Original Title: Plasma: The World of On-Chain Payments

Original Source: Sumcap

Original Translation: Alex Liu, Foresight News

This article provides an in-depth analysis of Plasma, tracing the evolution of stablecoins and exploring how Plasma's architecture is reshaping this field.

From "Sound Money" to "Stable Money"

On January 3, 2009, the first Bitcoin block was mined, embedding a message: "The Chancellor is on the brink of a second bailout for banks." This referred to UK Chancellor Alistair Darling, who was preparing to use taxpayer money to bail out struggling banks on a large scale again—just months after the first bailout.

The first Bitcoin block; Source: https://bitaps.com/0;

These bailouts occurred after the collapse of Wall Street in September 2008. Following the bankruptcy of the 158-year-old investment bank Lehman Brothers, the shockwaves of its failure swept across the globe. Overnight, credit markets froze, and trillions of dollars in mortgage-backed securities became worthless—clearly demonstrating that "traditional finance" was unreliable: banks had recklessly taken risks, regulators had turned a blind eye, and when everything collapsed, taxpayers bore the losses.

For many, BTC was seen as a direct byproduct of this crisis, standing in stark contrast to the existing banking system: i) fixed supply, ii) no central authority, iii) an inflation-resistant peer-to-peer network.

However, this "sound" money came with a trade-off: volatility when priced in dollars. As more people got involved, the demand for predictable payments and invoicing grew. The alternative options: (a) wire funds to a bank, (b) wait days for settlement, and (c) pay high fees in the process only added fuel to the fire.

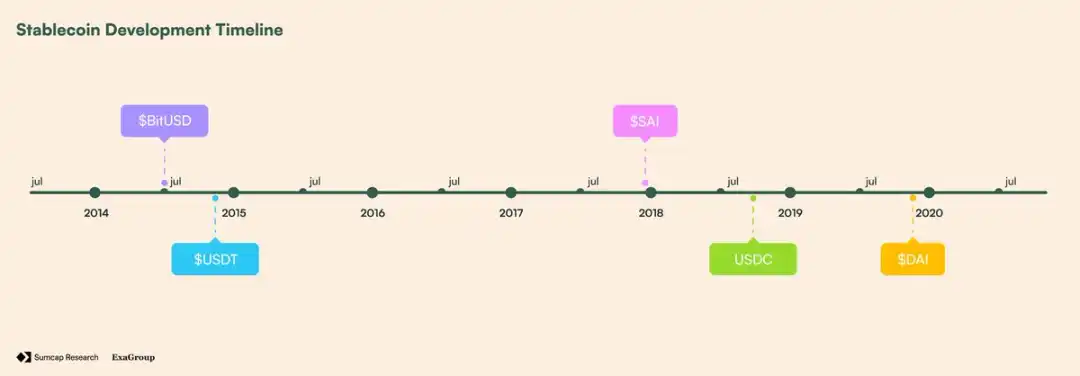

Ultimately, in July 2014, BitShares launched BitUSD—allowing users to lock BTS (the native token of BitShares) as collateral to create a token pegged to the dollar. However, it relied entirely on BTS, meaning that a price drop could easily push the collateralization ratio below a safe level, triggering mass liquidations.

Just a few months later, in November 2014, Tether launched USDT—a fiat-backed token that could be redeemed for held dollars at a 1:1 ratio. Unlike BitUSD, it did not require over-collateralization or complex mechanisms, and this simplicity allowed it to achieve a trading volume of $19.3 million and a market cap of $1.45 million in less than a year. In comparison, ETH was worth about $1 at the time, while BTC hovered around $240.

The success of USDT; Source: https://www.coingecko.com/en/coins/tether/historical_data;

The success of USDT spawned more alternatives. MakerDAO (@SkyEcosystem) launched SAI in December 2017, allowing users to lock ETH into debt positions to mint soft-pegged dollar tokens, but the volatility of ETH forced it to upgrade: Multi-Collateral Dai (DAI) was launched in November 2019. By decentralizing collateral and increasing risk control governed by MKR, DAI became the first truly adopted decentralized stablecoin.

Meanwhile, fiat-backed competitors were also developing in parallel: USDC launched in 2018, positioning itself as a regulated, fully dollar-backed token with transparency certification, quickly becoming the preferred collateral in DeFi.

