"Weekly Editor's Picks" is a "functional" column of Odaily Planet Daily. Based on the extensive coverage of real-time information each week, the Planet Daily also publishes many high-quality in-depth analysis articles, but they may be hidden among the information flow and hot news, passing you by.

Therefore, our editorial team will select some quality articles worth spending time reading and collecting from the content published in the past 7 days every Saturday, providing you with new insights from the perspectives of data analysis, industry judgment, and opinion output, as you navigate the crypto world.

Now, let's read together:

Investment and Entrepreneurship

Pantera Founder Predicts: Crypto Bull Market Will Last for Decades, SOL May Become the New King

We have been selling Bitcoin to invest in other projects. Our investors have also received good returns as a result. Currently, we still hold about $1 billion worth of Bitcoin.

The correlation between Bitcoin and traditional risk assets is not strong; we are in a cryptocurrency bull market that will last for decades.

Bitcoin is not a bubble; most people have not really entered this field yet, and we are still in the early stages of industry development.

The performance of many altcoins has not met expectations. The current market hotspots are still focused on the three major coins: Bitcoin, Ethereum, and Solana.

In the blockchain field, Pantera's investment success rate has reached 86%. Among the companies invested by Pantera, 25 have become unicorns.

Solana DATS, even with mediocre performance and trading prices close to face value, can still provide about 7% returns through staking, which is far more attractive than traditional ETFs.

Currently, our investment in Solana has reached $1.3 billion. Solana's market cap is currently only 5% of Bitcoin's, but in the long run, we believe it has the potential to surpass Bitcoin.

The Path of Value Circulation: On the Strategies of Destruction and Redistribution in Cryptocurrency

To maintain system health and the rationality of incentive mechanisms, is it better to destroy assets or to redistribute assets?

- When cuts are the initial stage of punishing malicious behavior, redistributing assets is usually more efficient than simple destruction.

- When destruction is a core feature of the design and does not involve cuts (such as in a deflationary economic model), there is no reason to implement redistribution.

- When redistribution is a core feature of the design but behaves like a loophole, destruction should not be used as a substitute; rather, the design needs to be fundamentally improved.

Also recommended: 《Token 2049 Revelation: Innovation Exhaustion, Capital Closed Loop, and the Silent Migration of the Crypto Industry》《Odaily Exclusive Interview with 1inch Co-founder: Earn an Extra $200,000 per Trade, Secrets of the Team's High Win Rate Trading》《He Yi: Opposing, Understanding MEME, and Finally Becoming MEME, the Clown is Myself》《Tiger Research: An Analysis of the Current Status of Centralized Exchange Licenses in Vietnam》。

