Written by: Tuo Luo Finance

Aster ignites the contract derivatives track.

Regarding the recent TGE, although Aster is not the most well-known, its growth has been the most remarkable. Among a host of projects that saw their value halved upon launch, Aster stands out, soaring from $0.03015 to $0.528 on its first day, a single-day increase of 1650%. It continued to rise dramatically, peaking at 65 times its initial value to $1.99. This surge not only sparked market discussions but also left many who missed out lamenting, being described as "selling all the way up."

As for why this token was able to rise against the trend, one must look to Binance for answers.

Aster is not a completely new project; it is the result of the merger of two major star projects on the BNB Chain: the multi-asset liquidity protocol Astherus and the decentralized perpetual contract APX Finance. By the end of 2024, these two projects completed their merger, targeting the perpetual contract track, leading to the birth of Aster.

Aster is a decentralized perpetual contract exchange, backed by Binance's venture capital arm, YZi Labs. Strategically, YZi Labs' choice of this track is no coincidence. From an industry perspective, as competition among exchanges intensifies, the on-chain market has become a battleground for leading trading platforms. Whether in the competition of Web 3 wallets or the advancement of contracts and MEME markets, it reflects the continuous expansion of traditional exchanges' market boundaries. In this context, whoever can first create a systematic trading mechanism that integrates on-chain and off-chain will have a better chance of gaining an advantage in the exchange wars. The emergence of Hyperliquid is a prime example, successfully putting centralized exchanges on edge.

On the other hand, Hyperliquid's success proves the feasibility of the perpetual contract track. Data shows that as of September 2025, the average monthly trading volume of Perp DEX has reached $333.4 billion, with the DEX/CEX futures trading volume ratio continuously rising to 10%. This indicates that decentralized exchanges for perpetual contracts have become a potential track within the DEX space.

In this context, Aster was strategically invested in by YZi Labs and is seen as an important piece of the derivatives ecosystem on the BNB Chain, with high hopes placed on it by Binance. As early as March, due to CZ's multiple responses to Aster on social media, Aster was even referred to as Binance's "favorite child." After achieving good results on its token launch day, CZ even praised it publicly, further solidifying the deep association between Binance and Aster in the market's mind.

Of course, with strong backing, the project itself cannot be too lackluster. Compared to other derivatives DEXs, Aster adopts a dual model of order book and liquidity ALP, supporting both simple and complex trading paths. Professional traders can use centralized limit orders for trading, benefiting from deeper liquidity, real-time data, and advanced trading tools such as API integration and automated grid trading, with a hidden order feature to prevent front-running and MEV attacks. Retail investors can focus on the more familiar full-chain perpetual contracts, achieving one-click trading that not only offers a smooth user experience but also supports up to 1001 times leverage on BTC/USD trading pairs, covering a rich array of assets including cryptocurrencies, forex, and popular MEMEs, while being compatible with both the BNB Chain and Arbitrum networks. By setting up a dual trading model, Aster aims to accommodate a broader target audience, catering to both retail and professional investors, thus continuously expanding the platform's business.

Additionally, on top of perpetual contracts, Aster has also introduced stock perpetual contracts, allowing users to trade US stock perpetual contracts on-chain based on USDT margin, marking an innovative attempt on the product front. Currently, Aster is built on the BNB Chain, but according to official indications, it may migrate to its own L1 Aster Chain in the future.

The project's pace of advancement is also quite rapid. On September 8, Aster officially announced the Aster token generation event (TGE), planning to airdrop 7.04 million Aster tokens to eligible users participating in the reward program. On September 17, the Aster token launched, and its debut was nothing short of spectacular. Within less than 24 hours, total trading volume exceeded $340 million, with the token soaring from an opening price of $0.03015 to a peak of $0.528, achieving a single-day increase of 1651%. It then continued to rise, moving from $1.7 to $1.8 to $1.9, currently reported at $1.506, which is already over 40 times its opening price.

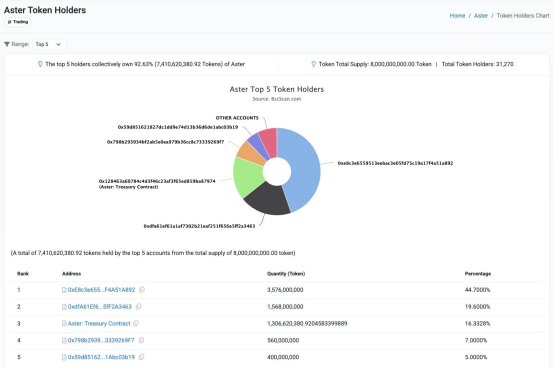

From the perspective of the token economic model, the total supply of Aster tokens is 8 billion, with 53.5% allocated to community airdrops for rewarding early contributors and traders, 30% for ecosystem and community development, 7% for treasury, 5% for team building, and 4.55% for liquidity.

Overall, while the project has notable highlights and impressive marketing, often drawing comparisons to Hyperliquid, the fundamental reason for its popularity still lies in its relationship with Binance and CZ. The presence of YZi Labs undoubtedly provides Aster with more room for imagination. From the market's perspective, Binance's support for its own perpetual contract DEX is evident, frequently providing funding and traffic support from the project's inception, allowing it to quickly navigate the cold start phase and establish a foundation of user trust. Strategically, the BNB Chain genuinely needs a perpetual contract DEX to fill its ecological niche, and any project that emerges will undoubtedly have significant potential. Most importantly, due to CZ's strong endorsement, the market's trust in CZ will transfer to the project, leading Aster to be viewed as one of CZ's entrepreneurial ventures, capturing attention early on. Coupled with the prevailing notion in the crypto space that "rising prices are just," Aster's popularity is understandable.

