加密货币中的网络钓鱼攻击:用户在 stETH 和 aEthWBTC 中损失数百万

在这一阶段,加密行业继续受到连续的名人泄露事件的困扰,这些事件使个人和公司都面临风险。这些泄露事件不仅展示了网络犯罪分子的复杂性,也凸显了该行业对安全保障的迫切需求。

网络钓鱼攻击造成的重大损失

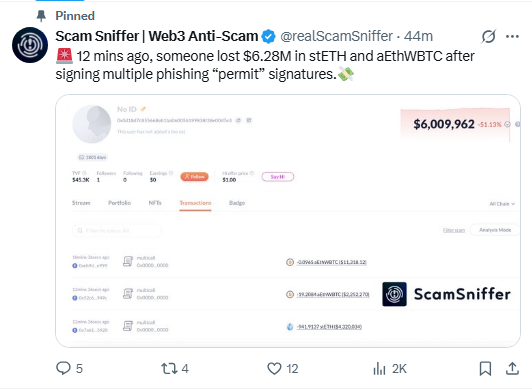

最近,Scam Sniffer 分享的一个案例显示,一名用户在网络钓鱼骗局中损失了惊人的 628 万美元的 stETH 和 aEthWBTC 代币,攻击涉及受害者在不知情的情况下签署了多个“许可”签名,授予攻击者对其资金的未授权访问。该诈骗嗅探器的推文揭示了钱包和相关交易的详细信息,实时显示了受害者的损失。

来源:X

受害者的钱包可以通过这个 Etherscan 链接 进行追踪,显示了受害者在网络钓鱼攻击中因信任而损失的资金。这提醒加密用户在与智能合约和去中心化应用互动时必须保持谨慎,因为此类网络钓鱼骗局正变得越来越复杂。

朝鲜黑客针对加密货币

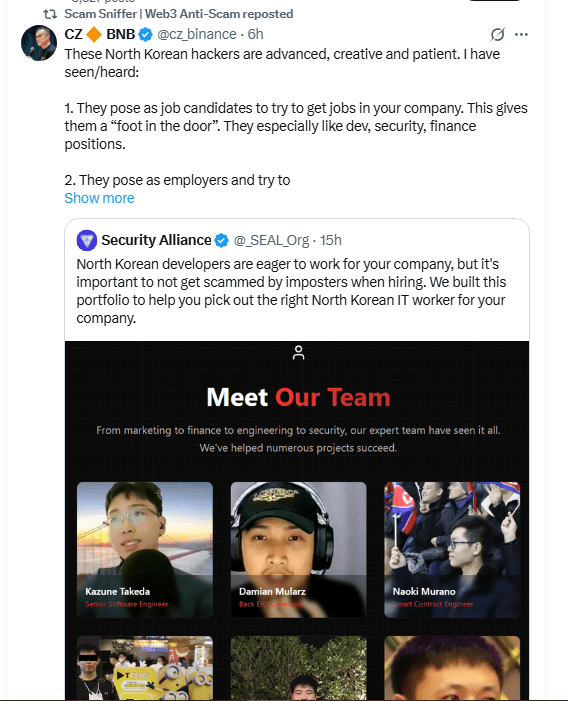

币安 的联合创始人赵长鹏(CZ)最近发推警告,指出来自朝鲜团体的高级黑客操作的持续威胁,CZ 的推文强调了这些攻击日益复杂的趋势,以及大型加密用户和平台提供商需要提高警惕。

根据报告,这些黑客与一系列针对各种加密平台的攻击有关,突显了国家支持的网络犯罪的全球影响和危险。

随着政府越来越关注网络犯罪防御,这些事件表明,加密业务和投资者必须时刻警惕新出现的威胁。

来源:X

影响加密项目的泄露事件

除了个人钱包,加密协议和项目也面临严重的安全问题,其中一个显著的例子是 Nemo Protocol 的泄露事件,该事件造成了 259 万美元的损失。根据报道,该公司迅速解决了漏洞,但这一泄露事件引发了对 DeFi 平台安全实践及其提供的保护措施的担忧。

这类黑客攻击时常发生,最终导致投资者和平台运营商的重大损失。因此,行业必须优先考虑更严格的安全协议,以防止此类事件的发生。

由于持续的黑客攻击而关闭的公司

这些持续泄露事件的后果开始对行业的稳定性造成影响,例如,Kinto,一种以太坊二层解决方案,最近宣布将在安全泄露后关闭。Kinto 的结束进一步例证了由于持续的黑客事件而不得不减少服务或完全关闭的企业日益增加的名单。

这些公司的损失不仅继续侵蚀用户信心,还可能产生真正的多米诺效应,持续的黑客事件导致其他公司也关闭。

需要更强的安全性

加密行业中黑客事件的增加解释了强大安全协议的必要性,个人用户和企业必须对持续的网络钓鱼、黑客攻击和其他网络犯罪风险保持警惕。用户在授予钱包权限或与智能合约互动时必须小心,以确保其数字资产的安全。

另一方面,加密平台必须实施更严格的安全协议,因此它们应该协同工作,以改善网络安全并及时更新可能发生的威胁。

尽管区块链技术承诺创造一个安全和去中心化的金融未来,但与黑客相关的现有安全漏洞削弱了这一愿景。例如,持续发生的安全漏洞事件说明了行业对增强网络安全的日益需求,以保护用户资金,同时促进任何加密项目的长期成功。为了遏制任何进一步的损害并为未来建立信任,整个行业必须迅速而果断地做出反应。

另请阅读: 币安每日词汇答案 2025年9月19日:完整的每日词汇列表

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。