撰文:Tyler

要想 CZ「喊单」,得证明自己在币安生态池子里,能活下来,也能扩张和捕获新的价值。

一条推文,能有多大能量?

答案是:让一个流通市值超 2 亿美元的代币,瞬间拉升 60%。

这就是 CZ 的影响力。9 月 24 日,CZ 转发 SafePal 原生集成 Aster 的推文,并附言:「SafePal 也是我们的 portfolio,投资得很早,紧随 Trust Wallet 之后」,SFP 价格应声暴涨。

这并非孤例,除了吸睛的 Aster,CZ 近期先后提及多个 YZi Labs(原 Binance Labs)投过的项目,都产生了显著的喊单效应。

如果把这些 portfolio 放在一起看,其实会发现,背后埋着一条很清晰的主线。

一、币安投资版图的正确打开方式

「SafePal is also a portfolio, btw. Invested way back.」

CZ 的这句话,也让很多人总结出一个直观的筛选方式,即去考古 YZi Labs 曾经投过的发币项目,大概率就能挖出下一个暴涨标的。

这个逻辑听上去没错,但真正操作起来,无异于「大海捞针」,原因很简单——币安的投资版图极其庞大。

首先,我们需要理解币安的投资逻辑。2018 年 7 月全资收购 Trust Wallet,是币安投资版图扩张的起点,标志着其战略从单一 CEX 向生态矩阵演进,此后币安逐渐形成了覆盖项目全生命周期的三大「投资抓手」:

- 孵化器模式(MVB、YZi Labs 孵化计划):广撒网式大量覆盖初创团队与早期潜力项目,最终筛选后对部分项目进行投资,金额相对不大,主要是从 0 到 1 的孵化;

- YZi Labs(VC 直投):面向成熟度更高的成长期项目,精准度更高、投资金额更大,旨在提供深入资源整合;

- 交易所上市代币(Alpha 上币或新币上线):聚焦成熟项目,提供顶级的流动性与市场曝光;

正是通过这三条路径的组合拳,Binance 几乎囊括了不同阶段、不同赛道的项目布局,实现了覆盖不同项目全生命周期(早期孵化、投资支持、上市交易)的错落布局,其中,YZi Labs 的直投是中前期生态搭建的核心。

但问题在于,根据数据平台 Messari 的第三方统计,YZi Labs(Binance Labs)自成立以来,累计投资(或布局)项目已超 300 个,显然,单纯以「被投过」作为筛选标准,基本等于闭眼撒网,毫无意义。

那么,真正的筛选逻辑是什么?

从 CZ 近期接连点名的 Aster、Sign、SafePal 三个案例来看,已经能梳理出一些共性,都满足几个核心特征:

- 首先,是与币安的高度生态协同性:譬如 Aster 作为 prep DEX 补齐了链上衍生品拼图,缓解了 Hyperliquid 的压力,SafePal 则通过紧贴币安产品线的集成策略,天然实现「托管 CEX & 非托管钱包」的生态互补;

- 其次,要有明确且持续推进的落地节奏:无论是 Aster(21 年),还是 Sign(20 年)、SafePal(18 年),这些项目都并非新晋明星,而是从 2018~2021 年一路坚持下来的「老兵」,在漫长周期中持续推进迭代和扩张;

这也正是解读 CZ 喊单逻辑的关键切口。

二、按图索骥,CZ 的「喊单」逻辑

如果仔细复盘 CZ 过去几个月的动态,会发现他的「喊单」并非心血来潮,甚至可以说是有意为之。梳理其时间线,能明显看到一条逻辑清晰、层层递进的草蛇灰线:

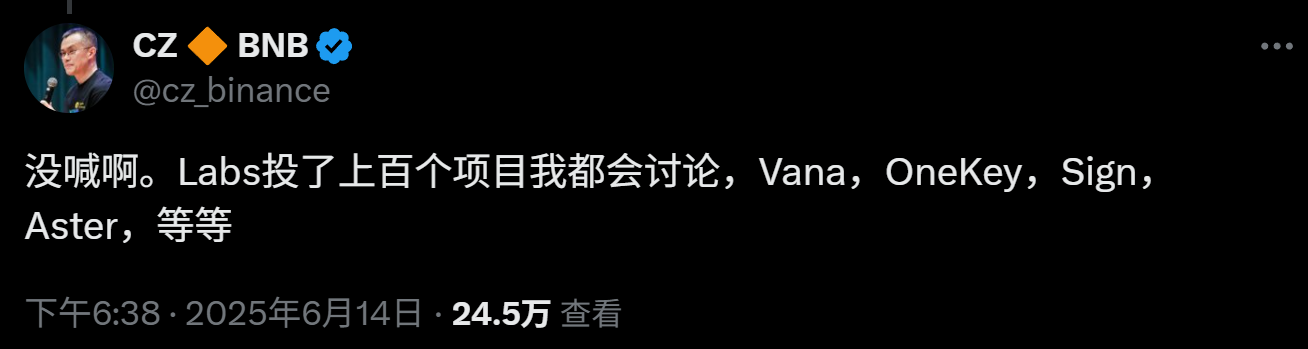

- 6 月 14 日,CZ 在回应社区关于其「喊单 Aster」的质疑时,就点名了一批已投项目,包括 Vana、OneKey、Sign、Aster 等,埋下伏笔;

