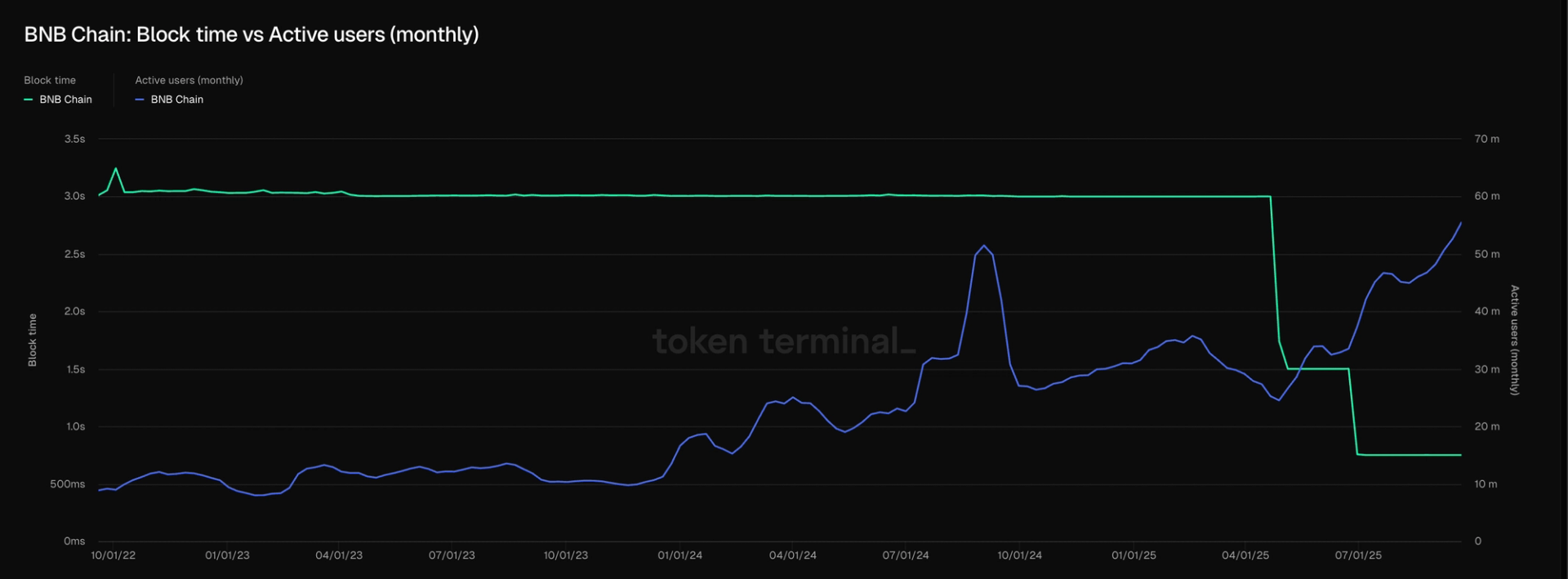

BNB链上的验证者已提议将最低燃气价格从0.1 Gwei降低到0.05 Gwei,同时将区块间隔从750毫秒减少到450毫秒。

目标是将平均交易成本降低到约0.005美元,使网络在与Solana和Base等低成本链的竞争中更具优势。

该提案是在2024年4月决定将燃气费用从3 Gwei削减到1 Gwei之后提出的,5月再次降至0.1 Gwei,费用因此下降了75%。

“只要质押年收益率保持在0.5%以上,BNB链就应该努力实现尽可能低的燃气费用,”提案指出,将超低成本视为网络增长的核心原则。

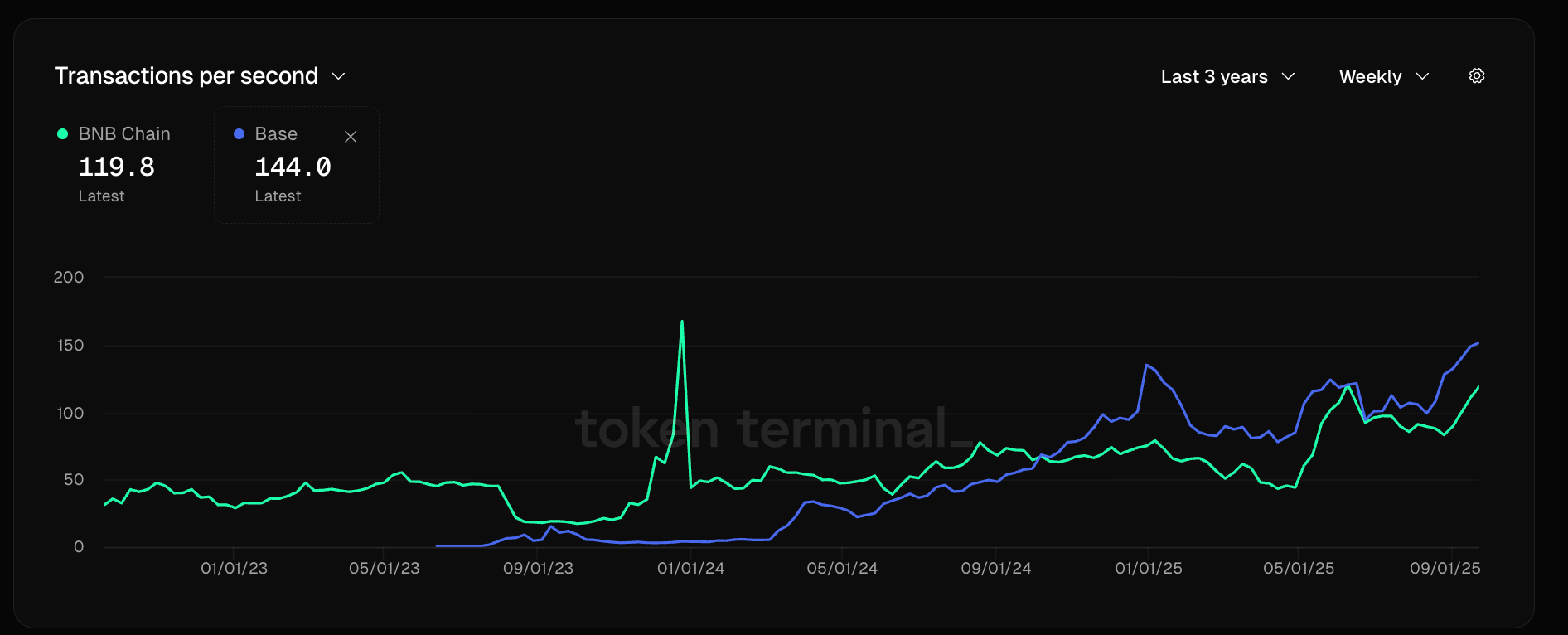

提案的时机至关重要;链上交易活动蓬勃发展,去中心化交易所Aster成为突出的交易场所。

根据CoinMarketCap,该交易所过去24小时内处理了293.7亿美元的永续期货交易量。DefiLlama的数据表明,Aster每天产生720万美元的收入,超过HyperLiquid的279万美元。

这种强劲表现在它们的代币中得到了体现。ASTR在过去24小时内上涨了37%,其市值从一周前的9.31亿美元升至37.4亿美元。相比之下,HYPE的价值则缩水了数十亿,从148.8亿美元降至117.3亿美元。

与交易相关的交易已经主导了BNB链的活动,从2025年初的20%上升到6月的67%。提案指出,降低成本的环境可能会推动进一步增长。

与此同时,BNB代币在过去24小时内下跌了1%,但仍保持在1000美元的关键心理水平之上,日交易量超过38亿美元。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。