Venture Capital Floods Back Into Crypto With Record Fundraising Week

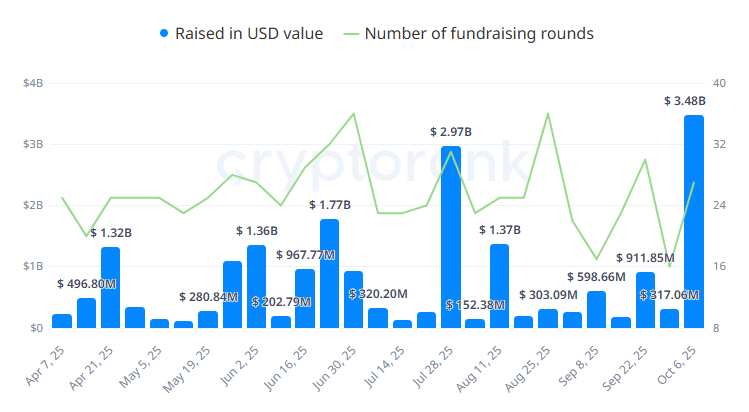

Crypto venture funding roared back to life this week, hitting a record $3.48 billion in total capital raised from 27 projects and companies, according to data from Cryptorank. The period between October 6 and 12 marks the highest weekly fundraising volume ever recorded in the industry.

The investment boom was led by Pantera Capital, which participated in four rounds, including two as lead investor, followed by Hack VC and Vaneck, which led two each. Other active players included Coinbase Ventures, Borderless Capital, X Ventures, and Road Capital, with two deals each this month.

Source: Cryptorank

DeFi and blockchain infrastructure projects dominated funding activity, with centralized finance (CeFi) ventures following closely behind. The data also shows that mid-sized raises remain the most common, with 268 rounds falling between $3–10 million, while $1–3 million and $10–20 million brackets accounted for 159 and 114 rounds, respectively.

Geographically, the United States continues to lead the crypto funding landscape, attracting $9.27 billion year-to-date. Malta and Singapore followed with $2 billion and $1.13 billion, respectively.

The record-breaking week underscores renewed investor confidence in the digital asset market, as capital flows increasingly target DeFi protocols, layer one (L1) infrastructure, and tokenized real-world asset (RWA) platforms, sectors driving the next wave of crypto innovation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。