Timeline of stablecoin development

The Adoption of Stablecoins and Infrastructure Gaps

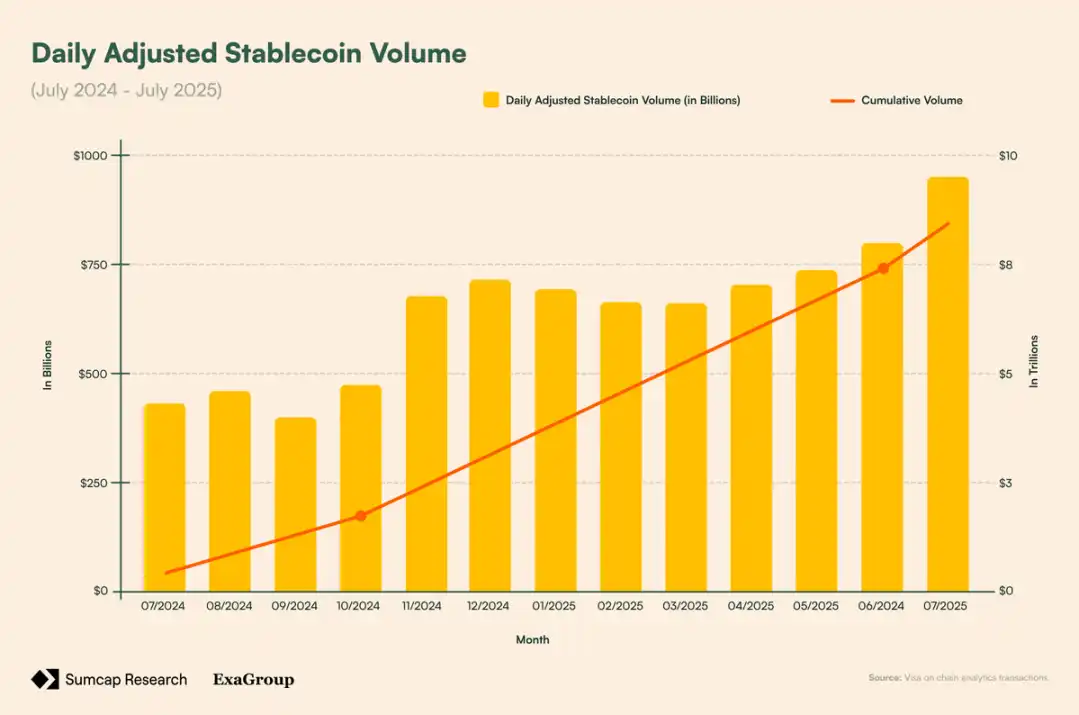

Today, stablecoins are the most widely used products in cryptocurrency by trading volume. Their market cap ($271.6 billion) has now surpassed the total locked value in DeFi ($166.1 billion). Moreover, in 2024, when Visa processed $13.2 trillion in payments, stablecoins settled over $22 trillion in raw on-chain transaction volume—adjusted for internal exchange transfers and MEV, this amounts to $5.67 trillion. Additionally, the adjusted daily trading volume grew by about 120% within a year (from $432.3 billion to $949.1 billion), highlighting the growing demand.

Adjusted daily trading volume of stablecoins; Source: https://visaonchainanalytics.com/transactions;

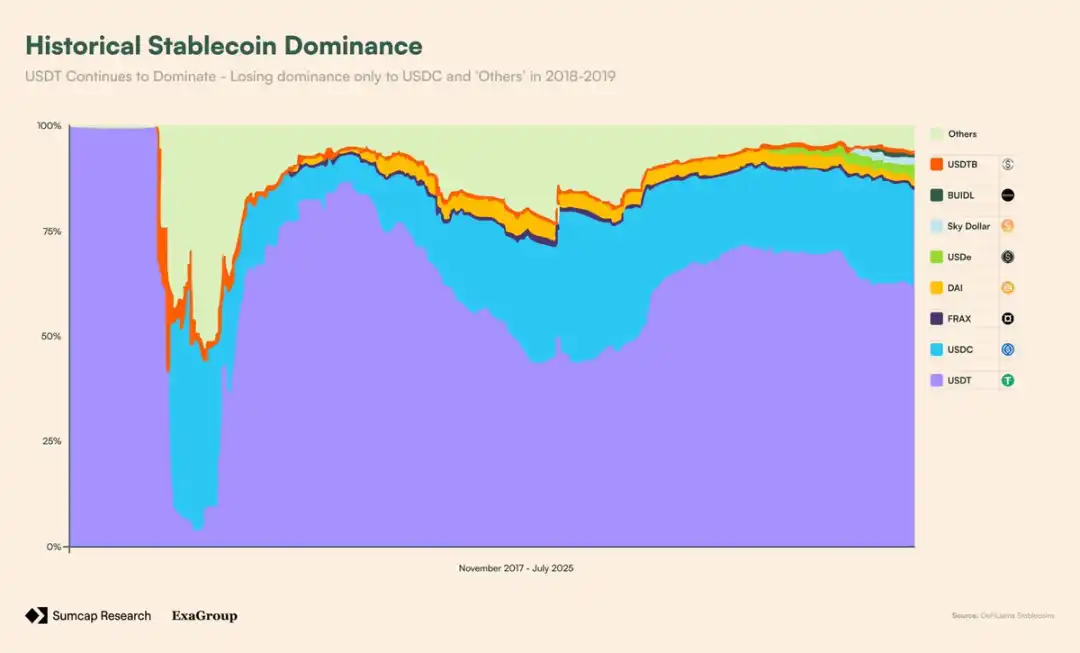

In July 2025, the U.S. "Genius Act" officially recognized stablecoins as legal payment instruments, placing them alongside debit card networks, ACH, and wire transfers. Nevertheless, the infrastructure still lags behind. USDT, which holds over 60% market share, still relies on general-purpose chains not designed for payments, where transfers require gas tokens with value volatility, and institutional scalability and compliance needs remain unmet.

The dominance of USDT; Source: https://defillama.com/stablecoins;

This creates a paradox: the annual trading volume of stablecoins can rival that of Visa, yet on-chain, they remain second-class citizens, treated merely as another type of token.