- 6 月 - 9 月,CZ 多次公开提及或互动 Aster,持续为其注入关注度;

- 9 月 23 日,CZ 专门转推 Sign,强调其是 YZi Labs portfolio 的身份,并透露曾亲自为其牵线搭桥;

- 9 月 24 日,轮到 SafePal,CZ 不仅点名,更特意强调投资的早期性与战略性——「很早之前就投资了,紧随 Trust Wallet 之后」

Aster、Sign、SafePal、Vana、OneKey,无一例外,都是能与币安主营业务深度协同,打出「组合拳」的 portfolio 生态项目。

这从侧面表明,CZ 的「喊单」绝非随机,而是在有意识地引导市场,重新关注那些与币安生态深度绑定的「老牌实干派」。

以 SafePal 为例,看懂它在币安版图中的多重身份,就能理解这些「喊单」背后的门道。

在币安的钱包布局里,很多人可能更熟悉早前的 Trust Wallet,或者今年刚获得投资的 OneKey,但某种程度上,Trust Wallet 是半路收购来的老团队,OneKey 属于后投资的新贵,而 SafePal,才是真正意义上币安首个从零开始投资并孵化的(硬件)钱包项目:

2018 年 9 月,币安前脚刚收购 Trust Wallet ,后脚就将 SafePal 作为唯一的钱包品牌纳入 Binance Labs 首期孵化器计划,随后年底完成投资,而 SafePal 则是次年上半年才正式开售首款硬件钱包 S1。

换句话说,在产品正式问世前,SafePal 就已被币安视为卡位硬件钱包赛道的重要棋子,也正因如此,在币安始终没有自研硬件钱包的背景下,SafePal 至今仍是其生态中战略地位最特殊、绑定最深的硬件钱包选项。

而除了硬件,其 App 钱包也几乎成为币安产品矩阵的延伸终端,几乎复制了核心交易与资管功能:

- CEX 层:小程序集成币安的现货、杠杆、合约、理财入口,可作为主站核心交易 & 资管功能的备份,在App内可以直接唤起币安 App 完成授权登录并交易;

- 交易层:Swap(支持直接使用币安主站的流动性),原生支持 BNB Chain 与 Aster、转账 BNB Chain 稳定币免 Gas;

- 资管层:理财(原生支持币安 Earn)、NFT、DeFi 模块均直连 BNB Chain生态;

- 法币入金层:集成了币安的 Binance Connect 法币出入金通道,内置法币购买与 U 支付支持;

- 转账层:可在 App 内币种详情页直接唤起币安 App 完成转账,无需复制粘贴钱包地址。

注:SafePal 钱包的币安小程序

许多老韭菜应该都有印象,2021 年币安清查部分国家/地区用户时,SafePal + Binance DApp的组合一度成为许多用户的「避风港」,这种深度绑定的协同关系,恐怕也是 CZ 点名 SafePal 的核心原因之一。

所以,当我们把这条逻辑线拉开来看,就会发现 CZ 的喊单并非随口带一带,不只是单纯的被投项目,背后指向的,实际是能和币安核心产品矩阵协同发力的「生态拼图」项目。

三、价值重估:成为「生态拼图」的筛选游戏

那为什么这些「生态拼图」的价值,值得被市场重估?

首先,它们都是对币安生态的缺口补齐:

- Aster 是币安在链上衍生品赛道的重要落子,用来呼应 CEX/DEX 竞争格局,并制衡 Hyperliquid 等新兴对手;

- Sign 卡位 RWA 叙事,为币安在新兴的链上 RWA 市场中埋下关键伏笔;

- SafePal 则通过硬件与 App 双重入口,覆盖币安的核心交易与资管场景,成为最贴近其主营业务的非托管钱包 portfolio;

它们在各自的赛道,都不是热点跟风的短期叙事产物,而是作为币安生态的功能性插件存在,某种程度上是其战略拼图里不可替代的一环。

其次,这些项目展现出长期主义的生存力,都经历了完整的牛熊周期,在市场冰冷时依旧持续迭代和扩张,正是这种 BUIDL 精神,让它们的叙事不依赖于短期情绪,而是通过产品和生态协同不断筑起护城河。

