Source: Coinbase

Compiled by: Golden Finance

Key Points:

- Bullish signals for October: A weaker dollar, increased liquidity, and rising federal funds futures prices increase the likelihood of a dovish stance from the Federal Reserve.

- Liquidity entering gold as a signal: BTC has a relatively high correlation with global liquidity, while gold has not shown consistent correlation.

Impact of the U.S. Government Shutdown

Coinbase's outlook for the cryptocurrency market in October is tactically bullish: we believe that a weak dollar, increased short-term global liquidity, and the Federal Reserve's cautious inclination towards rate cuts will create favorable conditions for the cryptocurrency market. Unless unexpected hawkish comments arise, we believe these factors will increase the likelihood of BTC leading the rally until November, when liquidity headwinds may come into play.

What does the U.S. government shutdown mean for cryptocurrency? The U.S. is currently in a partial government shutdown, which may delay the release of some key economic statistics that the Federal Reserve relies on for policy-making. Due to funding shortages, agencies such as the Bureau of Labor Statistics (BLS) and the Bureau of Economic Analysis (BEA) will suspend data collection and delay the release of major data—including the monthly employment report and the Consumer Price Index (CPI)—until funding is restored.

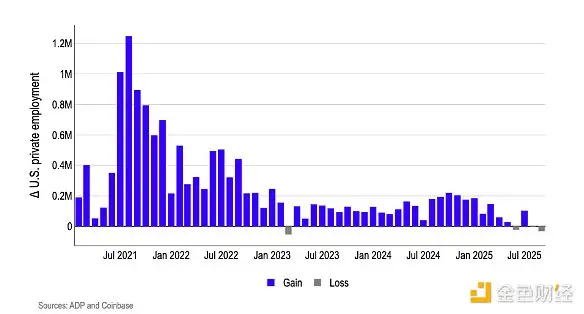

In the absence of official data releases, we believe the market will rely on private indicators such as ADP private sector employment data to gauge future rate cut expectations. ADP data shows that after years of slowdown (compared to over a million new jobs added monthly in 2021), the current net job additions are essentially zero (Figure 1). We believe that the logic of the Phillips curve suggests that current employment weakness will shorten the transmission of wage-driven service sector inflation, with a lag of about 10 months, reducing the cost of preemptively easing policy relative to the tail risks of a nonlinear labor downturn.

Our view: The data uncertainty triggered by the government shutdown, combined with stagnation in private sector hiring, makes the market more optimistic about the Federal Reserve adopting a less restrictive policy path. Additionally, it is worth noting that multiple factors have recently contributed to a temporary liquidity gap in the cryptocurrency market, specifically: (1) the U.S. Treasury's replenishment of its general account balance (which is now close to the target level of over $800 billion); (2) quarter-end and month-end fund flows; (3) the "conference effect" from the TOKEN 2049 conference in Singapore. As these influencing factors dissipate, they are expected to positively impact market price trends in the short term.

Figure 1. Monthly changes in U.S. private sector employment are at their lowest level since 2023

