原文标题:《Silicon Valley Doesn't Understand Money》

撰文:Marty Bent,TFTC 创始人

编译:Tia,Techub News

「科技让世界更高效,货币却让个人更贫穷。唯有当货币体系不再稀释个体价值时,科技带来的繁荣才可能被普遍共享。比特币以通缩性的货币逻辑,为这种平衡提供了新的可能——它正从情绪的泡沫,走向宏观秩序的一部分。」

我上周引用了 Nikita Bier 在 Twitter 上广为流传的一条推文。

他对这样一种现象感到困惑:比特币和黄金的价格正在上涨,无论是个人还是机构都在重新配置资本,为一个多极化的世界做准备。这个新世界将有更高的通胀率,因为各国政府和央行会通过印钞和高财政赤字来掩盖他们在过去五十年中制造的问题。

他的问题是:比特币和黄金的买家怎么就看不见 AI 已经来了?AI 即将接管世界,而且它是通缩的!

然而,这条推文的讽刺意味令人难以置信——因为,正如上文所描述的,那些刺激政策和财政赤字的相当一部分,恰恰是出于赢得全球 AI 军备竞赛的欲望所驱动的。

各国政府将会发行债务、货币化现有债务、补贴电网基础设施、数据中心以及关键制造能力的本地化建设。

而这一切,都将是通胀性的。

最终的结果可能是,我们可以向一个大型语言模型(LLM)发出请求,让它针对一个相对复杂的主题进行深入研究,然后几分钟后,它就能为我们提供一份极其详细的报告,成本不过几美分。

没错,从长远来看,如果这些 AI 模型真的不负盛名,最终可能会取代那些每年为公司花费数十万美元的白领岗位。

然而,这种生产力提升所带来的好处,将被启用它们的巨额印钞所彻底淹没。

我为什么知道会是这样?

