今天的作业难写了,上午的时候我还相信是 H-1B 带来的影响,到了晚上我都有点不确定了,确实美股开始反弹,而加密货币则还有些下跌,美股上涨的因素其实很多,看了一下,包括 TikTok 的原因,保罗苹果,特斯拉甚至是英伟达都有利好和预期利好,七姐妹中有三个上涨,剩下的四个小幅下跌,导致 QQQ 上涨了将近 0.5% ,所以是不是 H-1B 我确实也说不好。

但这并不是最重要的,最重要的是市场发生后的操作逻辑,写作业以前我就一直在看美股的走势,我也再三强调美股和 $BTC 的相关性很高,而且 Bitcoin 等加密货币领域现在并没有看到利空的趋势,也就是说今天的 BTC 和 上周三的 BTC 没有任何的区别,价格的下降大概率不是系统性风险。

美股停盘后我看到 BTC 的价格维持在 112,000 美元附近,美股的情绪已经不错了,即便是有 H-1B 的问题应该也被消化了,在搞定网络以后我就在 112,222 美元埋伏了,把之前 111,500 美元的订单取消,但发现一直挂不上,就直接现价112,361 美元挂上了,我的逻辑还是一样,美股上涨,BTC 应该不会太差。

当然,我未必是对的,其实这个位置还是有风险的,在于早晨亚洲小伙伴起床后的态度,尤其是亚洲时区流动性挺低的,如果亚洲小伙伴不买账,接续下跌的可能性也还是有的,所以这也就是第一个仓位,如果继续下跌的话,在 107,000 美元埋伏了第二个仓位,能不能吃到就再说了。

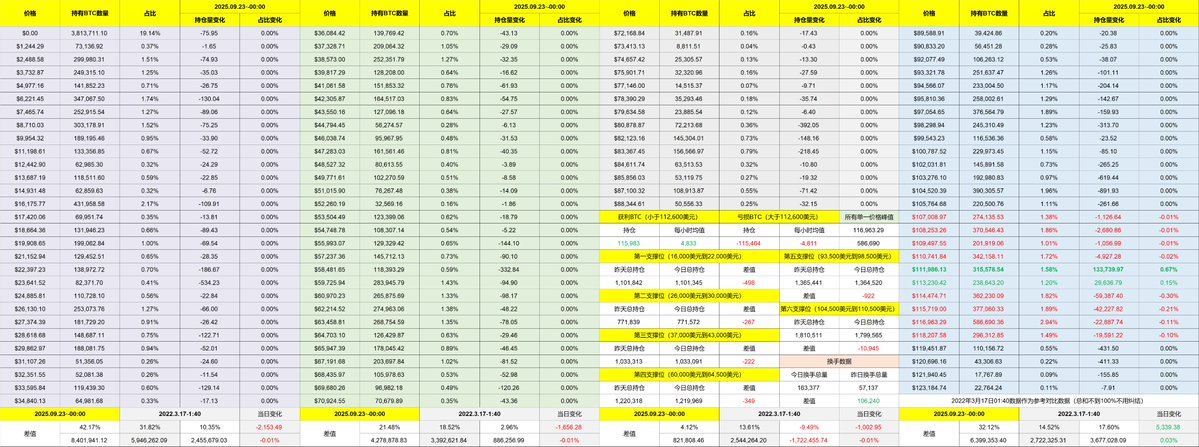

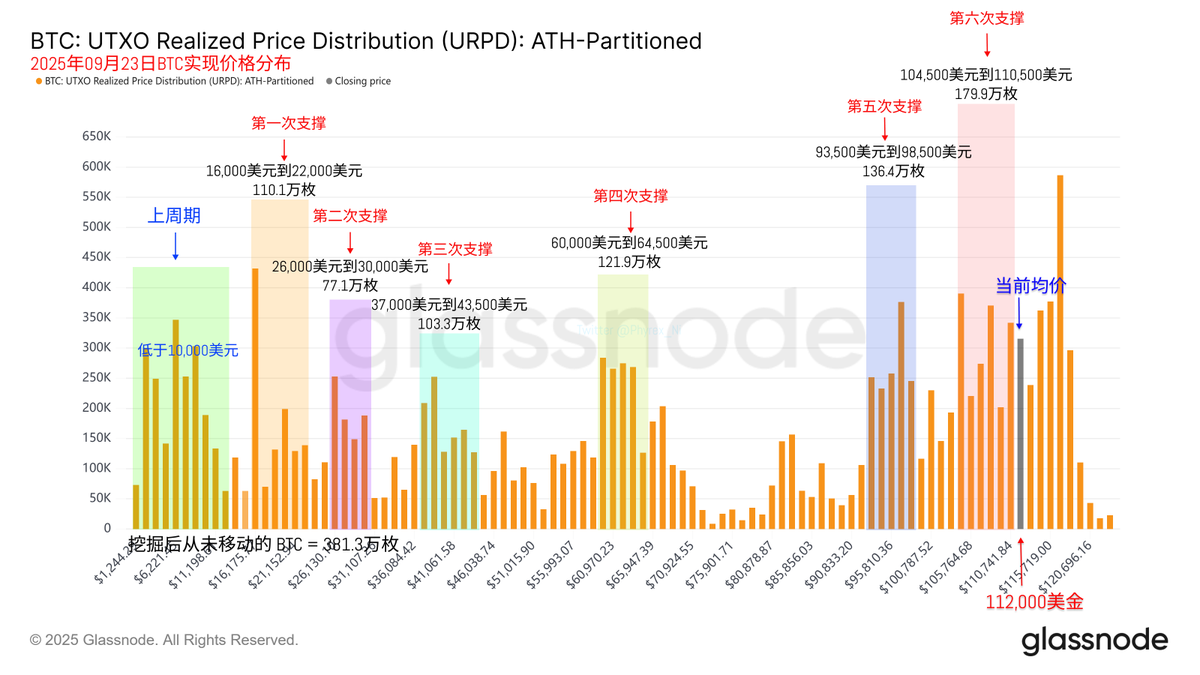

回到 Bitcoin 的数据来看,虽然 BTC 的价格下跌,引发了更多的换手,但实际上参与换手的投资者非常的集中,基本都是在美联储议息会议前后买入的短期投资者,而较早期投资者仍然是风平浪静的,目前的筹码结构也很健康,我个人是没有发现任何系统性的风险。

不过今天稍微注意到一点是美联储的博斯蒂克说美联储没有意义继续降息,他并不是2025年的票委,影响力并不算很大,但即便如此美股也应该有些反应才对,出乎意料的是几乎看不到反应,甚至是川普在议息会议以后就没有直接对利率表态了,这确实有点奇怪。

本文由 #Bitget | @Bitget_zh 赞助

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。