Written by: Luke, Mars Finance

Next Wednesday, October 1, the Dirksen Senate Office Building in Washington will become the focal point of the global crypto world. A carefully orchestrated legislative drama will reach its climax here—the U.S. Senate Finance Committee will hold a critical hearing titled "Review of Digital Asset Tax Policy."

This is not just another empty policy discussion. At this juncture, it resembles a decisive battle. With the House of Representatives having historically passed the market structure and stablecoin bills, tax policy has become the final and most crucial piece of the puzzle in building a comprehensive regulatory framework for the $2.5 trillion global digital asset industry in the U.S. The outcome of this hearing will not only clarify the tax ambiguities for 50 million American crypto investors but will also determine the future position of the U.S. in the global digital economy competition, setting new channels for the flow of global capital.

The Final Piece: The Formation of a Political Consensus

This hearing, chaired by Senate Finance Committee Chairman Mike Crapo, is not happening in a vacuum. It is built on a solid foundation of legislative and political groundwork, marking a shift in the U.S. Congress's attitude towards cryptocurrency from exploratory examination to decisive legislation.

The immediate precursor was a hearing titled "Making America the World Crypto Capital" held in July 2025 by the House Ways and Means Committee's oversight subcommittee. That hearing set the tone on Capitol Hill: providing a clear legal framework for the crypto industry is essential to maintaining America's technological and financial leadership. Following that, the House historically passed two landmark bills: the "U.S. Stablecoin Framework and National Innovation Act" (GENIUS Act), which established a federal regulatory framework for stablecoins, and the "Digital Asset Market Clarity Act" (CLARITY Act), which aims to delineate the regulatory authority of the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) over digital assets.

Tax policy is the missing final piece of this grand regulatory puzzle, and it is the most critical one.

Chairman Crapo's long-standing attention to this issue gives the hearing even greater significance. He has previously chaired hearings on cryptocurrency in 2018 and 2020. Notably, he co-signed an open letter with Democratic Senator Ron Wyden in 2023, soliciting detailed input from the industry on digital asset tax policy, with questions that almost cover all the core technical issues to be discussed in this hearing. This series of actions indicates that Chairman Crapo is committed to creating a lasting and stable legal environment for this emerging industry through bipartisan cooperation.

Thus, the hearing in Room 215 has transcended mere technical debates. It reflects a fundamental shift in the thinking of American legislators—from "whether" to regulate cryptocurrency to "how" to effectively and competitively regulate it. It resembles a publicly conducted legislative drafting session, with the ultimate goal of producing a concrete legislative proposal, marking the conscious end of the "ambiguous era" of U.S. crypto regulation.

The Dilemma in Washington: Using the Sword of the Past to Threaten the Officials of the Present?

However, despite the formation of a political consensus, to translate intentions into actionable law, legislators must confront a fundamental dilemma: how to use a tax code designed for a simulated world—a code from the "past"—to regulate a new digital-native species?

This is the core dilemma of this hearing, concentrated in two "soul-searching questions" that have plagued the entire industry.

The first is the fundamental disagreement over "creation equals income" versus "tax upon sale." For example, in the case of staking, the IRS's current vague guidance leans towards treating newly generated tokens as ordinary income at the moment of "gaining control." The industry's complaints are vivid and illustrative: "It's like asking a baker to pay taxes when the bread just comes out of the oven, rather than after the bread is sold."

The second stems from the disturbingly broad "broker" provision in the Infrastructure Investment and Jobs Act. Theoretically, miners, software developers, and even participants in DeFi protocols could be classified as "brokers," forced to bear user information reporting obligations that they are technically unable to fulfill. This is no longer regulation but a "toll booth" on the road to innovation.

The Four-Way Game: Who Will Define the Future at the Hearing?

Jason Somensatto | Advocate of Principles

As the policy director of the well-known Washington nonprofit research and advocacy organization Coin Center, Jason Somensatto represents a policy perspective in the crypto world centered on principles and rights. His career spans regulatory agencies (having worked at the CFTC) and industry analysis firms (Chainalysis), giving his views both regulatory feasibility and industry insight.

Coin Center's core argument is not to seek tax privileges for cryptocurrencies but to demand that their tax treatment be consistent with similar economic activities. They repeatedly emphasize the unique nature of crypto assets as "consumable commodity assets"—they are both assets like gold and easily tradable and divisible like dollars. Based on this, they strongly advocate for clarifying key tax issues, especially the timing of taxation on block rewards (including mining and staking rewards).

Somensatto and Coin Center believe that such rewards are newly created property and should be taxed upon disposal (i.e., sale or trade), rather than upon receipt. This view was vividly illustrated in the House hearing with the analogy that "farmers should not be taxed when they harvest their crops, but rather when they sell them," highlighting the absurdity of treating unrealized gains as taxable income.

Andrea S. Kramer | Mapper of the Legal Maze

Andrea S. Kramer is a recognized thought leader in the field of virtual currency law, known for her profound analysis of how digital assets fit (or do not fit) into existing legal categories—such as securities, currency, or commodities. Her presence highlights a core issue: the legal classification of digital assets is the cornerstone of all tax treatment.

Currently, the IRS broadly classifies cryptocurrencies as "property," but this definition is too coarse to address the diversity and complexity of the industry. Kramer's work delves into the nuances that determine whether traditional financial rules (such as the "wash sale rule") should apply to digital assets. Currently, since cryptocurrencies are not considered "securities," the wash sale rule does not apply, providing traders with tax planning opportunities not available in traditional markets.

