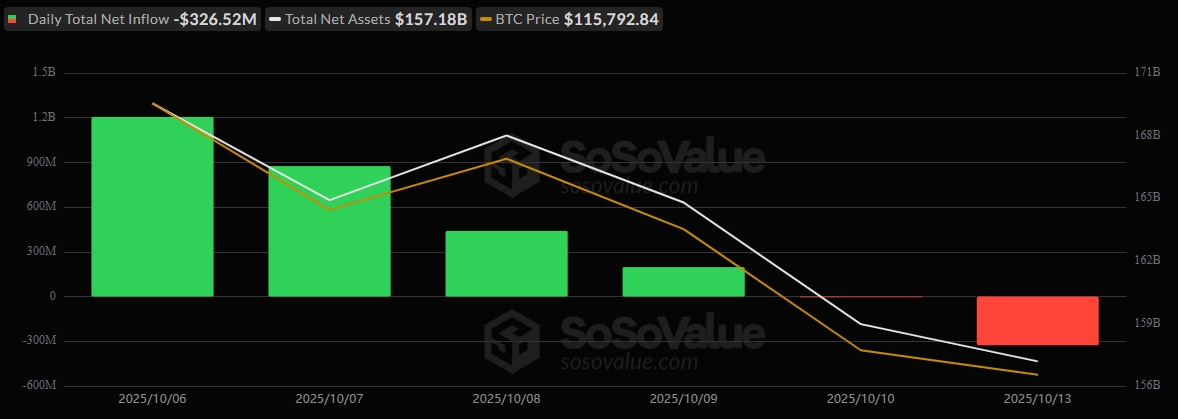

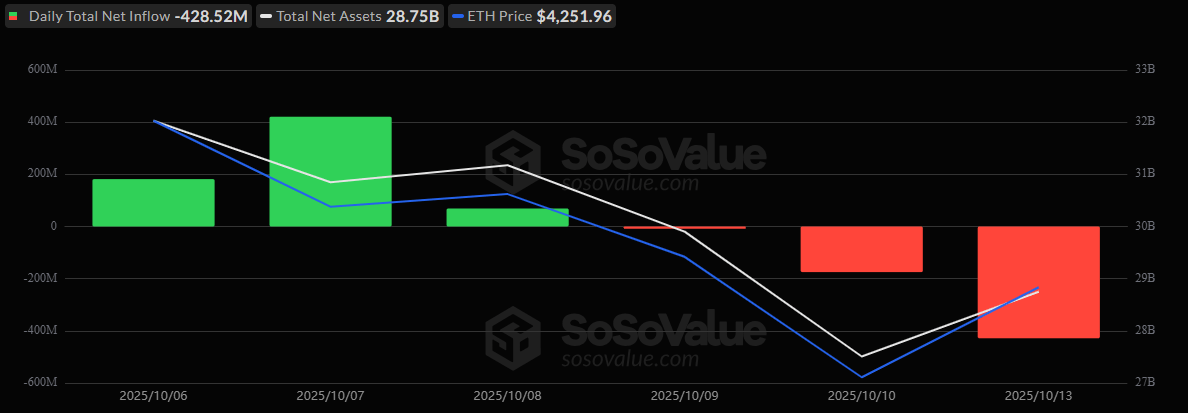

加密货币ETF抛售:比特币损失3.27亿美元,以太坊基金流出4.29亿美元

加密货币交易所交易基金(ETF)的乐观情绪在本周初遭遇挫折。在连续两周资金流入后,比特币和以太坊交易所交易基金在周一面临显著的抛售压力,共计损失7.56亿美元。

比特币ETF记录了3.2652亿美元的净流出,结束了其看涨走势,投资者在经历了两周强劲表现后选择获利了结。损失广泛,主要由Grayscale的GBTC主导,赎回金额达到1.4539亿美元。Bitwise的BITB紧随其后,流出1.1564亿美元,而Fidelity的FBTC则减少了9328万美元。Ark 21Shares的ARKB和Vaneck的HODL也有小额流出,分别损失2112万美元和1144万美元。

唯一的亮点来自Blackrock的IBIT,成功实现6036万美元的资金流入,缓解了整体下滑。尽管遭遇挫折,交易依然强劲,达到了66.3亿美元,总净资产为1571.8亿美元,仍然是历史最高水平之一。

以太坊ETF受到更大冲击,七只基金共计流出4.2852亿美元。Blackrock的ETHA承受了最大压力,流出3.1013亿美元,其次是Grayscale的以太迷你信托流出4967万美元和ETHE流出2099万美元。

流出还扩展到Fidelity的FETH(-1912万美元)、Bitwise的ETHW(-1280万美元)、Vaneck的ETHV(-934万美元)和Franklin的EZET(-646万美元)。总交易价值为28.2亿美元,以太坊ETF的净资产为287.5亿美元。

在经历了两周的强劲资金流入后,周一的巨大逆转是一个现实检查,提醒人们即使在加密货币ETF的繁荣中,波动性仍然主导着市场。

为什么比特币和以太坊ETF本周会出现如此大规模的流出?

投资者在经历了两周强劲的资金流入后,可能选择获利了结,导致主要加密货币ETF的广泛抛售。哪个比特币ETF的赎回金额最大?

Grayscale的GBTC以1.45亿美元的赎回金额领先流出,其次是Bitwise的BITB和Fidelity的FBTC。在抛售中是否有任何加密货币ETF记录了资金流入?

是的,Blackrock的IBIT以6000万美元的新资金流入脱颖而出,帮助缓解了整体下滑。以太坊ETF的损失与比特币ETF相比有多大?

以太坊ETF流出4.29亿美元,比比特币的3.27亿美元多出超过1亿美元。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。