Bitcoin faces a similar issue. As the seventh-largest asset in the world, with a market cap higher than silver, BTC should be the anchor of DeFi. However, most of it remains idle. Wrapped BTC solutions are fragmented and require custody, with independent versions on Ethereum, Polygon, and Arbitrum—each version's liquidity is siloed.

Plasma Architecture: A Blockchain Prioritizing Stablecoins and Native BTC Support

To address this issue, Plasma rethinks the infrastructure itself. It does not view stablecoins and BTC as add-ons but instead makes them first-class citizens through specially built components:

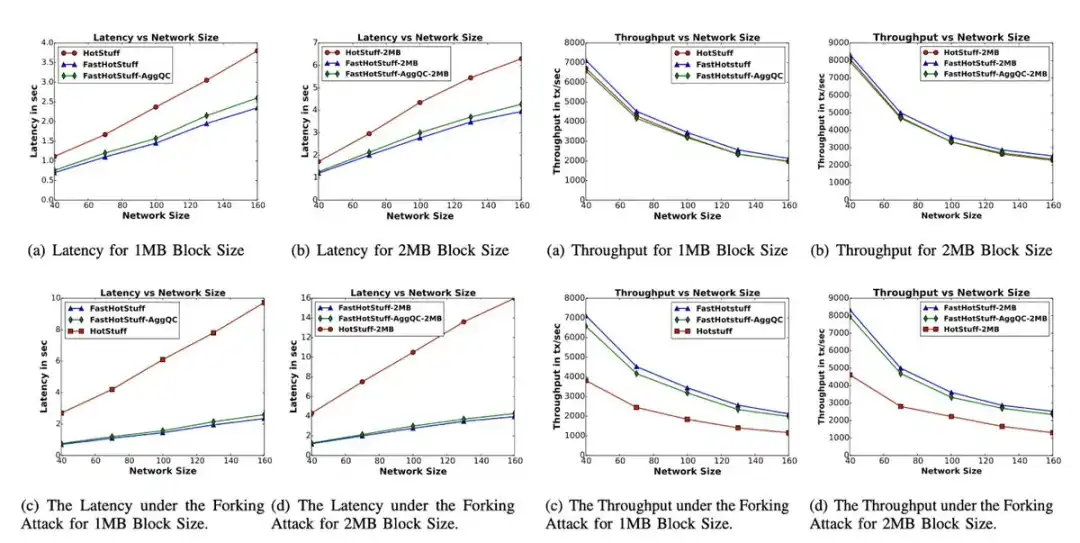

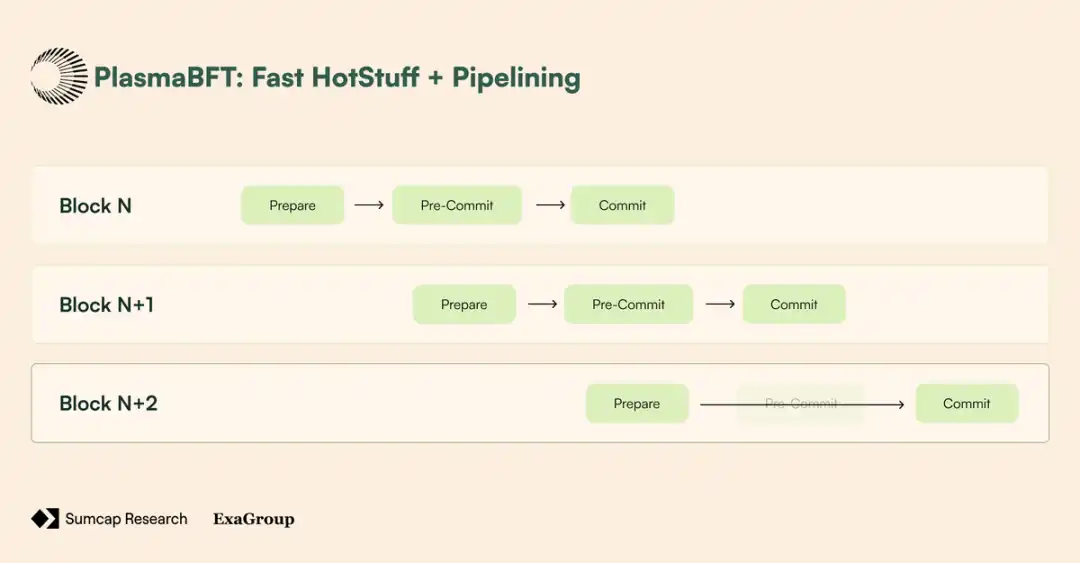

· PlasmaBFT - A pipelined version of Fast-HotStuff that provides rapid finality without sacrificing security.

· Reth Execution Layer - An EVM-compatible execution engine written in Rust.

· Native BTC Bridge - A decentralized network of validators that secures pBTC activity.

· Stablecoin-Centric Features - Native gas paid in dollars, zero-fee transfers via paymaster, and auditable confidential payments.

With this architecture, Plasma deviates from general-purpose design, aiming to become the natural settlement layer for BTC-USDT activity.