Globally, countries have different approaches to the legal classification of digital assets, some focusing on their property attributes, while others emphasize their payment functions, making it a complex and crucial task to develop a classification framework for the U.S. that aligns with international norms while being domestically feasible. Kramer's testimony will provide a critical legal perspective in this debate about definitions.

Lawrence Zlatkin | Commander on the Compliance Frontline

As the Vice President of Tax at Coinbase, the leading publicly traded cryptocurrency exchange in the U.S., Lawrence Zlatkin brings a crucial industry practice perspective. Coinbase needs to implement these tax rules for millions of users, so his views directly reflect the practical feasibility of the policy. Zlatkin also plays an important role in global tax policy, having collaborated with the OECD on its Crypto Asset Reporting Framework (CARF), giving him a deep understanding of global compliance trends. Coinbase's position encapsulates the significant challenges the proposed regulations face at the operational level. Zlatkin has been critical of the overly broad "broker" definition in the Infrastructure Investment and Jobs Act and the new 1099-DA reporting requirements. He has harshly pointed out in an open letter that these rules would impose "unprecedented, unregulated, and unlimited tracking" on the daily lives of Americans and would inundate the IRS with "useless data" due to the reporting of numerous trivial transactions. He advocates for rules that are operationally feasible, protect user privacy, and do not place the crypto industry at a competitive disadvantage against traditional finance.

Annette Nellen | Representative of Pragmatism

Annette Nellen is the chair of the AICPA Digital Assets Taxation Working Group and a respected scholar and tax policy expert. She represents thousands of CPAs who must apply these complex rules in practice. The numerous comment letters submitted by the AICPA to the IRS and Congress over the past few years provide a detailed technical roadmap for addressing crypto tax issues. Their recommendations consistently focus on practicality and operability, with core demands including: providing clear definitions for key terms like "digital assets" and "brokers"; establishing de minimis exemption rules for small personal transactions; providing clear guidance on the classification of NFTs (especially whether they are considered "collectibles"); and clarifying the timing of recognition for staking and mining income. The ultimate goal of the AICPA is to establish a tax system that is manageable for taxpayers, accounting professionals, and even the government itself.

The selection of these four witnesses clearly reveals the committee's strategic intent. The committee did not choose representatives with extreme positions or purely ideological stances but selected four top technical experts representing the core functions of the ecosystem—policy, law, operations, and accounting. This hearing is essentially a collaborative problem-solving exercise. The committee seeks not a battle but a lasting solution that can withstand the test of time and gain broad support.

Global Competition: While the U.S. Debates, the World Acts

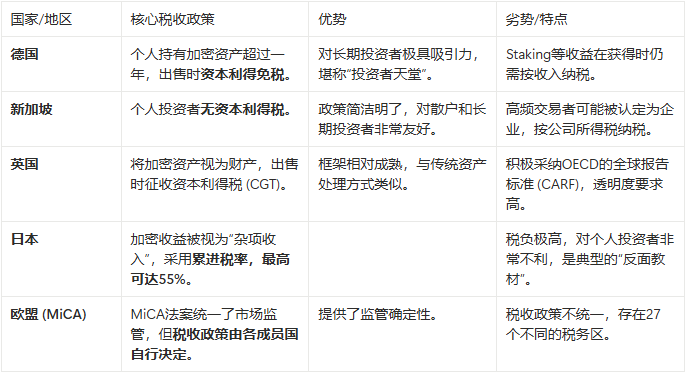

While Washington is still entangled in defining rules, the flow of global capital and talent has already begun. Other major economies are competing for the "new oil" of the digital economy era—innovative enterprises and high-net-worth investors—with more attractive policies.

This table clearly reveals the severe challenges faced by the United States. An American long-term Bitcoin investor, after holding the asset for more than a year and selling it, would need to pay a capital gains tax of up to 20%; whereas if he were in Germany, this tax would be zero. This difference is enough to make a significant amount of capital "vote with their feet," flowing to Frankfurt instead of New York.

The case of Japan serves as a profound warning: its stringent tax policies have led to a serious lag in the local crypto innovation ecosystem. U.S. lawmakers must answer a question: do they want the U.S. to become the next Germany or the next Japan?

Conclusion: A Choice at the Crossroads

The hearing on October 1 is unlikely to produce a perfect bill overnight. However, it undoubtedly serves as the "starting gun" for the U.S. crypto regulation to move from chaos to clarity. The consensus formed during the hearing is very likely to be integrated into the Senate version of the market structure bill or directly prompt the IRS to issue the long-overdue comprehensive guidelines.

For the crypto industry, the worst outcome is not harsh regulation, but rather ongoing uncertainty. From this perspective, any clear action is better than endless waiting. However, the details of that clarity will determine everything.

The United States stands at a historic crossroads. It can choose to establish a clear, fair, and globally competitive tax framework that seamlessly integrates digital assets into its robust capital markets, thereby attracting and retaining top innovations for decades to come; or it can choose a path paved with bureaucracy and outdated concepts, handing this vibrant industry over to more agile and visionary competitors with complex and punitive rules.

The whole world is waiting for Washington's answer. And this answer will largely define the flow of global capital and the technological landscape of the 21st century.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。