正因如此,这些项目的市值往往与实际生态位严重错配,而 CZ 的喊单,往往就是一个外部催化剂,推动市场开始重新审视它们的真实价值。

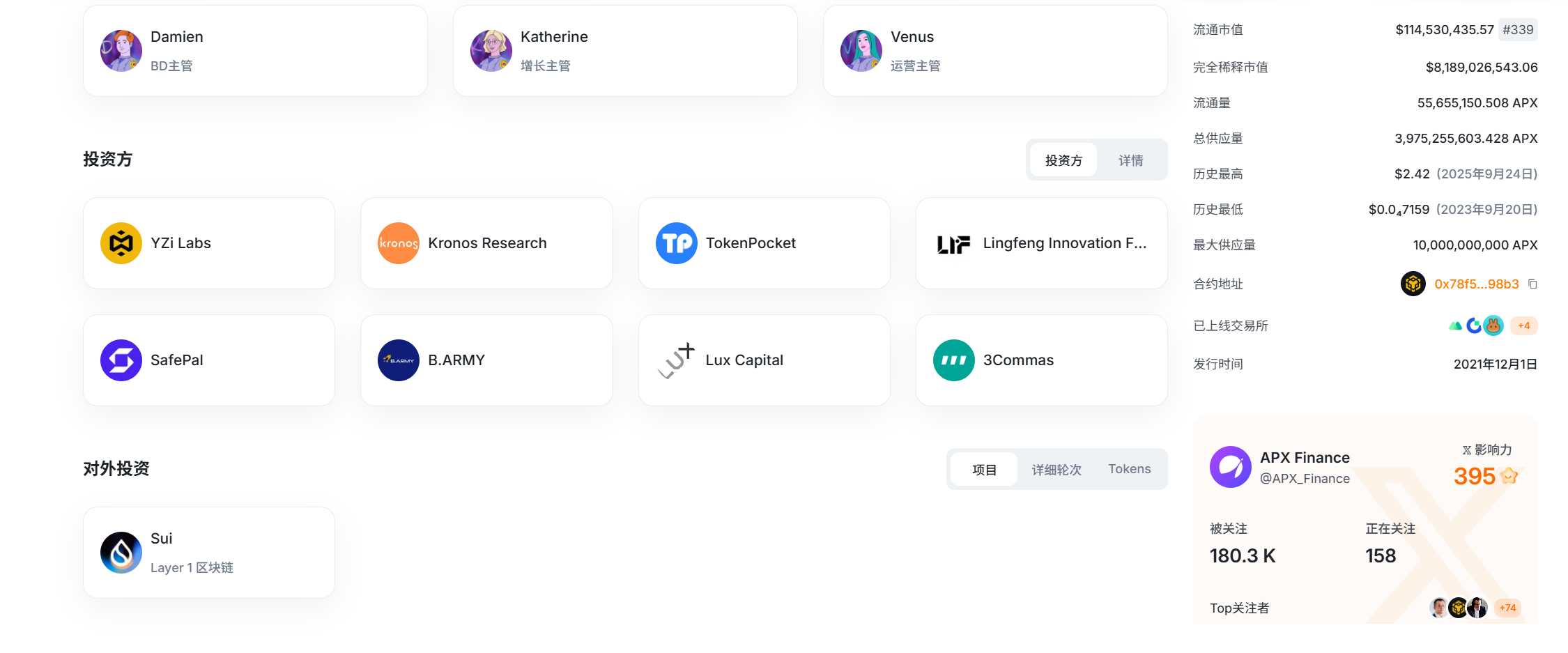

其中还有一个极具说服力的特别信号,许多人都未曾注意:SafePal 本身就是 APX Finance(Aster 前身)的早期投资方,而此次被 CZ 转发推文,也正是 SafePal 作为「首个原生内置集成 Aster 的钱包」发布的。

这是个很有意思的趋势,说明 CZ 也很认同币安生态内的优质「子项目」之间,彼此协同,形成「1+1>2」的矩阵效应。

在此之外,SafePal 今年声量颇大的举措,便是深度集成了合规的瑞士银行 Fiat24,让用户能够直接在钱包内开设银行账户,并申请万事达卡,打通了加密资产进入日常消费的便捷通道(延伸阅读《用 U 消费,SafePal 万事达卡的注册和使用保姆级教程》)。

从投资到使用场景,这种也正是 CZ 所谓生态拼图价值的最好注脚。

写在最后

换言之,CZ「喊单」币安系 portfolio 真正的筛选逻辑——你不仅要自己能在熊市中「活下来」,还要主动证明自己在币安这个大生态池子里,能扩张和捕获新的价值。

所以,预测下一个被点名的幸运儿,本质上也是在寻找和币安生态互补,真正值得关注的造富因子。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。