Author: Zhou, ChainCatcher

After nine months, the Federal Reserve has once again pressed the interest rate cut button.

In the early hours of September 18, Beijing time, the FOMC lowered the target range for the federal funds rate from 4.25%–4.50% by 25 basis points to 4.00%–4.25%, marking the first interest rate cut in 2025.

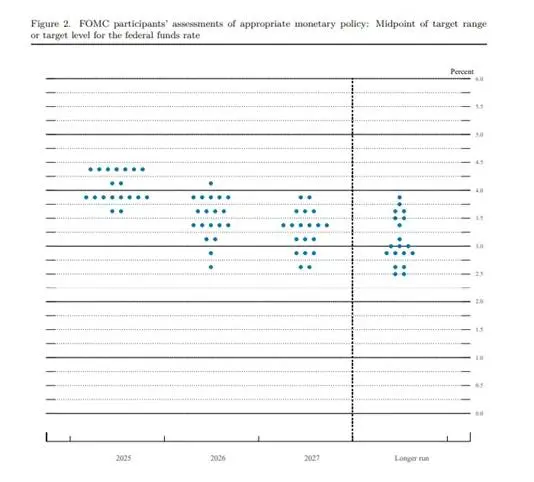

The latest dot plot shows that officials predict a median of another 50 basis points cut within the year. If the next two meetings each cut by 25 basis points, the federal funds rate may end the year in the range of 3.50%–3.75%.

Powell emphasized at the press conference that this action is a risk management-style rate cut, aimed at reducing the probability of errors in a complex environment with dual risks. The 50 basis point cut did not receive broad support, and there will be no rapid actions taken.

He added that the high inflation since April has shown signs of easing, related to a cooling labor market and a slowdown in GDP growth. Recent inflation increases are more influenced by factors such as tariffs, resembling a one-time shock, and are not sufficient to constitute evidence of persistent inflation.

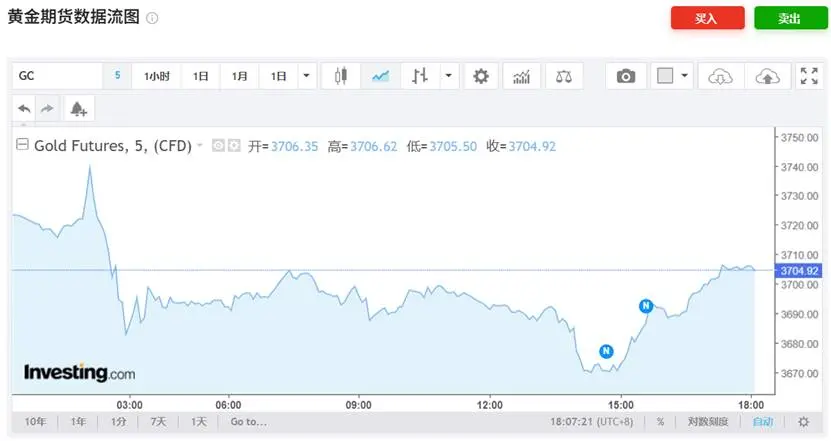

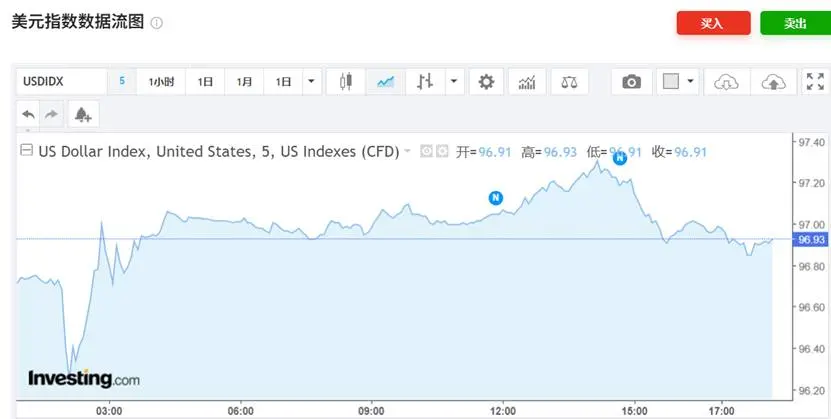

On the market side, the dollar gained support, and gold faced short-term pressure; Wall Street growth stocks saw profit-taking after a previous surge, with the "seven giants" stock basket closing lower, and the style briefly shifted to sectors with lower valuations; the overall response of crypto assets was also relatively muted.

How do institutions interpret this rate cut?

From domestic brokerages, Zheshang Securities believes that although the dot plot still leaves room, there is a possibility of a reversal in easing expectations, mainly depending on the impact of the core momentum of the U.S. economy and the stability of the unemployment rate.

