The 1-hour chart displayed a fading uptrend transitioning into a shallow pullback phase. Since peaking at $2.931, XRP exhibited a pattern of descending highs, with declining volume further confirming a bearish divergence. The asset hovered just above a key minor support at $2.82, repeatedly testing it without a decisive breakdown.

This level formed the lower bound of a tight range, with intraday rebound attempts struggling to sustain momentum above the $2.84 to $2.85 zone. Momentum remained weak, with short-term rallies lacking the conviction typically backed by increasing volume.

XRP/USDC via Binance on Sept. 30, 2025, 1-hour chart.

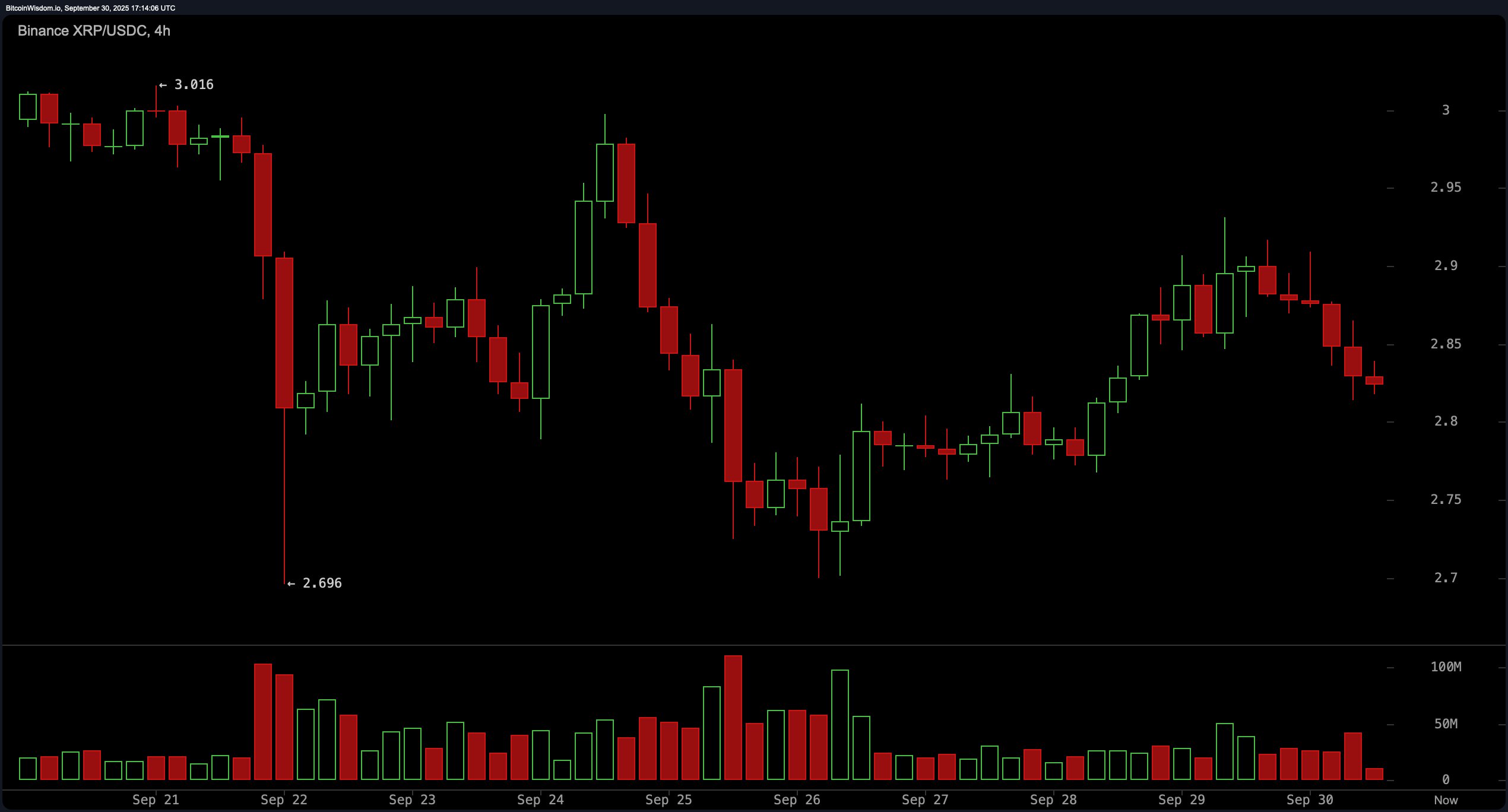

The 4-hour chart reinforced the cautionary outlook. XRP experienced a sharp breakdown from $3.016 on Sept. 21, falling to a local low of $2.696 before staging a modest recovery. Between Sept. 28 and 29, the cryptocurrency entered a brief consolidation phase that resembled a miniature bull flag. However, efforts to reclaim the $2.90 level met resistance, and a failure to break higher confirmed waning bullish pressure. The range between $2.75 and $2.80 remains critical for evaluating further directional shifts, as short-term resistance around $2.88 to $2.93 continues to cap any upside movement.

XRP/USDC via Binance on Sept. 30, 2025, 4-hour chart.

