BTC Futures Cool off While Bitcoin Options Traders Stay Loaded With Calls

Moreover, bitcoin traded between $113,696 and $115,792 intraday between Sunday and Monday after last week’s market carnage, with the price hovering between $114.8K to $115.3K into the U.S. afternoon Eastern time on Oct. 13.

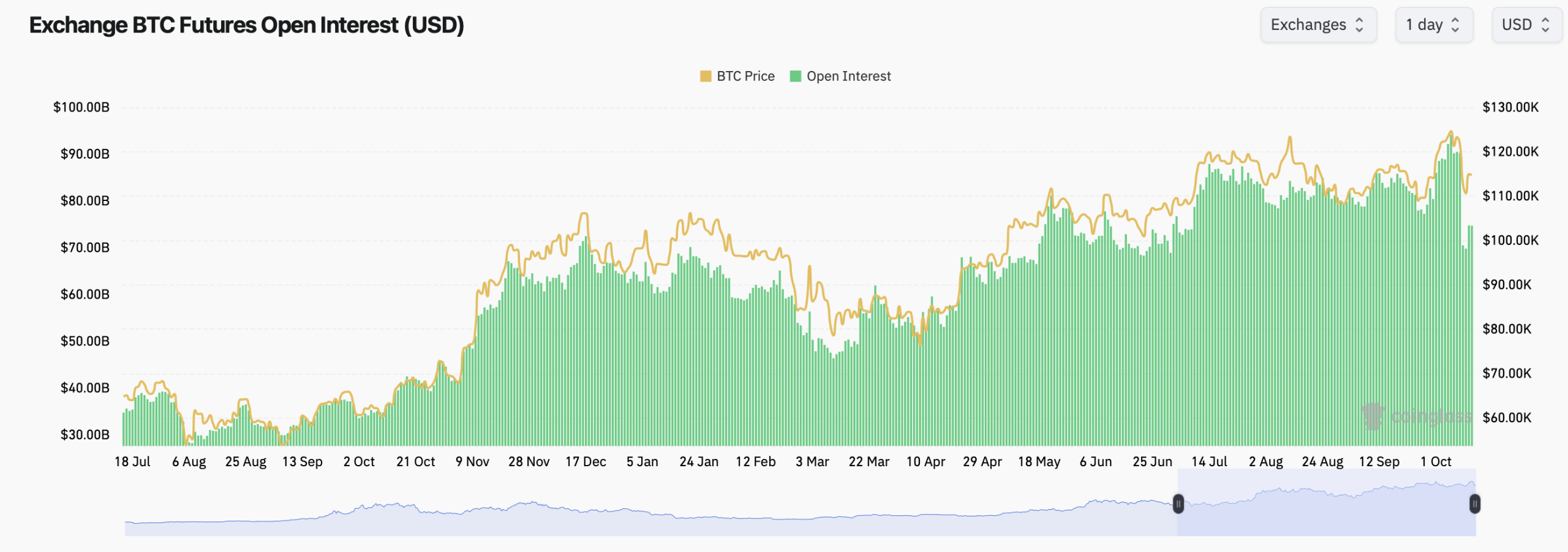

The quiet tape to start the week contrasts with a clear step-down in futures open interest (OI) across venues, even as options positioning remains busy. Futures OI has slipped meaningfully from recent highs on the composite chart, reflecting de-risking after last week’s fireworks.

Futures have cooled a great deal after open interest neared the $100 billion range just last week, and today it stands at $74.92 billion. When futures open interest drops fast, it usually means traders are packing up and heading for the exits — confidence fades, momentum fizzles, and the hype train runs out of steam. Source: Coinglass.com.

The latest action shows a decisive downtick and a lower band of positioning rather than the steady climb seen through late summer. Put plainly: fewer chips on the table, same game. By exchange, CME tops the OI leaderboard with 148.11K BTC (about $16.99 billion) and a 24-hour OI change of +0.60%.

Binance shows 108.22K BTC (roughly $12.43 billion, -0.72% 24h), while Bybit lists 65.46K BTC (about $7.52 billion, +2.37%). OKX sits at 33.29K BTC (near $3.82 billion, +1.72%). Rounding out the top ten: Gate (56.19K BTC, +0.45%), Bitget (41.52K BTC, -2.32%), MEXC (33.39K BTC, +3.72%), BingX (19.22K BTC, +4.93%), WhiteBIT (18.27K BTC, +0.96%), and Kucoin (4.13K BTC, -4.82%).

