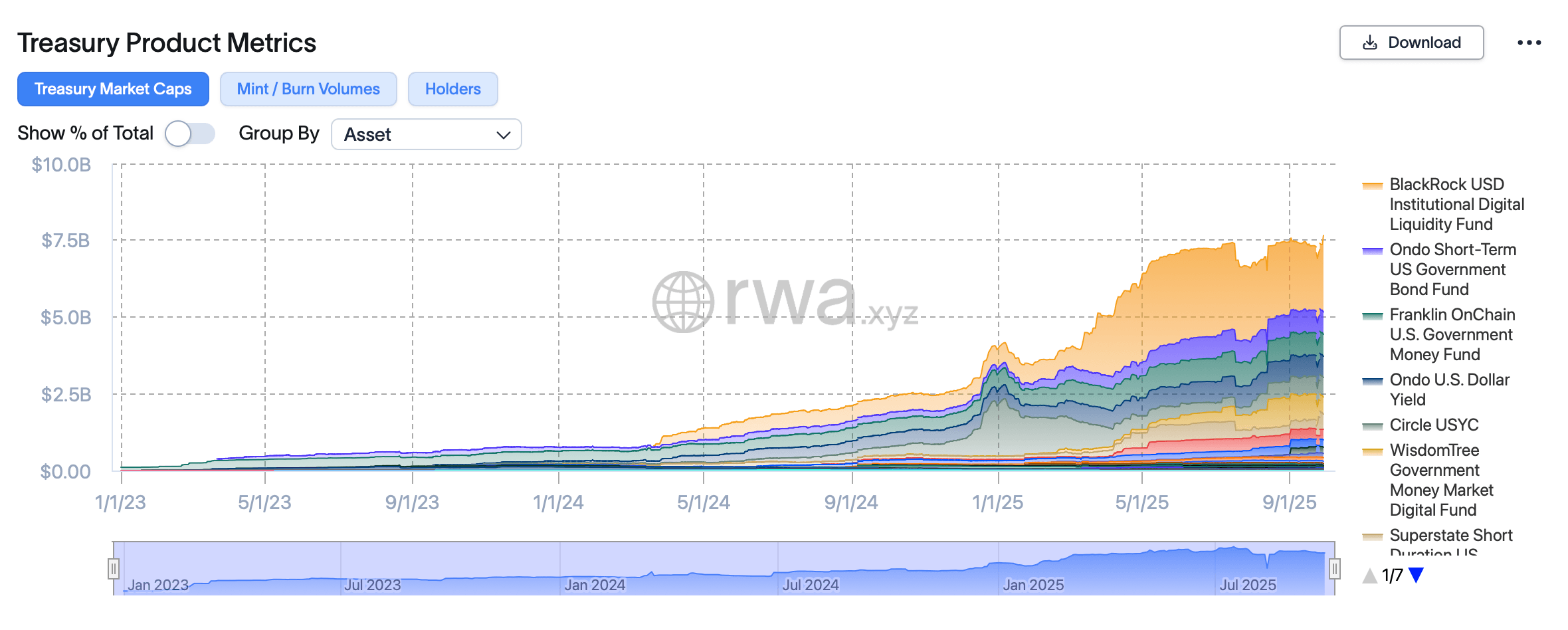

Current rwa.xyz data shows $7.65 billion in value, up 4.87% week over week, with average yield to maturity at 3.95%. There are 52,484 holders, down 1.08% on the week, hinting that larger tickets drove it. It is a concentrated market that keeps attracting traditional finance (TradFi) managers building on public rails.

By blockchain network, Ethereum remains the anchor with $5.3 billion in market cap. BNB Chain follows with $496.8 million, then Stellar at $476.7 million, and Solana at $456.0 million. Arbitrum sits at $197.1 million, XRP Ledger at $169.6 million, and Avalanche at $137.8 million, with smaller shares across other chains.

Seven-day net flows were headlined by Blackrock’s USD Institutional Digital Liquidity Fund, ticker BUIDL, at $391 million. Wisdomtree’s Government Money Market Digital Fund, WTGXX, drew $275 million, while Superstate’s Short Duration U.S. Government Securities Fund, USTB, pulled $156 million. Circle’s USYC added $60 million, KAIO’s UMA brought $20 million, and Libeara’s thBILL gained $12 million.

Not every product printed a positive week. Openeden’s TBILL posted $12 million in outflows and Opentrade’s flexible term USD vault, XTBT, shed $13 million. That mix fits a market with deepening liquidity that still rotates between products as issuers tweak fees, durations, and rails.

The league of tokenized treasury funds still remains rather top-heavy. Blackrock’s BUIDL leads at roughly $2.49 billion in market cap, and it’s starting to rebound from prior outflows. Ondo’s Short-Term U.S. Government Bond Fund, OUSG, stands at about $728.6 million, while Franklin Templeton’s onchain money fund, BENJI, sits at $717.4 million.

Ondo’s U.S. Dollar Yield, USDY, holds around $689.4 million. Circle’s USYC is close behind at $636.2 million, and Wisdomtree’s WTGXX lists $557.2 million, reflecting the demand for money-market exposure with onchain settlement.

Superstate’s USTB totals about $491.6 million, and Janus Henderson’s Anemoy Treasury fund, JTRSY, logs $345.6 million. Openeden’s TBILL holds $239.9 million, while Fidelity’s Digital Interest Token, FDIT, sits near $204.0 million on Ethereum. Libeara’s ULTRA clocks in around $136.4 million.

Further down the ladder, Spiko’s USTBL commands $116.4 million, and Vaneck’s VBILL lists $74.1 million. Fidelity’s FIUSD shows $45.4 million, and Opentrade’s XTBT is near $30.4 million. Guggenheim’s DCP lists $30 million, KAIO’s fund totals $22.1 million, and Nest’s nTBILL on Plume has valued locked-in around $17.5 million.

Abrdn’s AAULF tracks $15.5 million, Midas’s mTBILL carries $12.6 million, Wisdomtree’s USFR.d posts $12.1 million, and Theo’s thBILL shows $11.6 million. Backed’s bIB01 rounds out the group at $9.54 million, illustrating the long tail of niche treasuries tapping multiple issuance venues and chains.

Big picture: institutions are testing token rails with conservative paper, and the cash keeps showing up. Stable yields near 4% plus fast settlement is a tidy pitch to treasurers who want operational efficiency without exotic risk. This still looks early, but the scoreboard is getting bigger.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。