Bitcoin’s Winning Run Ends as Ether Follows With Modest Outflow

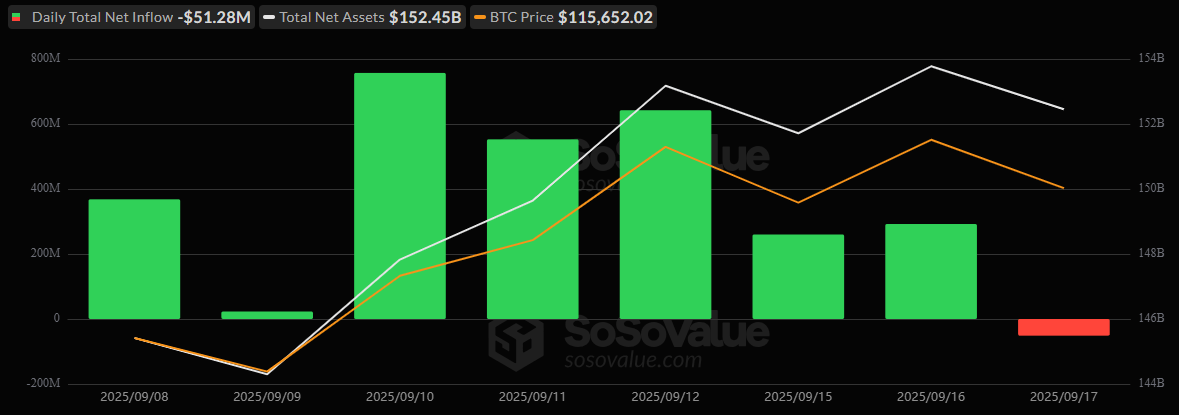

The relentless run of inflows into bitcoin exchange-traded funds (ETFs) came to an abrupt halt on Tuesday, Sept. 17. After seven straight days of green, the funds collectively registered a $51.28 million outflow, marking a sharp reversal in sentiment. Ether ETFs followed suit with a smaller $1.89 million decline, leaving both major crypto products in negative territory for the day.

For bitcoin ETFs, the day was a tug-of-war between inflows and outflows. Blackrock’s IBIT stood tall with $149.73 million in new money, and Grayscale’s Bitcoin Mini Trust added $22.54 million. But the exits were far greater. Fidelity’s FBTC led the withdrawals with $116.03 million, Grayscale’s GBTC saw $62.64 million flow out, Ark 21Shares’ ARKB lost $32.29 million, and Bitwise’s BITB shed $12.58 million. Despite the red net figure, trading volumes remained robust at $4.24 billion, with net assets sliding slightly to $152.45 billion.

BTC ETFs seven-day flow ends with $51 million outflow. Source: Sosovalue

Ether ETFs also struggled, though the picture was less severe. Fidelity’s FETH faced a $29.19 million exit, and Bitwise’s ETHW recorded $9.67 million in redemptions. These were partially offset by inflows into Blackrock’s ETHA ($25.86 million), Grayscale’s Ether Mini Trust ($6.38 million), Invesco’s QETH ($2.70 million), and 21Shares’ TETH ($2.02 million). Still, the combined flows landed at -$1.89 million. Total trading value reached $2.34 billion, with net assets holding steady at $29.72 billion.

With both bitcoin and ether ETFs dipping in unison, investors are left wondering whether this marks a short-term correction or the first signs of deeper rotation in crypto markets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。