PlasmaBFT

Plasma's consensus layer secures the chain through Fast-HotStuff, implemented for high performance. In traditional BFT protocols (like HotStuff), finalizing a block requires three stages:

· Prepare - The leader proposes a block, and validators check its validity and vote to approve it;

· Pre-commit - Validators confirm that an absolute majority (>⅔) has approved the prepare stage, then "lock" on that block to prevent forks;

· Commit - Validators confirm that an absolute majority has pre-committed, making the block final and irreversible.

While this process does ensure security, it slows down speed, as each step requires network communication and coordination. Fast-HotStuff reduces this overhead through what is known as the "two-chain commit rule": if two consecutive blocks (N and N+1) receive absolute majority approval, then N can be finalized immediately, as obtaining an absolute majority on N+1 proves that validators had already locked on N when approving N+1—thus eliminating the need for the pre-commit stage.

In effect, the three stages simplify to two:

· Stage 1 (Prepare) - Vote on block N.

· Stage 2 (Commit) - Vote on block N+1, thereby finalizing block N.

Comparison of FHS and HS; Source: https://europe1.discourse-cdn.com/flex013/uploads/aave/original/2X/0/0f142a3d4d228f2b4baa2ff4b51e2016fe76bb73.png;

Additionally, in cases where the network cannot achieve the rapid finality required by two consecutive absolute majorities, PlasmaBFT will revert to the full three-stage commit protocol, ensuring that all honest validators are safely "locked" on the same block before finalization. Once the reversion is resolved, PlasmaBFT resumes the rapid two-stage path.

Comparison of FHS and HS workflows

But that's not all. Through pipelining technology, multiple block stages can be overlapped and processed simultaneously: when validators are in the commit stage for block N, they may already be in the prepare stage for block N+1. This effectively keeps the network busy at all times, maximizing efficiency, as the next block does not have to wait for complete finality to begin its voting process.

Moreover, by selecting only a subset of validators (a committee), PlasmaBFT reduces communication overhead while still applying the same absolute majority rules.

FHS + Pipelining Technology

Reth Execution Engine

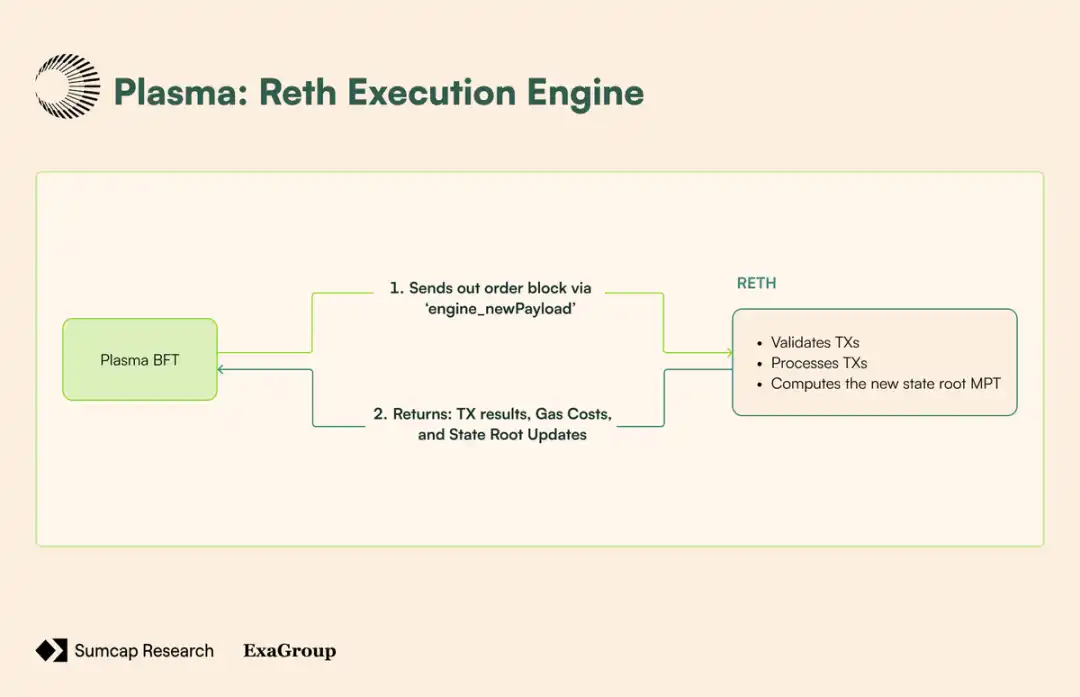

The execution layer of Plasma is built on Reth, an Ethereum client written in Rust that manages state transitions, transaction processing, and EVM operations in full compatibility. It connects to the consensus layer through the same engine API that Ethereum has used since the "merge"—allowing PlasmaBFT to handle consensus and block ordering while Reth focuses on transaction execution and state transitions:

Block Proposal - The CL sends an ordered block to Reth via the engine_newPayload call.

Transaction Validation - Reth verifies the format, signature, nonce, and gas requirements of each transaction.

State Execution - Reth processes transactions sequentially.

State Root Calculation - After executing all transactions, Reth calculates the new state root and transaction receipt root using a Merkle-Patricia tree.

Execution Confirmation - Reth returns the execution results (including gas usage, transaction receipts, and updated state root) to PlasmaBFT.

Block Finalization - PlasmaBFT incorporates the execution results into the final block header and completes the consensus process.