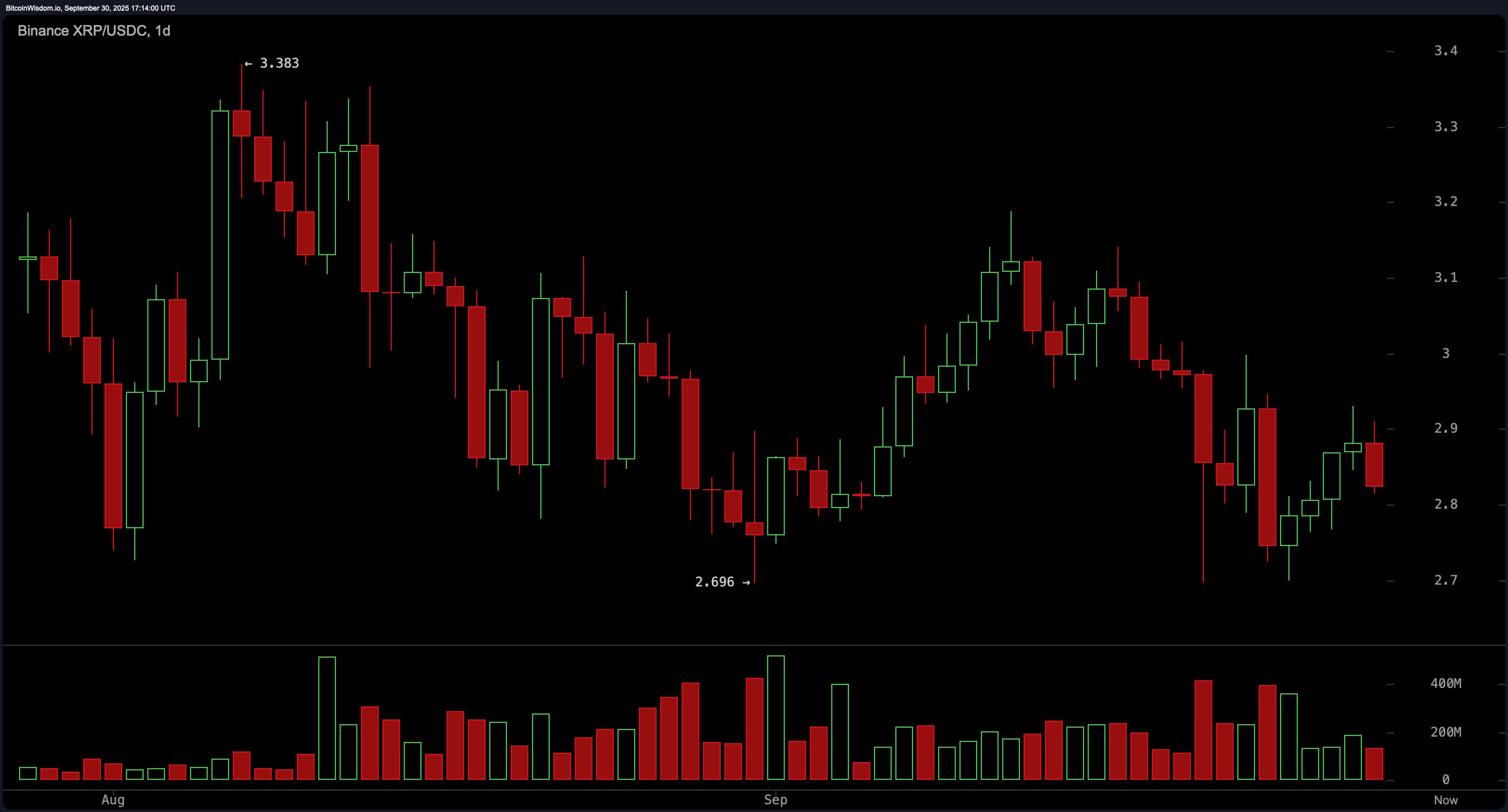

On the daily chart, XRP followed a sideways-to-downtrend structure marked by lower highs and tentative support zones. After reversing upward from the $2.696 area, the price managed to reach near $3.10 before being rejected. This rejection established a ceiling that has been tested multiple times, forming a dense resistance area between $3.00 and $3.10. Volume data suggest substantial activity around these levels, pointing to distribution near peaks and accumulation near troughs. Price action remained compressed, and a decisive move below $2.70 could potentially expose XRP to increased downside risk.

XRP/USDC via Binance on Sept. 30, 2025, 1-day chart.

Oscillator readings collectively signaled a neutral to mildly bearish sentiment. The relative strength index (RSI) stood at 44.12, indicating neither overbought nor oversold conditions. Similarly, the Stochastic oscillator read 36.74, and the commodity channel index (CCI) came in at −65.41—both in neutral zones. The average directional index (ADX) at 15.74 reflected a weak trend strength. The Awesome oscillator showed a value of −0.09159, aligning with broader neutral readings. However, the momentum oscillator at −0.15136 and the moving average convergence divergence (MACD) level at −0.03727 each implied underlying weakness, further emphasized by negative histogram bars.

Across moving averages (MAs), the technical posture skewed toward caution. The exponential moving averages (EMAs) for 10, 20, 30, 50, and 100 periods all indicated downward bias, with values such as EMA (10) at $2.864 and EMA (100) at $2.836 remaining below the current price. Simple moving averages (SMAs) painted a similar picture, with SMA (10) at $2.848 and SMA (50) at $2.952. Notably, only the EMA (200) at $2.612 and the SMA (200) at $2.554 presented a longer-term positive alignment relative to current levels, suggesting structural strength in the macro trend even as shorter timeframes display vulnerability.

Bull Verdict:

If XRP maintains support above $2.80 and reclaims momentum above the $2.90 resistance with increasing volume, it could challenge the $3.00 to $3.10 zone once again. Sustained bids above the 200-period moving averages reinforce a longer-term structural strength that may underpin a continued upward recovery.

Bear Verdict:

Failure to hold the $2.82 minor support, especially with volume confirmation below $2.80, would likely expose XRP to further downside toward the critical $2.70 area. The alignment of negative momentum indicators and persistent resistance at higher levels suggests continued selling pressure in the near term.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。