The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome everyone's attention and likes, and reject any market smoke screens!

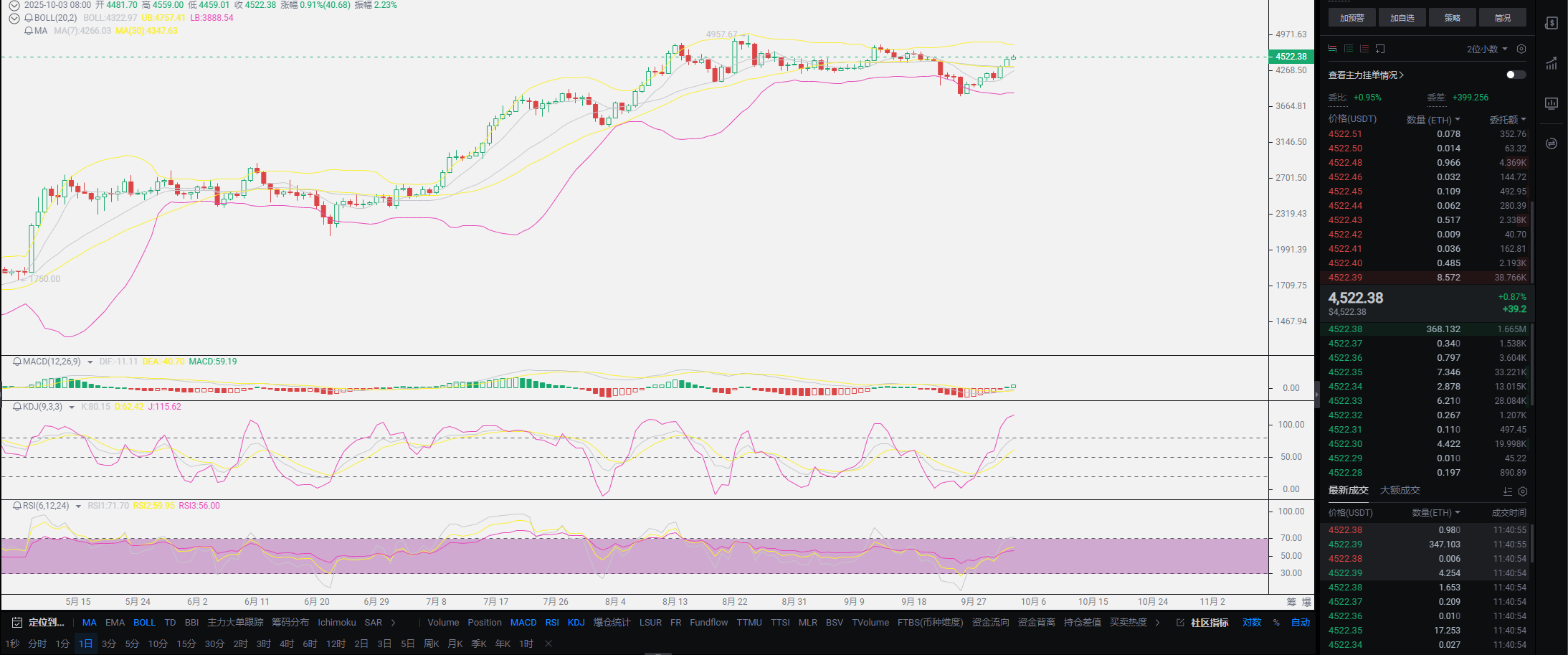

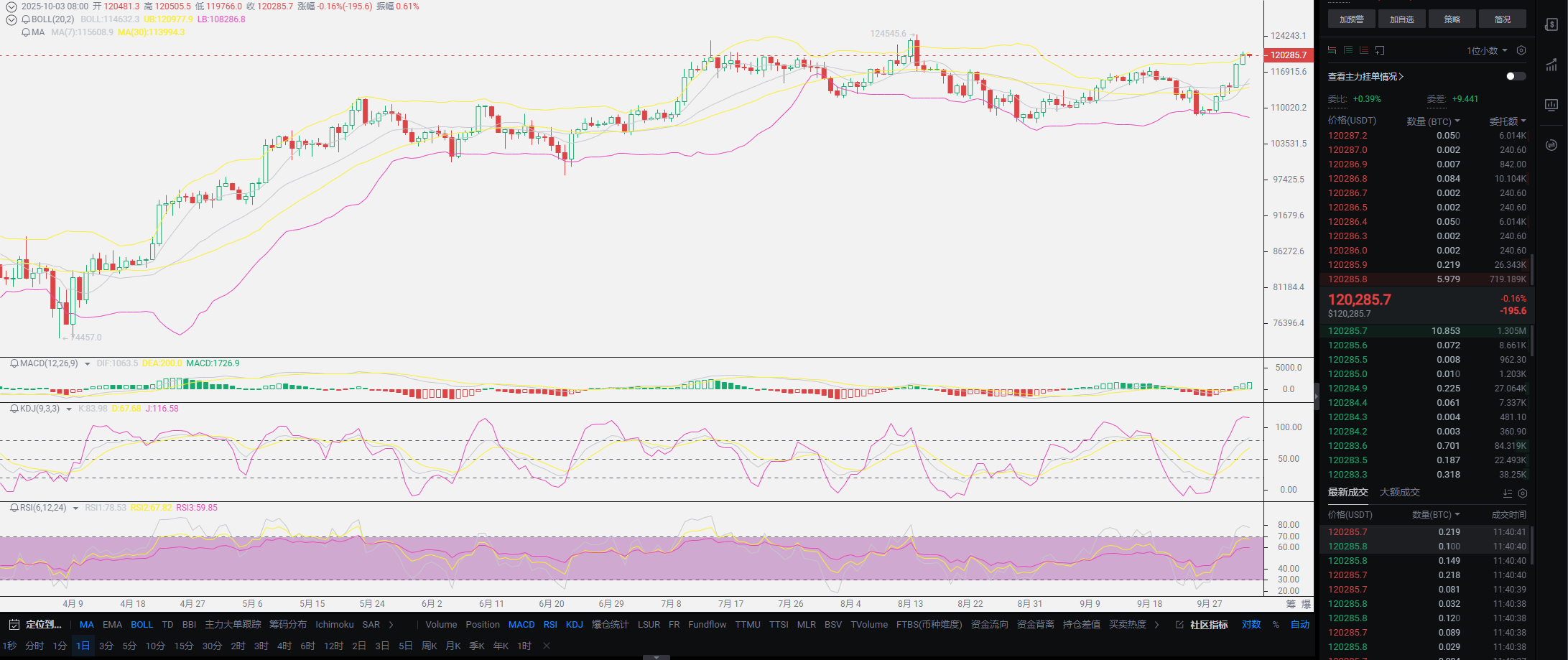

Many friends feel that the author's market predictions are very accurate, including Ethereum, Bitcoin, OKB, and BNB, with the support levels almost matching the predictions; only for SOL, the author's prediction was a bottom around 195, but the lowest point reached 190, fortunately, the difference is not large. Many coin friends are gradually starting to feel that the author's trend predictions are very accurate. In fact, it is not that difficult; regarding market predictions, the author firmly believes in one point: the main force's manipulation is rotational. The essence of this rotation is to avoid retail investors and then harvest again. The logic of any financial market is interconnected; this year's growth is also inevitable. A large amount of panic selling will only provide opportunities for opponents to go long. Giving up chips is the most foolish choice in the current crypto circle. If you cannot understand the trend, you might as well think from another perspective: if you were the market maker, how would you choose the timing to enter the market? Do not think of market makers as too terrifying; they are also traders, and they cannot go against the trend.

After communicating with too many traders, the conclusion drawn is that market makers are their own opponents, and their operations are all for personal profit. They believe that market makers can determine the trend's existence, and regarding trend judgment, everyone should try to ignore the role of market makers. They can only follow the trend. The author has never seen a bear market during a rate-cutting cycle. The weakening of the dollar and the rate-cutting cycle are the foundations of the entire bull market. To put it bluntly, as long as these two strategies continue to be implemented, there will be no large-scale capital withdrawal. Therefore, the role that large funds can play is minimal. A wave of short-term selling? This wave of selling has already been maximized by large funds, and it has always been emphasized that on-chain data has been breaking historical highs. In just two days in October, on-chain funds have all returned, coupled with the expectation of a large number of ETF approvals in October, such as SOL, LTC, XRP, ADA, DOGE, etc.; at the same time, the second wave of rate cuts in October and the favorable talks in South Korea. The overall trend is a very obvious continuation of the bull market.