However, apart from external allure, whether the project truly has a solid fundamental basis as its price trend suggests remains to be seen. A typical comparison is that while user experience is one of Aster's main marketing points, it still shows certain gaps compared to existing Hyperliquid. Many users report frequent bugs and lagging issues, with some likening the experience to a game, stating "Aster is like Candy Crush, while Hype is a AAA title." Ironically, the Aster token contract on Hyperliquid has about 159 million holdings, which is more than six times that of Aster's platform, indicating that the trading volume of its own token on a competing platform far exceeds that on its own platform, which not only raises concerns about it being a "wedding dress" for others but also presents a significant market spectacle.

Data source: X user @_FORAB

From the perspective of token distribution, Aster also exhibits clear characteristics of high FDV and high control. The FDV of this token reaches $11.7 billion, which, although significantly lower than Hyperliquid's $50 billion, still holds an advantage compared to other token platforms, such as Arbitrum's FDV of just over $5.5 billion. However, the high FDV cannot mask the serious inadequacies in Aster's product strength. More notably, according to disclosures from X user @nobrainflip, 96% of Aster's supply is controlled by six wallets, possibly even the same entity. High control implies strong manipulation potential, but it also inevitably faces the risk of "pouring out" when selling pressure arises, especially with a large influx of funds into contracts, the selling pressure upon spot launch will be substantial.

Data source: X user @nobrainflip

Moreover, the market's FOMO is predicated on the CZ and Binance effect, but for YZi Labs, this may just be a part of a strategic layout, where casting a wide net and fully racing horses is the essence of investment. Therefore, Binance's attitude will significantly determine Aster's subsequent trajectory, introducing uncertainty to the project.

On the other hand, there is also controversy regarding the necessity of decentralized contract exchanges. Some industry insiders believe that the demand for decentralized exchanges is insufficient, often being used for illegal trading activities such as wash trading. While Hyperliquid has emerged as a typical project, it is still difficult to change the current landscape dominated by centralized exchanges. Some even argue that the differentiation of DEXs lies merely in regulatory advantages.

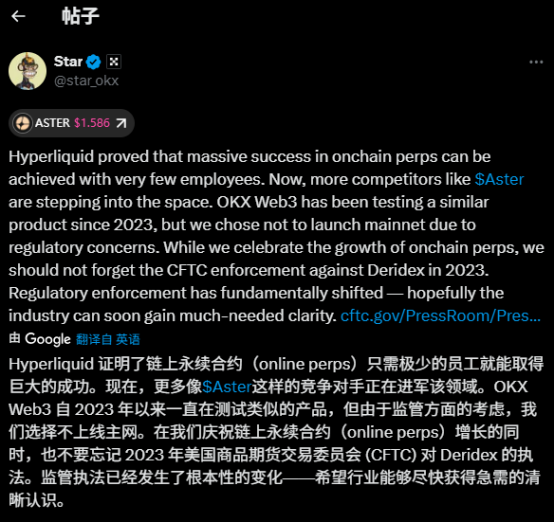

This statement is not unfounded. Regardless of how bright the prospects for DEXs may be, from the current infrastructure perspective, both user experience and trust connections still lag far behind CEXs, with advantages only in the area of censorship resistance. Interestingly, in response to Aster's popularity, OKX's Xu Mingxing stated, "OKX Web3 has been testing similar products since 2023, but due to regulatory considerations, we chose not to launch on the mainnet," emphasizing, "While celebrating the growth of on-chain perpetual contracts, we must not forget the CFTC's enforcement against Deridex in 2023."

Overall, with the support of CZ and Binance, Aster occupies advantages in resources and ecological positioning, but due to product strength and self-sustainability issues, the market also exhibits certain bubbles. The high FDV brings inherent unlocking risks, so despite the continuous price surge, investors remain cautious, with contract hedging, closely monitoring chip layouts, and large holder movements being more prudent strategies.

Shifting focus to Binance, Aster's meteoric rise also benefits from Binance's continuously improving outlook. Over the past six months, BNB has performed exceptionally well, breaking through the four-digit mark from $540 in March to $1,083, consistently setting new historical highs, which has led to increased market expectations for Binance.

Especially in recent months, there have been frequent positive developments for BNB. In addition to the macroeconomic benefits of interest rate cuts for risk assets, Binance's regulatory fundamentals are also improving. Just as Bloomberg reported that Binance is negotiating with the U.S. Department of Justice regarding a potential agreement that could end the compliance monitoring period that began in 2023, CZ changed his X account bio from "ex-@binance" to "@binance," all signaling Binance's return to the U.S. market.

The improvement in external liquidity has also catalyzed price growth. BNB ETFs are in progress, and several companies, including BNB Network Company, Nano Labs, Windtree Therapeutics, and Huaxing Capital, have initiated BNB treasury strategies, indicating real buying interest. CZ has also stated that he is in talks with 50 potential teams regarding DAT-related matters, but will only support a few strong companies.

From a micro perspective, Binance itself is a leading exchange, with massive traffic, unique influence, and ongoing technological optimization continuously empowering BNB. The trust effect of founders CZ and He Yi further adds value to BNB. The combination of an improved external environment and a solid internal foundation has driven BNB's growth.

Of course, another reason is that there are simply too few investable and trustworthy assets in the market. Apart from Bitcoin and Ethereum, BNB stands out among large exchange platform tokens, making it a prime candidate for regulatory benefits in the industry.

In this context, Binance's immense influence and CZ's endorsement naturally provide Aster's derivatives ecosystem with more growth potential. However, it is essential to remember that Aster is just one of the projects Binance has invested in, not the only one, and certainly not the only project CZ has endorsed. Even with strong endorsement capabilities, it ultimately must return to fundamentals.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。