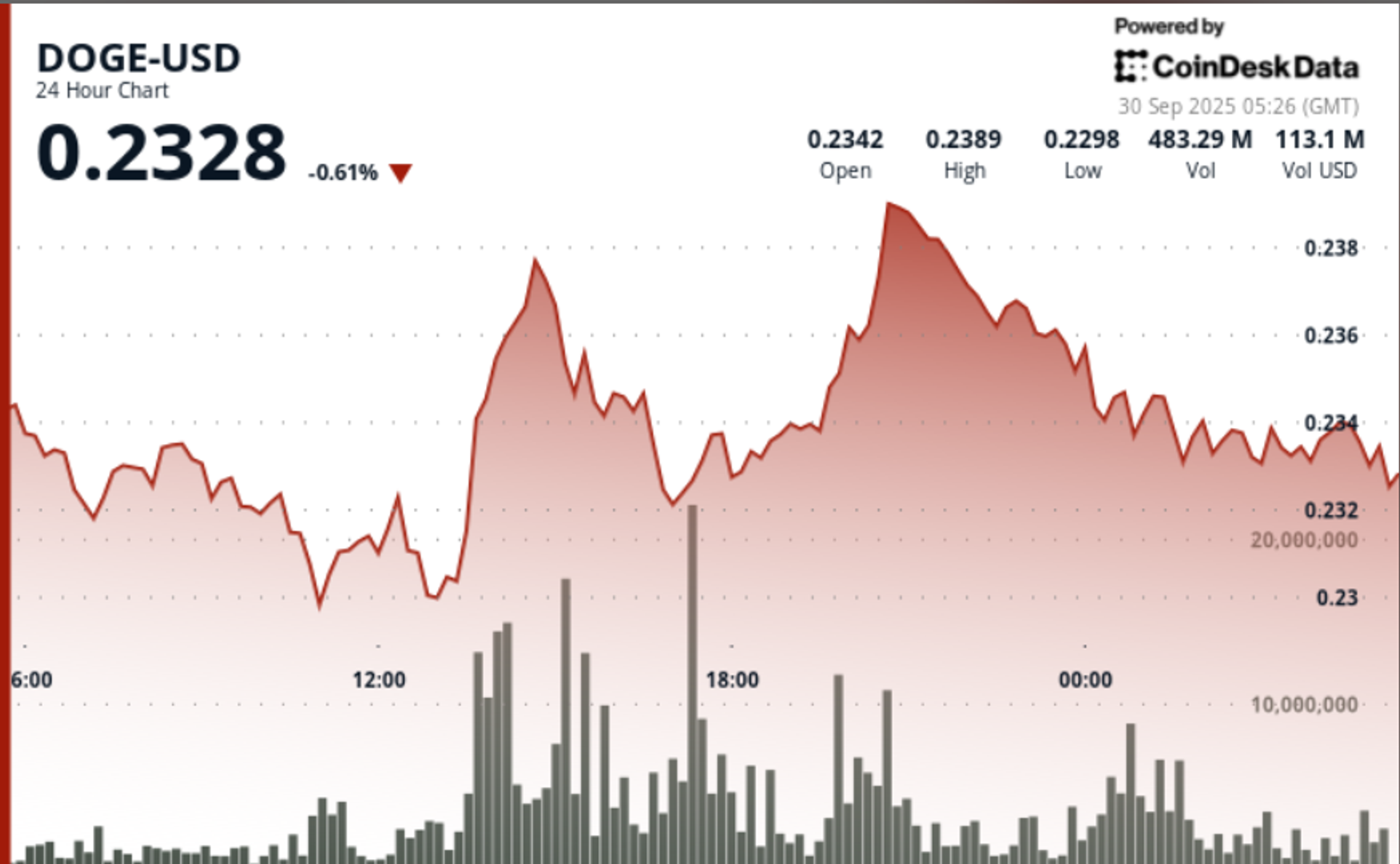

DOGE 在日内上涨后未能维持在 $0.24 以上,逐渐陷入紧缩的反弹后盘整。780M 的交易量激发了午间的上涨;在交易的后期,供应重新出现,价格回落至 $0.23 的支撑位。

新闻背景

- 大户流动在当天转为净负,鲸鱼抛售了约 4000 万 DOGE,使总余额从 ~110 亿减少到 107.5 亿个。这一分配帮助限制了 $0.24 的测试,尽管现货交易量很大。

- 尽管供应过剩,DOGE 仍然交易在 200 日移动平均线(~$0.22)之上。趋势偏向仍然积极,如果短期移动平均线向上弯曲,可能会监测到黄金交叉的设置。

- 流动性主要由现货流动和日内动量账户主导。在此期间没有新的催化剂出现;头寸和订单流动机制推动了价格行动,而不是外部新闻。

价格行动与交易量

- 在 9 月 29 日 03:00 – 30 日 02:00 期间,DOGE 在 $0.01 的区间内波动(~4%),触及接近 $0.24 的高点和接近 $0.23 的低点,最后收盘在区间的下半部分。

- 13:00–14:00 的突破序列产生了超过 780M 的成交量,是该交易时段的最大流动。价格从低 $0.23 上升到 $0.24 的区间,然后因供应吸收买盘而停滞。

- 在最后 60 分钟(01:10–02:09),DOGE 在 01:26 激增至 ~$0.24,然后在 01:30 快速回落至 ~$0.23,成交量为 1296 万。重新出现的卖盘确认了阻力,并将价格锁定回日内区间内。

- 净结果:未能突破 $0.24,随后有序回归至 $0.23 支撑区,回调需求保持一致。

技术分析与关键水平

- 支撑位:$0.23 是活跃的防线;反复的日内买盘和稳定性表明短期积累。在此之下,200 日移动平均线在 ~$0.22 是趋势追随者的结构线。

- 阻力位:$0.24 仍然是上限。多次拒绝和在交易后期快速回落标志着重大的供应。若能实现干净的日收盘 >$0.24,将打开 $0.245–$0.25 的空间,然后是 $0.255。

- 趋势/结构:反弹后的整合在 $0.23–$0.24 之间。突破/收盘出此区间将设定下一个方向性走势。

- 移动平均线:DOGE 仍在其 200 日移动平均线之上,保持中期偏向。短期移动平均线向上弯曲将确认黄金交叉的观察。

- 流动:鲸鱼净流出约 4000 万 DOGE 解释了未能突破 $0.24。如果供应减弱而现货需求持续,上行的可能性将改善。

交易者关注的事项

- 日收盘突破 $0.24 并伴随扩大交易量:将阻力转化为支撑,并验证向 $0.245–$0.25 的延伸,如果动量账户追逐,则有向 $0.255 的后续风险。

- 在回调时捍卫 $0.23:持续的吸收保持了区间内的多头偏向。若干净突破下行,则 $0.225–$0.22(200 日移动平均线)将被纳入考虑,并将结构转变为分配顶部。

- 在 $0.24–$0.245 的鲸鱼净流动和订单簿供应:如果大宗卖盘减少而需求持续,最小阻力路径将向上移动。持续的供应壁垒将延长震荡。

- 下一次上涨的波动性和广度:实现波动上升而没有广度 = 虚假突破。交易者需要在任何突破中同时具备交易量和广度以确保持久性。

- 移动平均线对齐:短期移动平均线向上交叉,同时价格保持在 >$0.23 之上,将是系统策略重新进入多头的更清晰技术触发信号。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。