这是CoinDesk分析师和特许市场技术员Omkar Godbole的分析文章。

目前几乎没有理由怀疑比特币(BTC)的上升轨迹。尽管在过去24小时内反弹暂停,但从略低于110,000美元的低点开始的陡峭近90度的上升趋势线仍然保持强劲。事实上,价格今天早些时候测试了该趋势线并迅速反弹,如下方的小时蜡烛图所示。

分析师建议那些错过初始反弹的人可以考虑使用看涨价差以更有效的风险方式捕捉进一步的收益。

接下来会怎样?

在日线图上,突破扩展三角形的上边界可能会为向135,000到140,000美元的区间铺平道路。周一,上边界作为阻力。

另一方面,如果BTC跌破小时图的上升趋势线,我们可能会看到一个修正阶段,首个支撑位在118,000美元左右。

传统市场怎么说?

超越BTC,传统市场描绘出一个看似同时存在看涨和修正情景的图景。

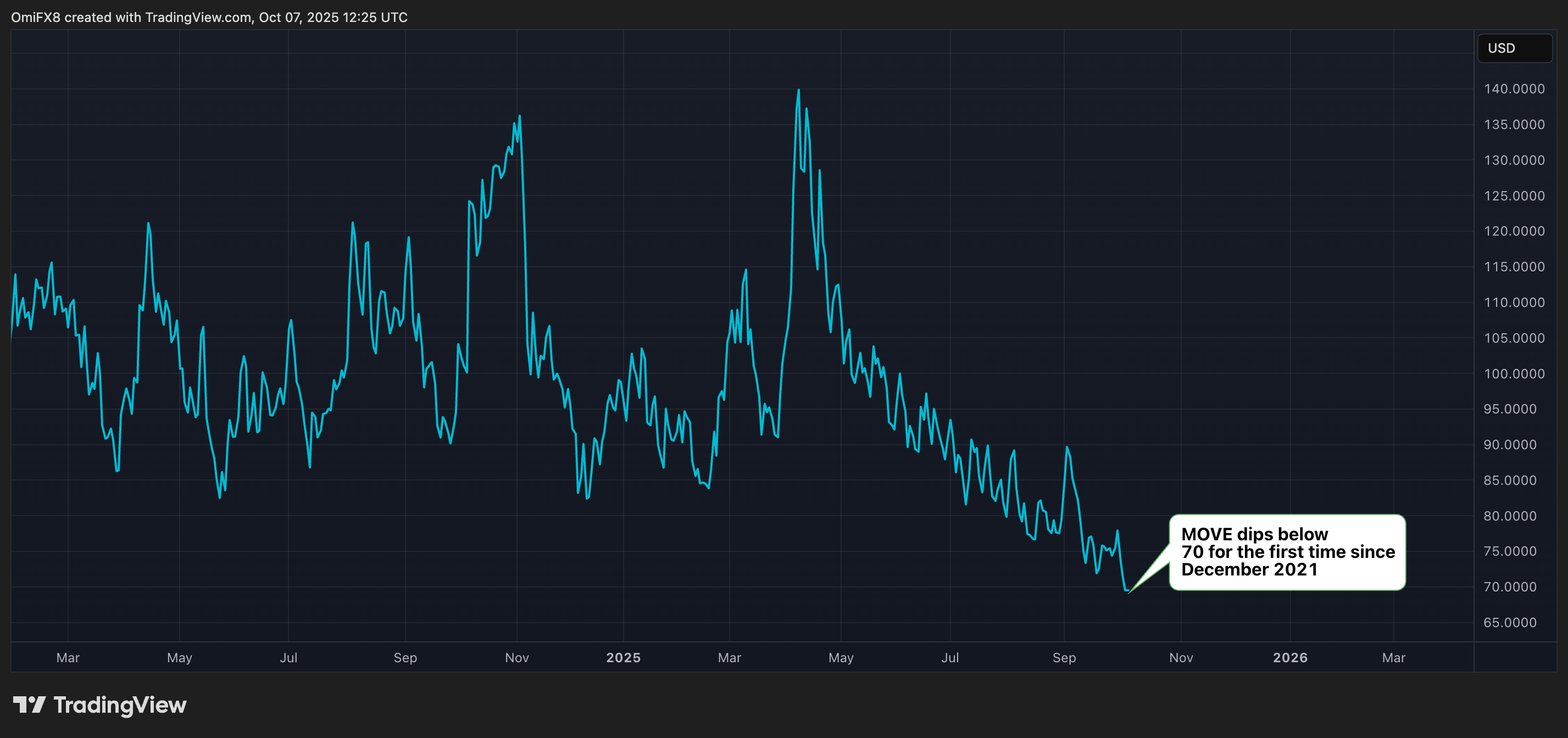

多头可以从MOVE指数中获得安慰,该指数衡量国债票据的预期波动性,持续下降。该指数周一跌破70,为2021年12月以来的最低点,表明风险资产的金融条件更加宽松。

然而,尽管9月份降息和对更多宽松的预期,美元指数(DXY)和国债收益率仍然保持韧性。

DXY正在 flirt 一个看涨的双底形态,而10年期国债收益率自9月17日美联储降息25个基点以来上升了16个基点,达到4.16%。换句话说,收益率至少部分抵消了降息的影响。

此外,高盛警告日本的债券市场冲击,受到新首相对安倍经济学的偏好的驱动,可能会蔓延到美国国债和其他主要债券市场,给局势带来更多不确定性。

交易者应密切关注这些指标,因为美元和收益率的持续强劲可能会扰乱加密货币的反弹。

ETH:看涨旗形突破

以太坊(ETH)上涨4%,在周线图上形成看涨旗形突破。看涨旗形是一种逆趋势的整合模式,通常预示着前期上升走势的延续。可以将旗帜视为一个暂停,疲惫的多头在此重新集结并为下一轮上涨积蓄力量。

也许,强劲的反弹将突破5,000美元的水平。然而,如果我们看到从这里开始的抛售导致周末前出现亏损,这将是空头掌控的明确信号。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。