在加密市场回暖之际,稳定币赛道正迎来前所未有的爆发。Plasma、STBL和Falcon Finance等新兴项目正凭借创新的机制与丰厚的收益脱颖而出,$XPL、$SBTL代币空投与上线发行后,投资者蜂拥买入,以及$FF社区销售创下Buidlpad超募历史新高的盛况,无一不推动着“Stablecoin Summer”成为2025下半年最热叙事之一。PANews在本文将涵盖各大主流平台,为读者整理前述三大项目的矿池布局,把握着这一波“矿潮”。

PANews郑重声明,本文仅为信息汇总,非投资建议,且文中的数据或因时间变化有所出入。

Plasma($XPL)矿池选择丰富,兼顾APR及TVL

Plasma是一个专为全球稳定币支付而设计的Layer 1公链,致力于解决在处理大规模、高频稳定币交易的效率和成本问题,其核心创新在于提供了零费用转账功能。Plasma具备EVM兼容性,开发者可部署基于以太坊的智能合约。此外,其还支持自定义Gas代币以及无信任的比特币桥,允许用户在智能合约中使用BTC。

Plasma的项目代币XPL于9月25日启动TGE(代币生成事件),目前市值已达28亿美元,其发行的稳定币为USDT0。

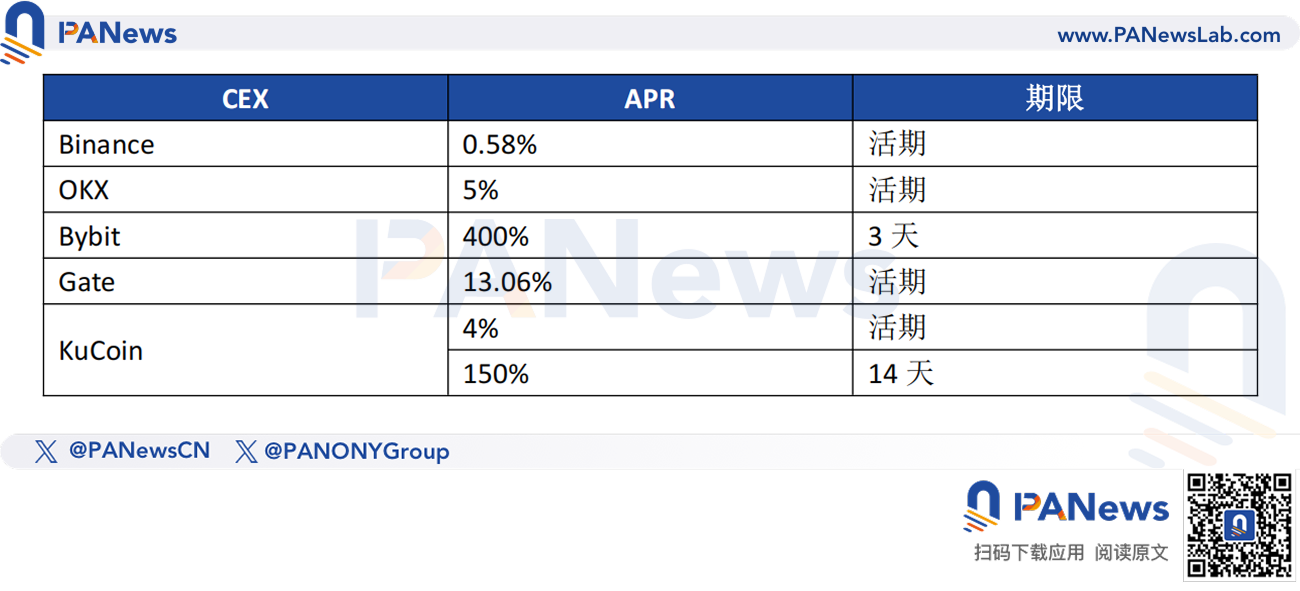

$XPL的矿池主要主要在5家CEX与PancakeSwap上。

CEX矿池分为活期和定期产品。活期产品中,Gate提供的APR最高,为13.06%;定期产品中,Bybit提供的APR最高,达400%,但仅限3天;KuCoin则在产品选择方面最丰富,同时上线了两类产品。

此外,$XPL在PancakeSwap上有大量矿池,但有部分被提示代币未经验证,且总锁仓价值(TVL)及24小时交易量较低,仅V3上费用等级为0.01%的XPL/USDT矿池的数据较为可观,其TVL超170万美元,24H交易量近5,700万美元,合计APR(挖矿+LP费用)高达117.73%。

涉及稳定币$USDT0的矿池共29个,分布于9大DeFi协议,其可被分为四类,分别是流动性提供(LP)、借款、贷款及存款,矿池的代币激励大多仍是以$XPL的形式发放。

其中,LP矿池的数量最多,共有13个,分布在Uniswap、Curve与Balancer三大DEX上。Balancer基本占据了半壁江山,一家就提供了6个矿池。三家DEX中,Balancer上的WXPL/USDT0流动性池激励APR最高,为134.71%,若再叠加交易费用,合计APR高达211.48%,TVL超过450万美元.TVL最高的USDai-aUSDT流动性池也在Balancer上,超6,900万美元,其APR处于平均水平,为14.24%。

