1小时图反映了一个典型的市场犹豫期,交易波动且区间震荡。在从$2.963的局部低点反弹后,XRP一直在形成更高的低点,但在$3.00附近的持续阻力限制了向上的动能。

最近一次下跌期间的成交量激增暗示可能的积累,这可能预示着突破的到来。短线交易者可能会在$2.95–$2.97区间找到买入机会,止损设置在$2.94以下。若确认突破$3.02以上,可能会触发看涨动能,特别是如果伴随成交量激增的话。

2025年9月21日,XRP/USDC通过Binance的1小时图。

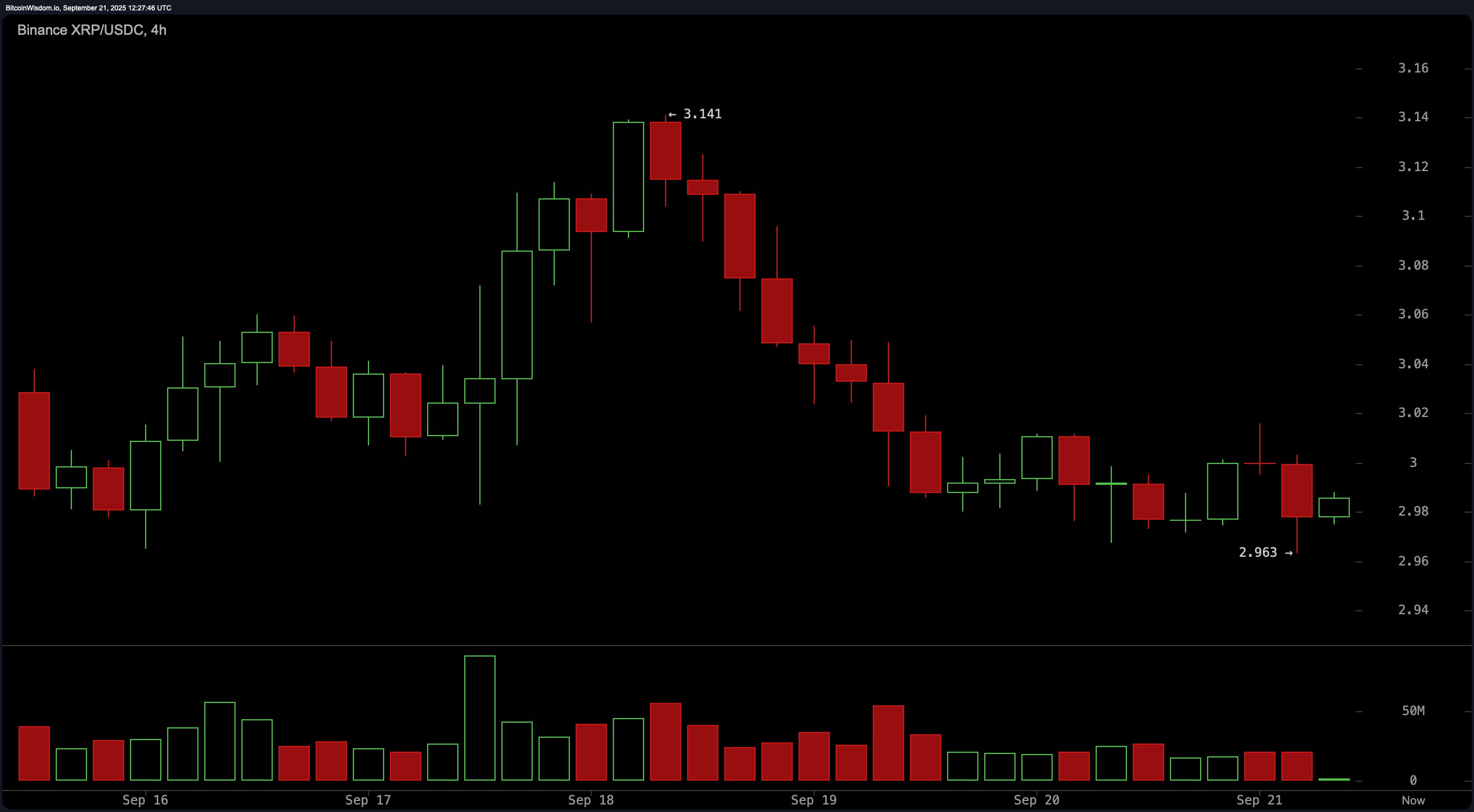

在4小时图上,当前趋势仍然是短期看跌,源于最近的高点$3.141。XRP形成了一系列更低的高点和更低的低点,已跌至$2.963的局部底部,这与日线图的整合区间重叠。值得注意的是,连续红色蜡烛的成交量下降表明看跌压力减弱。如果价格走势确认突破并收盘在$3.00–$3.02区域以上,这为潜在的看涨反转奠定了基础。交易者应密切关注这一水平,因为这可能标志着当前下行趋势的结束和新一轮上涨的开始。

