that has remained unsolved for over a decade — creating a functioning spot market for pre-IPO stocks. All other attempts are merely irrelevant noise.

I. Current Landscape of the Pre-IPO Market

The pre-IPO market can be broadly divided into two segments: platforms aimed at institutions and those aimed at retail investors. Among them, institutional platforms represented by Nasdaq Private Market and Forge dominate over 90% of the market share, completely controlling the industry landscape.

(A) Platforms for Institutions

1. Broker/Trading Market Model (Taking Forge as an Example)

Operational Mechanism: Forge operates through its broker-dealer subsidiary registered with the Financial Industry Regulatory Authority (FINRA). Most transactions are coordinated by brokers — they acquire large blocks of stock from company employees, funds, or early investors and then seek institutional buyers. Unlike real-time public order books, brokers typically take 2-6 weeks to match large trades between institutional buyers and sellers through private negotiations.

Advantages:

No balance sheet risk: The platform does not hold stock inventory;

Direct ownership: Buyers receive actual company shares, not derivatives;

Very low counterparty risk: Transactions are executed through regulated broker-dealers, with custodial and company transfer approval processes in place to ensure compliance;

Scalability and exclusive channels: Brokers maintain long-term partnerships with funds, banks, and issuers, allowing them to access large stock resources and provide buyers with opportunities for "exclusive participation in large trades."

Disadvantages:

Opaque pricing: Transactions are completed through private negotiations, often resulting in significant price discrepancies between quotes and fair prices;

Long settlement periods: Typical transactions take weeks rather than days to complete, failing to meet the need for quick liquidity;

High fees: Broker commissions of 2%-5% erode profits for both buyers and sellers;

Retail investors are excluded: The six-figure (usually over $100,000) investment threshold, combined with company restrictions on stock transfers, completely bars retail investors;

Company approval bottlenecks: Issuers have the right to block or delay stock transfers;

Liquidity remains scarce: Despite being labeled as a "trading market," actual liquidity is thin and unstable, with trading opportunities being sporadic;

Minimum holding period restrictions: According to the SEC's Rule 144, most private company stocks must meet a minimum holding period requirement of at least 12 months before they can be legally resold.

2. Company Authorized Liquidity Programs (Taking Nasdaq Private Market as an Example)

Operational Mechanism: Platforms like Nasdaq Private Market (NPM) and Carta Liquidity conduct tender offers, stock buybacks, or secondary market trading plans approved by the issuer. These transactions are not ongoing market activities but rather structured, periodic events — typically occurring 1-2 times a year, synchronized with major company financing activities. After obtaining board approval and legal compliance confirmation, the platform opens a trading window for 2-6 weeks, during which eligible shareholders can sell their stocks; the company aggregates buyer quotes, determines a clearing price, and executes trades in bulk.

Advantages and Disadvantages: Essentially consistent with the aforementioned "Broker/Trading Market Model," the core difference is that the "Company Authorized Plan" is a "structured, time-limited event," with the issuer's participation ensuring lower fees and clearer management of equity structure.

It is important to note that the ability of institutional platforms to dominate the pre-IPO market is primarily due to the fact that almost all large private companies require stock transfers to be approved by the company in their shareholder agreements. Every secondary market transaction must be manually approved by the issuer, and more than half of the applications are typically rejected. Additionally, each transaction requires mediation by brokers, legal review, company coordination, and compliance checks, making the costs of small transactions far exceed the benefits, rendering them economically unfeasible. This structural friction has given rise to the current pre-IPO platforms aimed at retail investors — most of which adopt a special purpose entity model to attempt to circumvent the conventional transfer approval processes.

(B) Platforms for Retail Investors

3. Inventory/Self-Operated Model (Taking Linqto as an Example)

Operational Mechanism: The platform first acquires pre-IPO stocks from company employees, early investors, or funds (taking on inventory risk), then splits the stocks into fractional shares and resells them to retail investors.

Advantages: The retail investor onboarding process is simple, allowing for instant transactions.

Disadvantages: The platform bears high balance sheet risk and profit margins; there may be compliance loopholes; investor protection measures are weak; there is no secondary market for exit.

4. SPV Aggregation Model (Taking EquityZen, AngelList-type Transactions as Examples)

Operational Mechanism: Funds from multiple qualified retail investors are pooled into an SPV, which then collectively acquires large blocks of pre-IPO stocks.

Advantages: Lowers the investment threshold, with risks shared among multiple investors, resulting in lower inventory risk for the platform.

Disadvantages: High fees; no secondary market; inadequate investor protection measures.

In summary, the choices in the pre-IPO market essentially boil down to "either/or":

Institutional channels: Completely inaccessible to retail investors;

Retail channels: Plagued by issues of unfair pricing, high fees, lack of exit routes, and inadequate investor protection.

So, can tokenization and perpetual contracts really solve these problems?

II. Pre-IPO Perpetual Contracts: Too Early

With the implementation of Hyperliquid's HIP-3 proposal, launching a pre-IPO perpetual contract DEX has become a necessary condition. But the real challenge lies in the oracle — specifically, where to obtain reliable pricing data and how to acquire it.

As mentioned earlier, trading in the pre-IPO spot market is slow, pricing is opaque, and it is primarily dominated by brokers, with no real-time pre-IPO price data source available.

Taking Ventuals (a new pre-IPO perpetual contract platform based on HIP-3) as an example, its founder John stated that the platform uses a combination of off-chain data (Nasdaq Private Market prices, 409A valuations, etc.) and an 8-hour moving average of perpetual contract prices as the pricing basis.

