Millions of Americans cross the threshold of wealth but find it difficult to enjoy a luxurious lifestyle due to asset limitations.

Authors: Andre Tartar, Ben Steverman, Stephanie Davidson

Translation: Deep Tide TechFlow

The number of millionaire households is increasing, but much of their wealth is trapped in assets that are difficult to liquidate quickly.

According to a long 18-month survey conducted by the now-defunct New-York Tribune in 1892, during the peak of America's Gilded Age, there were 4,047 millionaires in the country, and the newspaper listed their names in a special edition.

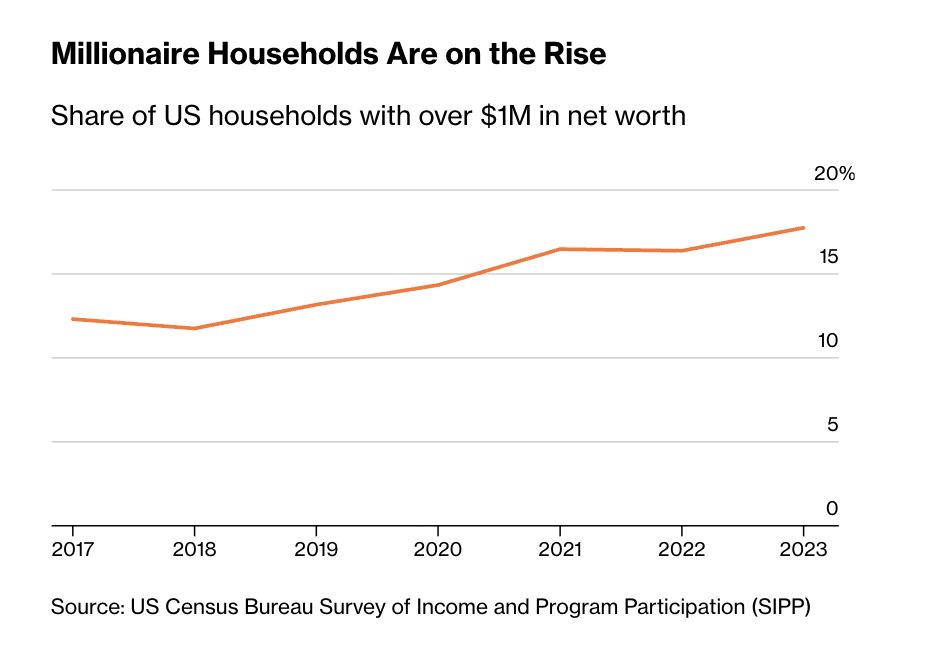

Today, an analysis of government survey data by Bloomberg shows that the number of millionaire households in the U.S. has surpassed 24 million, accounting for nearly one-fifth of all U.S. households.

Of these, a full third of modern millionaires were created after 2017, primarily due to the rapid increase in property values and the stock market.

Millionaire households are on the rise

Proportion of U.S. households with net worth over $1 million

Source: U.S. Census Bureau Survey of Income and Program Participation (SIPP)

This does not mean they have ample cash on hand.

In fact, an increasing number of millionaires have their wealth locked in assets that are difficult to quickly or easily liquidate, such as home equity and the growing number of age-restricted retirement assets like 401(k) accounts and Individual Retirement Accounts (IRAs). Coupled with inflation and higher interest rates, financial advisors say that $1 million is no longer sufficient to guarantee a secure retirement, let alone serve as a golden key to the wealthy class.

“The term ‘millionaire’ used to mean automatic wealth,” said Ashton Lawrence, an advisor at Mariner Wealth Advisors in Greenville, South Carolina. “Now the goal has changed. It’s still an important milestone, but for most people, it’s no longer enough.”

