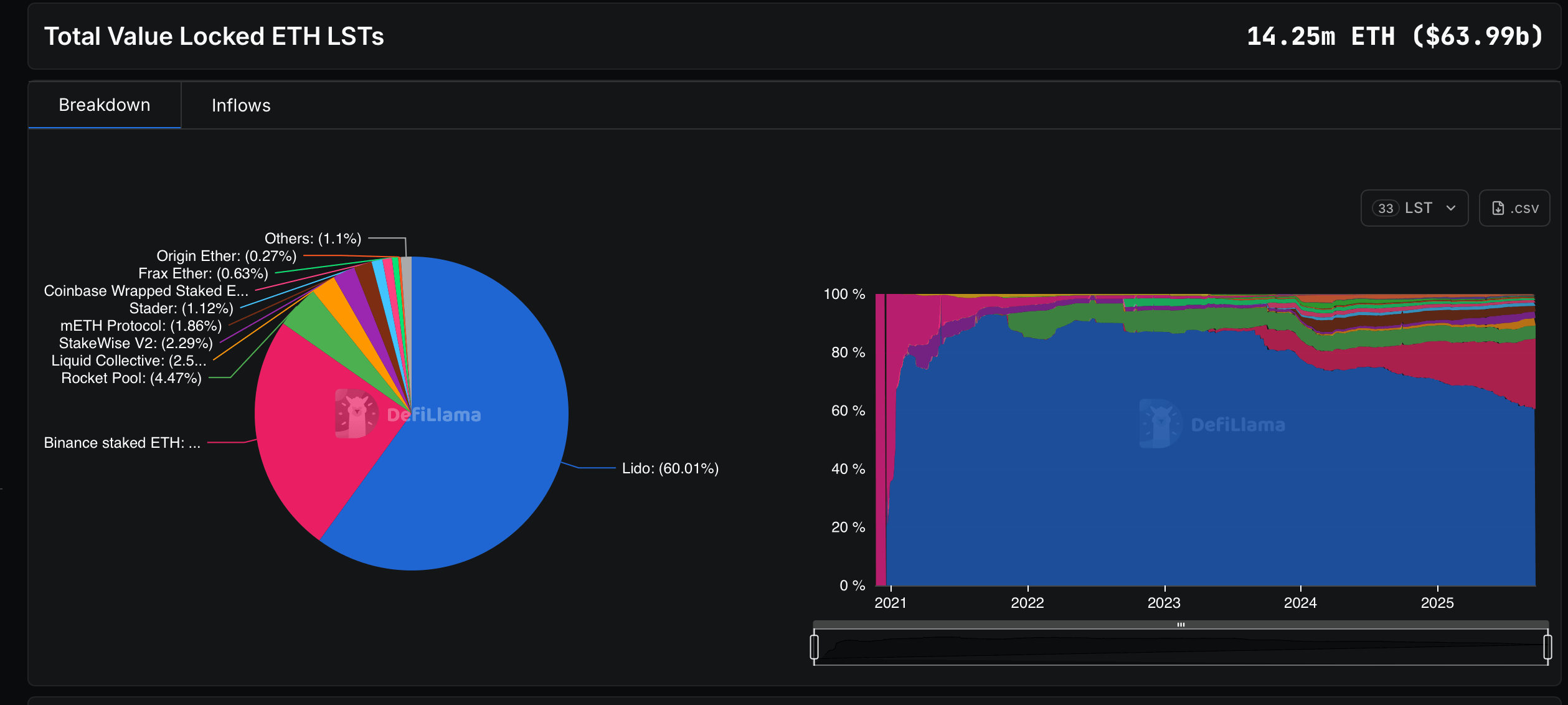

ETH LSPs have shed $268.55 million — about 60,000 ether — since Aug. 24, 2025, after raking in hefty inflows over the 14 weeks before that date. Today, ethereum-powered LSPs account for $63.99 billion of the $87.177 billion locked across all liquid staking protocols, giving the No. 2 crypto a hefty 73.4% slice of the pie.

Despite the 60,000 ETH reduction, ethereum’s liquid staking world is serving up some serious numbers with plenty of sass. At the top of the food chain, Lido is flexing with a TVL of $38.524 billion across five unique chains, raking in $21.68 million in fees this past week, which trickled down into $2.17 million in revenue.

Source: Defillama.com on Sept. 20, 2025.

Not far behind in size but with a tighter focus, Binance Staked ETH has locked $15.862 billion across two chains, data from defillama.com shows. It pulled in $8.01 million in fees, yet only $800,767 in revenue—big wallet, slimmer margins. Binance’s liquid staking protocol has really climbed the ranks over the past 12 months.

Rocket Pool holds third place with 636,780 ETH ($2.856 billion TVL), though it dipped 0.33% over the past week. Liquid Collective stays put at 363,138 ETH and $1.629 billion in TVL, barely budging with a -0.08% move in seven days. Stakewise V2, however, lit up the weekly chart, amassing 325,962 ETH worth $1.462 billion in TVL, up 1.92% this week.

From there, the mid-tier players keep the drama alive. The LSP mETH Protocol holds 264,488 ETH ($1.186 billion TVL) but wore the week’s biggest scar with an -8.06% drop. Stader clocks in at 160,327 ETH worth $721.88 million, easing just 0.18% over seven days. Meanwhile, Coinbase Wrapped Staked ETH stole the spotlight, jumping 10.27% this week to 139,426 ETH ($624.39 million TVL).

Frax Ether shows up with 90,468 ETH and a $405.82 million TVL, clocking in nearly flat at -0.12% for the week. Origin Ether hangs on with 38,039 ETH ($170.63 million TVL), slipping a slight -0.29%. Crypto.com Liquid Staking, on the other hand, flexed with a +5.68% lift to 36,376 ETH ($162.9 million TVL). Closing out the top 12, Swell Liquid Staking manages 25,327 ETH ($113.6 million TVL), though it contracted -3.52% since Sept. 13.

Ethereum’s liquid staking arena may be flexing billions, but it’s no chill weekend picnic—it’s a gladiator pit in slow motion. Lido towers, Binance moves, and the mid-tier crew keeps things spicy. With inflows flipping to outflows, the only sure bet is that next week’s stats won’t look the same.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。