It should be noted that when the 409A valuation report is released, the data may be up to 90 days outdated. More critically, 409A valuations are often intentionally suppressed — the goal is to set a lower fair market value (FMV) for employee stock options (ESO), thereby reducing the tax burden when employees receive equity incentives. Therefore, the 409A valuation is not the fair price of the stock in the public market; its value is often only 1/4 of the latest round of primary market financing valuation.

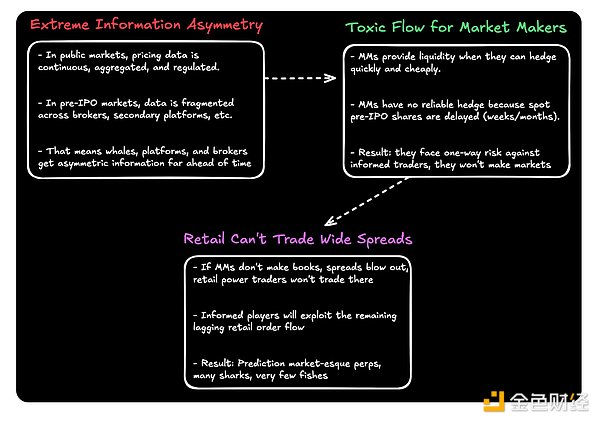

Based on this, I believe that the operational model of early pre-IPO perpetual contract platforms is closer to a prediction market — in such markets, harmful order flow is not a flaw but a norm. The reasons are as follows:

In short, the pre-IPO market attracts a large number of informed traders — at least including brokers, secondary market funds, and platform operators. For market makers, this leads to the harmful order flow problem: without a real-time spot market, they cannot hedge to offset risks. The outcome is predictable: market makers are unwilling to quote, the bid-ask spread widens, and retail investors ultimately lose all interest in trading.

III. Why Tokenization of Pre-IPO Stocks Currently Does Not Work

Since perpetual contracts face the dual problems of oracles and harmful order flow, would skipping the derivatives layer and directly tokenizing pre-IPO stocks — deploying stocks on-chain and using DEX prices as real-time oracles, allowing market makers to actually hedge positions — solve the problem?

The answer is no. Tokenization cannot fundamentally solve any core issues in the pre-IPO market. Whether it is high fees, slow execution efficiency, or high investment thresholds, they are essentially the result of poor market design and strict regulatory constraints. Simply tokenizing stocks does not address any of these issues.

Before advancing tokenization, platforms must first resolve the following key questions:

How to scale the acquisition of pre-IPO stocks without taking on inventory risk?

How to attract market makers to provide liquidity and build an order book?

Investor protection is core: What is the "debt" that investors actually own? Does the SPV have bankruptcy isolation capabilities? Is the platform compliant?

Other related compliance and operational issues.

Creating a spot market for pre-IPO stocks is the biggest challenge that has remained unsolved for over a decade.

Only when the underlying spot market structure is repaired can tokenization truly create value. At the current stage, tokenization will only amplify the flaws of a poor market structure.

IV. Social Acceptance

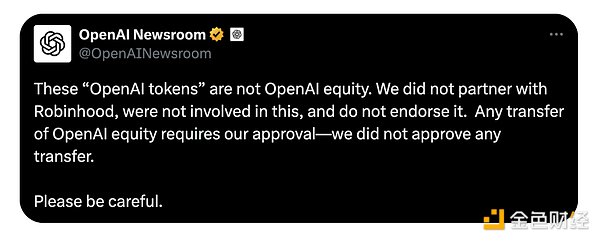

Moreover, for tokenization of pre-IPO stocks to achieve scale, recognition from the underlying companies (i.e., stock issuers) is required — but currently, this seems almost impossible.

If issuers believe that tokenization of pre-IPO stocks will severely harm their interests, they may declare the stock units corresponding to the relevant tokens invalid. Ultimately, retail investors who purchase these tokens are often the last to know that their funds are facing such risks.

Regulators are also highly vigilant regarding tokenized securities. Recently, the European Securities and Markets Authority and the World Federation of Exchanges jointly called on the U.S. SEC to strengthen its regulation of tokenized stocks — it is important to note that the complexity of tokenized stocks is an order of magnitude lower than that of pre-IPO stocks. From the perspective of social consensus, it is still too early for the tokenization of pre-IPO stocks.

V. The Final Solution

To gain an advantage in the pre-IPO market, the first step must be to create a sufficiently liquid, real-time trading spot market. This market needs to be based on "low fees, short holding periods, and bankruptcy isolation structures."

Only when the market's daily trading volume reaches a certain scale — sufficient to support a substantial open interest in perpetual contracts for the top 5-10 companies' pre-IPO stocks — can low-leverage perpetual contracts be introduced. By then, the platform's own spot market can serve as a real-time price data source, and more importantly, provide real-time liquidity for market makers, laying the foundation for the deepest and most efficient market.

Looking ahead, the tokenization of private stocks may ultimately allow the spot market to fully migrate on-chain, achieving the full composability and accessibility of DeFi. However, this vision will take at least several more years to realize, as it is still constrained by multiple obstacles such as regulation, market structure, and market drivers.

For a long time, retail investors have been excluded from the private market. Now, the trend of companies choosing to delay going public and viewing the public market merely as an exit liquidity channel is becoming increasingly evident. In this context, providing retail investors with liquidity channels to participate in the private market will become one of the most important innovations in personal finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。