Bitcoin and stocks each have their unique advantages and disadvantages, and their futures ultimately depend on economic, technological, and social transformations.

Written by: Emi Lacapra, Cointelegraph

Translated by: Shaw Jinse Finance

Key Points

- If the stock market can quickly adapt to the ever-changing technological and economic demands, it may survive the impact of artificial intelligence.

- New businesses spawned by artificial intelligence, such as robotics, biotechnology, or aerospace, are expected to drive economic growth, and stocks reflecting such advancements are more likely to survive the turmoil of innovation.

- As artificial intelligence reshapes the workforce and markets, periods of turbulence should be expected; thus, the coming years will be a time to adapt to new technologies.

- The future of Bitcoin depends on its ability to prove itself as a true store of value while also transforming into a medium of exchange. Artificial intelligence can facilitate this process, primarily by influencing its scalability and transaction processes.

- Bitcoin, as a decentralized system, is not affected by internal political factors, and human factors may also disrupt its operation. It only needs to keep pace with the development of new technologies to remain relevant.

No one can predict what will happen in the next 50 years, especially in financial markets influenced by so many external factors.

However, by analyzing the current state of artificial intelligence (AI) and its impact on financial technologies like Bitcoin and stocks, we can understand what the best investment choices are between these financial tools.

The purpose of this article is to help you make more informed decisions and understand which is the better choice for the future: Bitcoin or stocks.

Stocks or Bitcoin: Which Will Survive the AI Revolution?

Artificial intelligence will accelerate innovation and efficiency improvements across multiple industries, fields, and aspects of our lives, undoubtedly driving improvements in technologies like Bitcoin in terms of efficiency and scale. But what about stocks? Has their investment philosophy become a thing of the past? Let’s explore further.

What About Stocks?

In 1602, with the establishment of the Dutch East India Company, the world's first stock market was formed in Amsterdam. This initial venue for trading company stocks quickly evolved into a model for financing and investment. By the end of the 17th century, London had developed its own trading venue, while the New York Stock Exchange did not appear until 1792, spreading this model across the Atlantic.

Stocks represent ownership in a company, and the stock market is where investors buy and sell stocks. The value of stocks fluctuates based on company performance and market conditions, including the ability to adapt to technological changes like artificial intelligence.

For centuries, stocks of companies that embraced technological advancements have withstood the tests of economic cycles, wars, and turmoil brought about by technology. In hindsight, companies betting on artificial intelligence seem unlikely to escape a similar fate.

Specifically, companies applying artificial intelligence through automation, data analysis, and new business models are more likely to succeed.

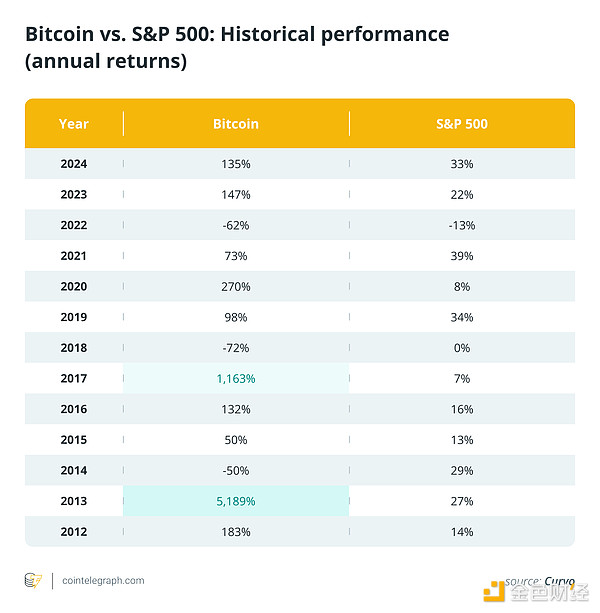

Historically, market indices like the S&P 500 have provided an inflation-adjusted annualized return of about 7%-10% over the past few decades. This index tracks the performance of the 500 largest publicly traded companies in the U.S. and is widely used as a benchmark for the overall stock market.

Compared to the S&P 500, Bitcoin (BTC) has performed significantly better, as shown in the table below:

What About Bitcoin?

