Although USDe has seen price declines on every centralized exchange, it is not uniform.

Written by: Haseeb Qureshi, Partner at Dragonfly

Translated by: Luffy, Foresight News

I have seen a lot of discussions about Ethena's de-pegging during the market turmoil this weekend. The situation is that USDe (the stablecoin issued by Ethena) briefly de-pegged to around $0.68 and then recovered. This is the Binance chart that everyone is referencing:

However, after diving deep into the data and talking to many people over the past couple of days, I can now clearly state that this assertion is incorrect; USDe did not de-peg.

One key point to understand is that the most liquid venue for USDe is actually not on exchanges, but on Curve. Curve has hundreds of millions of dollars in permanent liquidity, while any exchange, including Binance, only has tens of millions of dollars in liquidity.

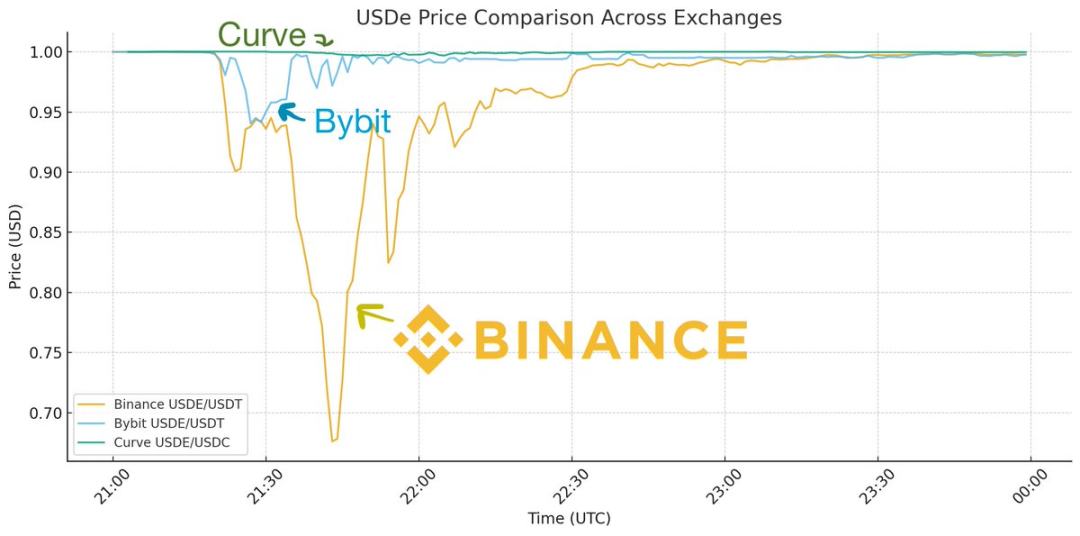

So if you only look at the chart for USDe on Binance, it appears to have de-pegged. But if you overlay the other liquidity venues for USDe, you get a different picture:

We can see that while USDe has experienced price declines on every centralized exchange, it is not uniform. Bybit briefly dropped to $0.95 but quickly recovered, while Binance's de-pegging was much more severe and took a long time to regain its peg. Meanwhile, the price on Curve only dropped by 0.3%. How do we explain this discrepancy?

Keep in mind that every exchange was under immense strain that day, as it was the largest liquidation event in cryptocurrency history. Binance was extremely unstable during this time, with API failures, deposit and withdrawal functions hindered, and market makers unable to shift positions, leaving no one able to step in for arbitrage.

It's like there was a fire at Binance, but all the roads were blocked, preventing firefighters from getting in. This led to chaos on Binance, but in almost every other place, the fire was quickly extinguished by liquidity bridges. As Guy illustrated in his post, due to the same widespread instability issues, USDC also briefly de-pegged by a few cents on Binance; it was just that liquidity couldn't get in, but this was not a de-pegging event for USDC.

So, it is not surprising that there are significant price discrepancies on exchanges under unstable API conditions, as no one could access positions. But why was the price drop on Binance much deeper than on Bybit?

There are two aspects to the answer. First, Binance has no primary dealer relationship with Ethena, meaning they cannot directly mint and redeem on the platform (Bybit and other exchanges have integrated this feature), allowing market makers to stay on the platform for arbitrage. This is crucial; otherwise, market makers would have to withdraw funds from Binance, go to Ethena for pegging arbitrage, and then bring the positions back. During a crisis with API failures, no one could do that.

Secondly, Binance's oracle performed poorly, starting to liquidate positions that should not have been liquidated. A good liquidation mechanism should not trigger during a price flash crash. If you are not a primary trading venue for a particular asset (Binance is not the primary trading venue for USDe), you should reference the prices from the primary trading venues. If you only look at your own order book, you will over-liquidate. This led Binance to start liquidating USDe at around $0.80, triggering a chain reaction. This is also a significant reason why Binance is refunding users who were liquidated on USDe (as far as I know, other exchanges have not done this). They only looked at their own prices rather than the true external prices, leading to mistakes.

So this is a Binance-specific flash crash event that could have been avoided with better market structure. USDe remained relatively stable at its peg of $1 on the primary trading venue, Curve, throughout the day. This is really different from the de-pegging situation you described.

If you remember the USDC situation during the Silicon Valley Bank crisis in 2023, that was a true de-pegging scenario:

During the Silicon Valley Bank crisis, the price of USDC dropped across every trading venue, and there was nowhere you could sell USDC for $1. Redemptions were effectively paused, so $0.87 was its true price, which is what de-pegging means.

This time, it was just a price misalignment specific to Binance. This is an important lesson for market infrastructure, but if you try to infer USDe's mechanism from the events of this weekend, it is crucial to understand the nuances.

Throughout the entire event, USDe was fully collateralized at the primary trading venue, valued at $1, and due to price fluctuations, its collateral actually increased over the weekend. In other words, this market instability ultimately has benefits, as it provides lessons for the entire industry. Guy's post explains how any exchange, including Binance, can avoid such issues in the future.

In short: USDe did not de-peg; it was Binance's price that had issues.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。