RETH Workflow

Native BTC Bridge

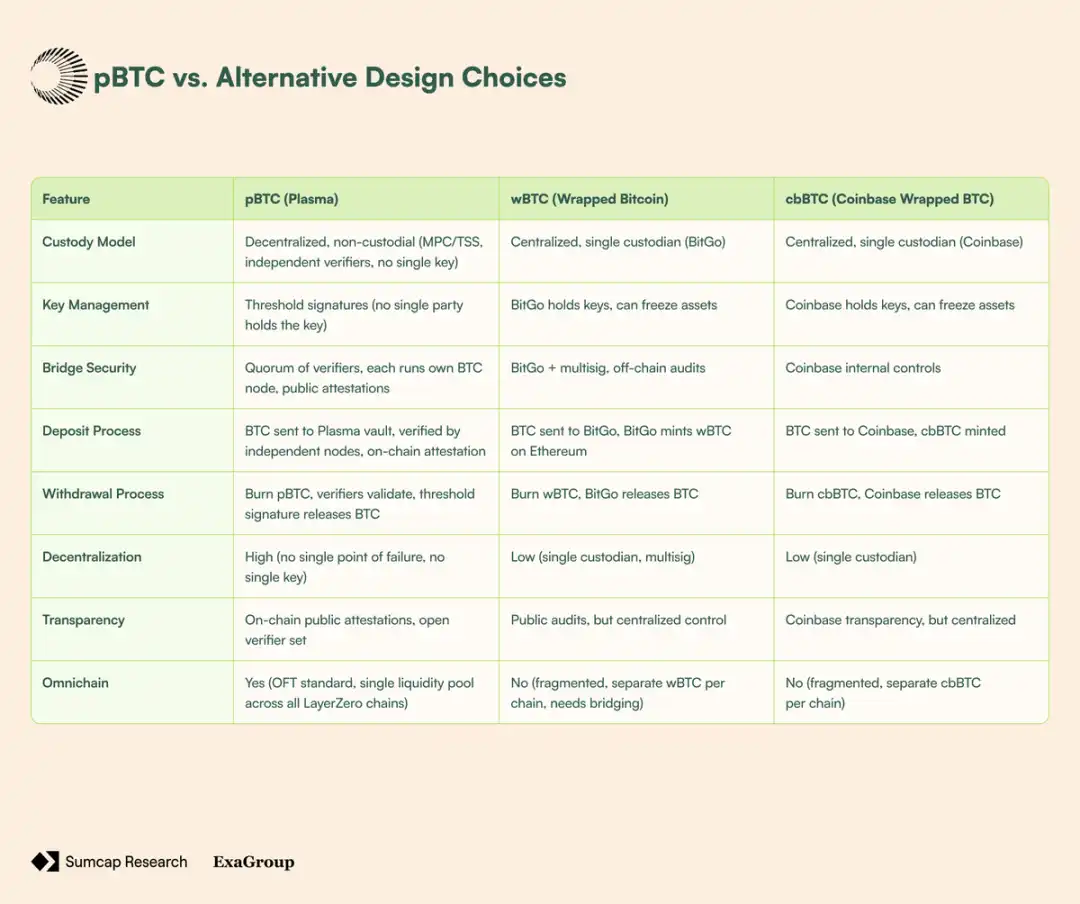

Most BTC bridges today appear decentralized on the surface, but peeling back the layers reveals either:

· A single custodian (like BitGo, the issuer of wBTC) holding everyone's coins, or

· A small multi-signature wallet that can freeze the treasury at any time.

This is a trade-off that users have accepted: if you want to use BTC in DeFi, you have to give up the trust-minimized design of Bitcoin.

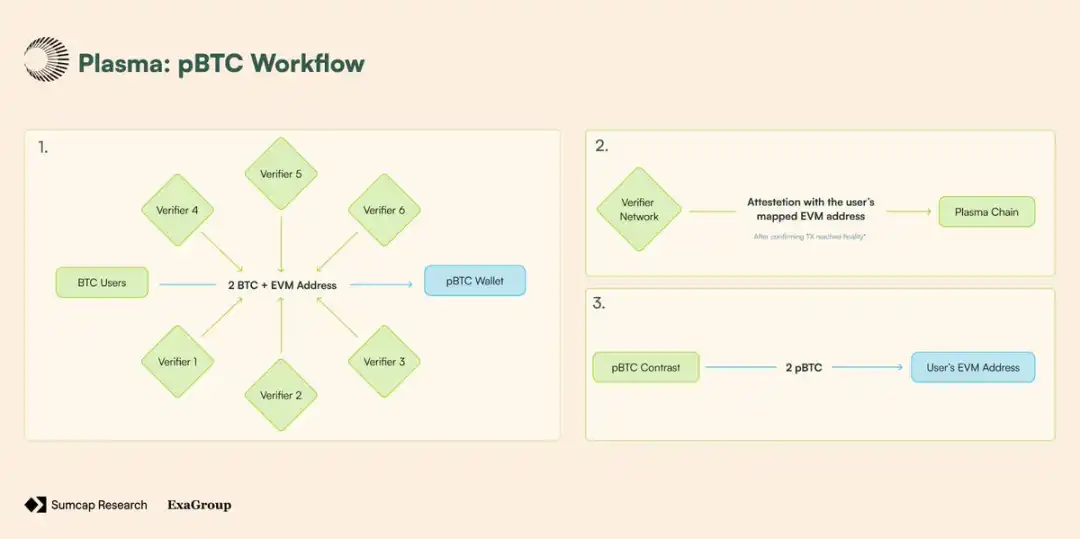

Plasma's BTC bridge is not driven by custody but is supported by a network of validators, each running their own Bitcoin node. There is no single party controlling the treasury; the inflow and outflow of BTC must be collectively approved by a threshold signature from a legally required number of validators.

