A seismic shift is shaking traditional finance as more than 30 cryptocurrency exchange-traded fund (ETF) applications flood the U.S. Securities and Exchange Commission (SEC), underscoring how rapidly institutional interest in digital assets is expanding. Analysts say the surge of filings represents one of the clearest signals yet that Wall Street is preparing for large-scale integration of crypto-based products into regulated investment markets. The flood of applications highlights an intensifying race among fund managers to secure early ground in the crypto ETF arena.

Nate Geraci, president of Novadius Wealth Management, shared on social media platform X on Oct. 3:

30+ crypto-related ETFs filed w/ SEC this afternoon… Just the beginning. Any crypto ETF you can possibly imagine will be filed w/ SEC over next several months. You all have no idea what’s coming.

Geraci’s statement, which captured the momentum behind the filings, references Bloomberg ETF analyst James Seyffart’s statement on X regarding 21 crypto ETF filings by Rexshares and Ospreyfunds. Seyffart wrote:

@REXShares / @OspreyFunds just filed for 21 crypto ETFs … Yes, Twenty One.

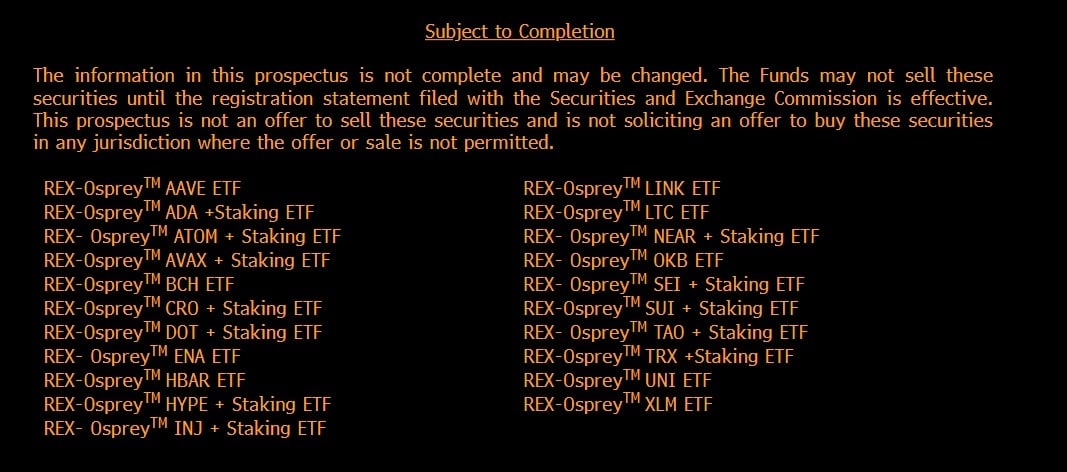

The 21 ETFs filed by REX Shares and Osprey Funds include AAVE, ADA + Staking, ATOM + Staking, AVAX + Staking, BCH, CRO + Staking, DOT + Staking, ENA, HBAR, HYPE + Staking, INJ + Staking, LINK, LTC, NEAR + Staking, OKB, SEI + Staking, SUI + Staking, TAO + Staking, TRX + Staking, UNI, and XLM.

List shared by Bloomberg ETF analyst James Seyffart.

In addition, Seyffart also shared that Defiance and Leverage Shares also filed a number of crypto-related exchange-traded products (ETPs). Altogether, more than 30 crypto and crypto-related ETFs were filed in this latest wave, marking a significant step toward bridging traditional and decentralized finance. Supporters say this broad set of filings reflects growing institutional acceptance of digital assets, while critics warn that regulatory scrutiny could still determine the timeline for market entry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。