撰文:岳小鱼

稳定币热潮还在继续,最近很多圈外的大佬们在咨询我稳定币相关信息。

其中很多人都问过我一个问题:之前企业手里如果有流动性资金,其实会做一些低风险的理财投资。之后如果换成了稳定币,稳定币本身没有升值空间,那么企业怎么实现自己的流动性资金增值呢?

其实很多圈外的人还停留在发币这一层,并不知道区块链世界早已构建了一套CeFi+DeFi的金融系统。

通过CeFi+DeFi的可组合性,稳定币同样有诸多理财渠道,甚至能做到10%的年化收益。

为什么稳定币理财可以做到这么高收益呢?

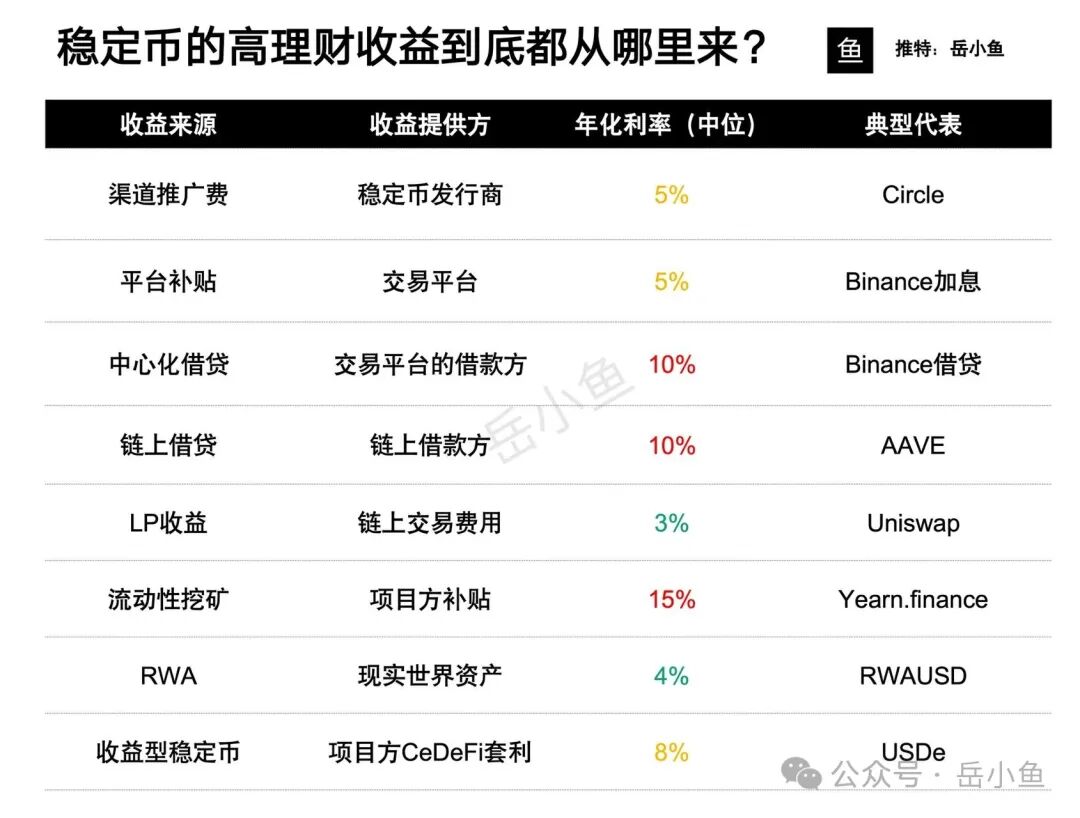

我们可以看下市面上稳定币收益的8大来源:

稳定币发行商会通过渠道推广费用变相给用户返息,比如Tether或Circle的合作伙伴奖励。

交易平台们为了做推广,吸收用户的资沉,同样会进行理财加息,推出复合利息产品。

交易平台们可以通过借贷的市场运作,借入U的用户会支付利息给借出U的用户。

链上借贷平台们,则可以通过去中心化的方式,实现U的借入和借出。

提供流动性到DEX流动性池,赚取交易手续费分成。有些池子还会叠加代币奖励,形成双重收益。

参与DeFi的流动性挖矿或收益农场(Yield Farming),这个属于项目方的补贴,高回报但易受黑客和激励衰减影响。

现实世界收益搬到链上,典型就是美债上链,可以包装成收益型稳定币,普通用户也可以享受到美债收益,大概在4%左右。

收益型稳定币,项目方通过CeDeFi套利,尤其是这一轮周期中比较火的中性策略,通过对冲隔离价格波动风险,不过熊市收益可能会降低。

细数之后,我们就可以发现稳定币理财的高收益并不是无根之木,而是确定的收益来源。

稳定币热潮还在继续,之前预想的稳定币大战还没有出现,但是稳定币理财补贴大战倒是先出现了。

这场稳定币热潮,入局的都是传统金融机构和传统资本,其实我们普通散户很难有大机会。

但是能在这场热潮中,我们散户也可以喝口汤,能直接赚到的收益就是稳定币理财收益。

稳定币理财补贴大战,受益的是我们普通用户,抓住这波稳定币热潮红利。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。