Policy

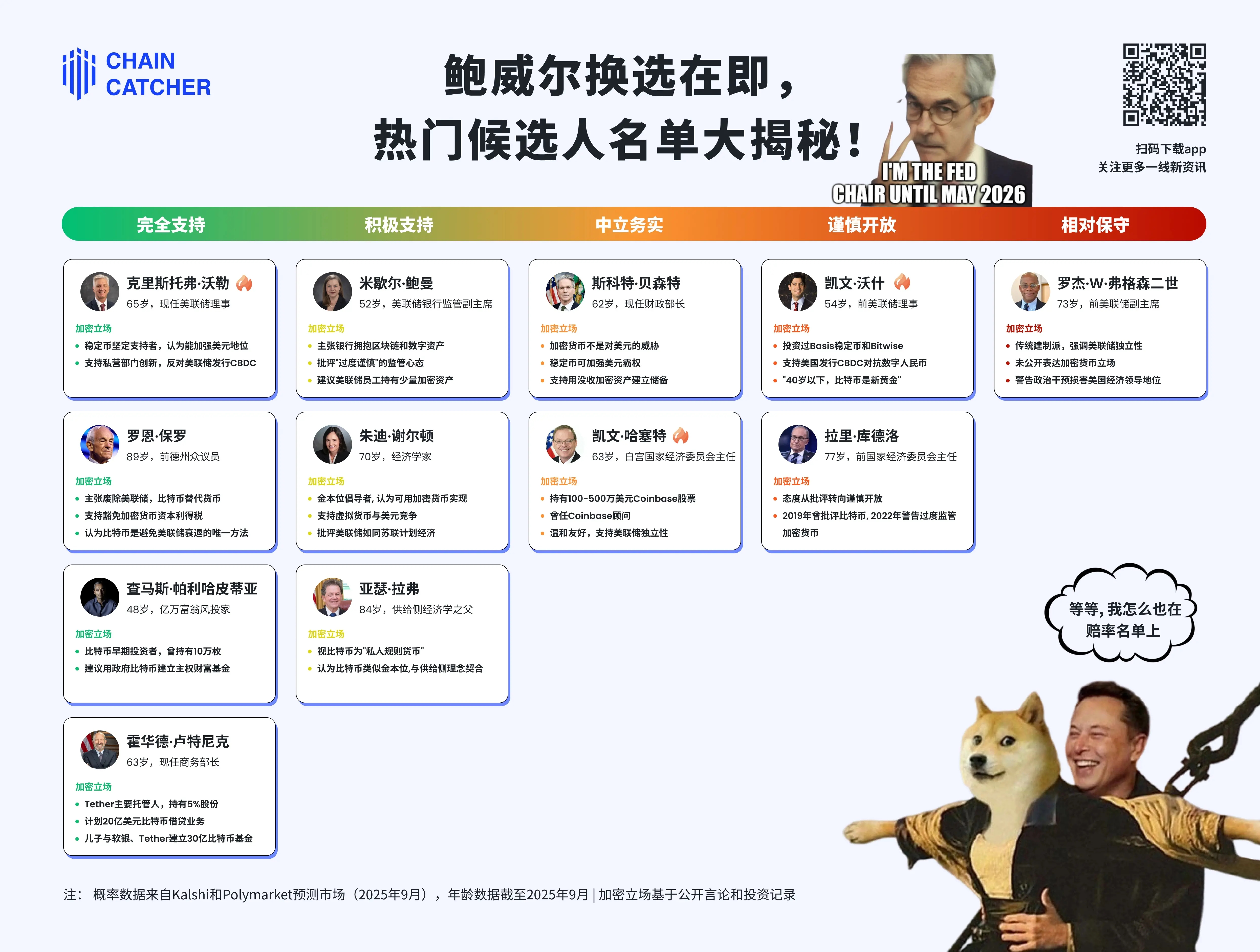

With Powell's Re-election Approaching, What is the Crypto Stance of Potential Successors?

Stablecoins

Tether's Next Chapter: From Offshore Issuance to Ambitions for Global Compliance Infrastructure

Tether remains the leader in global stablecoins, anchoring dollar acquisition channels in emerging markets and driving demand for U.S. Treasury bonds through its reserves.

As new regulations and competitive dynamics reshape the stablecoin market, leading to differentiation in compliance and yield distribution, the dominance of USDT is declining.

The roles of Ethereum and Tron in USDT activities are evolving, with Tron maintaining a leading position in high-frequency, low-cost payment areas, while the decline in Ethereum fees and increased liquidity are driving broader retail and settlement applications.

Emerging channels bring new growth opportunities, with USDT 0 and networks focused on stablecoins (like Plasma) expanding Tether's distribution to more networks and use cases (like payments).

Also recommended: 《Analysis of Stablecoin Strategies of Major Global Economies》。

Airdrop Opportunities and Interaction Guide

MetaMask is About to Launch a Points Program, What Can You Do Now?

MetaMask specifically mentioned the related project Linea and its own stablecoin product mUSD, and has clearly stated that it will provide additional points bonuses for the Linea chain. It is speculated that MetaMask's subsequent activities are also expected to offer additional treatment for Linea and mUSD in terms of continuous rewards and points.