When users deposit BTC into the Plasma vault on the Bitcoin network, each validator independently "sees" the deposit through their own Bitcoin node, confirms that the deposit has reached finality, and then broadcasts a proof on-chain.

These public proofs confirm that BTC has been received and carry the user's mapped EVM address. Once an absolute majority of validators reaches consensus, pBTC is minted directly to that user's address on Plasma, and the proof is sent on-chain.

Figure 10 - pBTC Workflow;

However, the improvement in the trust model is only part of the story. Most BTC bridges today also suffer from another critical flaw: liquidity fragmentation. Take wBTC as an example—it exists as an independent version on each chain. wBTC on Ethereum cannot directly interact with wBTC on Polygon or Arbitrum without additional cross-chain steps and independent liquidity pools, adding more complexity for users and protocols.

Plasma addresses this issue by implementing pBTC using LayerZero's OFT (Omnichain Fungible Token) standard, creating a single token across all chains connected to LayerZero. This creates a single liquidity pool for pBTC that spans the entire omnichain ecosystem.

Comparison of pBTC with alternative design choices;

Native Design of Stablecoins

· Zero-fee USDT Transfers: The contract-level paymaster sponsors the transfer and transferFrom functions through an account abstraction system built on EIP-4337 and EIP-7702 standards.

· Custom Gas Tokens: The protocol-managed paymaster calculates gas costs using rates provided by oracles (including slippage protection) under the EIP-4337 standard, without charging fees.

· Confidential Payments: Conceal amounts, recipients, and metadata while retaining optional disclosure to meet compliance requirements.

Competitive Landscape and Opportunity Scale

Total Addressable Market

We've all heard the classic business adage: "Better to be a head of a chicken than a tail of a phoenix."

Plasma embodies this in the world of on-chain payments and yield market opportunities. Plasma does not compete as another general-purpose chain with technically unbeneficial innovations but laser-focuses on becoming the infrastructure used by institutions.

"Native BTC": Tokenization and Yield Market Opportunities

Despite BTC being the largest crypto asset, it is largely underutilized in DeFi—wrapped products strip away all of its trust-minimized principles.

BTC in wrapping; Source: https://bitcointreasuries.net/;

As the most decentralized BTC wrapping solution, pBTC offers "native BTC" DeFi opportunities that other solutions cannot replicate. Currently, over 242,600 BTC are wrapped, with 209,800 BTC (approximately 86.5%) actually deployed across various protocols to earn yield—pBTC's foundational opportunity comes from retail users seeking safer ways to:

· Use BTC in DeFi;

· Store BTC on more accessible EVM chains.

However, retail demand is only part of the story. Institutional and corporate adoption is on the rise, with public and private companies currently holding approximately 1.38 million BTC. This is an increase of 833,000 BTC since the beginning of the year—highlighting a clear trend of accelerated institutional adoption.

BTC held by institutions and companies; Source: https://bitcointreasuries.net/;

However, there is a key insight here: as more institutions incorporate BTC into their treasuries, their strategies will evolve from simple holding to active management. In this regard, pBTC represents the perfect intermediary—because these participants prioritize infrastructure security above all else.