CICC mentioned that the threshold for rate cuts will become increasingly high, as the coexistence of weak employment data and rising inflation will limit the space for easing; the current issue in the U.S. is rising costs, and excessive easing may exacerbate inflation, leading to "stagflation." Minsheng Macro stated that the rate cut is the beginning of the problem, and a larger cut may trigger inflation risks, while insufficient cuts may lead to political risks.

Overseas institutions also have differing opinions. "Fed mouthpiece" Nick Timiraos stated that this is the third time under Powell's leadership that the Fed has begun to cut rates without a clear economic downturn. However, considering the more challenging inflation situation and political factors (the White House's confrontational stance), the stakes in 2019 and 2024 are different from now.

Olu Sonola, head of U.S. economic research at Fitch, stated that the Fed is now fully supporting the labor market, clearly signaling that 2025 will enter a decisive and aggressive rate-cutting cycle. The message is very clear: growth and employment are the top priorities, even if this means tolerating higher inflation in the short term.

Jean Boivin, head of investment research at BlackRock, indicated that the Fed's rate cut outlook will likely depend on whether the labor market remains sufficiently weak. He pointed out that Powell stated the latest rate cut was due to intensified signs of weakness in the job market as "risk management," which may mean that future policy actions will heavily rely on data performance. Boivin believes that further weakness in the labor market will provide justification for more rate cuts from the Fed.

Barclays economists noted that the risks to the Fed's rate path are leaning towards delaying rate cuts. They stated in a research report that if inflation data continues to show strong price increases in early 2026, or if tariff policies push up prices in non-commodity sectors against a backdrop of moderately rising unemployment, such a situation may arise. Conversely, if the unemployment rate suddenly spikes, the FOMC may take more aggressive rate-cutting measures. Barclays expects that in 2026, the FOMC will keep rates unchanged until signs of monthly inflation data slowing appear and is confident that inflation is returning to the 2% target trajectory.

Hu Yifan, Chief Investment Officer for Greater China and Head of Macro Economics for Asia Pacific at UBS Wealth Management, stated that looking ahead, under the baseline scenario, the Fed is expected to further cut rates by 75 basis points by the first quarter of 2026. It is expected that the Fed will continue to prioritize the weakness in the labor market over the temporary rise in inflation. In a downside scenario, if the weakness in the labor market proves to be more severe or persistent, the Fed may cut rates by 200-300 basis points, with rates potentially dropping to 1-1.5%.

How do institutions view the financial markets?

In early trading on September 18, gold futures fell by as much as 1.1%; the dollar weakened initially after the decision was announced but quickly reversed and rose. Soojin Kim, an analyst at Mitsubishi UFJ Financial Group, stated that investors believe the Fed's guidance is less dovish than expected, as Chairman Powell emphasized the inflation risks driven by tariffs and indicated that further rate cuts would be pursued through a "meeting-by-meeting decision" approach, which pushed the dollar higher.

Francesco Pesole from ING, however, stated that the Fed's rate decision on Wednesday is overall bearish for the dollar, as he believes the decline in dollar financing costs will further drive down the dollar's value. Additionally, the euro against the dollar (EUR/USD) retreated from a four-year high set on Wednesday. Pesole also noted that the euro may regain upward momentum, as ING continues to maintain its target of 1.2 for the euro against the dollar in the fourth quarter.

George Goncalves, head of U.S. macro strategy at Mitsubishi UFJ, stated that the Fed's decision is the most dovish statement yet, adding a rate cut to the dot plot expectations. He pointed out that the Fed has not entered a rate-cutting sprint mode but is restarting the rate-cutting process due to weaker-than-expected labor market performance. This is also the reason for the muted response from risk assets. The Fed may cut by 25 basis points in both October and December, and a 50 basis point cut may not necessarily be beneficial for credit.

Kerry Craig, a strategist at J.P. Morgan Asset Management, stated that the U.S. rate cut may support emerging market assets and noted that the Fed's 25 basis point cut aligns with market expectations. He believes that the rate cut means the dollar may weaken, which is expected to boost the performance of stocks and local currency debt in emerging market assets. Additionally, the reduced risk of a U.S. economic recession also means that the credit market will continue to receive good support.

Richard Flax, Chief Investment Officer at European digital wealth management firm Moneyfarm, stated that the Fed's rate cut may boost short-term market sentiment for risk assets, with the stock market expected to benefit. He noted that for American households and businesses, this rate cut can provide moderate relief, but the broader policy signal is to remain cautious rather than shift to rapid easing.

Jack McIntyre, a portfolio manager at Franklin Templeton, stated that there are significant differences in the Fed's policy outlook for 2026, which may mean more volatility in financial markets next year. He pointed out that this rate cut is a risk management operation, indicating that the Fed is paying more attention to the weakness in the labor market. Investment strategist Larry Hatheway believes that although the market has digested expectations for significant easing from the Fed, the challenge for investors is that the Fed is not yet willing to acknowledge the future low interest rate path anticipated by the market.

Click to learn about ChainCatcher's job openings

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。