2025年9月21日,XRP/USDC通过Binance的4小时图。

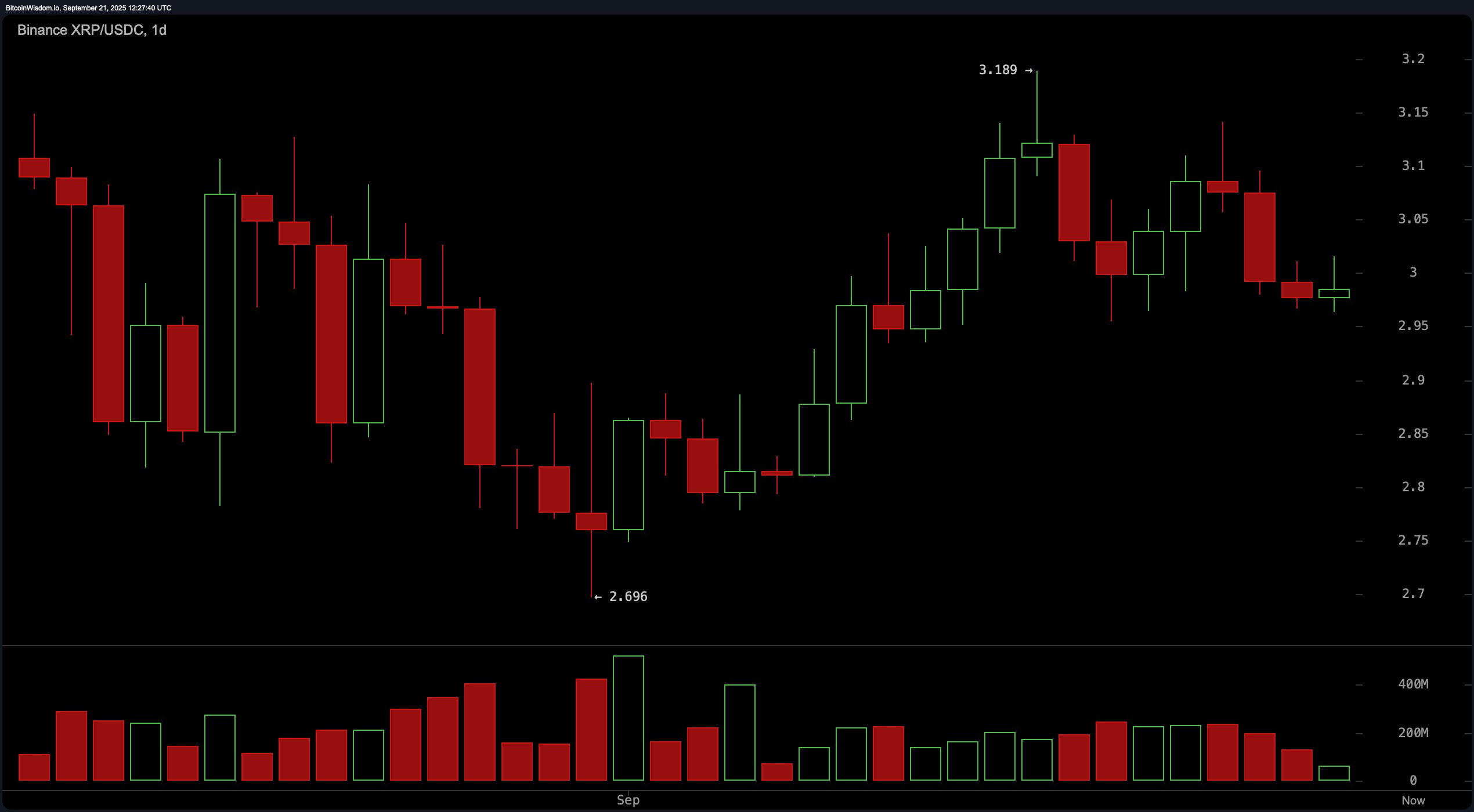

从日线图的角度来看,XRP表现出在更广泛的中性到略微看涨趋势中的短期整合迹象。价格已从最近的高点$3.189回落,目前徘徊在$2.97–$2.98区间。尽管出现回调,价格结构显示出更高的高点,并从最近的低点$2.696反弹,表明潜在的强劲。最近红色蜡烛的成交量正在减弱,进一步强化了卖出动能疲弱的观点。关键支撑位在$2.80–$2.85,而阻力位在$3.10–$3.18。若以强劲的成交量突破$3.10,可能会重新点燃看涨兴趣。

2025年9月21日,XRP/USDC通过Binance的日线图。

对XRP的振荡器进行回顾,显示出一个大致中性的技术环境。相对强弱指数(RSI)为49.86,随机指标为43.97,商品通道指数(CCI)为16.04,平均方向指数(ADX)为14.66,强势振荡器(AO)为0.082,均表明缺乏强烈的方向性动能。只有动量指标发出看跌信号,值为−0.056,而移动平均收敛发散(MACD)为0.018,显示出看涨交叉。混合的振荡器信号表明,交易者应保持谨慎,等待价格走势和成交量的更强确认后再进行更大仓位的操作。

移动平均线(MAs)在中长期内提供了更具建设性的前景。10期的指数移动平均线(EMA)为$3.008,10期的简单移动平均线(SMA)为$3.041,均显示出看跌信号。然而,较长期的指标如30期EMA为$2.984,30期SMA为$2.947,50期EMA为$2.958,50期SMA为$3.005则显示出混合信号,而100期EMA为$2.837,100期SMA为$2.819,以及200期EMA为$2.592和200期SMA为$2.529,均指向看涨条件。短期和长期平均线之间的这种分歧表明,尽管短期动能可能受到压力,但更广泛的趋势仍然看涨。

看涨判决:

如果XRP在强劲成交量的支持下突破并维持在$3.02的阻力位之上,特别是在1小时和4小时图上得到确认,向$3.10甚至可能$3.18的看涨延续是很可能的。较高时间框架的移动平均线与下降的卖出动能的对齐,支持了多头头寸的有利风险回报设置。

看跌判决:

如果XRP在成交量激增的情况下收盘低于$2.94,这将使当前的支撑结构失效,并增加向$2.80区间重新测试的概率。在这种情况下,短期看跌压力可能占主导地位,直到确认新的支撑基础之前,应避免看涨设置。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。