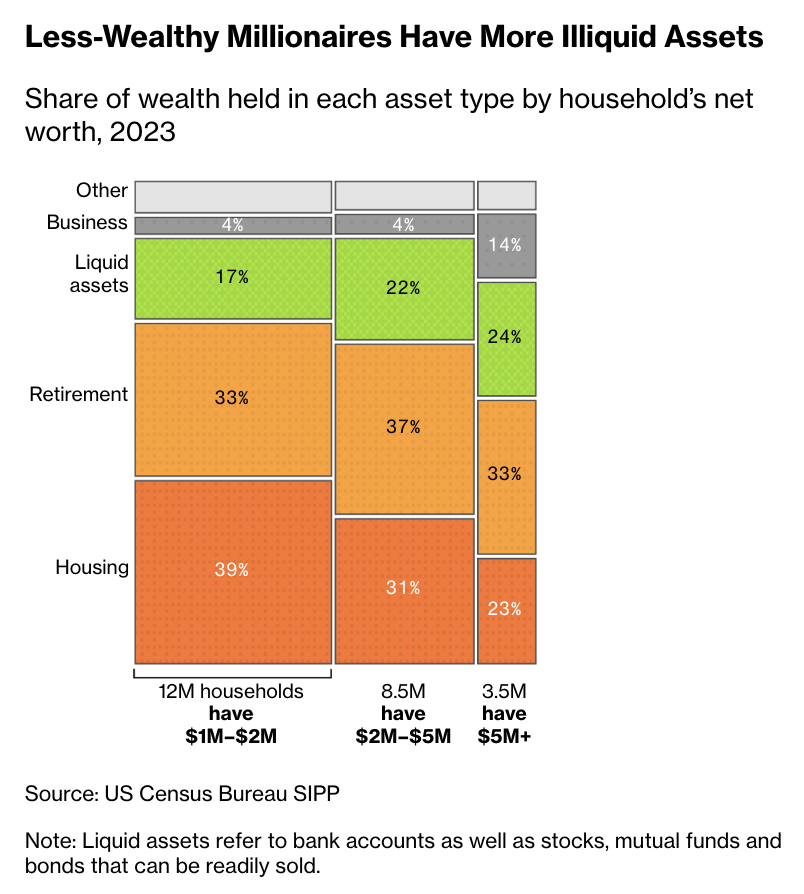

The $1 million threshold used in Bloomberg's analysis takes into account debts and other liabilities. Nevertheless, today’s millionaires rarely have nearly $1 million in liquid funds at their disposal. For those households that “barely meet the millionaire standard,” their net worth falls between $1 million and $2 million, with the vast majority of their wealth being illiquid. In 2023, about 66% of their wealth was tied up in primary residences and retirement accounts, an increase of 8 percentage points since 2017.

To have the freedom to manage their wealth, millionaires typically need higher asset levels. In 2023, households with a net worth of $5 million or more had about 24% of their wealth in more accessible bank or brokerage accounts, while households close to the $1 million mark had only 17%.

Less wealthy millionaires hold more illiquid assets

Proportion of various assets in household net worth in 2023

Source: U.S. Census Bureau SIPP

Note: Liquid assets refer to bank accounts and stocks, mutual funds, and bonds that can be sold at any time.

Bloomberg's analysis used data from the U.S. Census Bureau's Survey of Income and Program Participation, which tracks long-term changes in thousands of households. Another analysis of the Federal Reserve's Survey of Consumer Finances from 1989 to 2022 shows that the number and proportion of millionaire households have also rapidly increased in recent years, confirming that home equity and retirement account balances are increasingly significant components of millionaire net worth.

Of course, for most Americans, $1 million is still a life-changing amount. In 2024, the median household income in the U.S. is $83,730, while the median account balance in 4.8 million retirement plans managed by Vanguard Group last year was only $38,000.