The author recommends adding liquidity for mUSD on Etherex, as this can effectively utilize several "children" of Consensys: Linea, MetaMask, mUSD, and Etherex; even if MetaMask's airdrop expectations fall short, this can still yield considerable mining rewards through Linea Ignition.

Reviewing Major Projects Set to Launch Tokens This Year

Meteora, Monad, Abstract, Pharos, OpenSea, MetaMask, Rainbow, Football.Fun, Limitless, Lighter, Grvt.

Also recommended: 《Q4 Airdrop List: A Comprehensive Review of 60+ Potential Airdrop Projects》《Airdrop Weekly | MetaMask Releases Airdrop Points Details; Meteora Confirms October 23 TGE (9.30-10.5)》《Popular Interaction Collection | StandX Official Discord Earn Points Activity; T-REX Earn Badges by Completing Tasks (October 9)》《Public Beta Launch, How to Participate in Lighter's Second Season Points Program?》《The Monad Airdrop, Which Once "Smoked" on the Testnet, is Coming Soon; Users Must Complete Tasks Within a Limited Time to Claim?》。

Ethereum and Scalability

What Will be the Peak of Ethereum?

The basic assumptions are as follows:

- Ethereum's price is 250% higher than the 200-week moving average, corresponding to a price of $8,500;

- The realized price has reached $3,000; if the price-to-realized price ratio is 2.9, the corresponding Ethereum price is $8,700;

- Ethereum's market cap reaches 35% of Bitcoin's market cap; if Bitcoin's price is $150,000, the corresponding Ethereum price is $8,600;

- Ethereum's ratio to the Nasdaq index reaches a new high; if the ratio is 0.35, the corresponding Ethereum price is $8,300.

If the bull market continues, Ethereum's price may break $10,000; if the market turns bearish, Bitcoin's peak increase will be limited, and Ethereum will also come under pressure. Overall, Ethereum is expected to reach its peak for this cycle within this quarter.

Multi-Ecosystem and Cross-Chain

The Charging Gate Dispute of USDT: Tether's Plasma Conspiracy

- Core Positioning: Plasma is a Bitcoin sidechain supported by Tether, aimed at becoming the ultimate settlement layer for USDT and Bitcoin.

- Business Motivation: Plasma's core goal is to help Tether reclaim billions of USDT transaction fees lost annually to public chains like Ethereum and Tron, achieving a strategic upgrade from "stablecoin issuer" to "global payment infrastructure."

- Technical Strategy: Robust Combination: Plasma does not pursue high-risk new technologies but integrates proven mature solutions from the industry.

- Advantages: It has top-tier resources and background, with a clear and grand narrative, based on the two most core assets in the crypto industry (USDT and BTC).

- Challenges: It will face fierce competition from existing ecosystems like Ethereum and Tron, user migration will require time and cost, and its financial products also face significant regulatory uncertainty.

CeFi & DeFi

Hyperliquid has chosen an aggressive path, not relying on the performance constraints of existing public chains, but instead building its own dedicated L1 application chain based on the Arbitrum Orbit technology stack, and equipping it with a fully on-chain order book and matching engine. This means that from order placement, matching to settlement, all trading processes occur transparently on-chain, while achieving millisecond-level processing speeds. Therefore, from an architectural perspective, Hyperliquid resembles a "fully on-chain version" of dYdX, no longer relying on any off-chain matching, aiming directly at the ultimate form of "on-chain CEX."

Recently passed HIP-3 proposal introduces a permissionless, developer-deployed perpetual contract market on core infrastructure. Previously, only the core team could launch trading pairs, but now any user staking 1 million HYPE can directly deploy their own market on-chain. In short, HIP-3 allows for the permissionless creation and launch of derivative markets for any asset on Hyperliquid. This completely breaks the limitation that past Perp DEXs could only trade mainstream cryptocurrencies.

Why Did the NYSE Spend $2 Billion Betting on Polymarket?

