US China Tariff Chaos Surge: How Will This Impact Crypto Market?

The crypto market has once again plummeted as the US China tariff tensions escalate. Bitcoin, Ethereum, and major altcoins plunged after China warned it would “fight to the end” if Donald Trump proceeds with a full-blown trade war.

With both superpowers doubling down, uncertainty has gripped investors, and risk assets like crypto are taking the hit. Despite yesterday’s brief rebound, the market quickly reversed into another decline, signaling that losses may persist until the countries step back from the brink.

US China Tariff Tensions Escalate

On October 14, 2025, the Chinese authority issued a strong warning, declaring that the country is prepared to “fight to the end” if the US pushes ahead with the trade war. This statement comes in response to Trump’s recent decision to impose a 100% trade tax on China, which triggered the largest crypto market crash ever.

“On the matter of tariff wars and trade wars, China's position remains consistent,” a commerce ministry spokesperson stated. He added,

"If you wish to fight, we shall fight to the end; if you wish to negotiate, our door remains open. The United States cannot simultaneously seek dialogue while threatening to impose new restrictive measures. This is not the proper way to engage with China."

Notably, Trump’s decision stemmed from the country’s recent curbs on rare earth exports, which Trump condemned as “hostile” and an attempt to “hold the world captive.” However, the spokesperson noted that the country’s export controls on rare earths were legitimate measures taken in line with domestic laws and regulations to strengthen its export management framework. The spokesperson further emphasized that the nation, as a responsible global power, had always been committed to protecting both its own national security and broader international security.

US China Tariff Chaos Turns Crypto Market Red

In a recent X post , analyst Ted stated that the latest crypto market crash and sell-off was largely driven by the US China tariff tensions. He added that the industry would continue to decline until clarity is brought to the trade policy. The crypto industry is now at $3.78 trillion, down 3.4%. All top cryptocurrencies are now trading in the red, despite a recent rebound following Trump’s hint at policy easing.

In a subsequent X post, Ted suggested that if Trump were to announce a new deal with the country, the stock could reach record highs, with cryptocurrencies following suit. He expects Ethereum to outperform other digital assets if such a scenario occurs. In his view, this process would take 1-2 weeks.

He suggested that if Trump were to announce a new trade deal with the Chinese government, the stock market could reach record highs, and cryptocurrencies would likely follow suit, with Ethereum expected to outperform other digital assets. He added that, in his view, this process could take one to two weeks.

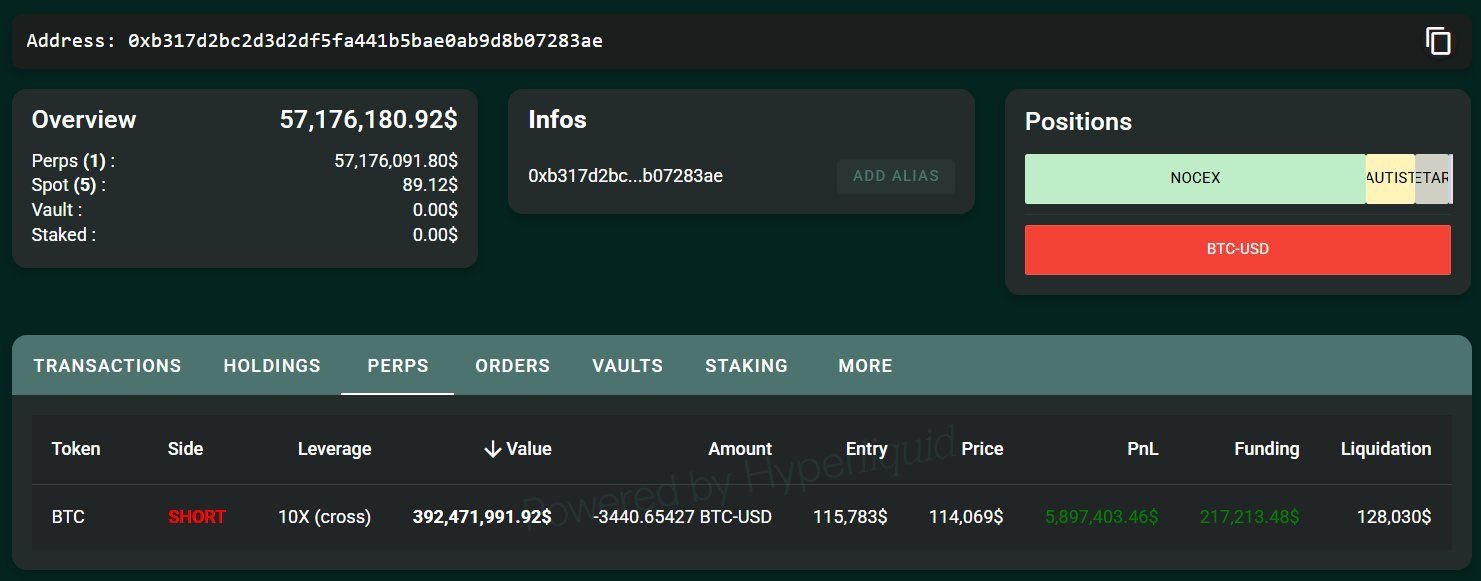

Analyst Gordon took to X to share insights on a mysterious development involving a crypto whale. The analyst noted that the whale who had made $191 million from shorting Bitcoin just minutes before the tariff announcement now holds a $392 million short position. This sparks speculation that the trader might have information unavailable to other market participants. Gordon wrote, “Does he know something we don't?”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。