Despite the latest data showing that the number of millionaires in the U.S. has surged by 50% in six years, they still face a range of factors that hinder wealth mobility. For instance, high interest rates exacerbate liquidity issues. To raise funds for significant expenses, investors and homeowners often borrow against their assets, but the costs have risen significantly. According to Bankrate's latest survey of major lenders, the average interest rate for home equity lines of credit (HELOCs) is 7.89%, nearly double the rate homeowners paid at the beginning of 2022. Meanwhile, major retail brokerage firms like Fidelity, Vanguard, and Charles Schwab now have margin loan rates starting at 10% or 11%, depending on the size of the portfolio.

“When interest rates are high, we feel less wealthy regardless of asset values,” said Nicole Gopoian Wirick, president of Prosperity Wealth Strategies.

So-called “paper millionaires” can always sell assets directly. However, they now have more reasons to hesitate. Selling a home involves significant hassle and transaction costs. Homeowners also need to find a new place to live during a time when housing affordability in the U.S. has sharply declined. Moving may mean giving up a mortgage rate far below current market rates. Even if they have substantial assets outside of their homes and age-restricted retirement accounts, accessing that wealth is not easy. Advisors warn that clients who sell large amounts of stock may trigger hefty tax bills.

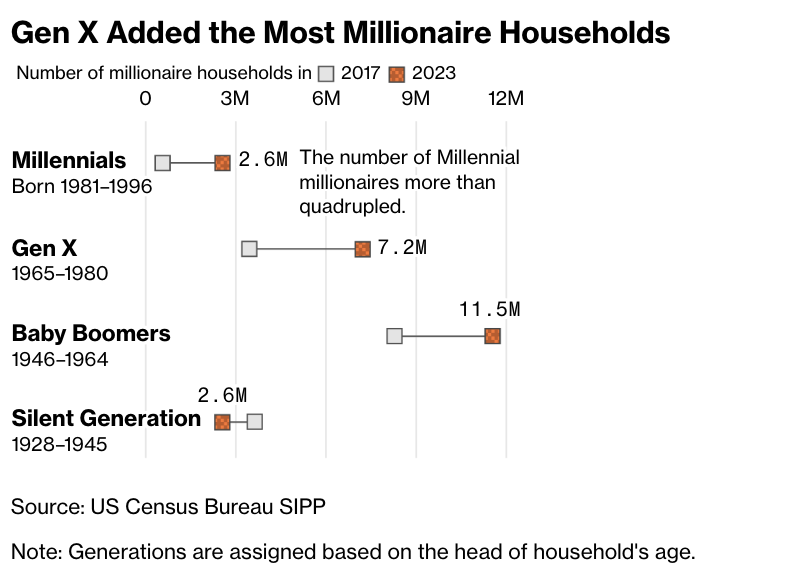

There are significant differences in the number of millionaires across generations and their wealth distribution. As the Silent Generation gradually passes away, the only group showing a decline in numbers is millionaires born before 1946. Meanwhile, older Americans have had more time to accumulate 401(k) or IRA retirement savings and can begin withdrawing those funds freely six months before their 60th birthday. According to Bloomberg's analysis, only about 27% of millennial millionaires' wealth is held in retirement accounts, while that figure for baby boomers is 37%.

Generation X has the highest number of new millionaire households

Source: U.S. Census Bureau SIPP

Note: Generational classification is based on the age of the household head.

Advisors say that even having millionaire status is not enough to make wealthy clients consider quitting their jobs. However, the amount of money needed to stop working and maintain a pre-retirement lifestyle can vary widely. “Factors like inflation, longevity, taxes, and geographic location all affect how much money you need,” said Ashton Lawrence.

