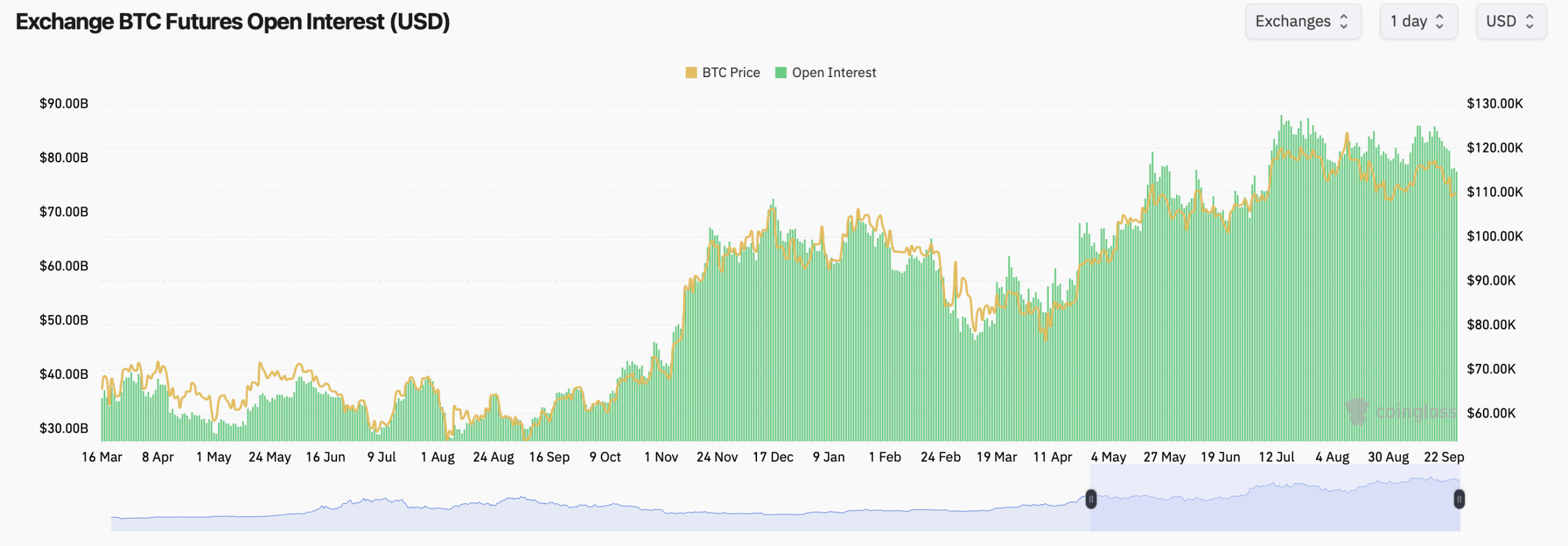

比特币在周六的交易价格为109,449美元,期货市场活跃:总未平仓合约(OI)为707.59K BTC,或774.5亿美元。市场深度广泛,交易记录显示出双向兴趣。

CME占据最大份额,持有138.82K BTC(151.9亿美元),占19.6%,24小时内小幅上涨0.32%。Binance紧随其后,持有123.30K BTC(135亿美元),占17.42%,尽管其OI在当天下滑了0.90%。

来源:Coinglass.com,2025年9月27日。

Bybit的未平仓合约为84.39K BTC(92.3亿美元),24小时内下滑0.87%。OKX发布37.78K BTC(41.3亿美元),日内上涨1.31%,而Gate显示78.24K BTC(85.6亿美元),下滑1.07%。

二线流动性表现不一:Bitget持有52.33K BTC(57.2亿美元),当天上涨0.45%。Kucoin为6.12K BTC(669.49百万美元),下滑2.88%。WhiteBIT有20.94K BTC(22.9亿美元),下滑0.55%。MEXC上涨4.87%至26.42K BTC(28.9亿美元)。BingX显示9.15K BTC(10亿美元),经历了42.96%的大幅下跌。

本周末,比特币期权在仓位上偏向看涨,但在交易记录上并非如此。认购期权占据未平仓合约的60.66%,为199,102.16 BTC,而认沽期权占39.34%,为129,149.11 BTC。

然而,在过去24小时内,Deribit的认沽期权在交易量上略微领先,交易量为16,247.21 BTC(50.87%),而认购期权为15,694.48 BTC(49.13%)。交易者在周末进行对冲,而不仅仅是欢呼。

最活跃的合约集中在比特币当前的交易区间。9月28日,Deribit的$110,000认沽期权交易量为1,311.9 BTC。10月10日的$100,000认沽期权增加了853.3 BTC,而10月31日的$116,000认购期权记录了812.5 BTC。与$110,000行权价相关的其他几个合约也保持着活跃。

展望更远,12月的认购期权主导了未平仓合约排行榜。12月26日的$140,000认购期权持有9,804.5 BTC,紧随其后的是$200,000认购期权,持有8,527.2 BTC。$120,000和$150,000行权价也有强劲的合约堆积,突显出交易者对年末高位押注的兴趣。

最大痛苦点——期权买方感受到的最大压力水平——在近期期权到期中,平滑地围绕$110,000到$116,000波动,至12月底的合约有轻微下滑至$105,000。

综合来看:期货流动性充足,期权未平仓合约偏向认购,短期交易量倾向于认沽,而最大痛苦图则将磁力点固定在$110K附近。比特币交易者有他们的游乐场;现在价格决定谁为这次旅程买单。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。