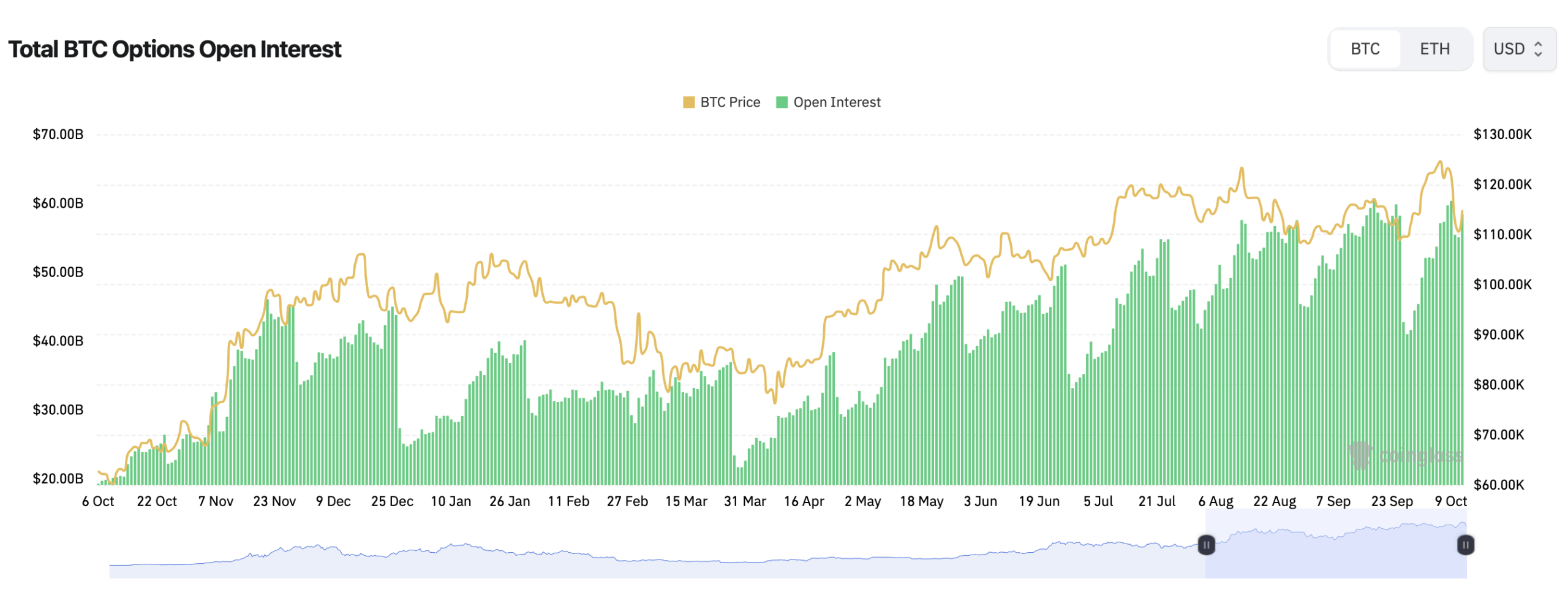

Translation: OI is lower overall, but pockets of growth remain uneven across venues. On the options side to start the week, coinglass.com stats show open interest is still quite hefty and tilted toward calls: 59.93% calls (278,956.79 BTC) versus 40.07% puts (186,522.81 BTC). The past 24 hours of options volume lean call-heavy too—53.90% calls (28,384.43 BTC) against 46.10% puts (24,279.2 BTC)—suggesting traders kept some topside exposure even as futures trimmed risk.

While futures are down, open interest via options is still sky high. If options open interest stays high while futures cool off, it means traders aren’t done playing—just changing tactics. They’re still in the mix, hedging bets or gearing up for whatever twist comes next, likely expecting fireworks or fresh drama in the market. Source: Coinglass.com.

December options on Deribit are where most of the action is happening. The biggest open interest sits at the $140,000 call with about 10,004 BTC, followed by the $200,000 call (8,632 BTC), $120,000 call (7,137 BTC), and $150,000 call (6,334 BTC). On the flip side, there’s a standout $85,000 put holding around 5,468 BTC — proof that some traders are still hedging in case bitcoin takes a turn south.

Max-pain—the level where option holders feel the most collective discomfort—clusters in the $114K–$117K area for near-dated expiries, dips closer to $111K into late December, then arcs back toward $115K around spring maturities. With spot milling around that neighborhood today, the options market isn’t exactly rolling out a red carpet for trend followers.

Net-net: futures OI down, options OI firm, and price loitering near max-pain. It’s the kind of setup where boredom can vanish quickly—just ask anyone who blinked last week.

💡FAQ

- Where is bitcoin trading now? Around $114,861 to $115,275 as of 2:50 p.m. EST in New York.

- What’s today’s price range? Roughly $113,696 to $115,792 during U.S. hours.

- How does derivatives positioning look? Futures OI fell hard, while options OI remains elevated with more calls than puts.

- What’s the near-term max-pain zone? The options market clusters around $114K–$117K for nearby expiries.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。