On-Chain Payments: Cross-Border Payments and Payroll

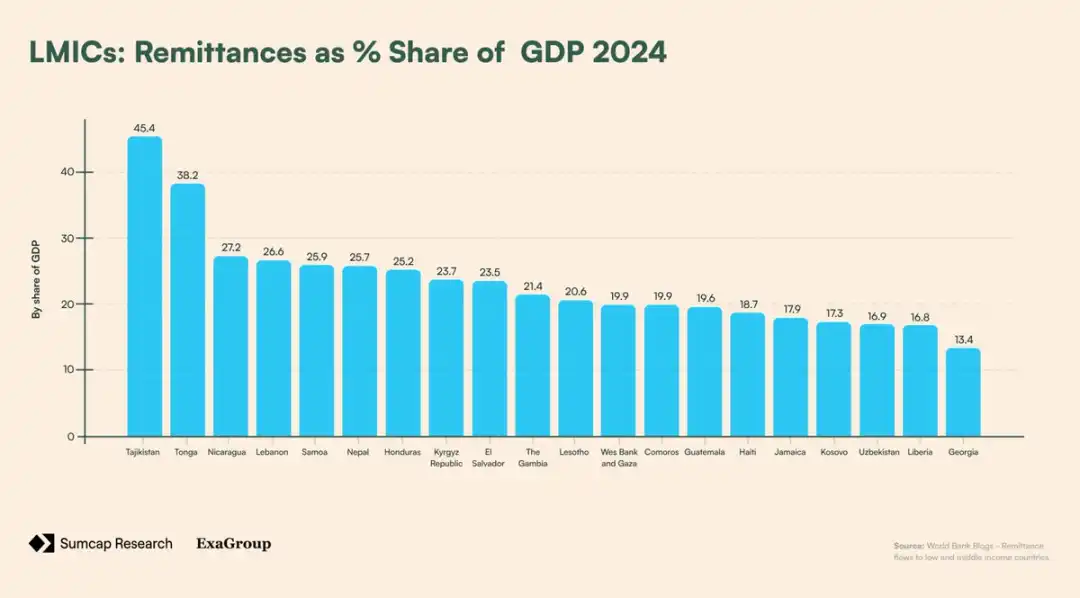

In 2023, it was reported that 184 million people (2.3% of the world's population) live outside their country of nationality. Driven by economic opportunities, these migrant workers often need to send remittances across borders to their families and communities. These cross-border payments (or "remittances") play a crucial role in supporting the economies of low- and middle-income countries—accounting for as much as half of the GDP in some of these countries.

LMICs classified by remittance as a percentage of GDP; Source: https://blogs.worldbank.org/en/peoplemove/in-2024--remittance-flows-to-low--and-middle-income-countries-ar;

In 2024, remittances to low- and middle-income countries reached $685 billion, with the top five recipient countries being:

India - $129 billion

Mexico - $68 billion

China - $48 billion

Philippines - $40 billion

Pakistan - $33 billion

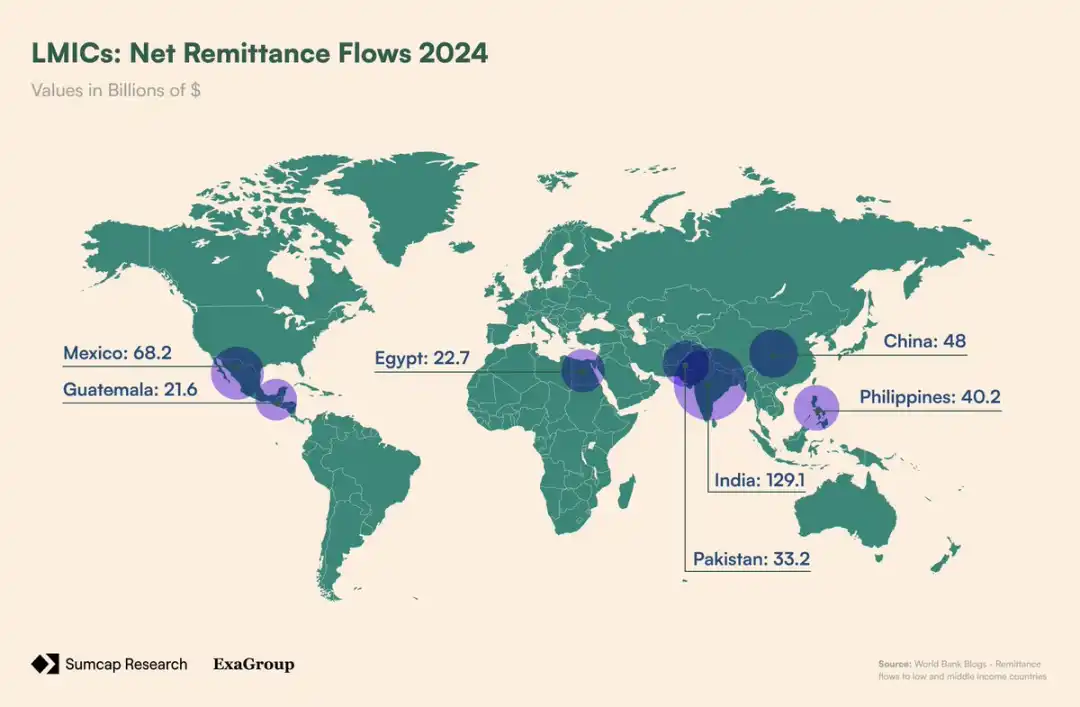

Net remittance inflows to LMICs; Source: https://blogs.worldbank.org/en/peoplemove/in-2024--remittance-flows-to-low--and-middle-income-countries-ar;

These massive flows of funds are a lifeline for millions of families worldwide—but they come with hidden costs. For example, India reportedly received $16 billion in remittances from the U.S. in 2023. With an average transfer cost of 4.16% (exchange rate spread + fees) on a $200 transfer, India lost $665 million to banks/foreign exchange institutions. This pattern repeats across every major remittance corridor. Mexico receives over $50 billion annually from the U.S., losing over $2.4 billion due to fees at current transfer costs. Meanwhile, Nigeria receives $6 billion in remittances from the U.S., losing $180 million.

The opportunity for Plasma here is clear. With its zero-fee USDT transfers, Plasma can eliminate the billions of dollars in extraction imposed on vulnerable populations by traditional channels each year. Migrant workers can finally send the full $200 to their families in Guatemala instead of the $187 after fees. Over time, this will save each family thousands of dollars—money that will stay in the communities that need it most.

However, remittances only represent part of Plasma's coverage. When we combine zero-fee USDT transfers with auditable confidentiality, Plasma opens the door to an entirely new market: on-chain payroll.

