本文由 Tiger Research 撰写,深度解析越南加密货币交易所新规:3.8 亿美元最低注册资本门槛下,币安、Bybit 等国际巨头与本土机构围绕限量牌照展开的激烈角逐。

要点总结

- 越南新监管框架设立极高准入门槛,仅大型银行、证券公司或具备强势合作伙伴的全球交易所方有望达标。

- 七家本土企业虽已提前布局,但多数资本实力薄弱,机构资质不足,难以满足监管要求。

- 币安与 Bybit 已获越南政府高层接见,预示着外资交易所将与少数本土持牌机构共同瓜分市场蛋糕。

1、监管新时代:越南数字资产市场迈向规范化

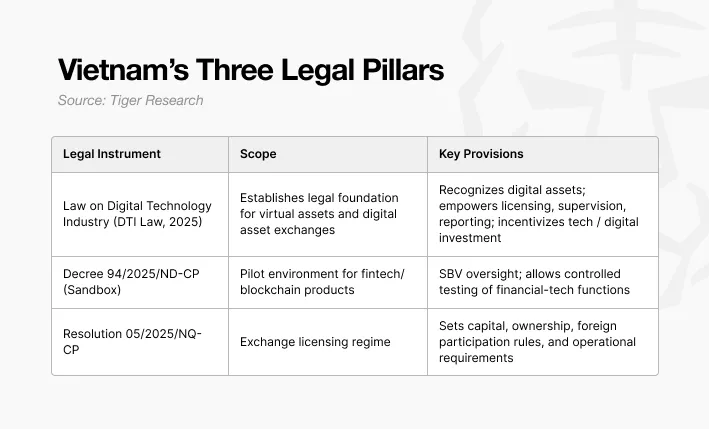

2025 年,越南数字资产市场迎来决定性转型。历经多年监管模糊期后,政府接连推出三大政策框架,标志着该国正式从放任的"灰色地带"迈入全面监管、税收可控的新阶段。

首要基石是国民议会于 2025 年 6 月通过的 《数字技术产业法》,定于 2026 年 1 月 1 日正式实施。该法案首次在法律层面明确数字资产的独立地位,将其与证券和法定货币工具区分开来,为后续征税、反洗钱监管及执法权限提供了法律依据,具体细则将通过实施条例进一步明确。

第二项关键举措是 2025 年 7 月 1 日生效的 《监管沙盒法令》。在越南国家银行主导下,该沙盒机制为金融创新提供测试环境。虽未专为加密货币设计,但通过反洗钱、客户身份验证及结算等核心要求,预计将与交易所牌照制度形成监管联动。 最具即时影响力的当属 2025 年 9 月 9 日颁布的 第 05/2025/NQ-CP 号决议,正式启动为期五年的虚拟资产发行与交易试点。这成为交易所在越南合法运营的首个实践框架。关键限制在于:试点阶段仅越南本土企业可申请运营商牌照,境外交易所须通过合资或提供技术、合规系统及流动性支持等方式间接参与。

系列组合拳彰显政府意图:在严格监管下逐步将数字资产活动纳入境内体系。政策导向清晰倾向于本土控盘、对接国际反洗钱标准,并与建设岘港区域金融中心的战略目标深度绑定。

对机构而言,核心在于越南已告别监管真空时代,此乃积极信号。但高企的牌照门槛与外资限制,预示着开放程度仍属有限。未来 12-18 个月将见证越南究竟能成长为结构型市场,抑或仅停留于政策试验田。

2、持牌运营的高门槛

2025 年 9 月 9 日发布的第 05/2025/NQ-CP 号决议,为越南五年期加密货币试点设立严苛准入条件:仅依据《企业法》注册的越南企业具备运营商申请资格。

持牌机构须维持 10 万亿越南盾(约合 3.8 亿美元)最低法定资本,且必须全部以越南盾实缴。其中至少 65%资本需来自机构股东,且该部分股份中超过 35%须由至少两家以下类型组织共同出资:商业银行、证券公司、基金管理公司、保险公司或科技企业。机构股东还需满足连续两年盈利记录,且经审计财报均获无保留意见。

外资持股比例严格限定于法定资本的 49%以内,确保运营主导权掌握于本土。此外,持牌机构还需满足严格的人力与基础设施要求:首席执行官需具备至少两年金融业经验,技术总监需五年相关 IT 资历,且须配置至少 10 名持网络安全认证及 10 名持证券从业资格的员工。技术系统必须达到金融业最高标准的国家信息安全四级认证。

该框架虽彰显政府规范市场的决心,但其要求即便对成熟金融机构也构成挑战。若未来将适用范围扩展至钱包服务、GameFi 项目或中型交易所,绝大多数原生加密企业将难以达标。

KyberSwap 限制越南用户访问。来源:KyberSwap

值得注意的是,KyberSwap、Coin 98 等越南本土项目已主动暂停国内业务。实践中最可能形成混合模式:银行、券商、保险公司与科技巨头构成持牌核心,Web 3 项目则以技术和服务供应商身份参与。此消彼长间,市场主导权将向持牌机构倾斜,初创企业及原生加密项目恐被边缘化。

业务范围亦受严格限制:仅允许资产背书型代币发行与现货交易,且结算必须使用越南盾。加密货币支付功能仍在禁止之列,衍生品与杠杆交易均未开放。相较美国、新加坡、香港等先行者,越南的许可业务范围明显收窄。