因为事情一直都是这样的。

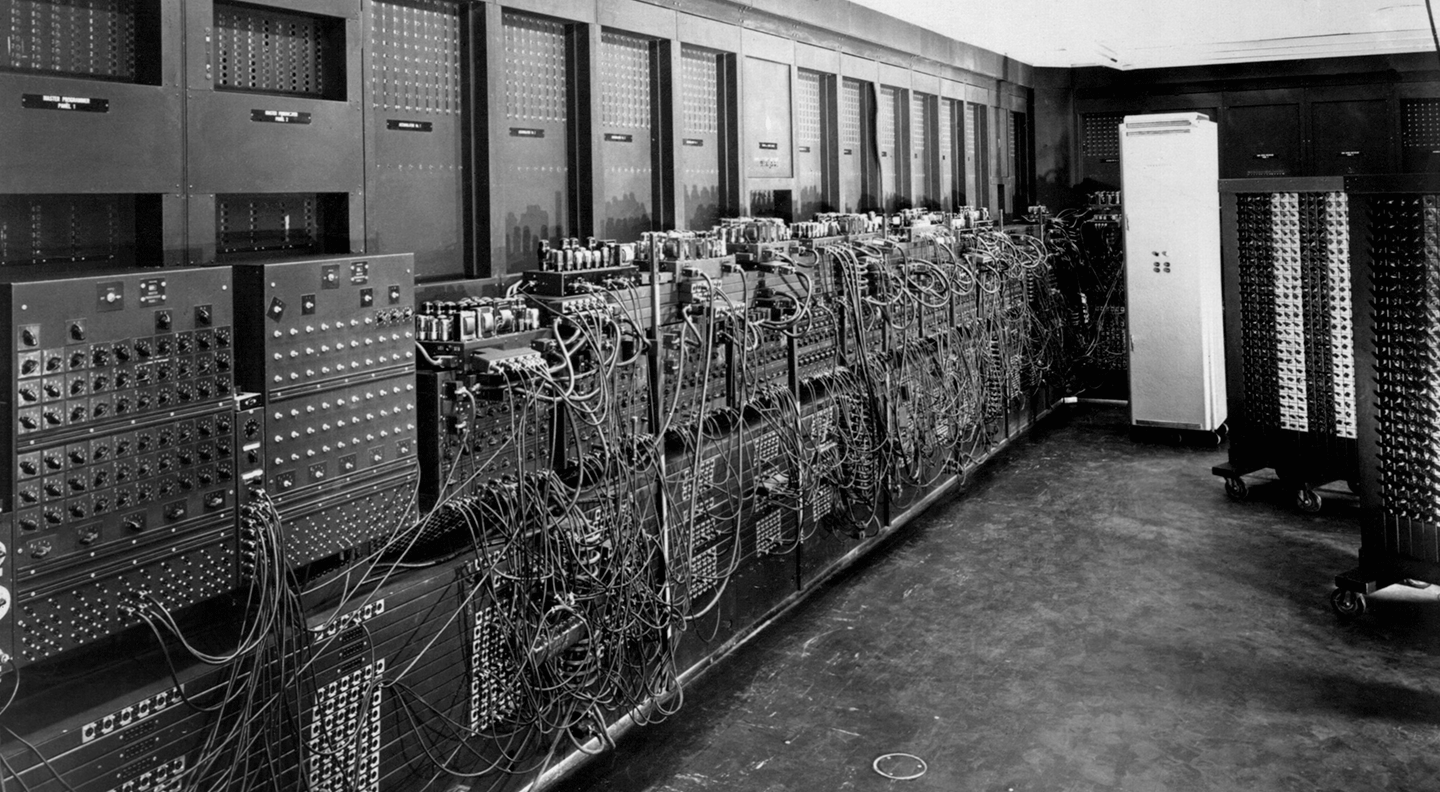

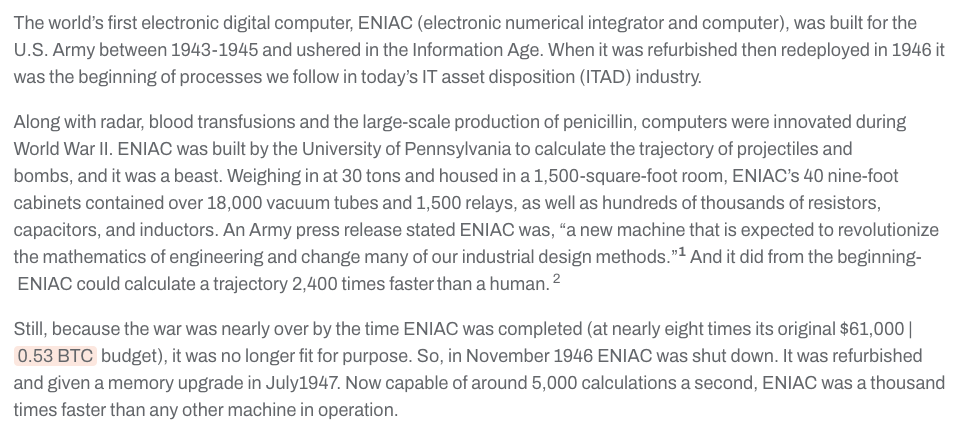

Nikita 的推文还有一个讽刺之处在于,他似乎完全没有意识到:科技一直以来都是通缩的,而且几个世纪以来我们见证了令人叹为观止的科技通缩。 这是美国陆军建造的第一台计算机的照片。

以下是关于它的尺寸、计算能力以及制造成本的一些信息。

(来源:simslifecycle.com)