In 2023, the total wages and salaries generated in the U.S. amounted to $11.07 trillion, involving 134.06 million employees. This means there are 1.6 billion (12 × 134 million) bank transfers each year—all of which incur costs for companies.

To simplify, let's assume these wages are paid monthly via ACH direct deposit. The fixed fee per transfer ranges from $0.20 to $1.50, with U.S. companies spending approximately $1.37 billion annually just to transfer money to employees' accounts:

134.06 million × 12 × $0.85 = $1.37 billion

Similar to remittances, funds that could have been better utilized by the companies making the transfers are wasted on fees. By adopting Plasma's gas-free USDT transfers, U.S. employers will save approximately $1.4 billion annually, while confidentiality adds another layer of value for both employers and employees.

Opportunity Scale Assessment

Plasma sits at the intersection of the three largest flows of funds in the world:

Savings and capital allocation—allowing users to earn yields in DeFi through BTC.

Cross-border payments—saving billions in remittance fees.

Payroll—eliminating friction and costs in domestic and international wage payments.

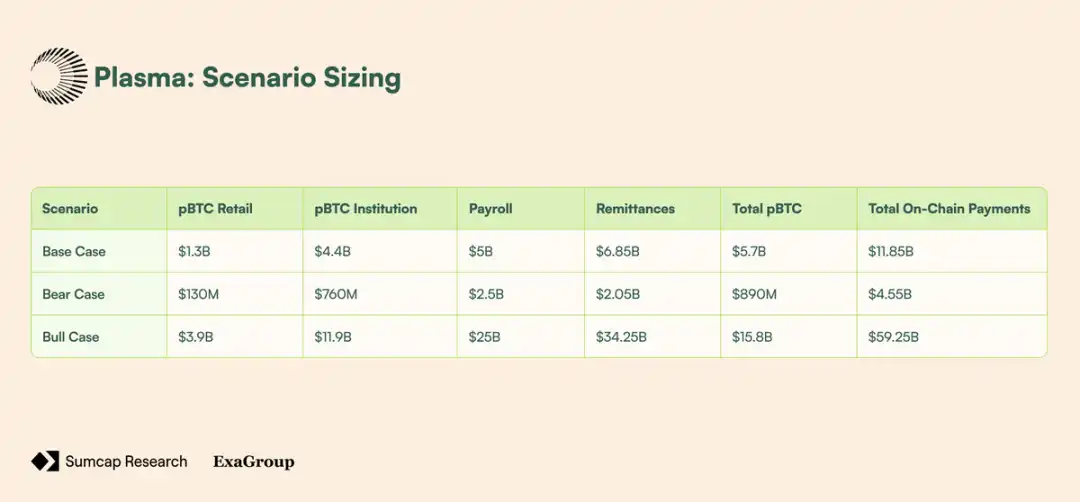

Even moderate adoption in each of these areas would be sufficient to support a total addressable market (TAM) worth billions. By assessing the scale of these opportunities based on different adoption possibilities, we arrive at three different scenarios: base case, pessimistic case, and optimistic case.

Base Case: Adoption of pBTC comes from retail users seeking safer alternatives and early institutional interest in DeFi yields. On-chain payments gain attention with remittance cost savings and a small wave of tech companies experimenting with crypto payroll.

Pessimistic Case: Wrapped BTC maintains dominance due to familiarity and integration, leading to lagging adoption. Regulatory uncertainty and a knowledge gap in crypto slow institutional inflows and remittance usage, while payroll faces resistance from existing systems.

Optimistic Case: Improved user experience, regulatory clarity, and mainstream adoption drive large-scale BTC migration, remittance flows, and corporate payroll integration.

Scenario Scale Assessment;

Competitive Landscape

The competitive landscape for Plasma is as follows:

· Tron (trondao) - Dominates USDT circulation but is limited by centralization, limited scalability, and rising costs.

· Ethereum - Serves as the foundation for issuance and large transfers but is unsuitable for retail payments due to high fees, delays, and competition for block space.

· USDC - Positioned as a regulated, transparent option, but its usage leans towards financial platforms and exchanges, lacking representation in real-world commerce.

Competitive Landscape

Conclusion

The evolution of crypto payment infrastructure has been shaped by incremental workaround solutions rather than thoughtful design. This has led to a mismatch between the assets driving adoption (BTC and USDT) and the infrastructure they rely on.

Plasma addresses these inefficiencies by restructuring the underlying framework around these assets:

· Treating stablecoins as native gas assets eliminates reliance on volatile tokens, enabling payroll and remittances.

· pBTC integrates cross-chain liquidity through LayerZero's OFT standard, facilitating productive deployment of BTC in DeFi.

· Privacy and compliance features align with corporate demands for predictable costs and operational security.

Its impact spans various market segments:

· Enterprises gain a cost-predictable and compliant settlement method.

· Institutions can productively deploy their BTC treasuries.

· Retail users unlock instant low-cost remittances and payroll receipts.

Plasma positions itself not as a general-purpose chain but as a settlement infrastructure built specifically for USDT and BTC. By aligning the infrastructure with the most important assets, it fills the gaps left by Ethereum and Tron, supporting real-world payment flows and ushering in the next era of adoption across retail, corporate, and institutional levels.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。