Bitcoin is a relatively new invention created in 2009 by an individual using the pseudonym Satoshi Nakamoto.

The project was introduced in a white paper detailing a peer-to-peer electronic cash system using blockchain technology.

The significance of Bitcoin goes far beyond the concepts of an investment tool or store of value. It proposes a true monetary revolution, challenging gold and other financial instruments.

Bitcoin's decentralized design can resist the centralized control and inflation common in fiat currency systems. With a fixed supply of 21 million coins, its scarcity attracts those seeking protection from currency devaluation.

Moreover, the transparency and security of blockchain align well with the demand for verifiable data in artificial intelligence.

Over the years, Bitcoin has established itself as a store of value and alternative currency while still striving towards its original goal of becoming a widely used medium of exchange.

How AI Affects Stocks and the Stock Market

Analyst and investor Jordi Visser predicts that in the next 50 years, "the acceleration of innovation cycles by artificial intelligence may challenge the existence of the stock market as an institution, making publicly traded companies inefficient investment tools."

The stock market has a long history, but the disruptive changes brought by artificial intelligence make it difficult to be complacent, and companies that fail to adjust face the risk of falling behind. This is especially true for tech giants like FAANG stocks (Facebook, Amazon, Apple, Netflix, and Google). Despite being among the largest investors in artificial intelligence, these companies still need to keep pace with rapid developments and effectively apply these technologies.

Artificial intelligence will also impact the stock market, from rapidly analyzing vast amounts of data to predicting market trends and automating decision-making processes, leading to faster and more efficient operations. AI will have a significant impact on investors' trading and investment strategies.

Overall, artificial intelligence may promote corporate innovation but could also widen the gap between adaptable companies and those that stagnate.

How AI Affects Bitcoin

Jordi Visser believes Bitcoin is the better investment choice for the future and compares it to gold, which has remained relevant for thousands of years.

In addition to being a store of value, Bitcoin occupies a favorable position in the future financial landscape. The combination of artificial intelligence and blockchain could disrupt traditional financial systems, bringing more capital and participants into the digital economy.

Artificial intelligence is expected to improve Bitcoin's security and trading strategies, enhancing cryptocurrency trading through automation tools, advanced data analysis, and market pattern predictions. All these changes could also lead to higher system efficiency.

Bitcoin mining will also benefit from artificial intelligence by predicting the best mining times to improve efficiency and optimize resource allocation, thereby reducing costs and increasing output. Additionally, as AI can detect existing or impending failures, system maintenance will improve, enhancing overall reliability.

However, Bitcoin faces regulatory risks, scalability issues, and price volatility, which may deter investors who typically prefer more predictable and stable investments like stocks.

The integration of artificial intelligence and blockchain could usher in a new era for Bitcoin, promoting its broader application by creating a more intuitive and secure ecosystem, giving it an edge in competition with stagnant stocks.

Who Will Survive in the Next 50 Years?

Looking ahead 50 years is nearly impossible. Both Bitcoin and stocks have their unique advantages and disadvantages, and their futures ultimately depend on economic, technological, and social transformations.

If stocks can adapt to an AI-driven economy, they are likely to persist. Investors can mitigate the risk of individual company failures by diversifying their investment portfolios (e.g., index funds), as these portfolios appear safer. Stocks in robotics, biotechnology, aerospace, and artificial intelligence sectors may outperform assets with lower technological drivers.

The emergence of quantum computing is often discussed in relation to Bitcoin's security model, but most experts believe its risks remain theoretical and have not yet materialized. Combined with artificial intelligence, its impact could be positive or negative, depending on the direction of technological development and how the Bitcoin network adapts. If only a few entities can gain access to advanced quantum-AI systems first, centralization of mining could also become an issue.

On the other hand, this combination could enhance Bitcoin's security and network optimization through improved transaction processing, wallet security, or blockchain analysis, thereby increasing Bitcoin's efficiency and user experience. As long as the Bitcoin community stays ahead in quantum-resistant upgrades, its overall impact could be positive.

As decentralized finance (DeFi) gains popularity in the investment space, Bitcoin is also gaining an advantage in its competition with gold. This positions it as a superior store of value and encourages traditional markets to shift funds towards digital finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。