按今天的通胀调整计算,这台怪物在 1946 年造价约 800 万美元。

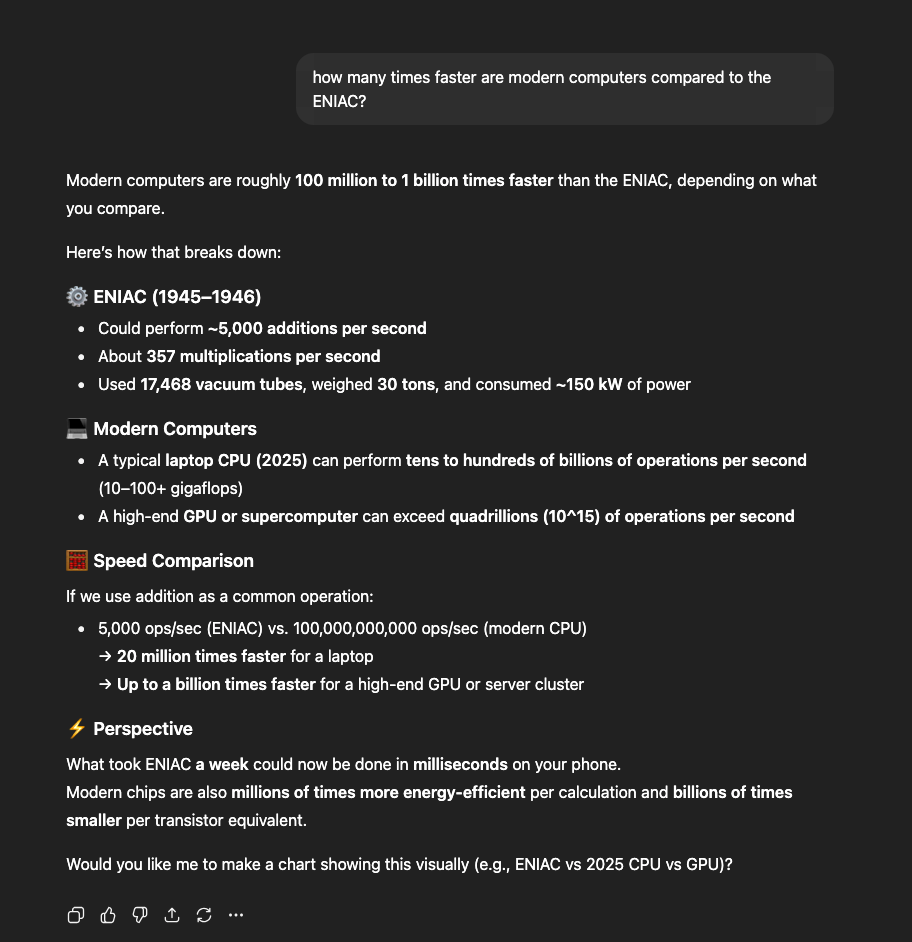

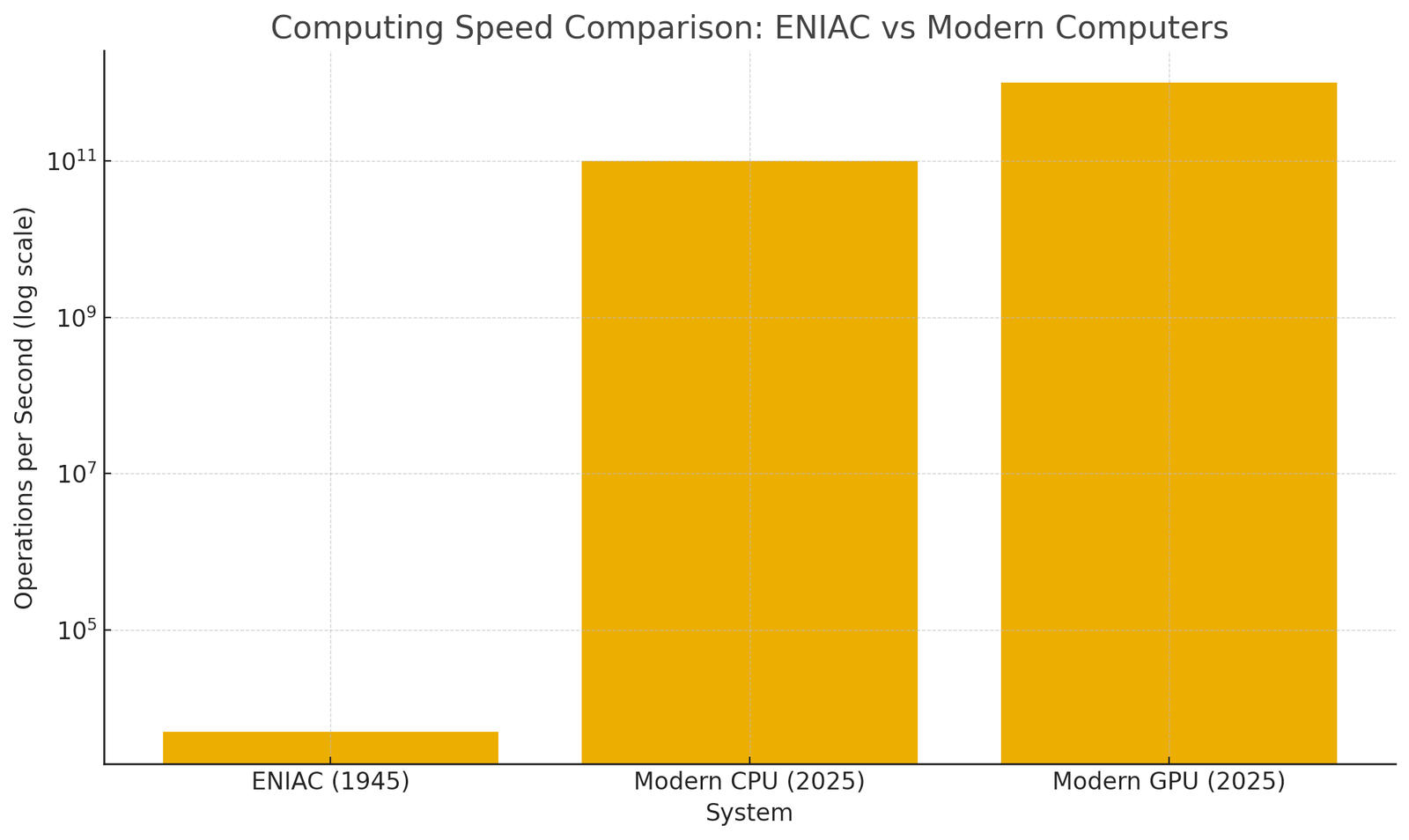

而且,今天的人根本不会把 ENIAC 看作是一台「计算机」——它看起来太笨了。因为如今的计算机使用的芯片性能比 ENIAC 快 1 亿到 10 亿倍。

1946 年,美国军方造 ENIAC(第一台计算机)要花 800 万美元;

