Offering up to $100K in ecosystem credits, the program helps startups cut acquisition costs by connecting directly to Bitcoin.com’s global crypto audience, integrations, and partners.

Web3 startups face a steep challenge: getting real users. Before a token generation event (TGE) or a large-scale rewards campaign, projects often struggle to attract attention. Cost per acquisition can be prohibitively high (even exceeding $100 per user), building a community takes time, and trust is hard to win. Meanwhile, advertising on platforms like Meta, Google, or X requires licenses most crypto startups can’t access.

Bitcoin.com is addressing this bottleneck with the launch of its Bitcoin.com Accelerator, a program designed to help projects break through the noise by plugging directly into a ready-made network of millions of crypto users. The company detailed the program in its Bitcoin.com Accelerator press release.

Unlike traditional accelerators that take equity, the Bitcoin.com Accelerator provides up to $100,000 in ecosystem credits to selected startups. In return, Bitcoin.com takes a 5–7% allocation of project tokens through SAFT agreements. The credits can be spent across the Bitcoin.com platform, spanning news coverage, wallet integrations, liquidity support, and community engagement tools.

For founders, this means immediate access to distribution channels and visibility that would otherwise take months — or require licenses and budgets out of reach for early projects.

Ecosystem credits can be used across key growth levers:

- Marketing & Media: Bitcoin.com News coverage, newsletters, social media promotion, podcast features.

- Community Growth: AMAs, X Spaces, and dedicated campaign support.

- Technical Integration: Wallet and markets listings, dApp browser placement, and integration to Bitcoin.com Maps for payments.

- Liquidity & Acquisition: Swap integrations and introductions to Bitcoin.com’s trusted partner network, which includes fiat on-ramps, market makers, centralized exchanges and more.

Bitcoin.com also plans to leverage its Accelerator and network of sponsors to support hackathons and host events that showcase emerging projects, creating another entry point into the program.

Role of Accelerators in Historical Context

Accelerators have long played a role in startup ecosystems, with Silicon Valley programs like Y Combinator popularizing the equity-for-advice model. In crypto, accelerator structures often rely on upfront cash contributions or token swaps. Bitcoin.com’s approach is part of a shift toward in-kind support, where platform services are leveraged to secure exposure to tokens without deploying large amounts of capital.

“This model gives founders the best of both worlds: resources to grow quickly, without the trade-offs of equity dilution,” said Bitcoin.com CEO Corbin Fraser. “By aligning incentives through token agreements, and by plugging projects directly into our ecosystem, we’re creating a launchpad that helps innovative ideas scale into global networks.”

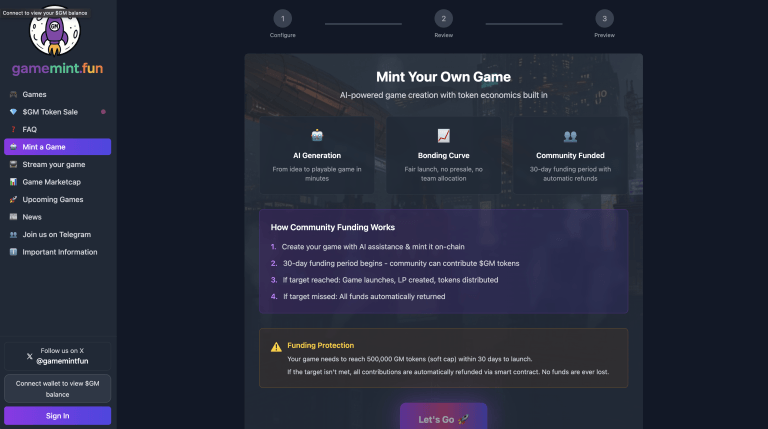

Applications are open for the first cohort, with Bitcoin.com targeting projects in DeFi, gaming, infrastructure, and consumer crypto products. The first confirmed participant is gamemint.fun, a platform that uses generative AI to let anyone create and monetize games with instant token economies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。