3、本土与国际势力的对垒

3.1 本土参与者布局

多家越南企业已未雨绸缪,注册成立"数字资产交易所"实体,以期在新政实施后抢占先机。然而当前这些机构的资本规模与股权结构,距 05/2025 号决议的硬性要求仍相去甚远。

对于机构投资者来说,有三个观察值得注意。首先,资本差距是决定性的。所有当前参与者的资本化水平都在 20 亿越南盾到 1.47 万亿越南盾之间,远低于 10 万亿越南盾的法定最低要求。如果没有来自银行、证券公司或保险公司的大规模注资,这些实体中的大多数将不符合牌照资格。

其次,机构锚定将决定谁能存活。决议要求至少 65%的机构所有权,包括至少两家银行、证券公司、保险公司或技术企业的 35%份额。这一条款明显有利于已经与 SSI、VIX、Techcom、HD 和 MB 等主要金融机构有联系的参与者,而让 DNEX 或 CAEX 等金融科技主导的载体处于劣势,除非他们能够吸引更强大的合作伙伴。

最后,市场预期表明牌照将是有限的。传言表明,在初始阶段将批准不超过五个运营商。由于至少已有七个竞争者在定位自己,一些必然会被排除在外。对于评估越南市场的全球交易所来说,这提高了尽早与最可信的国内合作伙伴结盟的重要性。

3.2 全球玩家与政府战略互动

Bybit 首席执行官周本会见越南副总理阮和平。来源:Bybit

全球交易所正积极搭建与越南政府的沟通桥梁。2025 年 9 月 24 日,在阿联酋正式访问期间,常务副总理阮和平会见了币安首席执行官 Richard Teng。副总理当面邀请币安在岘港设立区域总部,并参与越南国际金融中心的持牌数字资产交易所建设。更邀请曾执掌阿布扎比全球市场的 Teng 担任越南金融中心高级顾问。此举通过政府官方渠道公告,释放出明确政策信号。

币安首席执行官 Richard Teng 在岘港与越南领导层会面。来源:币安

同期,岘港人民委员会与币安签署合作备忘录,确立在区块链与数字资产领域的战略合作。这意味着币安既获高层背书,又具地方政府合作框架。

Bybit 同样攻势凌厉。2025 年 9 月 17 日,它与岘港人民委员会、阿布扎比区块链中心及 Verichains 共同签署三方备忘录,合作涵盖流动性供给、基础设施安全及生态联通,精准契合越南监管目标。虽未达币安的高层会晤级别,但为其参与国际金融中心建设奠定实操基础。

当前格局显示,币安与 Bybit 已在全球交易所的越南竞逐中抢占先机。若如传闻仅发放 5 张牌照,且其中 2 席预留给国际交易所,则本土企业仅剩 3 个名额。面对至少 7 家蓄势待发的竞争者,本土机构必须加速证明自身实力与机构背景,方能夺得剩余席位。

此番布局亦引发连锁思考:如 BingX、MEXC 等已占据越南零售市场主流的全球交易所将何去何从?这些通过离岸平台服务越南用户的交易所,若未能及时开展政府公关,恐在持牌市场中被边缘化。除非它们迅速与获批本土实体结盟或获得特殊邀请,否则其业务将继续游走于监管之外,待持牌市场成熟后可能面临监管风险。

4、战略破局:"CEX Tiger"虚拟案例的进军路径

在新制度下,寻求进入越南的项目有哪些选择?考虑一个假设的案例"CEX Tiger",一个计划扩展到越南的全球交易所,以及哪些策略将是最可行的。

第一个也是最重要的决定是选择合作伙伴。外国交易所不能直接获得牌照,必须与强大的国内机构结盟。确定哪些越南银行、证券公司或保险公司最有可能获得有限牌照之一是至关重要的。合作伙伴的选择将决定市场准入、合规态势和长期可扩展性。

一旦确保了合作伙伴,下一步就是定义运营模式。需要一个混合结构:越南合作伙伴持有牌照和监管责任,而 CEX Tiger 贡献技术、流动性和运营专长。合资企业成为正式实体,国内机构作为法律和监管前端,外国交易所运行底层服务。

业务预期也必须进行校准。该框架将活动限制在现货交易、越南盾结算和有限的投资者参与。这不是一个为立即交易量或衍生品驱动收入而设计的市场。相反,战略目标应该是确保早期存在,建立监管善意,并在潜在的未来自由化之前建立合法性。

然而,竞争将会很激烈。如果两个牌照分配给币安和 Bybit,国内机构只剩下三个。对于后来者来说,真正的问题不是越南是否有吸引力——市场的增长和用户基础使这一点很明显——而是是否能够确保一个可信的国内合作伙伴,以及该合作伙伴是否愿意合作。错过第一轮牌照可能会延迟进入,直到框架扩展。

对 CEX Tiger 这类交易所,应将越南视为长期战略支点而非短期利润来源。成功关键在于:择优选派本土合作方、甘居次要股权地位、提前深耕亚洲最具增长潜力的加密市场。

从用户端考量,挑战更为复杂。越南用户已习惯全球交易平台。即便获得牌照,新进入者仍将面临安全标准、资产品类、平台稳定性等多维度考验。牌照带来合规性,却无法自动转化为用户信任与市场份额。

终极战略抉择摆在 CEX Tiger 们面前:是携手本土伙伴投身牌照竞逐,还是坚守监管外围维持现有用户,同时密切跟踪政策演进?这场关乎越南市场的战略博弈,刚刚拉开序幕。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。