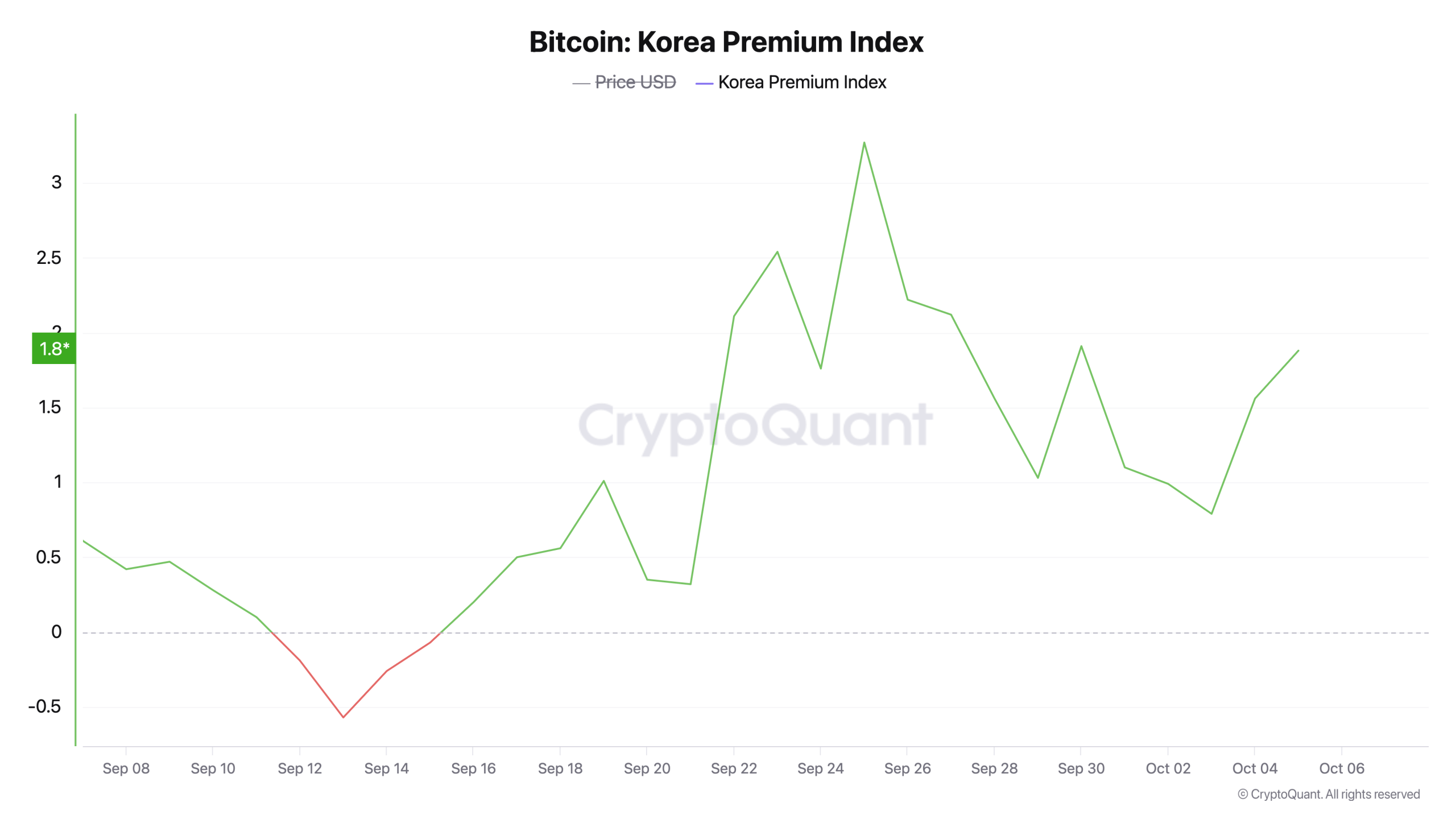

对于加密货币爱好者来说,这一周真是刺激不已,比特币(BTC)在历史价格区间中滑行。随着最新的上涨,韩国的BTC价格从九月份的折扣状态转变为溢价领域。

Cryptoquant的数据表明,9月15日的0.57%的折扣在一夜之间消失,第二天就被0.2%的溢价所取代。在过去的20天里,以韩元交易的比特币一直舒适地高于全球平均水平。

在9月25日,该溢价达到了3.27%,但在10月3日滑落至仅0.79%。昨天,它再次回升至比加权全球价格高出1.88%。在最新的126,000美元峰值之前,coinmarketcap.com的存档数据显示,周一上午11:57(东部时间)BTC的价格为125,117美元。在Upbit上,同一时间的存档数据显示BTC的交易价格为126,109美元。

韩国的比特币溢价并不是什么新鲜事——它们几乎是当地的特色。严格的资本管制和严厉的金融规则阻碍了国内和外国市场之间的资金流动,抑制了套利机会,让价格差距持续存在。

再加上该国对比特币和山寨币的强烈需求,这就形成了持续溢价定价的局面。尽管溢价喜欢玩捉迷藏,但它总能照亮韩国独特的加密货币场景。

在其他地方,交易者看到价格差距消失得比一个表情包币的上涨还快,但在首尔,这些差距却喜欢停留——受到严格监管和零售人群的推动,这些人群就是不肯放弃。到10月6日下午3点(东部时间),当BTC首次突破126,000美元区间时,Upbit上的价格仍然高出约1,000美元。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。