Currently, the #RWA US stock tokenization has a bug, which is that you can only buy spot, unable to go long or short, and even less able to use options strategies. We know that the overall valuation of US stocks is at a historically high position, with many star stocks in the S&P and Nasdaq (such as Meta and Nvidia) having risen a bit too much on expectations. When buying RWA tokenized stocks or ETFs traditionally, you either have a spot long strategy or simply avoid it altogether. However, for investors like us who want to seize short-term opportunities while worrying about being trapped at high positions, we need a more flexible tool—this is where the contract trading of #RWA US stock tokenization has its advantages.

Recently, #Bitget launched 25 US stock USDT perpetual contracts (including basically all popular stocks like #TSLA, #NVDA, #AAPL, etc.), with prices sourced from multiple channels (xStock, Ondo, etc.), providing much stronger transparency and depth than a single channel. I took a serious look at the mechanism, and to be honest, it is quite attractive for those of us who often watch and trade US stocks and hope for flexible operations. Let me give a simple example:

• If I think #NVDA has risen to an absurd level, I can directly open a short position without borrowing shares or dealing with complicated margin procedures, just using the traditional logic of trading contracts, with zero learning cost.

• If a tech stock has good news, like Apple recently releasing new products, I can also open a long position immediately and quickly take advantage of the wave.

Personally, I feel that #Bitget's upgrade has the biggest advantage: you can go long or short on #RWA US stock tokens anytime and anywhere, with no operational learning difficulty, making both long and short positions very flexible and convenient.

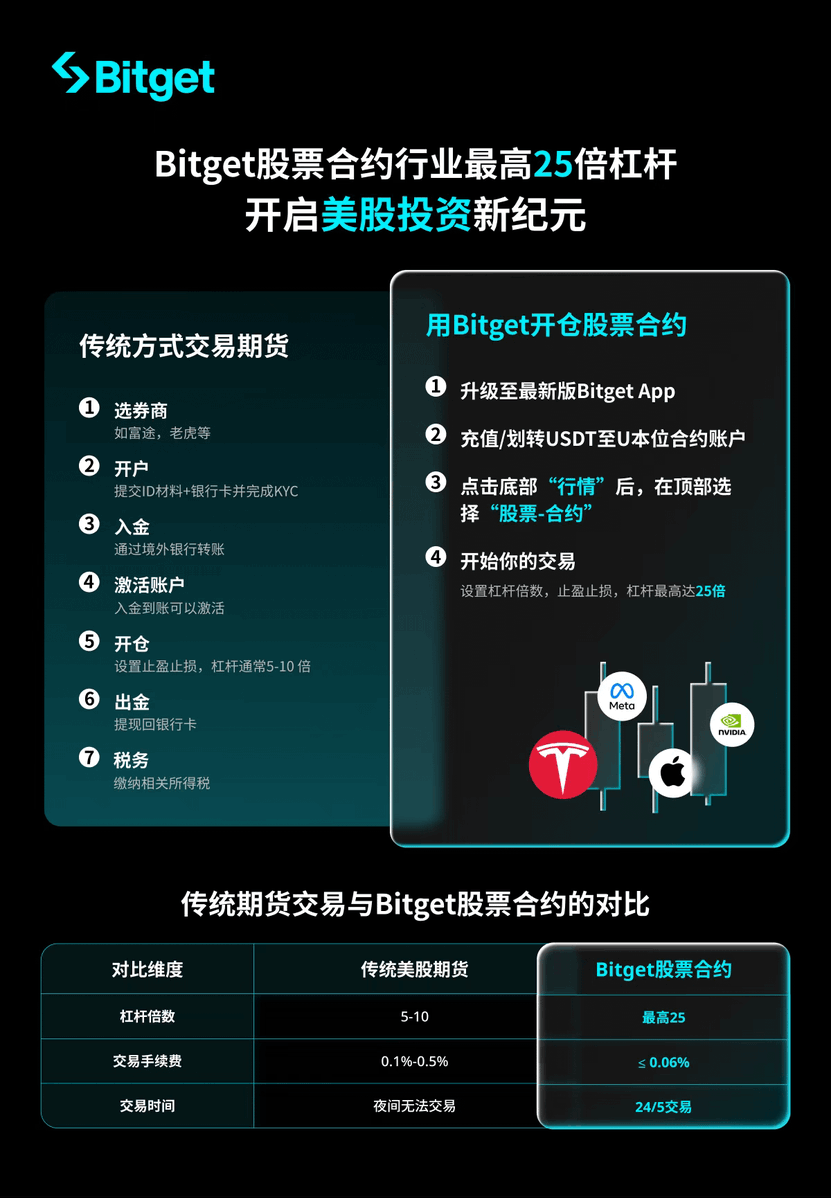

📝 Next, let's talk about the differences between traditional US stock futures and #Bitget RWA contracts.

When I used to trade US stock futures, the biggest issues were several:

1️⃣ Low leverage: Traditionally, it is generally only 5-10 times, which limits the ability to amplify returns. #Bitget offers up to 25 times leverage, meaning that with $1,000, I can control a position of up to $25,000. Of course, the risk is also amplified, but for short-term traders, the flexibility is much higher.

2️⃣ Non-continuous trading hours: Traditional US stock futures cannot be traded during night sessions. #Bitget offers trading hours of 5*24h, meaning that except for weekends and holidays, you can get in and out anytime, without missing out on major overnight movements.

3️⃣ High fees: Traditional fees are often above 0.2%, making frequent operations very costly. #Bitget has low fees: ≤ 0.06%, which is much cheaper than traditional futures, suitable for high-frequency trading.

Overall, my personal suggestions are that if you are a long-term investor, you can continue holding ETFs or large-cap stocks; but if you, like me, pay attention to short-term fluctuations in US stocks and want to take advantage of pullback opportunities in a high valuation context, #Bitget's contracts are a very practical supplementary tool. However, it should also be emphasized that "high leverage is a double-edged sword"; you can quickly amplify profits, but you may also face instant liquidation. Therefore, my trading habit is to generally use 3-5 times leverage, leaving enough safety margin. I always set stop-loss and take-profit orders, and do not blindly hold on. Treat it more as a short-term hedging tool rather than a long-term heavy holding asset. 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。