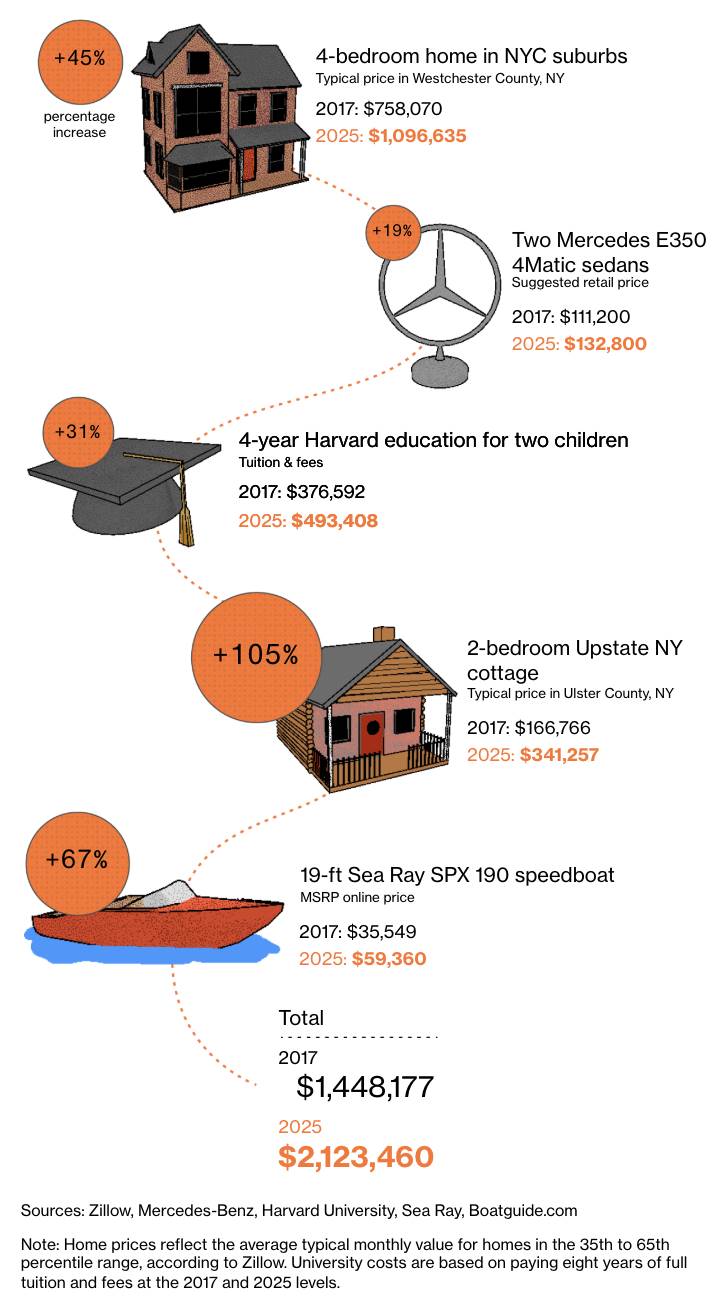

Millionaires may still afford a comfortable middle-class lifestyle, but for many, the classic millionaire lifestyle—such as vacation homes, private jets, yacht rentals, and high-end fashion shopping—is becoming increasingly out of reach.

Take the lifestyle of a wealthy family in New York as an example: a four-bedroom home, two brand-new Mercedes sedans, an Ivy League education for two children, a small vacation home up north, and a 19-foot speedboat. Less than a decade ago, these expenses totaled about $1.4 million. By 2023, the cost of the same lifestyle has risen to $2.1 million.

The millionaire lifestyle is no longer what it used to be

Since 2017, iconic expenditures for a wealthy lifestyle have nearly doubled.

Source: Zillow, Mercedes-Benz, Harvard University, Sea Ray, Boatguide.com

Note: Housing price data is based on Zillow's typical monthly average value for homes in the 35th to 65th percentile range. College costs are based on the full tuition and fees levels for 2017 and 2025.

“This is one of the indirect reasons why some young people feel frustrated that they cannot enjoy the same standard of living as their parents,” said Thomas Murphy, a senior financial planner at Murphy & Sylvest Wealth Management in Dallas. “They think $1 million should solve all financial problems, but what they really need to consider is $10 million.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。