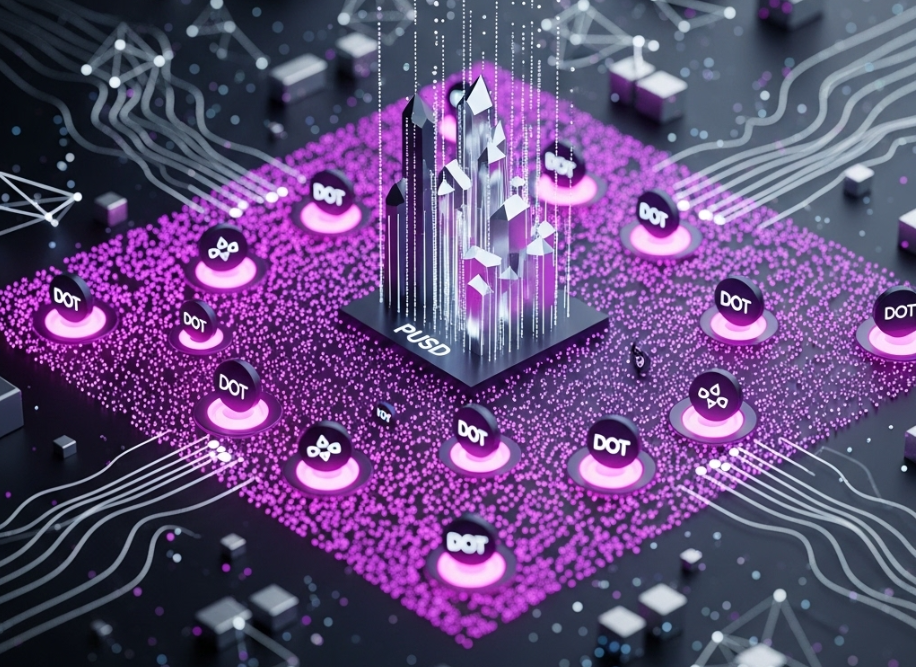

In the volatile world of cryptocurrency, where fluctuations can be a double-edged sword, a recent proposal by Polkadot co-founder Gavin Wood has sparked intense discussions within the community regarding the future of stablecoins. The proposal, named PUSD, aims to replace DOT with a stablecoin pegged to the US dollar, which would be directly distributed as block rewards to validators, attempting to alleviate the income uncertainty caused by the drastic price fluctuations of DOT.

1. Proposal Background: The Reward Dilemma Under High Volatility

As the core infrastructure of a multi-chain architecture, Polkadot's network security heavily relies on validators participating in block production and cross-chain transactions through staking DOT. However, the high volatility of DOT prices has long troubled the validator community. For instance, in 2024, the price of DOT surged from about $7 at the beginning of the year to $15, only to drop below $3 again. Such drastic fluctuations directly lead to extremely unstable income for validators—staking the same amount of DOT could result in monthly earnings shrinking from hundreds of dollars to less than a hundred.

Gavin Wood pointed out in the proposal that the current reward mechanism reliant on DOT makes the network security budget subject to market sentiment. When the market declines, validators may be forced to sell DOT, further exacerbating network pressure. The introduction of PUSD aims to "decouple" the reward mechanism from DOT price fluctuations, providing validators with predictable and stable income.

2. PUSD Operating Mechanism: Exclusive DOT Collateral and Liquidation Design

According to the publicly available proposal details, PUSD will adopt a pure DOT collateral model. Users can borrow PUSD by staking DOT, with a collateralization ratio set between 150% and 200%. For example, staking DOT worth $150 would allow borrowing of 100 PUSD. The system has an automatic liquidation mechanism: when the value of the collateral falls below a threshold, the system will auction the staked DOT to maintain the dollar peg of PUSD.

In terms of reward distribution, block rewards will be injected directly into the treasury in the form of PUSD and distributed to validators, avoiding the impact of secondary fluctuations in DOT. This design emphasizes "localization," using only DOT as collateral to maximize the utilization of liquidity within the Polkadot ecosystem. Currently, Polkadot's total locked value (TVL) has surpassed $10 billion, and if PUSD is implemented, it is expected to become the "ecological blood" circulating between parachains.

3. Community Divisions: Support and Doubts Coexist

After the proposal entered discussion, community reactions have been polarized. Supporters believe that PUSD will enhance the stability of validator earnings, attract institutional participants, and drive the ecosystem's transition from "high risk, high reward" to "sustainable." Community media like PolkaWorld pointed out that if the circulation of PUSD reaches $1 billion, validators' annualized returns could stabilize at 8%-10%, significantly higher than the returns in the current volatile environment.

However, the dissenting voices are equally strong. Opponents worry that a single DOT collateral model could amplify systemic risks. If the price of DOT were to drop significantly, a chain liquidation could impact the entire network. Additionally, the governance voting threshold is relatively high, requiring over 50% support for the proposal, while small and medium holders tend to favor conservative strategies, making the proposal's passage uncertain.

4. Risks and Prospects: The Volatile Reality Under Data

The potential and risks of PUSD are deeply tied to the price fluctuations of DOT. Below are the price fluctuation data for DOT from August to September 2025:

| Date | Opening Price (USD) | Closing Price (USD) | Daily Volatility (%) | |------------|----------------------|---------------------|-----------------------| | 2025-08-29 | 3.9804 | 3.9909 | +0.26 | | 2025-08-30 | 3.7768 | 3.8215 | +1.19 | | 2025-08-31 | 3.8102 | 3.8695 | +1.54 | | 2025-09-01 | 3.7420 | 3.8809 | +3.67 | | 2025-09-27 | 3.5000 | 3.6200 | +3.43 |

Data Source: AICoin

Despite significant short-term volatility, if PUSD is successfully implemented, it could drive Polkadot's TVL to exceed $15 billion by 2025 and enhance its competitiveness in cross-chain payments and DAO governance. However, achieving this vision requires balancing risks, such as introducing a liquidation buffer mechanism or expanding multi-collateral options in the future to avoid "putting all eggs in one basket."

5. Conclusion

The PUSD proposal represents a critical attempt at a pivotal shift within the Polkadot ecosystem, reflecting an exploration of sustainable incentive mechanisms. Although there are divergences within the community regarding technical feasibility and economic models, the discussion itself has already propelled the ecosystem forward. The next step will be the on-chain governance voting results, which will determine whether this stablecoin can transition from blueprint to reality, and the future landscape of Polkadot may hinge on this decision.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。