2025 年,你只需要 1000 美元就能买到性能快上 10 亿倍的 MacBook。

这简直是惊人的通缩。

然而,尽管科技通缩如此剧烈,我一生中生活成本仍在持续上涨,且近年来加速上升。

印钞机的力量,远比科技驱动的通缩强上几个数量级。

AI 不会改变这一点。

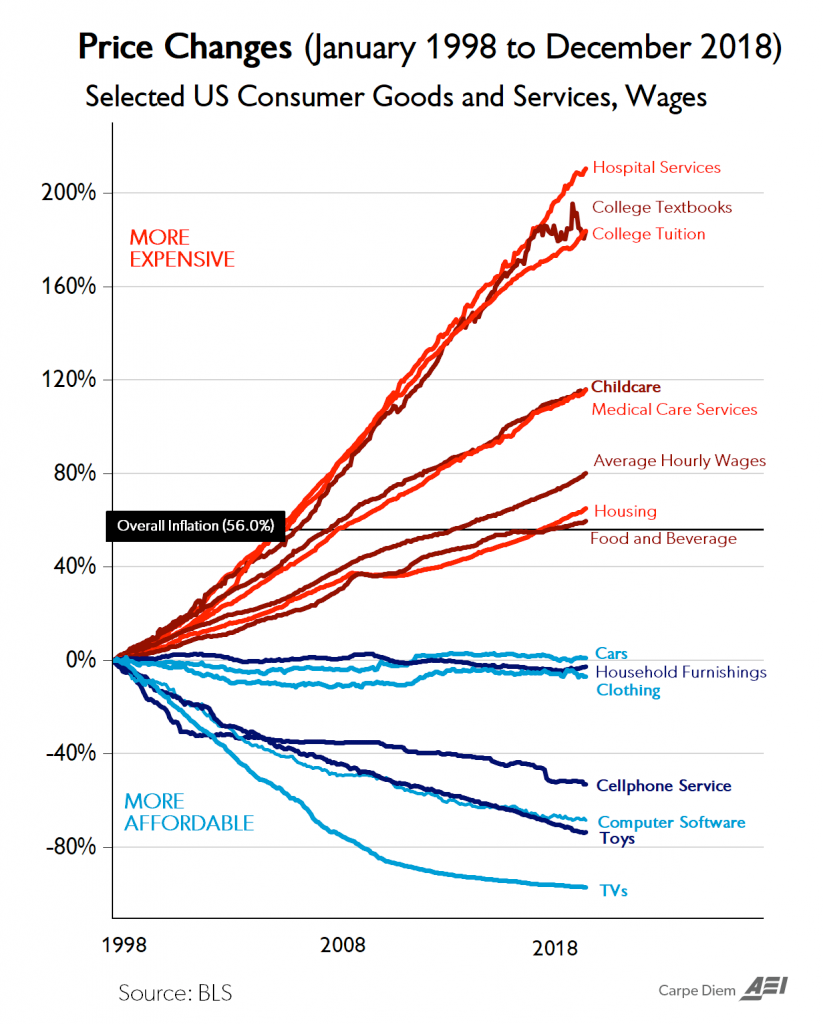

多年前有一张广为流传的图表,它真正揭示了这个问题。(我很想看到这张图表更新到新冠疫情后的版本——我想它看起来只会更糟。)

印钞会扰乱资本配置。

钱被印出来之后,它必须流向某个地方。

从图表中可以看到,过去 27 年间,资金从「货币水龙头」流入市场,这推高了被视为维持 2025 年生活所必需的东西的价格:医疗、住房、教育、食品和托儿服务。

在大屏幕电视、智能手机和电子游戏上省点钱固然不错,但那并不足以抵御生活中这些高价刚需项目的涨价压力——这些才是维持体面生活的关键。

科技通缩当然是真实存在的,而且它无疑对人类大有裨益。

但遗憾的是,人类无法真正享受到科技通缩带来的全部红利——因为人们被迫与货币通胀的强大力量对抗。

如果我们想要生活在一个人人都有指数级更高机会享受高质量生活的社会中——一个能充分受益于技术进步带来的世界——那么科技通缩必须与像比特币这样通缩性的货币结合起来。

当技术让我们更高效、让市场上能以更低成本提供更多种类的商品和服务、让人类不断前进时,人们理应能以更低的价格购买更多的东西,并且把他们多余的生产力储存在一种为他们工作而不是与他们作对的货币中。

在那之前,我们在市场上看到的所有科技通缩,都是苦乐参半的。

我们确实在迅速进步,但并非所有人都感受到生活质量的提升。

很多人感受到的,恰恰相反。

出于某种原因,硅谷的大多数人似乎并不理解这个简单的事实。

散户投资者不会像 2017 和 2021 年那样推动比特币的 2025 年行情

James Check 提出了一个令人清醒的观察:

在本轮市场周期中,散户投资者可能不会再像 2017 和 2021 年那样热情回归。

事实很简单:普通美国人已经没有钱了。

当机构投资者悄悄地通过 ETF 和复杂衍生品积累比特币时,普通人正被不断上涨的生活成本淹没。

在这个医保登记季,美国各地的健康保险保费上涨了 25% 到 60%。

德国刚宣布计划将退休年龄提高至 72 岁,而美国国内也在讨论把退休年龄提到 67 岁。

对于那些没有金融资产的人来说,他们的生活质量已大幅恶化——实际生活成本飙升,而工资停滞不前。

「我不认为散户有钱。我不认为他们有钱再进场了。」 —— James Check

这一轮周期在本质上不同于以往。

由散户 FOMO(错失恐惧症)驱动的狂热阶段可能不会出现,因为散户根本没有可支配收入来进行投机性投资。

相反,我们正目睹一件更深刻的事情:

机构投资者开始承认比特币在「货币贬值交易(debasement trade)」中的角色。

虽然这比过去那些热闹的行情显得平淡,但它标志着比特币正逐渐成熟为一种真正的宏观资产——一种不再需要散户热情也能升值的资产。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。