The downtrend has ended, and everyone can review it again. Since the new low of 98115 on June 22 this year, Bitcoin has not dipped below the 100K mark again, and this time the depth of the pullback is also above 107000. After this round of increase, it is probably difficult to think about dipping below the 110K mark in the short term; the entire low point has been continuously rising, and the current funds are recovering from the previous decline. The market will only become more stable, with only a little over 4000 points away from the previous high; many friends have different views on the capital inflow from rate cuts, seeing rate cuts more as speculative expectations. Just like this trend, on September 14, the decision to cut rates on the 18th was almost digested. Instead, after the rate cut, there was a wave of nearly half a month of continuous decline. This decline was not caused by the rate cut; the inflow of funds after the rate cut requires a time lag to compensate. It is not that a decrease in interest rates will lead to an inflow of funds.

Everyone can think about it: if you need a loan, knowing that there will be a rate cut in October, and even the expectation in September is a 50 basis point cut, would you still take out a loan to buy into the crypto market before the expectation is met? The rate cut in October is merely a compensation for the September rate cut, so it is highly likely that the inflow of funds will peak after this rate cut. The early October trend also belongs to the rate cut expectation market, combined with the capital return after the September rate cut, which will definitely lead Bitcoin to reach new highs, and the rate cut expectation in December will most likely allow Bitcoin to create this year's peak. Finally, I remind everyone again: do not short; shorting is something to consider only after 26 years. At this stage, there is only one way to go long. If you missed the opportunity during the last downward trend, you can only continue to buy under the growth. For users who have already bought in, do not increase your position with floating profits; just wait for the harvest. This round of increase is aimed at new highs, so seize the opportunity!

Original article created by: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on one piece or one territory, aiming for the final victory. The novice, on the other hand, fights for every inch of land, frequently switching between long and short positions, only competing for short-term gains, and ends up frequently trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this carries risks!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。