贷款矿池共10个,分布在Aave、Euler、Fluid及Gearbox四家借贷平台上。用户在贷款矿池中出借USDT0或其它指定代币,即可获得激励。其中,Gearbox提供的APY最高,为19%。其中,$WXPL、$GEAR分别贡献了15.44%、3.67%的激励。Aave承载的TVL最高,为34.9亿美元,但其APY相对较低,仅8.9%。

借款矿池共有4个,均集中在Fluid上。虽然用户借入UST0需要向平台支付利息,但$WXPL提供的代币激励更高于平台的借款利率,因此用户在借款的同时依然可赚取收益。USDai-USDT0/USDT0金库的激励APR最高,为31.1%,扣除借款利率后,用户仍能享受28.34%的净APR。syrupUSDT/USDT0金库的TVL最高,近8,500万美元,但其净APR最低,仅1.15%。

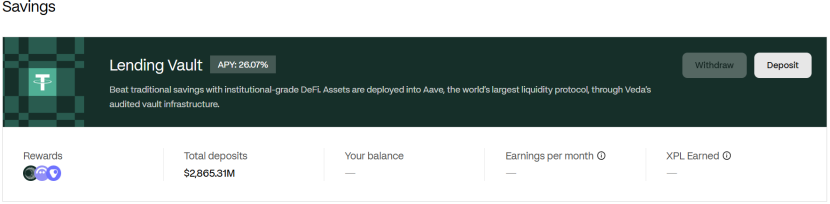

存款矿池仅2个,分别经由Veda和Term Finance部署。Veda是Plasma的官方合作伙伴,助其将资产部署至Aave。目前,Plasma官方的储蓄金库APY高达26.07%,USDT0存款金额为28.6亿美元。Term Finance上的存款总额超3,800万美元,其将资金分配至K3 Capital、Tulipa Capital、MEV Capital及Shorewoods四家机构的USDT0收益策略,APY已达24.66%,包含了1.73%的USDT0基准收益率。

STBL($SBTL)矿池APR虽高但风险较大,且选择较少

由Tether联创所在团队推出的STBL协议,正在打造一个“Stablecoin 2.0”生态。该协议的创新之处在于其具有“收益剥离”机制的三代币系统:当用户存入生息的RWA抵押品时,将同时获得美元挂钩稳定币USST和代表未来收益权的YLD(一种NFT),意味着用户可自由交易USST或将其部署到DeFi中,并通过持有YLD NFT独立赚取原始抵押品(如代币化美债)的持续收益,项目代币SBTL则承担着协议的治理功能。

$STBL于9月16日开启代币空投,目前市值已超2亿美元。

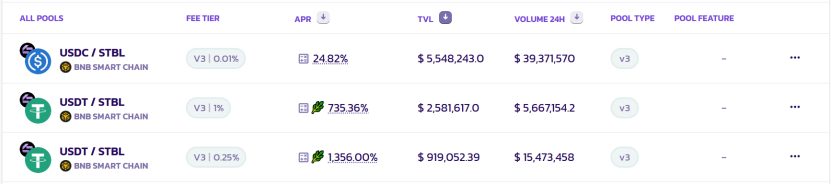

$STBL没有CEX矿池,或因发行在BSC链上,故仅Pancake Swap上线了其矿池。综合TVL与24H交易量判断,有3个矿池较为值得参与。其中,V3上费用等级为0.01%的USDC/STBL流动性池TVL与24H交易量均为最高,分别超过了550万美元、3,900万美元。费用等级为0.25%的USDT/STBL流动性池APR最高,达1,356%(包括挖矿+LP费用),但其TVL较低,尚不足百万美元。

值得注意的是,稳定币USST暂未发行,PancakeSwap上与其相关的流动性池均须注意风险。

Falcon Finance($FF)矿池激励发放稳定币USDf

Falcon Finance是一个专注于将各类抵押资产转化为合成美元流动性的DeFi平台,核心产品是合成美元USDf,通过超额抵押模型维持与美元的挂钩。与传统稳定币不同,USDf的抵押品组合更多元,不仅包括USDC、USDT等稳定币,还涵盖了BTC、ETH等波动性资产。协议采用动态超额抵押率和Delta中性交易策略来对冲抵押品波动性风险,保障USDf的稳定性。

Falcon Finance的项目代币FF仍未发行,但近期引起了巨大反响,其社区销售超募至1.12亿美元,达到原定目标的2,821%,创Buidlpad历史新高。$FF代币的推出或将进一步完善Falcon Finance的双代币模型:$USDf提供稳定性与收益机会,$FF则通过治理促进协议发展。

截至目前,$USDf市值已高达18.9亿美元,月均增速达111.44%,其矿池共4个,分布在PancakeSwap和Uniswap上,代币激励就以$USDf的形式发放。

LP矿池中,PancakeSwap V3上费用等级为0.01%的USDT/USDf流动性池APR最高,为15.59%,但其TVL最低,约200万美元。Uniswap V3上费用等级为0.01%的USDT/USDf流动性TVL最高,近3,700万美元。相对低,其APR最低,仅0.18%。

纵观三个项目,Plasma相关的矿池最多,为投资者提供了足够的选择性。其中,PancakeSwap V3上费用等级为0.25%的USDT/STBL流动性池APR绝对值最高,但TVL较低,有可能出现收益无法覆盖风险的情况;Balancer上的WXPL/USDT0流动性池则兼顾了较高水平激励APR及TVL的优势;如果用户有借款的需求,可选择Fluid上的USDai-USDT0/USDT0金库,通过代币激励抵消借款利息,并享受正APR所带来的收益。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。