比特币ETF资金流入达到9.85亿美元;以太坊增加2.34亿美元

10月3日星期五,一波资金涌入加密货币ETF,为比特币和以太坊基金的完美资金流入周画上句号。这一反弹突显了机构投资者的信心回升,推动交易活动和净资产达到新高。

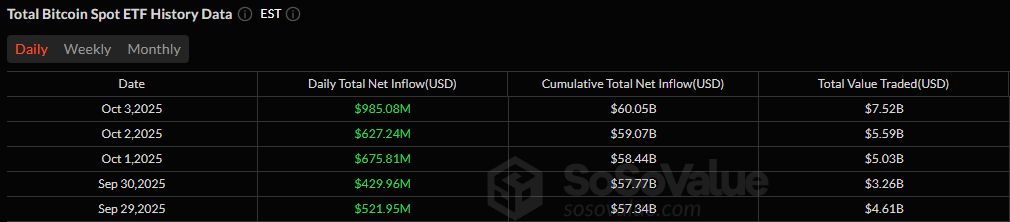

比特币ETF无疑是主要力量,共计录得9.8505亿美元的资金流入,涵盖七只基金。黑石的IBIT以惊人的7.9155亿美元占据主导地位,而富达的FBTC则获得6,985万美元。Ark 21shares的ARKB增加了3,548万美元,Vaneck的HODL和Bitwise的BITB分别贡献了2,604万美元和2,403万美元。

来自Grayscale的比特币迷你信托(2,011万美元)和GBTC(1,829万美元)的资金流入虽然较小,但也保持稳定。连续第四天,没有任何ETF记录到资金流出。交易量飙升至创纪录的75.2亿美元,推动净资产上升至1,645亿美元。

比特币ETF的全绿周。来源:Sosovalue

以太坊ETF延续了自己的胜利势头,共计获得2.3355亿美元的资金流入,涵盖四只基金。黑石的ETHA以2.0671亿美元领先,而Grayscale的以太坊迷你信托增加了1,788万美元。富达的FETH带来了565万美元,Vaneck的ETHV以331万美元结束了这一天。交易活动达到了22.8亿美元,推动净资产上升至305.7亿美元。

本周以比特币和以太坊ETF的资金流入不断为结尾,这一罕见的成就突显了当前需求的深度。在五天内,比特币ETF流入超过30亿美元,以太坊ETF流入12亿美元,十月为数字资产投资工具的开局带来了强劲的势头。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。