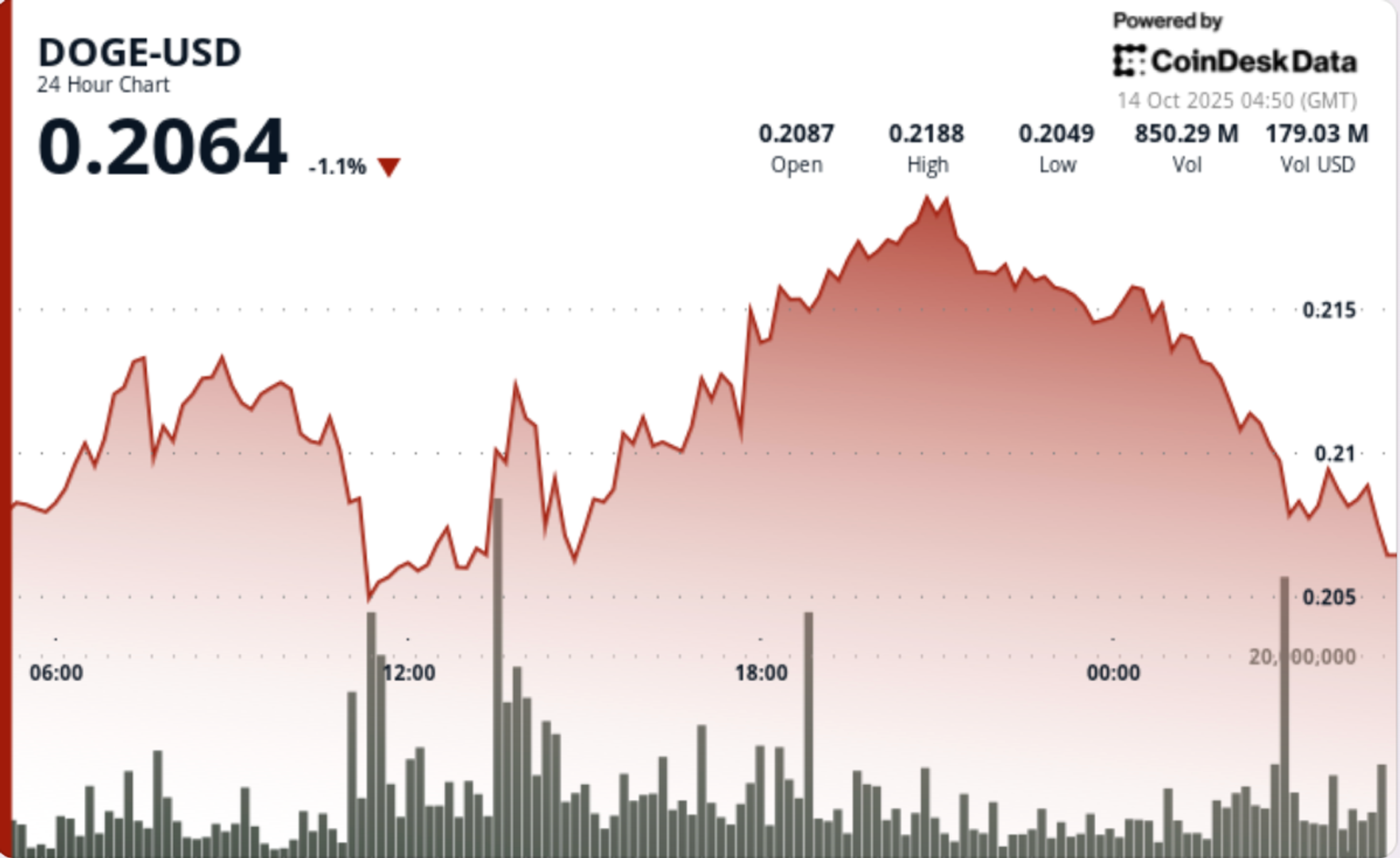

狗狗币在10月13日至14日的交易中波动剧烈,在未能维持突破0.22美元后下滑1%。尽管更广泛的市场对贸易言论的变化和在“狗屋”纳斯达克上市后重新审视的监管审查做出了反应,但该代币在0.20美元附近找到了强劲的需求,因为机构资金持续流入。

新闻背景

在特朗普政府对中国关税的语气有所缓和后,市场趋于稳定,风险资产部分反弹。DOGE从本周早些时候的0.18美元低点反弹,测试0.22美元的阻力位,但随后出现了获利回吐。狗屋的上市——这一迷因币的关联实体——通过反向合并在纳斯达克上市,增强了企业对数字资产的曝光,但也给机构投资者带来了合规挑战。

“我们看到的参与模式——强劲的早盘卖出量和有序的晚盘积累——是活跃机构管理的标志,”一家数字资产交易台的高级策略师表示。“财政团队正在对冲波动性,但并未退出头寸。”

价格行动摘要

- DOGE在10月13日03:00至10月14日02:00之间在0.20–0.22美元之间波动,收于0.21美元。

- 在21:00时以高于平均水平的成交量遭遇拒绝,阻力位被限制在0.22美元。

- 在11:00时段,0.20美元附近出现了大量机构买入,交易量为1.52亿个代币。

- 在01:54时段,因算法卖出触发止损,导致39.6百万的成交量推动价格突破0.21美元。

- 会话在0.21美元附近稳定,持续积累至收盘。

技术分析

DOGE继续在0.20–0.22美元区间内波动,巩固近期11%的涨幅。支撑位在0.20美元处明确,出现多次高成交量反弹。0.22美元的上限已被测试三次,但未能持续跟进,形成了动量交易者的短期支点。

在0.21美元的成交量集中表明机构正在建立库存,而非恐慌性分发。如果价格在下一个交易时段保持在0.21美元以上,向0.23–0.24美元的上行目标将重新出现;未能守住0.20美元则有回调至0.18美元的风险。

交易者关注的事项

- DOGE是否能够重新夺回并保持在0.22美元,以确认向0.24美元的延续。

- 在0.20美元支撑附近积累了15亿个代币后,是否有新的鲸鱼资金流入的迹象。

- 与狗屋上市相关的企业和监管头条新闻。

- 更广泛的迷因币情绪,因为XRP和SHIB在成交量下降的情况下交易平稳。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。