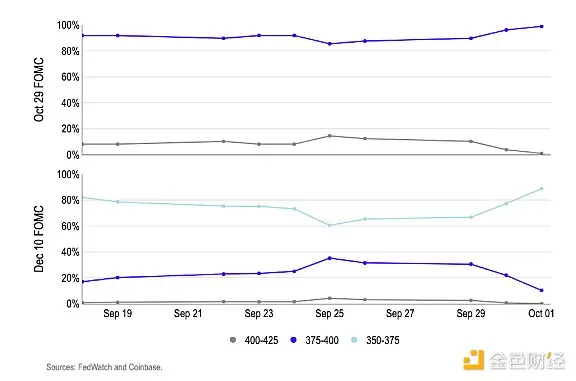

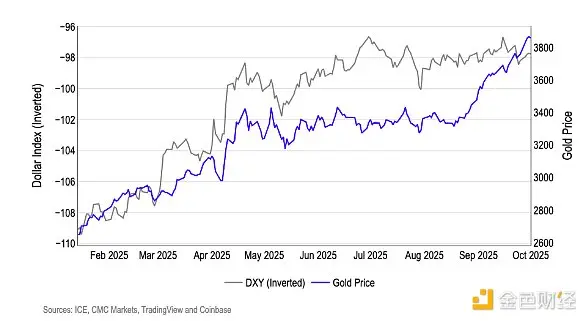

We believe the interest rate market has already digested this shift—30-day federal funds futures currently reflect an 87% probability of two 25 basis point rate cuts before the end of the year—cross-asset signals also confirm the mechanisms of lower real interest rates and a weaker dollar, which are favorable for cryptocurrencies (Chart 2). Currently, the pricing for successive FOMC meetings is centered around the 3.75-4.00% target range at the end of October, trending towards 3.50-3.75% by December. Meanwhile, the dollar is weakening, and gold prices have reached historic highs—indicating that expectations for real interest rates are easing, and broader "store of value" demand is emerging (Chart 3). We believe this combination will relax the dollar's financial environment and reduce the cash yield competition for risk assets, which should benefit cryptocurrencies.

Chart 2. The probability of two 25 basis point rate cuts before the end of the year reaches 87%.

Chart 3. The dollar weakens, gold reaches historic highs

Can We Stop Talking About Gold?

In short, the answer is no, but the market seems to be struggling to explain why gold broke its historic high in September while Bitcoin's price performance was lackluster last month. Part of the reason is that, despite Bitcoin's unstable performance during high inflation periods, many market participants and media commentators still cling to viewing Bitcoin as a gold-like inflation hedge. In fact, Bitcoin often serves as a safeguard against excessive monetary issuance, which is not entirely the same as inflation. This also explains why Bitcoin often benefits from global liquidity injections.

In September, gold prices surged due to rate cuts from multiple global central banks and market concerns about (1) the U.S. government shutdown and (2) potential damage to the Federal Reserve's independence. (That said, while the SPDR Gold ETF attracted $4.2 billion in funds last month, the U.S. spot Bitcoin ETF still saw a net inflow of $3.5 billion.) However, we believe this performance difference is not due to a divergence in institutional investor sentiment, but rather because Bitcoin led price movements in July and August. As a result, Bitcoin faced continued selling pressure during technical rebounds, while liquidity was drained from the market for the reasons mentioned above.

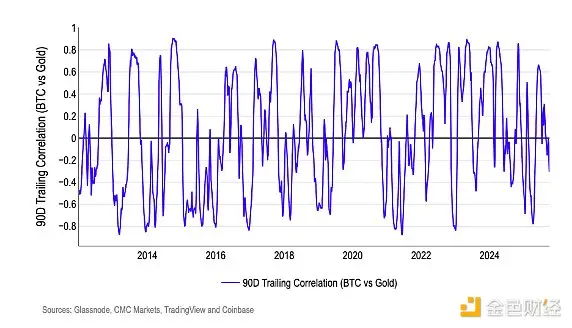

From a data perspective, we believe that relying solely on gold indicators cannot serve as a strong indicator for Bitcoin. Since 2013, the 90-day rolling correlation between BTC and gold has fluctuated between two extremes (-0.8 to +0.8) dozens of times, showing short-term clustering volatility but lacking long-term persistence, indicating extremely weak average linkage (Chart 4). We believe that the common driving factor for positive correlation is enhanced liquidity: when real interest rates decline and the dollar weakens, both assets tend to absorb excess liquidity in the market. Conversely, when gold rises due to safe-haven sentiment while the dollar strengthens and liquidity tightens (as has been the case in recent weeks), BTC, as a high-beta risk asset, typically decouples or even moves in the opposite direction.

Our view: In fact, we believe liquidity is the most reliable macro signal for Bitcoin, as evidenced by the consistent correlation of about 0.9 between our custom M2 global liquidity index and Bitcoin over the past three years.

Chart 4. Correlation between Bitcoin and gold over the past 90 days

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。