以太坊(ETH)首次跌破4000美元大关,已经超过一个月,随着看跌情绪在更广泛的加密市场中蔓延。根据Bitstamp的数据,ETH在9月24日晚上10:45(东部时间)跌至3967美元,随后略有反弹,收盘价刚好超过4000美元,24小时损失为4.4%。

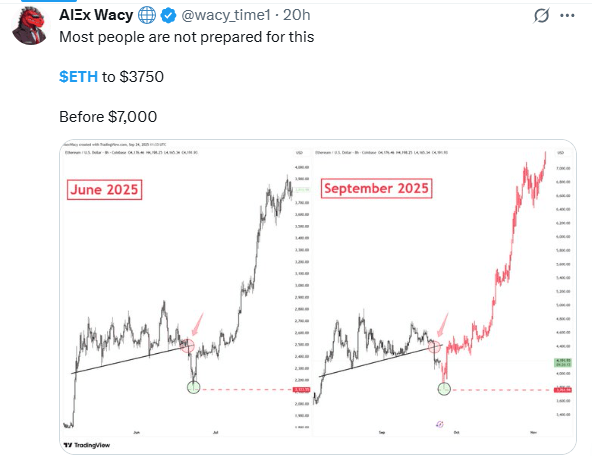

此次回撤使ETH的七天损失达到了12.5%,使其成为表现最差的高市值山寨币之一。自9月13日突破4750美元以来,ETH已下跌近20%,一些技术分析师预计在资产稳定之前还会进一步下跌。尽管出现下滑,但以太坊支持者的看涨情绪依然强烈,他们将此次修正视为新一轮上涨趋势的前奏。

Bitmine的执行主席汤姆·李(Tom Lee)依然乐观,预测ETH将在年底前达到新的历史高点。虽然一些分析师预测2025年的峰值在7000美元左右,但李的预测则更为雄心勃勃,范围在10000到12000美元之间。

支持这一看涨前景的是,社交媒体分析师报告称在下跌期间鲸鱼活动非常活跃。分析师Zyn指出,仅在9月25日,10个新钱包通过交易所和场外交易获得了约201,000 ETH,价值8.55亿美元。“当ETH接近底部时,这种情况经常发生,”Zyn表示。

MN Fund的创始人米哈伊尔·范德·波普(Michaël van de Poppe)也表达了这一观点,认为下行趋势的最糟糕阶段可能已经结束,并表示“没有更多的下行空间”。

然而,价格下跌带来了直接后果。ETH的下跌触发了1.785亿美元的多头头寸清算,其中在Hyperliquid上的最大单笔清算总额为2912万美元。根据Lookonchain的报告,这一波下跌还给一位名为Machi Big Brother的高风险交易者施加了压力,他 reportedly 在Hyperliquid上存入了472万美元的USDC以避免清算。

ETH的波动性继续考验投资者的韧性,但对许多看涨者来说,目前的下跌只是通往长期增长道路上的又一步。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。