The rally in crypto ETFs showed no signs of cooling midweek. For the eighth day in a row, both bitcoin and ether funds saw consistent inflows, underscoring a powerful wave of institutional demand driving digital asset markets higher.

Bitcoin ETFs attracted $440.73 million in new capital, extending what has become a good inflow streak. Blackrock’s IBIT once again dominated the day, hauling in a massive $426.20 million, a continuation of its remarkable leadership in capturing market flows.

Bitwise’s BITB followed with $13.43 million, while Grayscale’s Bitcoin Mini Trust added $1.09 million. No ETF recorded an outflow, marking a clean sweep of positive momentum for the category. Trading activity remained heavy at $5.15 billion, with total net assets rising to $168 billion, signaling unrelenting investor appetite for bitcoin exposure through ETFs.

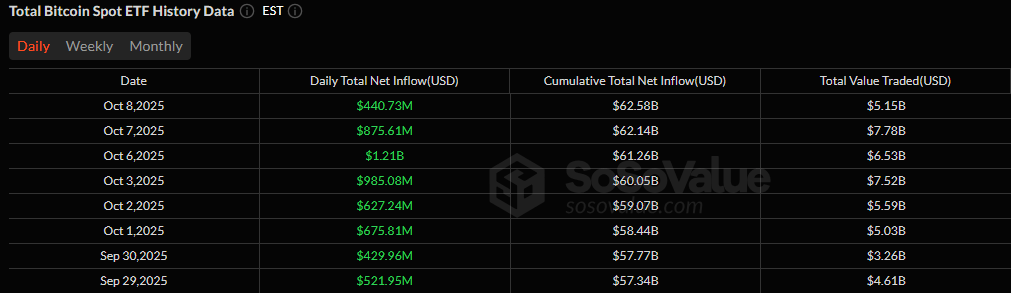

Bitcoin ETFs 8 Day Run. Source: Sosovalue

Ether ETFs also kept their winning streak alive with $69.05 million in total inflows, though not without turbulence. Blackrock’s ETHA led strongly with $148.88 million in new inflows, but the gains were tempered by outflows of $63.12 million from Fidelity’s FETH and $16.72 million from Grayscale’s ETHE. Despite the offsets, the asset class ended the day firmly in the green. Total value traded reached $2.05 billion, while net assets climbed to $31.17 billion, marking another solid step forward for ether ETFs.

Eight straight days of inflows for both bitcoin and ether ETFs reflect not just bullish sentiment, but growing institutional trust in crypto as a long-term asset class.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。