By supporting Polymarket, the NYSE is effectively acknowledging that the "market form" itself is evolving—Polymarket represents a frontier: a digital-native, socially-driven, open and verifiable market system, yet still built on a transparent, secure, and globally scalable trust architecture.

Future exchanges will price beliefs, probabilities, and truths.

The full-stack on-chain exchange Flying Tulip, created by the "former DeFi king" Andre Cronje (AC), has officially announced the completion of a $200 million private placement and plans to raise another $800 million at a $1 billion valuation to build a comprehensive platform that includes native stablecoins, lending, spot trading, contract trading, and on-chain insurance.

Flying Tulip will provide all investors with a reversible "redemption" option through permanent put options, allowing investors to destroy FT tokens at any time and redeem their principal in invested assets (such as ETH).

The author suggests strong participation: first, because 100% of FT will be minted at the same price in private or public offerings, meaning all investors have equal costs; second, the "permanent put option" provides ample downside protection when FT prices are below or equal to $0.10, and even when above $0.10, the potential downside protection offers strong psychological support to holders; third, Flying Tulip has designed multiple FT buyback mechanisms, which may benefit potential price increases.

Also recommended: 《In-Depth Analysis of Perp DEX: Hyperliquid, Aster, Lighter, edgeX (3)》。

NFT

$490,000 for a "Cat"! How Did Hypurr Become the Shining New Star of the NFT Market?

After three years of silence in the NFT space, the wind of hope is once again blowing from Hypurr.

Weekly Hotspots Recap

In the past week, Bitcoin broke $125,000, setting a new high; spot gold broke the $4,000 mark; the BSC Meme craze continues, with a war of words between leading exchanges; the U.S. government shutdown continues; on the morning of the 11th, a massive crash occurred, setting a record for daily liquidations at $19.1 billion;

Additionally, in terms of policy and macro markets, Anthony Pompliano stated that the U.S. government will disclose Bitcoin purchases at some point in the future; SEC Chairman: The SEC plans to officially launch "innovation exemptions" by the end of the year or Q1 2026; Jensen Huang: has invested in Musk's xAI but regrets not investing in OpenAI earlier;

In terms of opinions and statements, OKX CEO Star: OKX has never and will never artificially create tokens or manipulate the market; Monad Growth Director: Airdrops will have a time-limited window, and users must complete tasks within the time limit to receive them; Du Jun: the fund holds 7% of CRV's circulating supply and 1% of PENDLE's circulating supply;

Regarding institutions, large companies, and leading projects, the NYSE's parent company is close to reaching an agreement to invest $2 billion in Polymarket; Ondo Finance has completed the acquisition of Oasis Pro, obtaining SEC-registered digital asset service licenses; HashKey is considering an IPO; YZi Labs announced the establishment of a $1 billion Builder Fund aimed at increasing support for founders of BNB ecosystem projects; Four.Meme launched a dedicated token release page for Binance Wallet; Binance Wallet introduced the exclusive Meme Rush platform, during which users can earn 4x Alpha points; MetaMask GitHub released airdrop points details: spot weight is the highest, and using LINEA points doubles the rewards; MetaMask further disclosed the rewards program, with over $30 million in LINEA tokens to be distributed in the first quarter; Aster Genesis Phase Two will open airdrop queries on October 10 and claims on October 14; Meteora announced MET token economics: 48% of the supply will be in circulation at TGE; Enso opened ENSO token airdrop pre-registration, which must be completed by October 12; Monad is likely to conduct a token airdrop;

In terms of data, on October 7, BNB's market cap surpassed USDT; on October 8, Four.meme's protocol revenue in the past 24 hours surpassed pump.fun;

In terms of security, Abracadabra appears to have been attacked, with hackers transferring all stolen $1.7 million to Tornado Cash; 0 G Labs' official X account was hacked…… Well, it has been another tumultuous week.

Attached is the portal for the "Weekly Editor's Picks" series.

See you next time~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。